1095 -A Form

1095 -A Form - The form does not have to be returned to the government. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Learn how to find it. Note that this form comes from the marketplace, not the irs. Web what is a 1095a tax form? Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. This will help you claim your premium tax credit benefits on your tax return. Which states do you assist? Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is entitled.

Step 1 log into your marketplace account. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web what is a 1095a tax form? Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. It may be available online in your healthcare.gov account even sooner. It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is entitled. Which states do you assist? The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. The form does not have to be returned to the government. Step 2 under my applications & coverage, select your 2022 application — not your 2023 application.

This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. Note that this form comes from the marketplace, not the irs. The form does not have to be returned to the government. Step 2 under my applications & coverage, select your 2022 application — not your 2023 application. Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. Step 1 log into your marketplace account. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Learn how to find it. This form shows you details about health coverage that you or a family member may have received from the marketplace. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance.

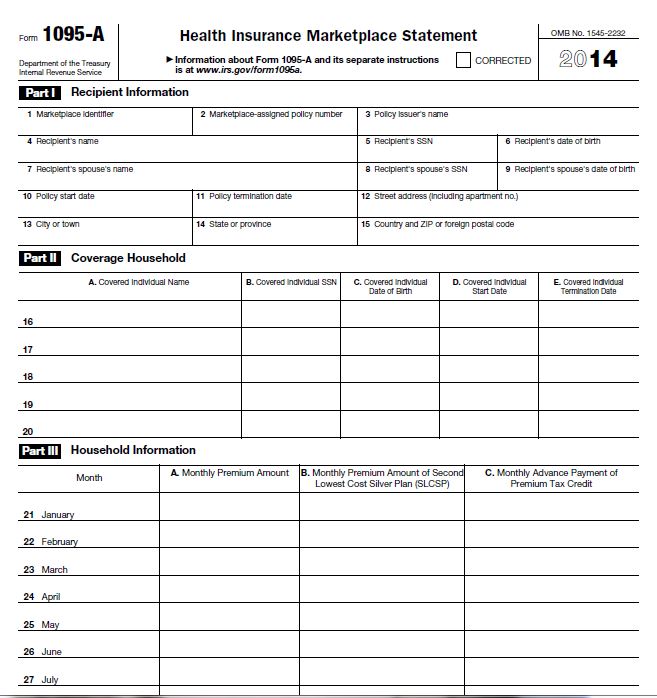

Form 1095 A Sample amulette

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. Which states do you assist? It reconciles the advance payments.

1095A, 1095B and 1095C What are they and what do I do with them

This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. This information was also reported to the.

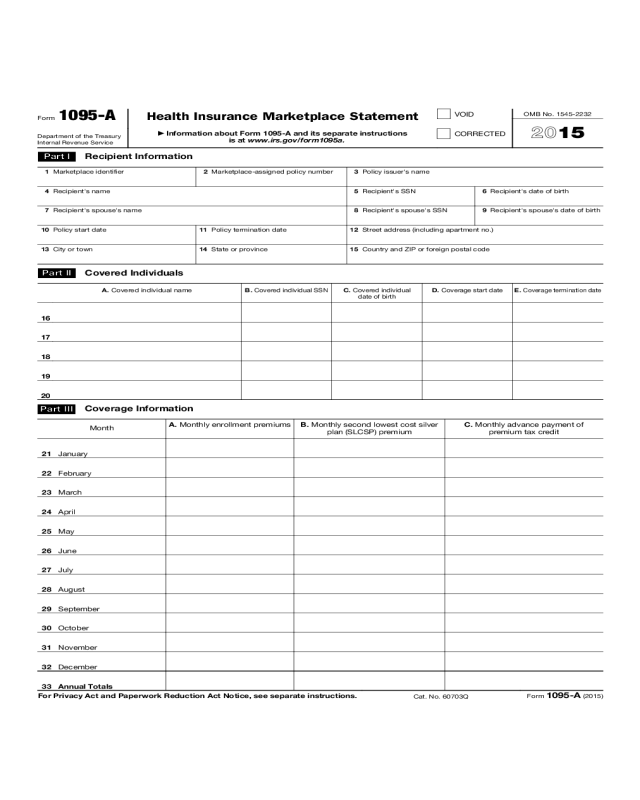

2015 1095 Tax Form 1095A, 1095B and 1095C Tax Filing

The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. The form does not have.

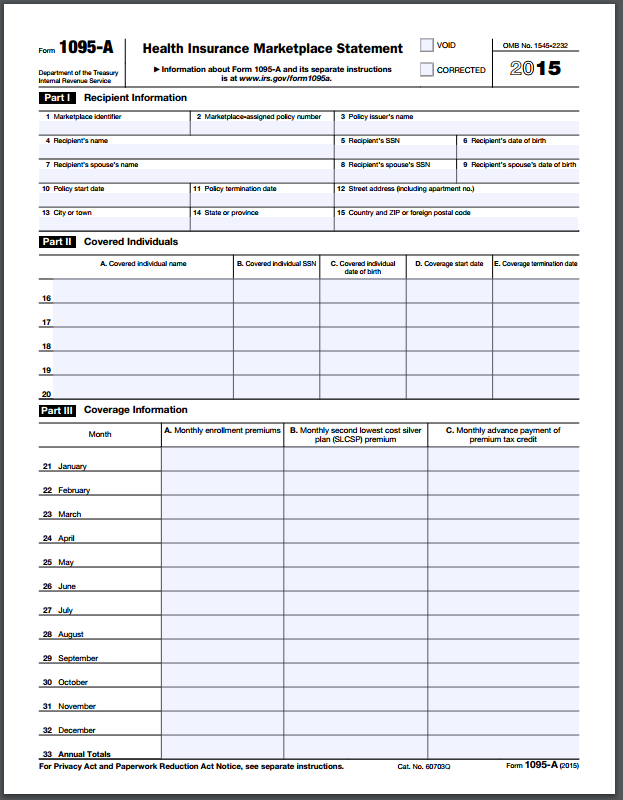

Corrected Tax Form 1095A Katz Insurance Group

Learn how to find it. Step 1 log into your marketplace account. Note that this form comes from the marketplace, not the irs. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance.

WHAT TO DO WITH FORM 1095A Insurance Information

This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Note that this form comes from the marketplace, not the.

Form 1095A Health Insurance Marketplace Statement (2015) Edit

Web what is a 1095a tax form? Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Learn how to find it. Which states do you.

1095A, 1095B and 1095C What are they and what do I do with them

Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes. This form shows you details about health coverage that you or a family member may have received from the marketplace. Which states do you assist? This information was also reported to.

Form 1095 A Sample amulette

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. The form includes the individual's and their dependents' name, the amount of.

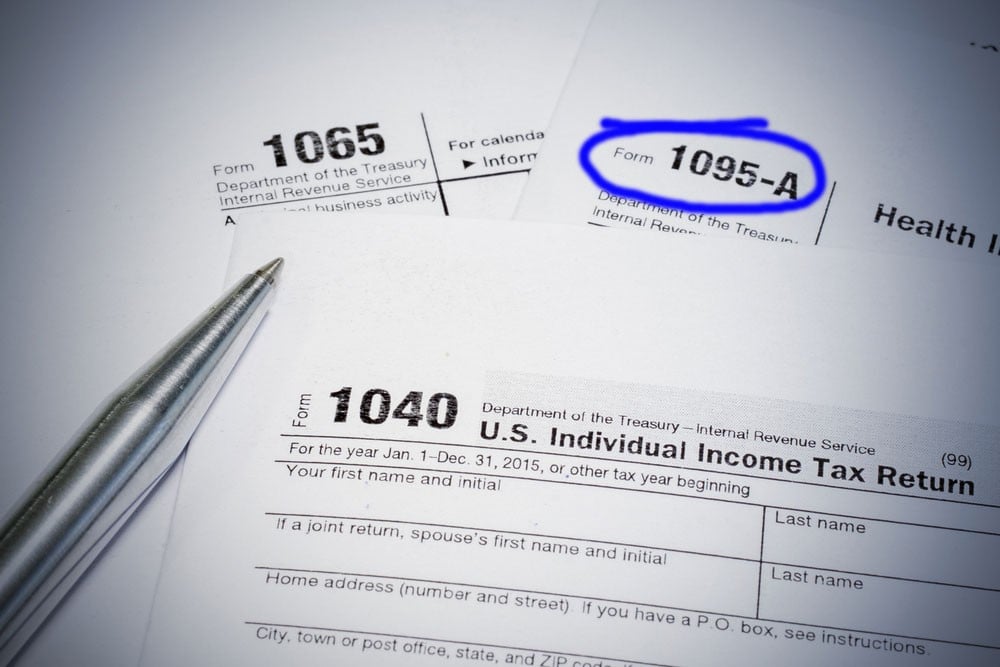

New tax form coming for those enrolled in Obamacare during 2014 New

Which states do you assist? Note that this form comes from the marketplace, not the irs. This information was also reported to the irs by the marketplace. This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. Web information about form 8962, premium.

Form 1095A What It Is and How to Make Use of It? Life Insurance

This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. The affordable care act introduced premium tax credits to help lower the cost of health insurance purchased through healthcare.gov and the 14 states. Web information about form 8962, premium tax credit, including recent.

Web What Is A 1095A Tax Form?

This form shows you details about health coverage that you or a family member may have received from the marketplace. Step 1 log into your marketplace account. This information was also reported to the irs by the marketplace. Health insurance marketplace statement is an internal revenue service (irs) form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes.

The Affordable Care Act Introduced Premium Tax Credits To Help Lower The Cost Of Health Insurance Purchased Through Healthcare.gov And The 14 States.

The form includes the individual's and their dependents' name, the amount of coverage they have, any tax credits they are entitled to and whether they used. Which states do you assist? The form does not have to be returned to the government. Learn how to find it.

This Will Help You Claim Your Premium Tax Credit Benefits On Your Tax Return.

Step 2 under my applications & coverage, select your 2022 application — not your 2023 application. This form is absolutely required for taxpayers who received advance payments of the premium tax credit (aptc) to help pay for health insurance coverage during the year. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. It reconciles the advance payments of the premium tax credit received if any, and the credit to which the taxpayer is entitled.

It May Be Available Online In Your Healthcare.gov Account Even Sooner.

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Note that this form comes from the marketplace, not the irs.