Crypto.com 1099 Form

Crypto.com 1099 Form - However, we may be required. We do not send your tax reports to any government organizations on your behalf. Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. This form itemizes and reports all. Did you stake any crypto or earn crypto rewards this year using coinbase? Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Web the first crypto tax online tool in the market that is entirely free for anyone who needs to prepare their crypto taxes. On november 15, 2021, president biden signed the infrastructure.

Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Web new cryptocurrency information reporting regime required on form 1099 and form 8300. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Did you stake any crypto or earn crypto rewards this year using coinbase? Besides, the irs says it. This form itemizes and reports all. 1099 tax forms come in two flavors: Those that have exceeded $20,000 in gross payments and. You will not receive tax documents if all the following. Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs.

Those that have exceeded $20,000 in gross payments and. Web new cryptocurrency information reporting regime required on form 1099 and form 8300. Did you stake any crypto or earn crypto rewards this year using coinbase? If you earned more than $600 in crypto, we’re required to report your transactions to the. Besides, the irs says it. However, we may be required. Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Web the first crypto tax online tool in the market that is entirely free for anyone who needs to prepare their crypto taxes. Due to the american infrastructure bill, all exchanges operating. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year.

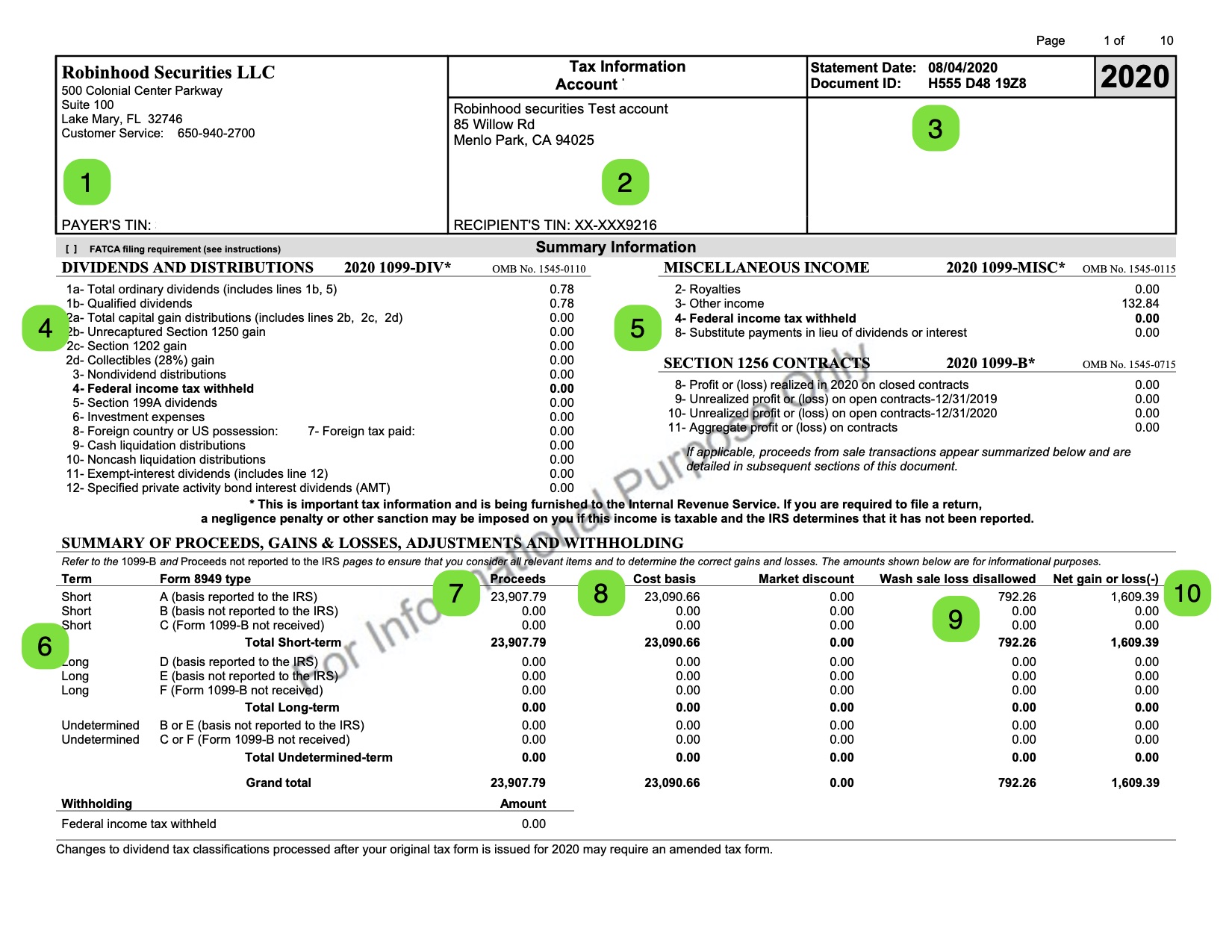

Form 1099B Proceeds from Broker and Barter Exchange Definition

Web does crypto.com tax report my crypto data to the government? The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web the first crypto tax online tool in the market that is entirely free for anyone who needs to prepare their crypto taxes. This form itemizes and reports all. If you earned more than.

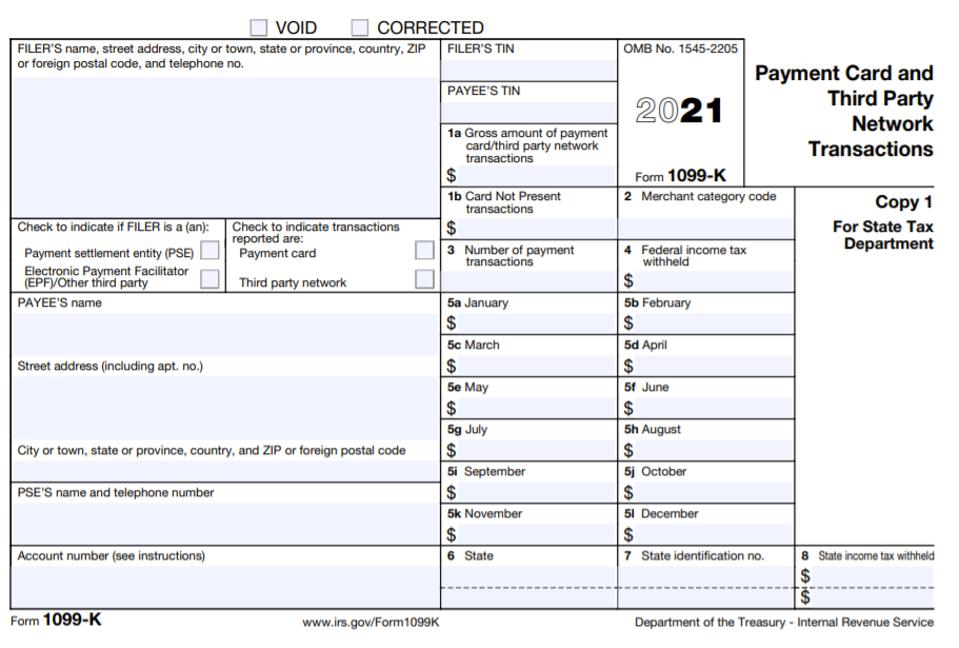

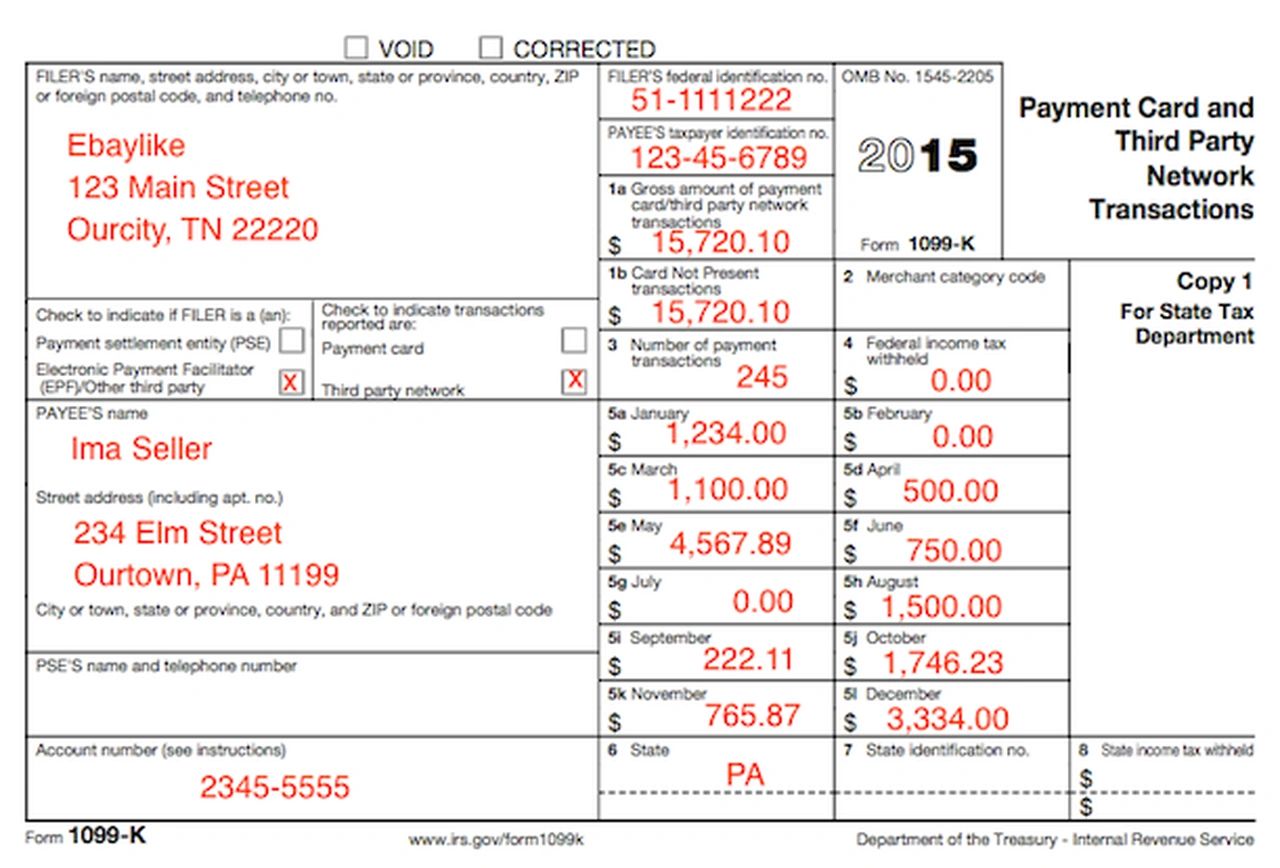

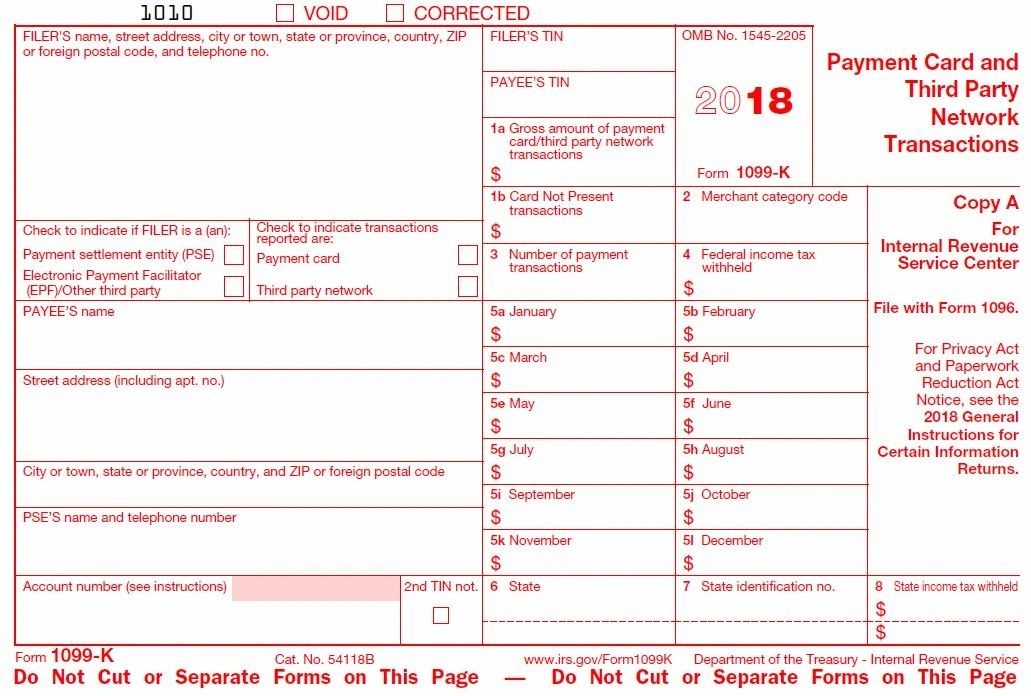

Don’t Follow 1099Ks To Prepare Your Crypto Taxes

You will not receive tax documents if all the following. 1099 tax forms come in two flavors: Those that have exceeded $20,000 in gross payments and. Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Besides, the irs says it.

How To Pick The Best Crypto Tax Software

This report will list the purchase date, sold. However, we may be required. Web did you receive a form 1099 from your cryptocurrency exchange or platform? Did you stake any crypto or earn crypto rewards this year using coinbase? Due to the american infrastructure bill, all exchanges operating.

Crypto Tax Advice for Uphold 1099K with Heleum 3/10/18 YouTube

Web does crypto.com tax report my crypto data to the government? Did you stake any crypto or earn crypto rewards this year using coinbase? We do not send your tax reports to any government organizations on your behalf. However, we may be required. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses.

Coinbase 1099 K / What To Do With Your 1099 K For Cryptotaxes Each

You will not receive tax documents if all the following. However, we may be required. Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web did you receive a form 1099 from your cryptocurrency exchange or platform? Web the first crypto tax online tool in the market that is entirely free for anyone.

What TO DO with your 1099K, for CRYPTOtaxes?

No matter how many transactions you have in the past years,. On november 15, 2021, president biden signed the infrastructure. Besides, the irs says it. You will not receive tax documents if all the following. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year.

Understanding your 1099 Robinhood

Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web the first crypto tax online tool in the market that is entirely free for anyone who needs to prepare their crypto taxes. This form itemizes and reports all. Web new cryptocurrency information reporting regime required on form 1099 and form 8300. Web we.

1099 Int Form Bank Of America Universal Network

The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. No matter how many transactions you have in the past years,. Due to the american infrastructure bill, all exchanges operating. On november 15, 2021, president biden signed the infrastructure. Web does crypto.com tax report my crypto data to the government?

How Not To Deal With A Bad 1099

We do not send your tax reports to any government organizations on your behalf. Web new cryptocurrency information reporting regime required on form 1099 and form 8300. Web did you receive a form 1099 from your cryptocurrency exchange or platform? Besides, the irs says it. However, we may be required.

How To File Form 1099NEC For Contractors You Employ VacationLord

The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web does crypto.com tax report my crypto data to the government? Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. Web did you receive a form 1099 from your cryptocurrency.

We Do Not Send Your Tax Reports To Any Government Organizations On Your Behalf.

Those that have exceeded $20,000 in gross payments and. Web new cryptocurrency information reporting regime required on form 1099 and form 8300. Due to the american infrastructure bill, all exchanges operating. This form itemizes and reports all.

However, We May Be Required.

Web the first crypto tax online tool in the market that is entirely free for anyone who needs to prepare their crypto taxes. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. Besides, the irs says it. No matter how many transactions you have in the past years,.

Web Did You Receive A Form 1099 From Your Cryptocurrency Exchange Or Platform?

Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web does crypto.com tax report my crypto data to the government? Did you stake any crypto or earn crypto rewards this year using coinbase? If you earned more than $600 in crypto, we’re required to report your transactions to the.

1099 Tax Forms Come In Two Flavors:

The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. You will not receive tax documents if all the following. On november 15, 2021, president biden signed the infrastructure. Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes.

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)