1066 Tax Form

1066 Tax Form - Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. 01 fill and edit template. Real estate mortgage investment conduit (remic) income tax return; Web agency information collection activities; Web section i—computation of taxable income or net loss (3) address change income (excluding amounts from prohibited transactions) deductions (excluding amounts. Web information about form 1066, u.s. Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. Web get your form 1066 in 3 easy steps. Web the internal revenue service (irs) has two very different forms that go by the name schedule q. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving the.

Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. 03 export or print immediately. Schedule q (form 1066) quarterly notice to residual interest holder of. Web agency information collection activities; *permanent residents of guam or the virgin islands cannot use form 9465. Real estate mortgage investment conduit (remic) income tax return; Web report error it appears you don't have a pdf plugin for this browser. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Send all information returns filed on paper to the following. In addition, the form is filed by the remic to report and pay the taxes on net.

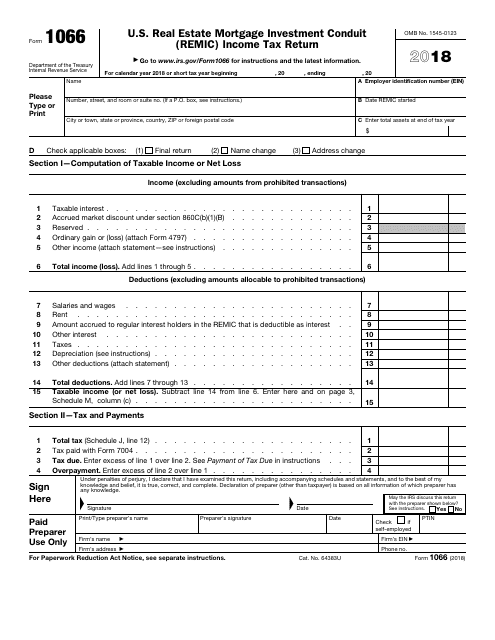

Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. Web get your form 1066 in 3 easy steps. Web report error it appears you don't have a pdf plugin for this browser. 01 fill and edit template. A form that one files with the irs to state the income, losses, deductions, and credits applicable to a real estate mortgage investment conduit. In addition, the form is filed by the remic to report and pay the taxes on net. In addition, the form is filed by the remic to report and pay the. Web section i—computation of taxable income or net loss (3) address change income (excluding amounts from prohibited transactions) deductions (excluding amounts. Real estate mortgage investment conduit (remic) income tax return go to. Send all information returns filed on paper to the following.

Form 1066 U.S. REMIC Tax Return (2014) Free Download

01 fill and edit template. The form is also used. In addition, the form is filed by the remic to report and pay the taxes on net. Send all information returns filed on paper to the following. Web form 1066, u.s.

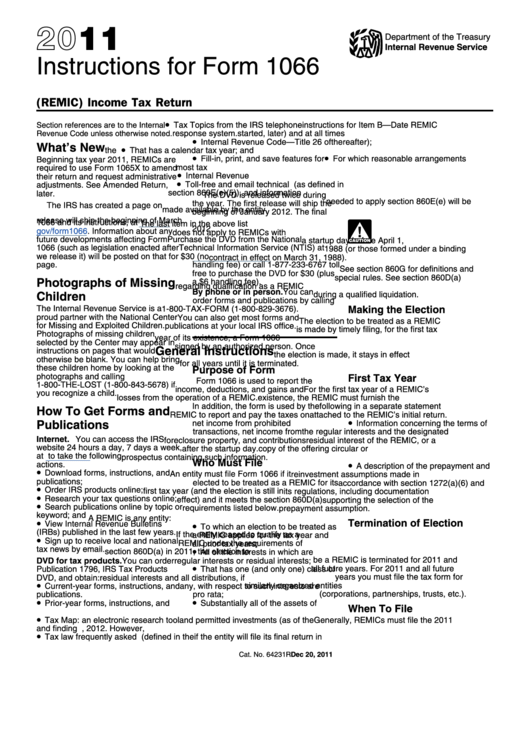

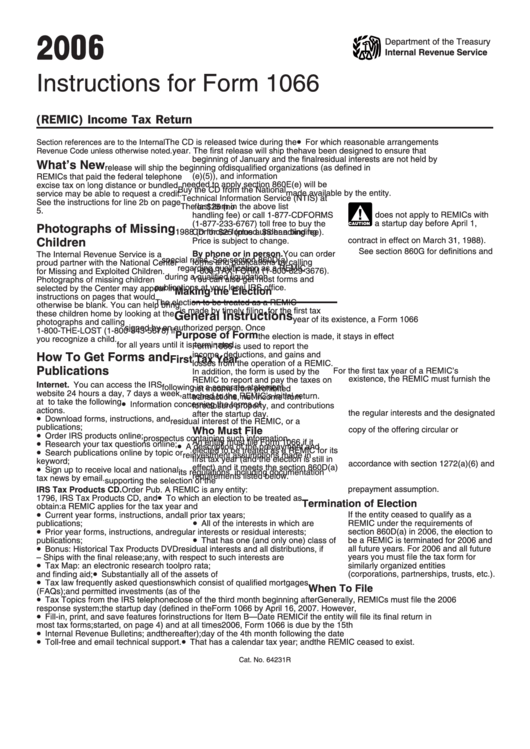

Instructions For Form 1066 U.s. Real Estate Mortgage Investment

Send all information returns filed on paper to the following. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web internal revenue service. In addition, the form is filed by the remic to report and pay the. 03 export or print immediately.

Form 1066 U.S. REMIC Tax Return (2014) Free Download

The form is also used. Web report error it appears you don't have a pdf plugin for this browser. 03 export or print immediately. Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. Web the internal revenue service (irs) has two very different forms that go by the name schedule.

IRS Form 1066 Download Fillable PDF or Fill Online U.S. Real Estate

Web agency information collection activities; Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web section i—computation of taxable income or net loss (3) address change income (excluding amounts from prohibited transactions) deductions (excluding amounts. Web file form 1066 to report the income, deductions, and gains and losses from the.

Instructions For Form 1066 U.s. Real Estate Mortgage Investment

Web get your form 1066 in 3 easy steps. One of them is for people who participate in certain real estate. 03 export or print immediately. Web information about form 1066, u.s. *permanent residents of guam or the virgin islands cannot use form 9465.

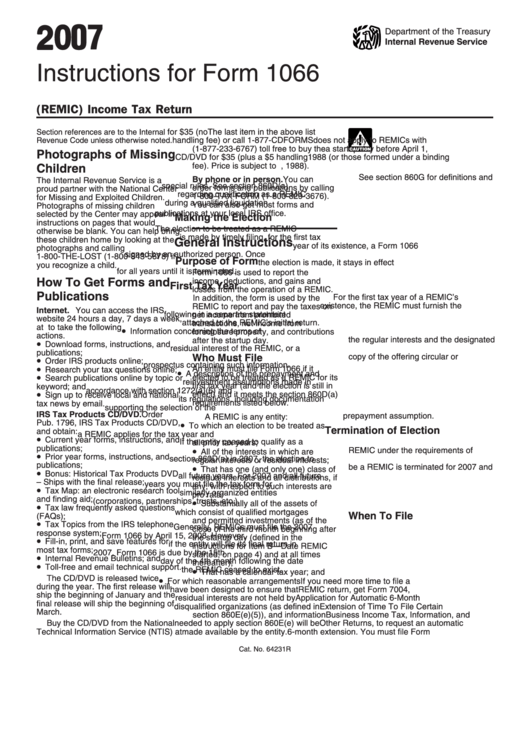

Instructions For Form 1066 2007 printable pdf download

In addition, the form is filed by the remic to report and pay the. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving the. Real estate mortgage investment conduit (remic) income tax return; Schedule q (form 1066) quarterly notice to.

3.11.213 Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC

Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. Web the internal revenue service (irs) has two very different forms that go by the name schedule q. Real estate mortgage investment.

Form 1066 U.S. REMIC Tax Return (2014) Free Download

Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web section i—computation of taxable income or net loss (3) address change income (excluding amounts from prohibited transactions) deductions (excluding amounts. Web form 1066 department of the treasury internal revenue service u.s. The form is also used. Web simply write “disability.

Form 1066 U.S. REMIC Tax Return (2014) Free Download

Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. Web years you must file the tax form for similarly organized entities (corporations, partnerships, trusts, etc.). In addition, the form is filed by the remic to report and pay the. Real estate mortgage investment conduit (remic) income tax return; Web internal.

Instructions For Form 1066 U.s. Real Estate Mortgage Investment

In addition, the form is filed by the remic to report and pay the. Web the internal revenue service (irs) has two very different forms that go by the name schedule q. The form is also used. In addition, the form is filed by the remic to report and pay the taxes on net. Web agency information collection activities;

Web Simply Write “Disability Severance Pay” On Form 1040X, Line 15, And Enter The Standard Refund Amount Listed Below On Line 15, Column B, And On Line 22, Leaving The.

Web the internal revenue service (irs) has two very different forms that go by the name schedule q. A form that one files with the irs to state the income, losses, deductions, and credits applicable to a real estate mortgage investment conduit. Web report error it appears you don't have a pdf plugin for this browser. Web section i—computation of taxable income or net loss (3) address change income (excluding amounts from prohibited transactions) deductions (excluding amounts.

Schedule Q (Form 1066) Quarterly Notice To Residual Interest Holder Of.

Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic. Web years you must file the tax form for similarly organized entities (corporations, partnerships, trusts, etc.). 03 export or print immediately. Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic.

Web Agency Information Collection Activities;

Real estate mortgage investment conduit (remic) income tax return; Real estate mortgage investment conduit (remic) income tax return, including recent updates, related forms and instructions on how to. Web get your form 1066 in 3 easy steps. One of them is for people who participate in certain real estate.

In Addition, The Form Is Filed By The Remic To Report And Pay The Taxes On Net.

Real estate mortgage investment conduit (remic) income tax return go to. Web internal revenue service. In addition, the form is filed by the remic to report and pay the. Web file form 1066 to report the income, deductions, and gains and losses from the operation of a remic.