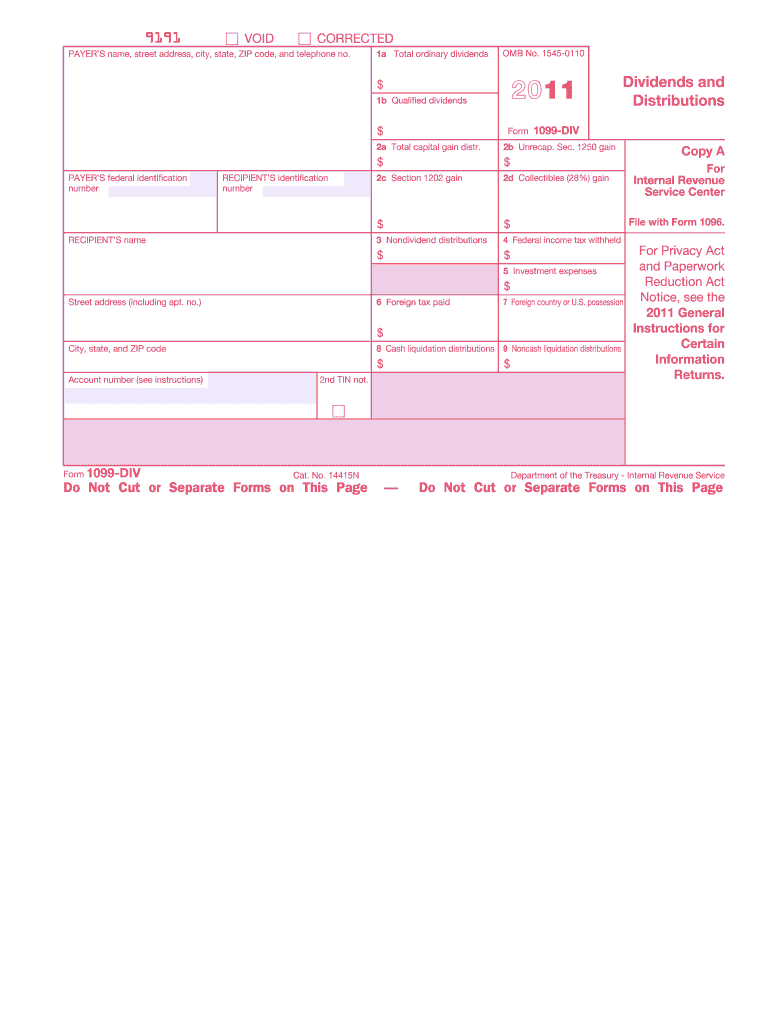

1099-Div Form 2022

1099-Div Form 2022 - Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Web furnish copy b of this form to the recipient by january 31, 2022. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. Web business income deduction under section 199a. If you file electronically, the due date is march 31,. Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. Web you'll need at least $10 in earnings. January 2022 on top right and bottom left corners. Supports 1099 state filings & corrections. File copy a of this form with the irs by february 28, 2022.

All taxable distributions from your fund (including any capital gains) and. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. File copy a of this form with the irs by february 28, 2022. Web sample excel import file: Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. Web business income deduction under section 199a. Web you'll need at least $10 in earnings. If you file electronically, the due date is march 31,. Web furnish copy b of this form to the recipient by january 31, 2022. Both the form and instructions will be updated as needed.

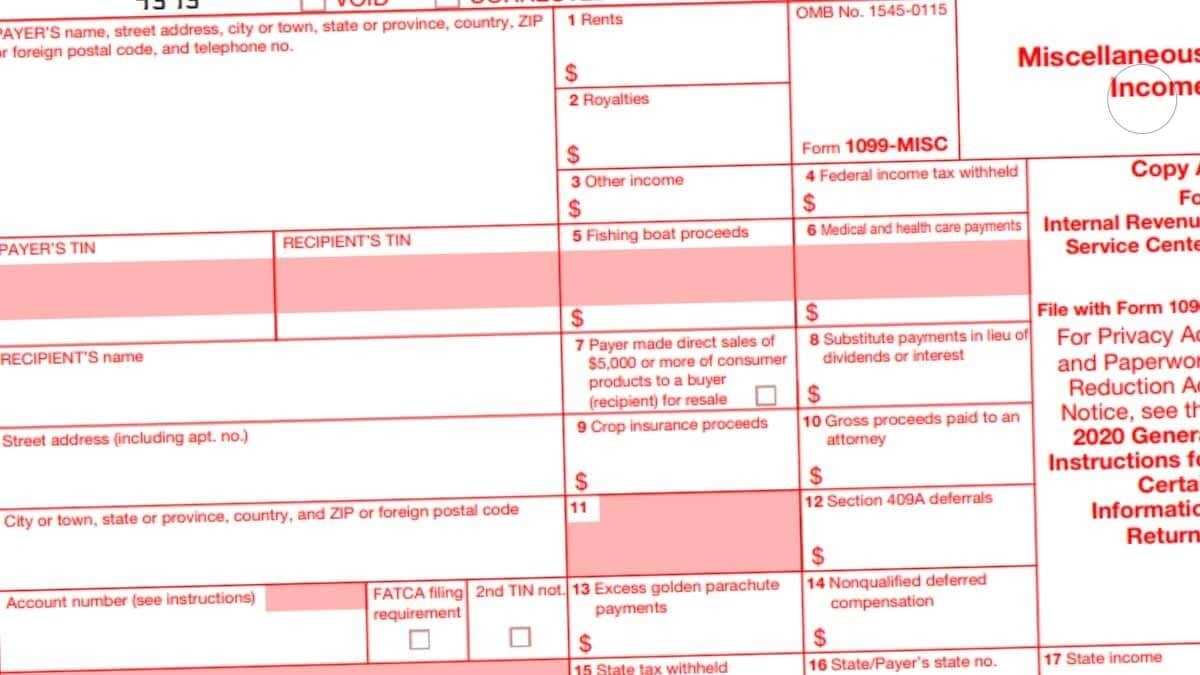

Web sample excel import file: Web furnish copy b of this form to the recipient by january 31, 2022. All taxable distributions from your fund (including any capital gains) and. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. If you have paid capital. January 2022 on top right and bottom left corners. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. File copy a of this form with the irs by february 28, 2022. If you received dividends from more than.

1099 Forms 2021 Printable Calendar Template Printable

If you received dividends from more than. All taxable distributions from your fund (including any capital gains) and. January 2022 on top right and bottom left corners. Web sample excel import file: Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs.

1099DIV Software Software to Print & EFile Form 1099DIV

If you have paid capital. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. All taxable distributions from your fund (including any capital gains) and. Ad most dependable payroll solution for small businesses in 2023 by.

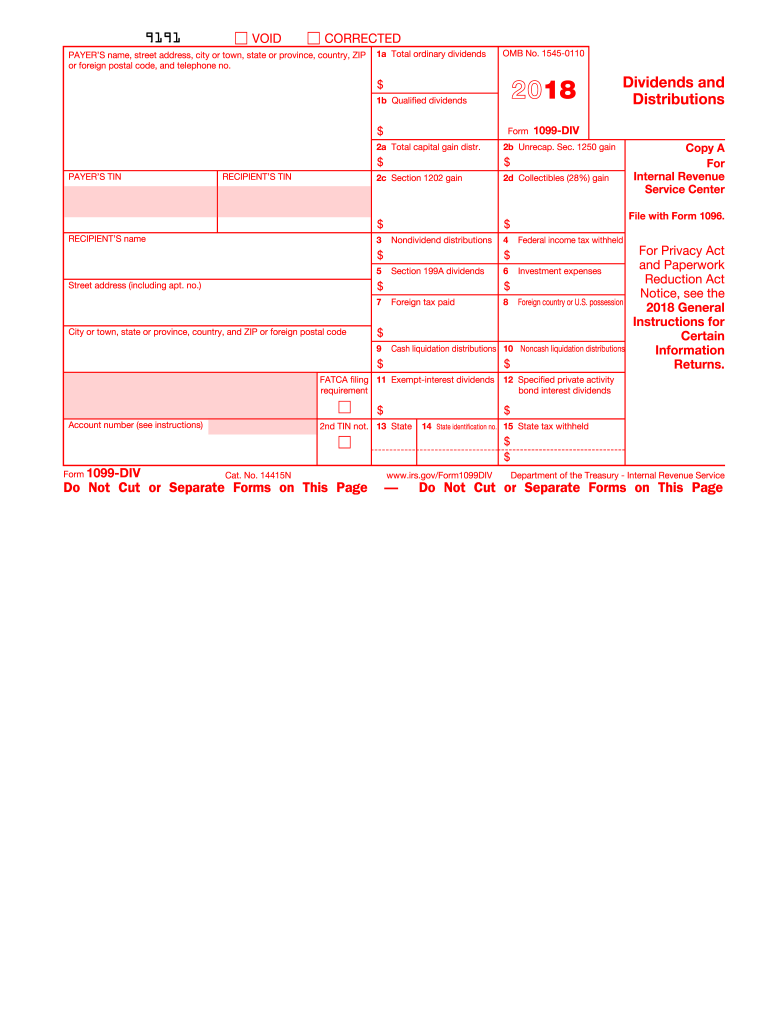

IRS 1099DIV 2018 Fill and Sign Printable Template Online US Legal

File copy a of this form with the irs by february 28, 2022. If you file electronically, the due date is march 31,. Web furnish copy b of this form to the recipient by january 31, 2022. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. All taxable distributions from your fund (including any capital gains).

Instructions For Form 1099 Div Blank Sample to Fill out Online in PDF

Web business income deduction under section 199a. January 2022 on top right and bottom left corners. Both the form and instructions will be updated as needed. All taxable distributions from your fund (including any capital gains) and. Ad most dependable payroll solution for small businesses in 2023 by techradar editors.

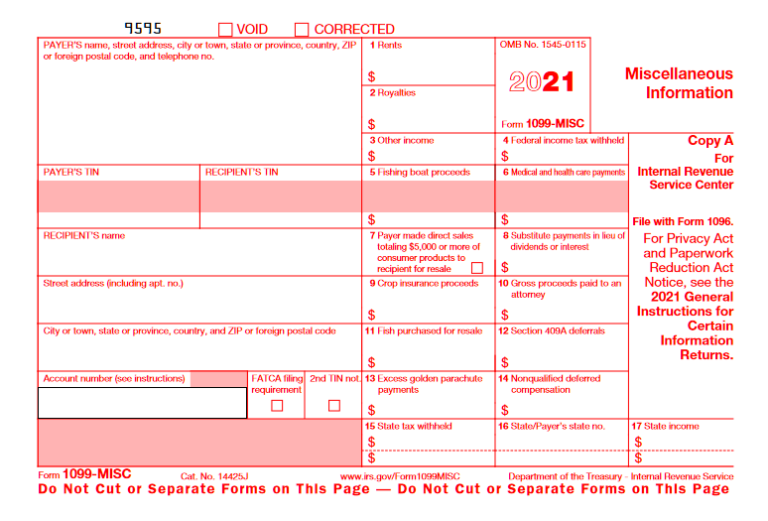

1099 MISC Form 2022 1099 Forms TaxUni

If you have paid capital. All taxable distributions from your fund (including any capital gains) and. Web business income deduction under section 199a. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the.

1099 Div Fillable Form Fill Out and Sign Printable PDF Template signNow

Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. File copy a of this form with the irs by february 28, 2022. Web you'll need at least $10 in earnings. All taxable distributions from your fund (including any capital gains) and. Web business income.

Understanding 1099 Form Samples

Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this.

Irs Form 1099 Ssa Form Resume Examples

January 2022 on top right and bottom left corners. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information.

Form 1099DIV, Dividends and Distributions Definition

January 2022 on top right and bottom left corners. Web furnish copy b of this form to the recipient by january 31, 2022. Web www.irs.gov/form1099misc (if checked) federal income tax withheld $ copy b for recipient this is important tax information and is being furnished to the irs. If you have paid capital. Web sample excel import file:

January 2022 On Top Right And Bottom Left Corners.

Web information for tax filing helpful resources for your income taxes computershare makes gathering your tax information and filing a little easier. Web business income deduction under section 199a. Both the form and instructions will be updated as needed. Web you'll need at least $10 in earnings.

If You Received Dividends From More Than.

File copy a of this form with the irs by february 28, 2022. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Web furnish copy b of this form to the recipient by january 31, 2022. All taxable distributions from your fund (including any capital gains) and.

Web Www.irs.gov/Form1099Misc (If Checked) Federal Income Tax Withheld $ Copy B For Recipient This Is Important Tax Information And Is Being Furnished To The Irs.

Web updated for tax year 2022 • june 2, 2023 08:40 am overview if some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains. If you have paid capital. Web sample excel import file: Supports 1099 state filings & corrections.

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)