1099 Form 2016

1099 Form 2016 - Department of the treasury internal revenue service For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). 2016 general instructions for certain information returns. 2016 general instructions for certain information returns. Web instructions for recipient recipient's identification number. Copy a for internal revenue service center. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this. For internal revenue service center. [4] payers who file 250 or more form 1099 reports must file all of them electronically with the irs. For privacy act and paperwork reduction act notice, see the.

For privacy act and paperwork reduction act notice, see the. 2016 general instructions for certain information returns. 2016 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. Web filing requirements each payer must complete a form 1099 for each covered transaction. Web taxes federal tax forms federal tax forms learn how to get tax forms. Web instructions for recipient recipient's identification number. [4] payers who file 250 or more form 1099 reports must file all of them electronically with the irs. This is important tax information and is being furnished to the internal revenue service. Department of the treasury internal revenue service

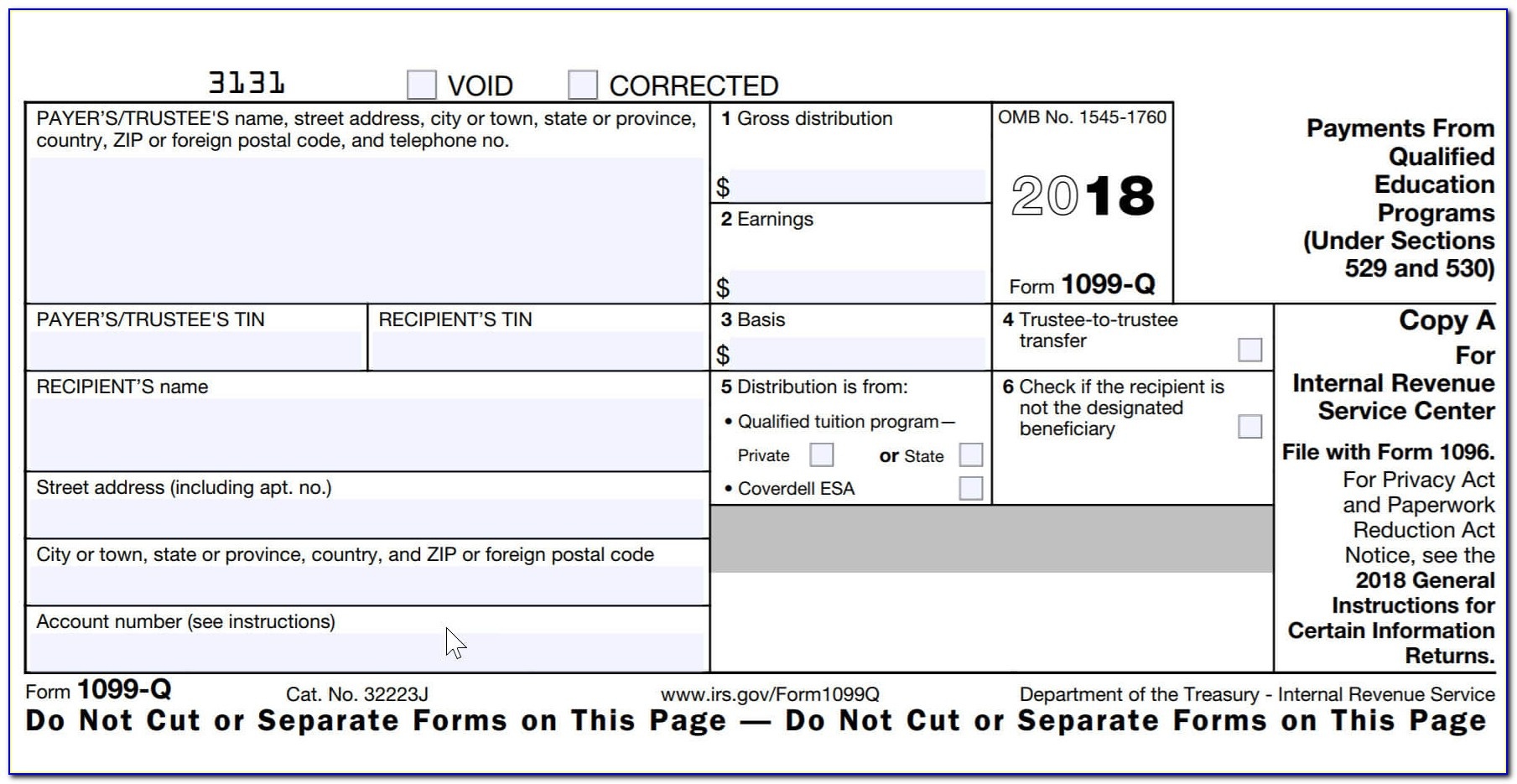

Proceeds from real estate transactions. [4] payers who file 250 or more form 1099 reports must file all of them electronically with the irs. For internal revenue service center. Three or four copies are made: This is important tax information and is being furnished to the internal revenue service. For privacy act and paperwork reduction act notice, see the. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website.due dates. 2016 general instructions for certain information returns. For internal revenue service center. Department of the treasury internal revenue service

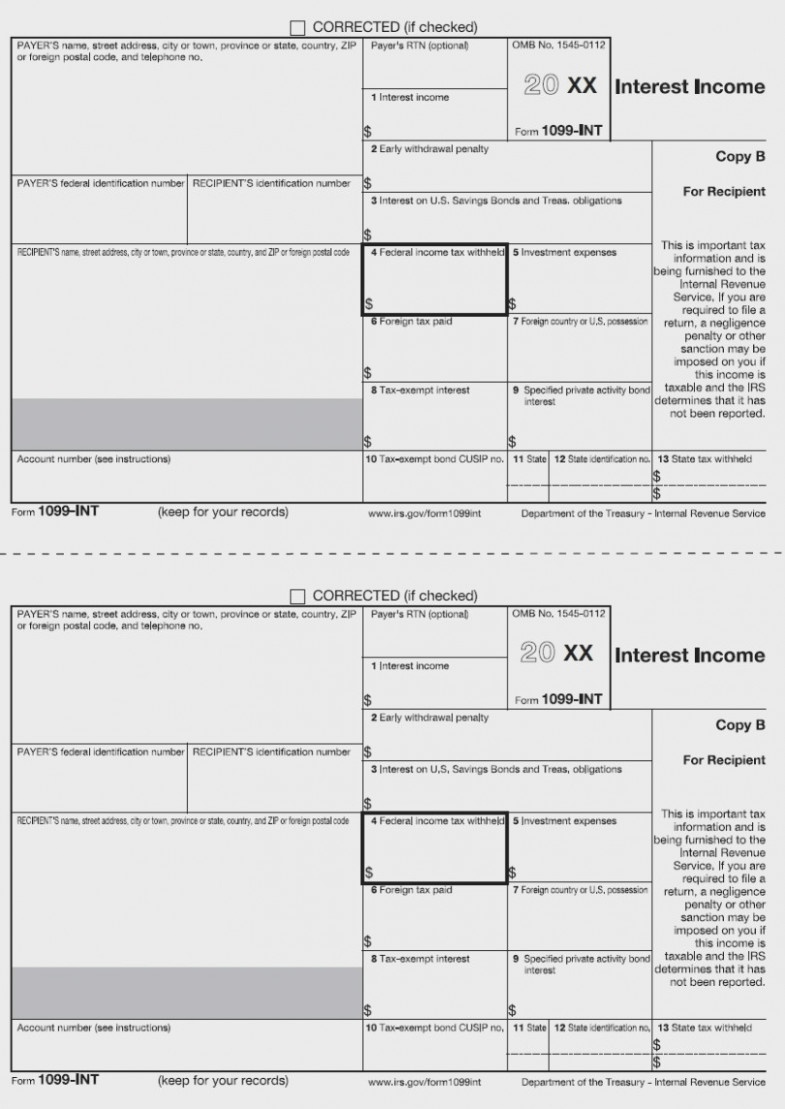

Form 1099INT Interest (2016) Free Download

For privacy act and paperwork reduction act notice, see the. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website.due dates. Web taxes federal tax forms federal tax forms learn how to get tax forms. Department of the treasury internal revenue service Proceeds from.

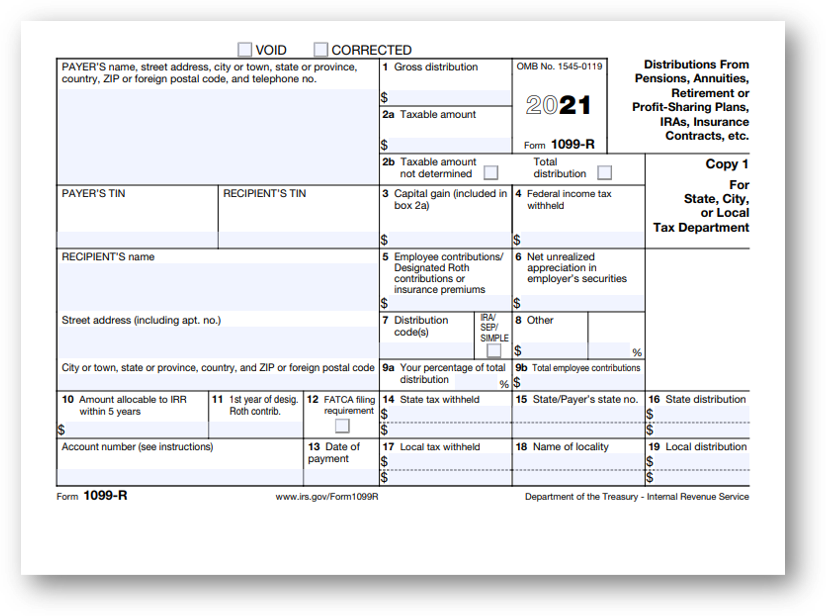

Tax Form Focus IRS Form 1099R » STRATA Trust Company

2016 general instructions for certain information returns. This is important tax information and is being furnished to the internal revenue service. One for the payer, one for the payee, one for the irs, and one for the state tax department, if required. For privacy act and paperwork reduction act notice, see the. For privacy act and paperwork reduction act notice,.

14 Ingenious Ways You Can Realty Executives Mi Invoice And Free

For internal revenue service center. This is important tax information and is being furnished to the internal revenue service. 2016 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. For internal revenue service center.

The Tax Times 2016 Form 1099's are FATCA Compliant

2016 general instructions for certain information returns. Department of the treasury internal revenue service For internal revenue service center. Web filing requirements each payer must complete a form 1099 for each covered transaction. This is important tax information and is being furnished to the internal revenue service.

1099 Int Fill out in PDF Online

Proceeds from real estate transactions. For privacy act and paperwork reduction act notice, see the. Web filing requirements each payer must complete a form 1099 for each covered transaction. For privacy act and paperwork reduction act notice, see the. For internal revenue service center.

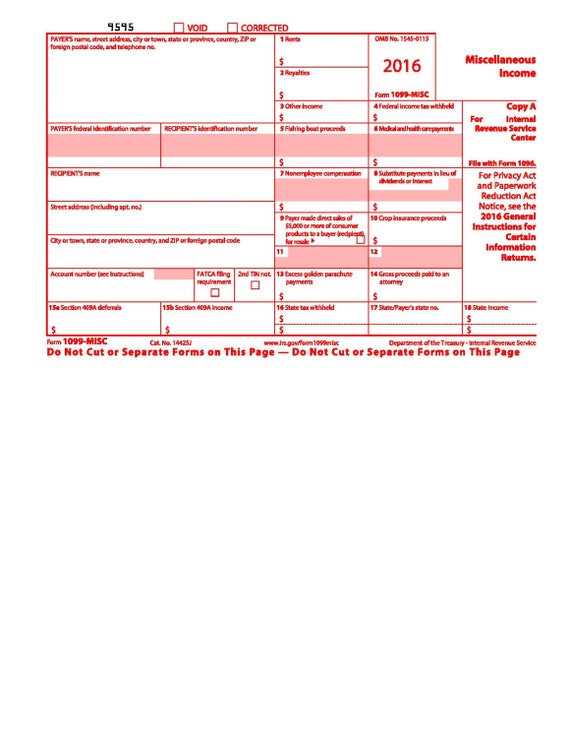

Form Fillable PDF for 2016 1099MISC Form.

For privacy act and paperwork reduction act notice, see the. 2016 general instructions for certain information returns. Copy a for internal revenue service center. For internal revenue service center. For internal revenue service center.

What is a 1099Misc Form? Financial Strategy Center

This is important tax information and is being furnished to the internal revenue service. Web taxes federal tax forms federal tax forms learn how to get tax forms. 2016 general instructions for certain information returns. For internal revenue service center. [4] payers who file 250 or more form 1099 reports must file all of them electronically with the irs.

Free Printable 1099 Form 2016 Free Printable

For internal revenue service center. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Department of the treasury internal revenue service 2016 general instructions for certain information returns. Copy a for internal revenue service center.

1099 Form Template 2016 Templates2 Resume Examples

For privacy act and paperwork reduction act notice, see the. Proceeds from real estate transactions. Copy a for internal revenue service center. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this. For your protection, this form may show only the last four digits of.

NJ Tax Preparer Admits Conspiring To Commit Tax Fraud Thru False Filing

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For privacy act and paperwork reduction act notice, see the. This is important tax information and is being furnished to the internal revenue service. Department of the.

2016 General Instructions For Certain Information Returns.

For internal revenue service center. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website.due dates. Web filing requirements each payer must complete a form 1099 for each covered transaction. Web taxes federal tax forms federal tax forms learn how to get tax forms.

2016 General Instructions For Certain Information Returns.

For privacy act and paperwork reduction act notice, see the. For privacy act and paperwork reduction act notice, see the. One for the payer, one for the payee, one for the irs, and one for the state tax department, if required. 2016 general instructions for certain information returns.

This Is Important Tax Information And Is Being Furnished To The Internal Revenue Service.

For privacy act and paperwork reduction act notice, see the. Copy a for internal revenue service center. Three or four copies are made: For internal revenue service center.

Department Of The Treasury Internal Revenue Service

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this. Proceeds from real estate transactions. [4] payers who file 250 or more form 1099 reports must file all of them electronically with the irs.