1099S 2017 Form

1099S 2017 Form - Proceeds from real estate transactions. Persons with a hearing or speech. Ad access irs tax forms. Downloadable 1099 forms are for. (see instructions for details.) note: For internal revenue service center. For internal revenue service center. If you are required to file a return, a. Web federal, state, or local governments file this form if they made certain types of payments. Payment card and third party network transactions.

Distributions from an hsa, archer msa, or medicare advantage msa. Complete, edit or print tax forms instantly. To order these instructions and. Get ready for tax season deadlines by completing any required tax forms today. Payment card and third party network transactions. Web $ www.irs.gov/form1099r city or town, state or province, country, and zip or foreign postal code omb no. If you are required to file a return, a. For internal revenue service center. Web get federal tax return forms and file by mail. Persons with a hearing or speech.

Ad access irs tax forms. Web form import fields; For internal revenue service center. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Downloadable 1099 forms are for. Web $ www.irs.gov/form1099r city or town, state or province, country, and zip or foreign postal code omb no. Web get federal tax return forms and file by mail. For internal revenue service center. Distributions from an hsa, archer msa, or medicare advantage msa. Get ready for tax season deadlines by completing any required tax forms today.

What Are 1099s and Do I Need to File Them? Singletrack Accounting

Ad access irs tax forms. Complete, edit or print tax forms instantly. Payment card and third party network transactions. If you are required to file a return, a. Web $ www.irs.gov/form1099r city or town, state or province, country, and zip or foreign postal code omb no.

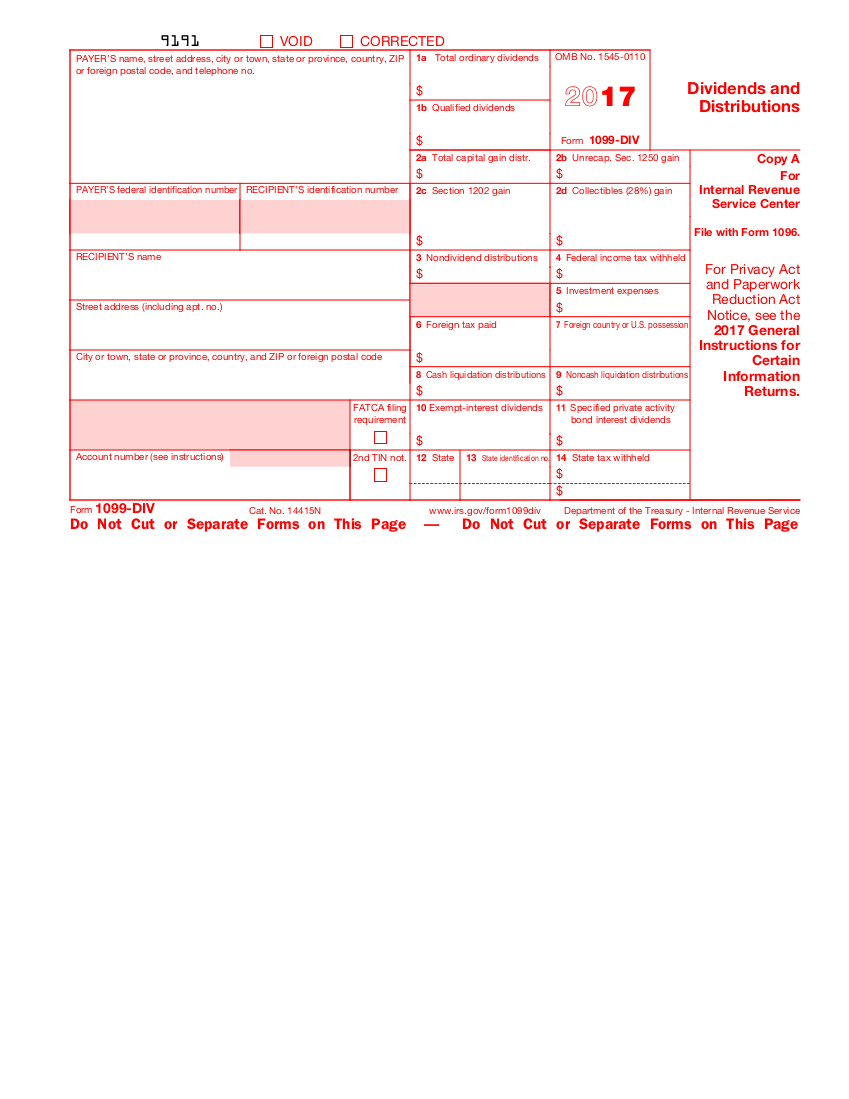

1099DIV (2017) Edit Forms Online PDFFormPro

Web federal, state, or local governments file this form if they made certain types of payments. For internal revenue service center. Complete, edit or print tax forms instantly. Ad shop a wide variety of 1099 tax forms from top brands at staples®. Web $ www.irs.gov/form1099r city or town, state or province, country, and zip or foreign postal code omb no.

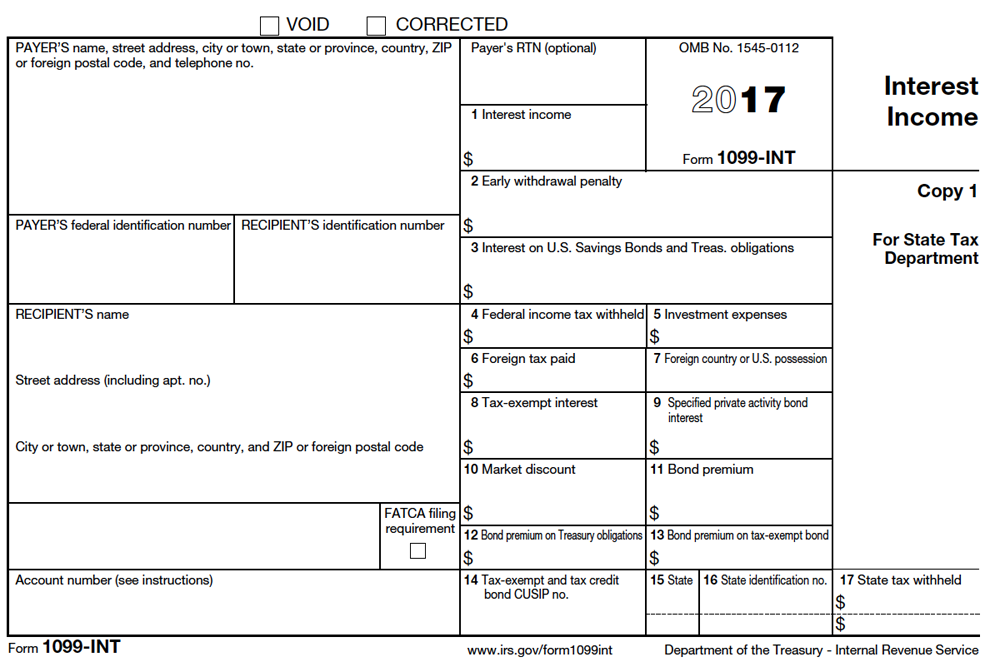

Tax Information Regarding Forms 1099R and 1099INT That We Send

Proceeds from real estate transactions. (see instructions for details.) note: Ad shop a wide variety of 1099 tax forms from top brands at staples®. If you are required to file a return, a. Ad access irs tax forms.

Sample 1099 Government Form Eclipse Corporation

To order these instructions and. Ad shop a wide variety of 1099 tax forms from top brands at staples®. For internal revenue service center. (see instructions for details.) note: Web form import fields;

The 1099s Understanding the Basics of a 1099 Form

For tax years beginning after 2017, applicants claimed as dependents must also prove u.s. If you are required to file a return, a. For internal revenue service center. Get ready for tax season deadlines by completing any required tax forms today. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

The 1099’s are coming… Wind River Financial

If you are required to file a return, a. Ad shop a wide variety of 1099 tax forms from top brands at staples®. Web get federal tax return forms and file by mail. Distributions from an hsa, archer msa, or medicare advantage msa. Persons with a hearing or speech.

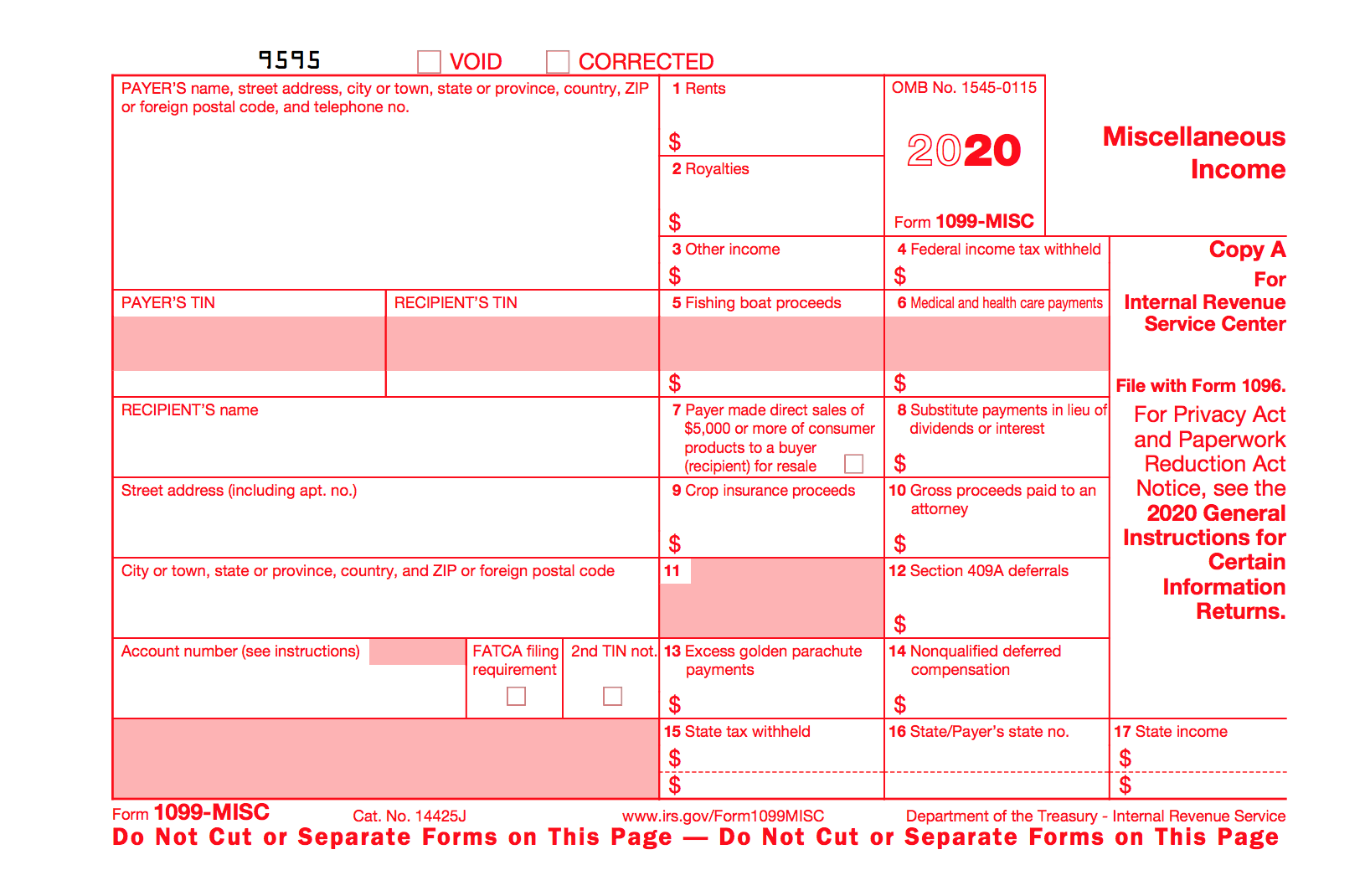

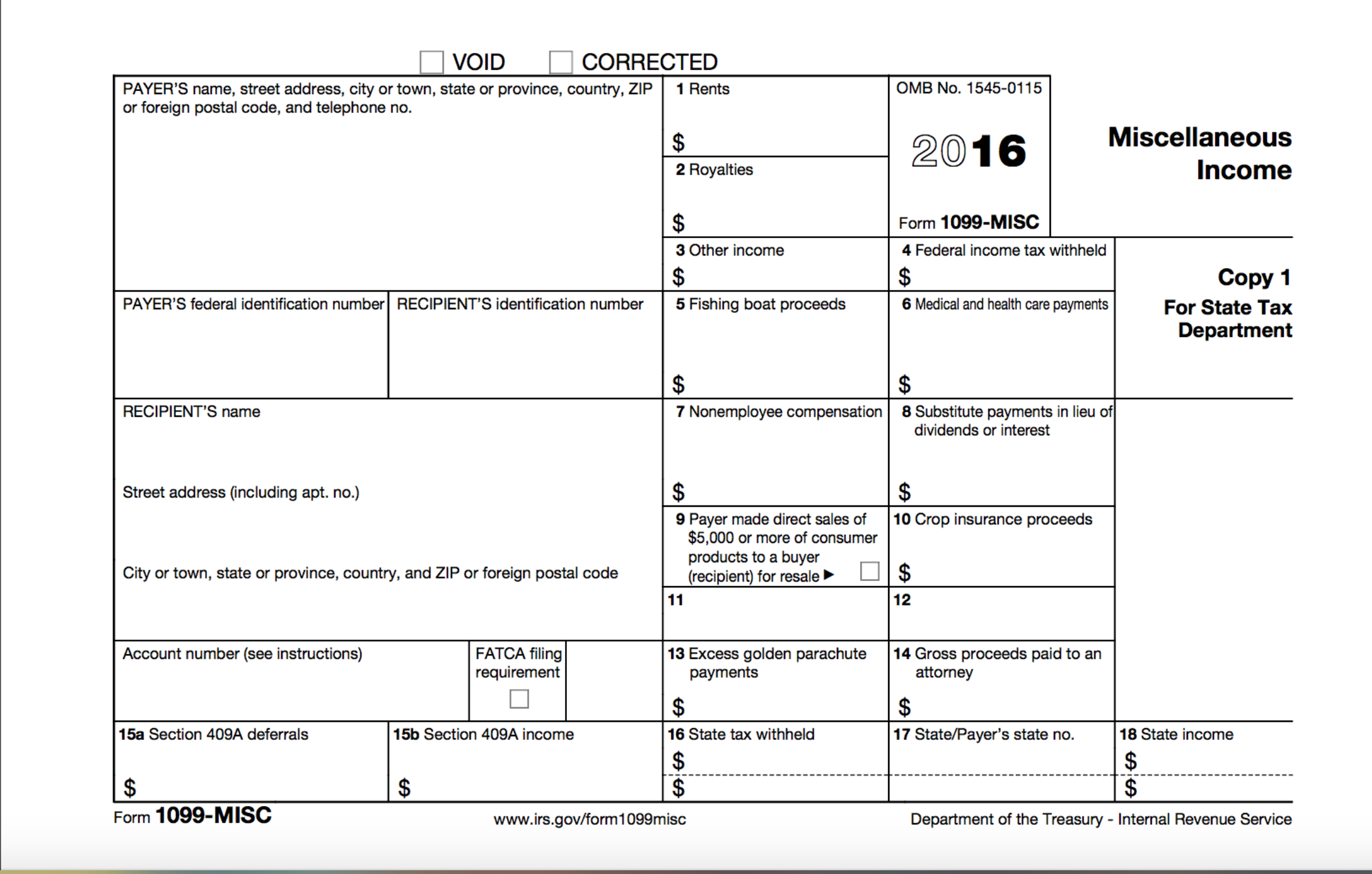

1099MISC tax form DIY guide ZipBooks

For internal revenue service center. Get ready for tax season deadlines by completing any required tax forms today. Web $ www.irs.gov/form1099r city or town, state or province, country, and zip or foreign postal code omb no. Ad access irs tax forms. If you are required to file a return, a.

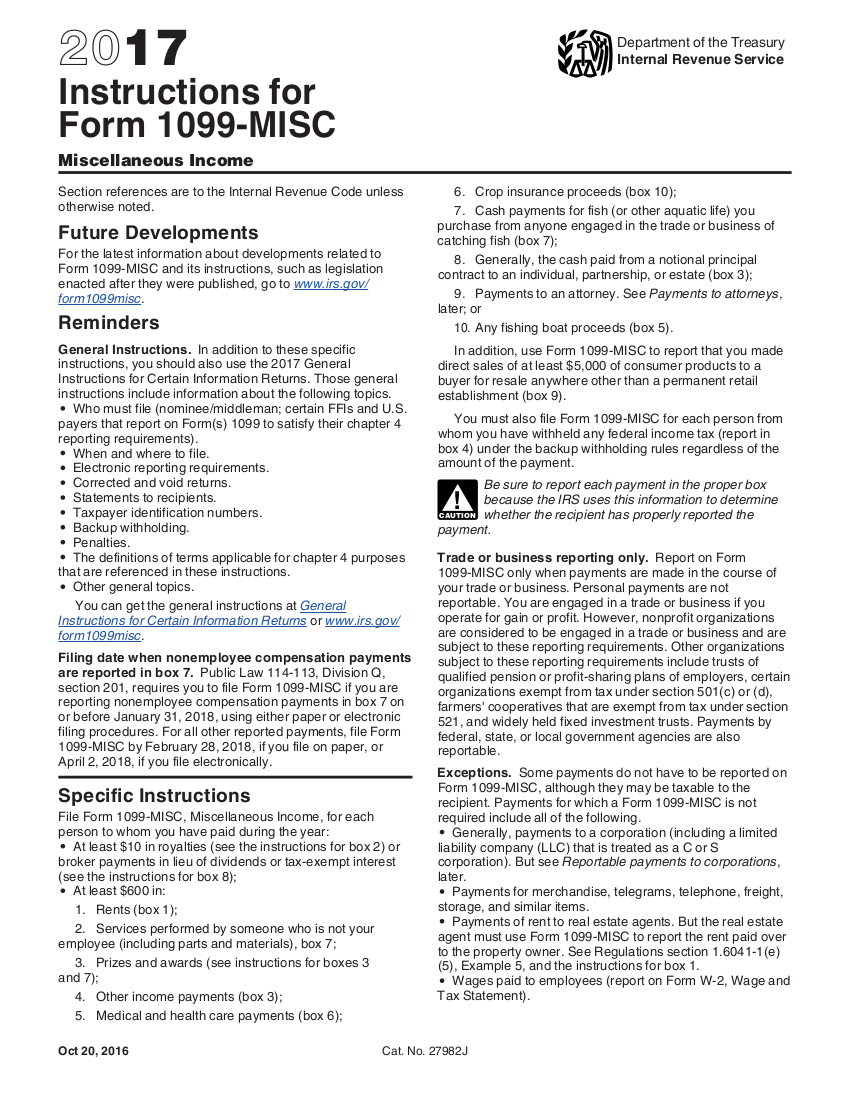

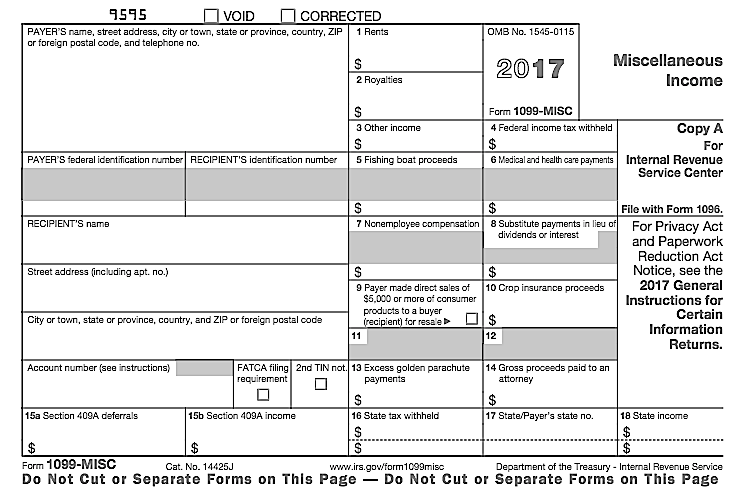

1099 (2017) Instructions Edit Forms Online PDFFormPro

For internal revenue service center. (see instructions for details.) note: Proceeds from real estate transactions. Complete, edit or print tax forms instantly. To order these instructions and.

2018 QuickBooks 1099 MISC 3 Part Preprinted Tax Forms with Envelopes

For tax years beginning after 2017, applicants claimed as dependents must also prove u.s. Ad access irs tax forms. Proceeds from real estate transactions. Persons with a hearing or speech. (see instructions for details.) note:

1099MISC forms The what, when & how Buildium

Ad access irs tax forms. For internal revenue service center. Discover a wide selection of 1099 tax forms at staples®. Ad shop a wide variety of 1099 tax forms from top brands at staples®. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security.

(See Instructions For Details.) Note:

Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Ad access irs tax forms. Distributions from an hsa, archer msa, or medicare advantage msa. For tax years beginning after 2017, applicants claimed as dependents must also prove u.s.

If You Are Required To File A Return, A.

For internal revenue service center. Payment card and third party network transactions. Complete, edit or print tax forms instantly. Web get federal tax return forms and file by mail.

A Sale Of Real Estate Under Threat Or Imminence Of Seizure, Requisition, Or Condemnation Is Generally A Reportable Transaction.

For internal revenue service center. Downloadable 1099 forms are for. Get ready for tax season deadlines by completing any required tax forms today. Web federal, state, or local governments file this form if they made certain types of payments.

Web $ Www.irs.gov/Form1099R City Or Town, State Or Province, Country, And Zip Or Foreign Postal Code Omb No.

Persons with a hearing or speech. Proceeds from real estate transactions. Ad shop a wide variety of 1099 tax forms from top brands at staples®. Discover a wide selection of 1099 tax forms at staples®.