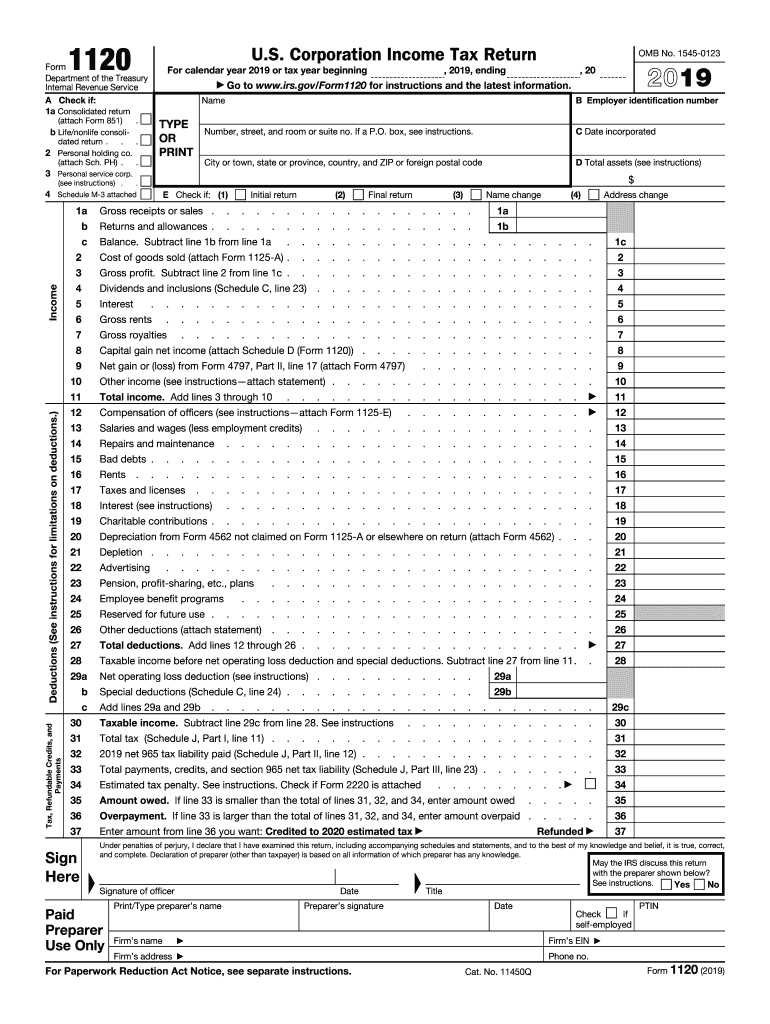

1120 Form 2019

1120 Form 2019 - The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. Corporation income tax payment voucher: Do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. After filing form 2553, you should have received confirmation that form 2553 was accepted. Number, street, and room or suite no. Corporation income tax payment voucher: Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. For instructions and the latest information. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020.

Do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. Web form 1120 department of the treasury internal revenue service u.s. Corporation income tax payment voucher: For instructions and the latest information. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020. For instructions and the latest information. If the election is made, the corporation is treated as making a payment against tax by the amount of the credit. Web instructions for form 1120 u.s. Corporation income tax payment voucher:

Web corporation, and the instructions for form 2553. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020. Corporation income tax payment voucher: Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Department of the treasury internal revenue service. Corporation income tax payment voucher: Do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. For instructions and the latest information. For instructions and the latest information.

2019 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Department of the treasury internal revenue service. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web.

Corporate tax returns are latest forms to get IRS onceover Don't

Number, street, and room or suite no. Corporation income tax payment voucher: Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Corporation income tax payment voucher: After filing form 2553, you should have received confirmation that form 2553 was accepted.

Editable IRS Form 1120S (Schedule K1) 2018 2019 Create A Digital

If the election is made, the corporation is treated as making a payment against tax by the amount of the credit. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Corporation income tax payment voucher: Do not file this form unless the corporation has filed or is attaching form 2553 to elect to be.

1120 tax table

The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. Corporation income tax payment voucher: Corporation income tax payment voucher: Web form 1120 department of the treasury internal revenue service u.s. For instructions and the latest information.

Editable IRS Form 1120 (Schedule M3) 2018 2019 Create A Digital

For instructions and the latest information. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions. Corporation income tax payment voucher: Do not file this form unless the corporation has filed or is attaching form 2553.

Editable IRS Form 1120PC 2018 2019 Create A Digital Sample in PDF

Department of the treasury internal revenue service. For instructions and the latest information. Web instructions for form 1120 u.s. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced manufacturing investment as a deemed payment. Web form 1120n, 2019.

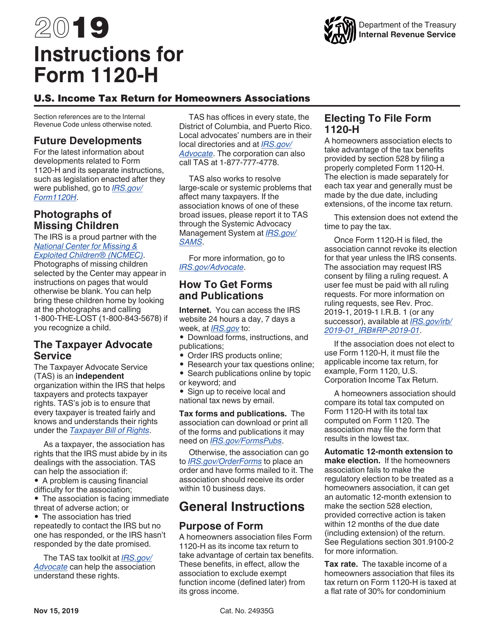

Download Instructions for IRS Form 1120H U.S. Tax Return for

Income tax return for an s corporation. Web instructions for form 1120 u.s. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. For instructions and the latest information. Web form 1120 department of the treasury internal revenue service u.s.

Draft 2019 Form 1120S Instructions Adds New K1 Statements for §199A

Department of the treasury internal revenue service. Corporation income tax payment voucher: Web form 1120 department of the treasury internal revenue service u.s. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020. Income tax return for an s corporation.

Form 1120 Fill Out and Sign Printable PDF Template signNow

Number, street, and room or suite no. Corporation income tax payment voucher: Income tax return for an s corporation. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020.

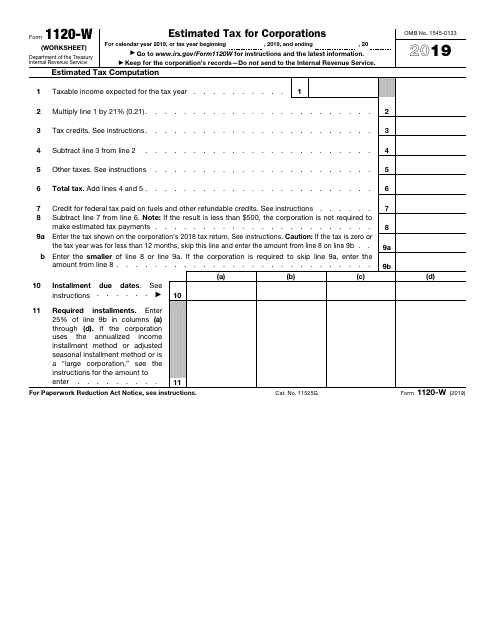

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

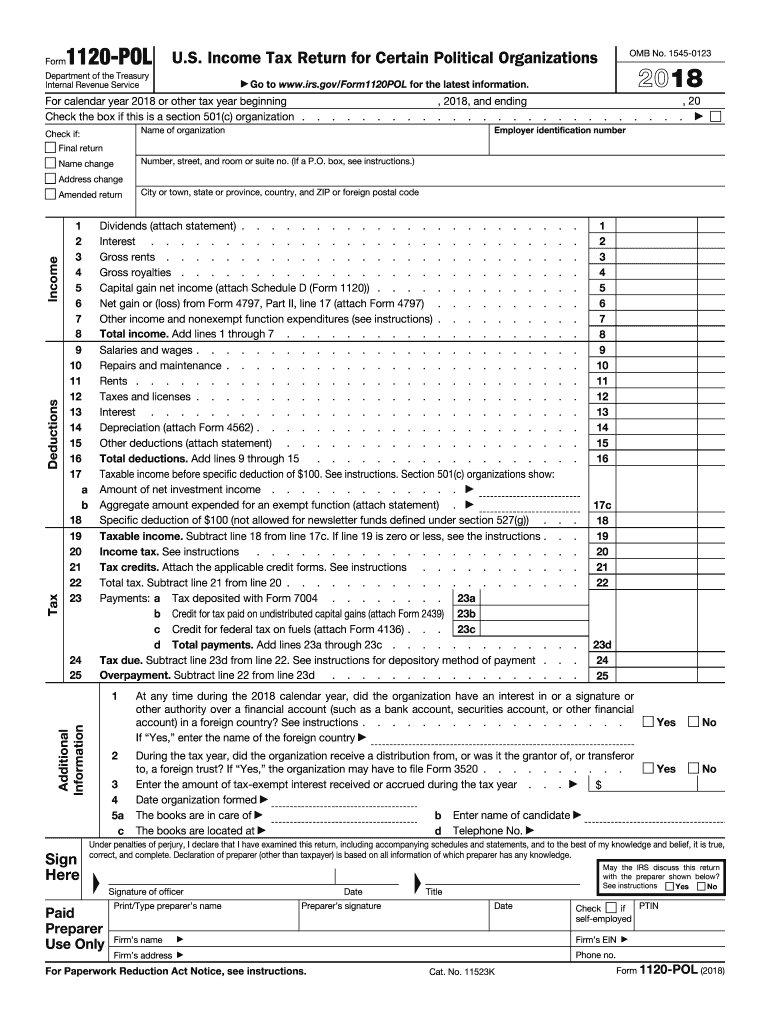

Do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. Web information about form 1120, u.s. The changes to the form and schedule aim to improve the quality of the information reported.

Web Instructions For Form 1120 U.s.

Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Income tax return for an s corporation. Web form 1120 department of the treasury internal revenue service u.s. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020.

Number, Street, And Room Or Suite No.

Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced manufacturing investment as a deemed payment. Corporation income tax payment voucher: Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. For instructions and the latest information.

Web Information About Form 1120, U.s.

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Corporation income tax payment voucher:

After Filing Form 2553, You Should Have Received Confirmation That Form 2553 Was Accepted.

Web corporation, and the instructions for form 2553. For instructions and the latest information. If the election is made, the corporation is treated as making a payment against tax by the amount of the credit. Corporation income tax payment voucher: