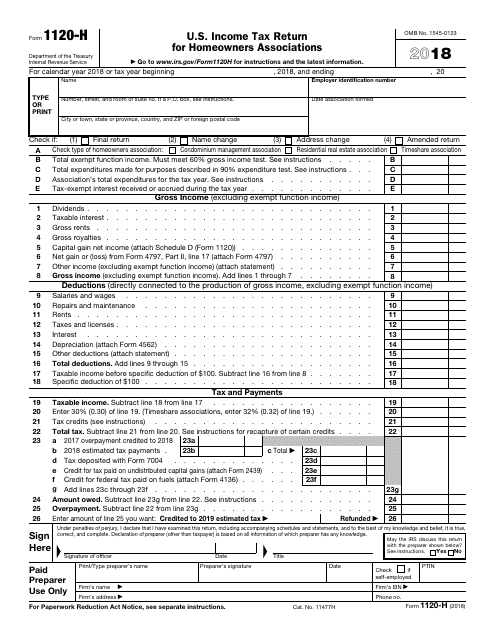

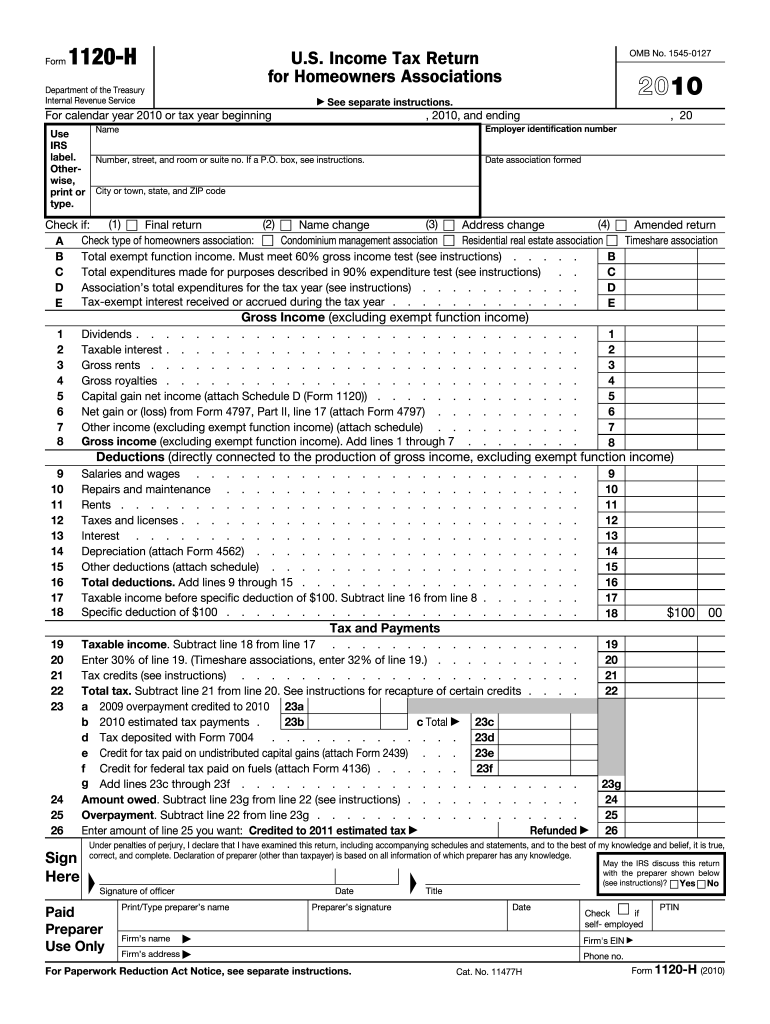

1120-H Tax Form

1120-H Tax Form - The tax rate for timeshare associations is 32%. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. The form requests information related to amount of money received and spent on. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. Income tax return for homeowners associations. It's an important tax form because it provides several specific tax benefits. Use the following irs center address. Compared to form 1120, this form allows for a more simplified hoa tax filing process. Web it appears you don't have a pdf plugin for this browser.

A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. Web it appears you don't have a pdf plugin for this browser. The form requests information related to amount of money received and spent on. From within your taxact return ( online or desktop), click federal. Income tax return for homeowners associations. It will often provide a lower audit risk than the alternative form 1120. These benefits, in effect, allow the association to exclude exempt function income from its. Use the following irs center address.

Number, street, and room or suite no. Click basic information in the federal quick q&a topics menu to expand, then click special filings. These rates apply to both ordinary income and capital gains. These benefits, in effect, allow the association to exclude exempt function income from its. Web it appears you don't have a pdf plugin for this browser. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. The tax rate for timeshare associations is 32%. If the association's principal business or office is located in. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. This form is specifically designated for “qualifying” homeowners’ associations.

Fillable Schedule H (Form 1120) Section 280h Limitations For A

If the association's principal business or office is located in. It's an important tax form because it provides several specific tax benefits. Number, street, and room or suite no. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. For calendar year 2022 or tax year beginning,.

IRS Form 1120H Download Fillable PDF or Fill Online U.S. Tax

Income tax return for homeowners associations. The form requests information related to amount of money received and spent on. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Click basic information in the federal quick q&a topics menu to expand, then click special filings. Web it appears you don't have a pdf plugin for.

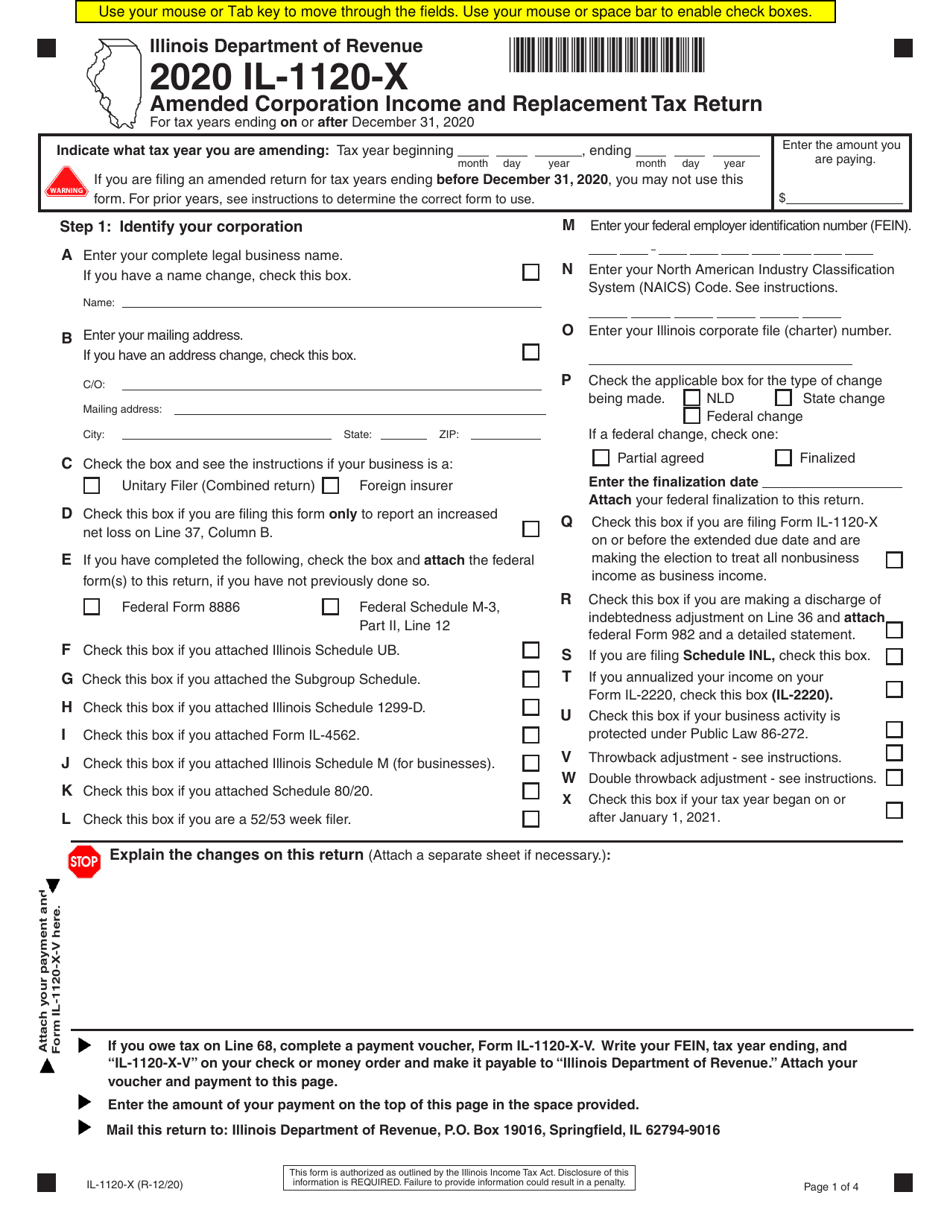

Form IL1120X Download Fillable PDF or Fill Online Amended Corporation

It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. If the association's principal business or office is located in. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. Use the following irs center address. Compared to form 1120, this form allows for a more.

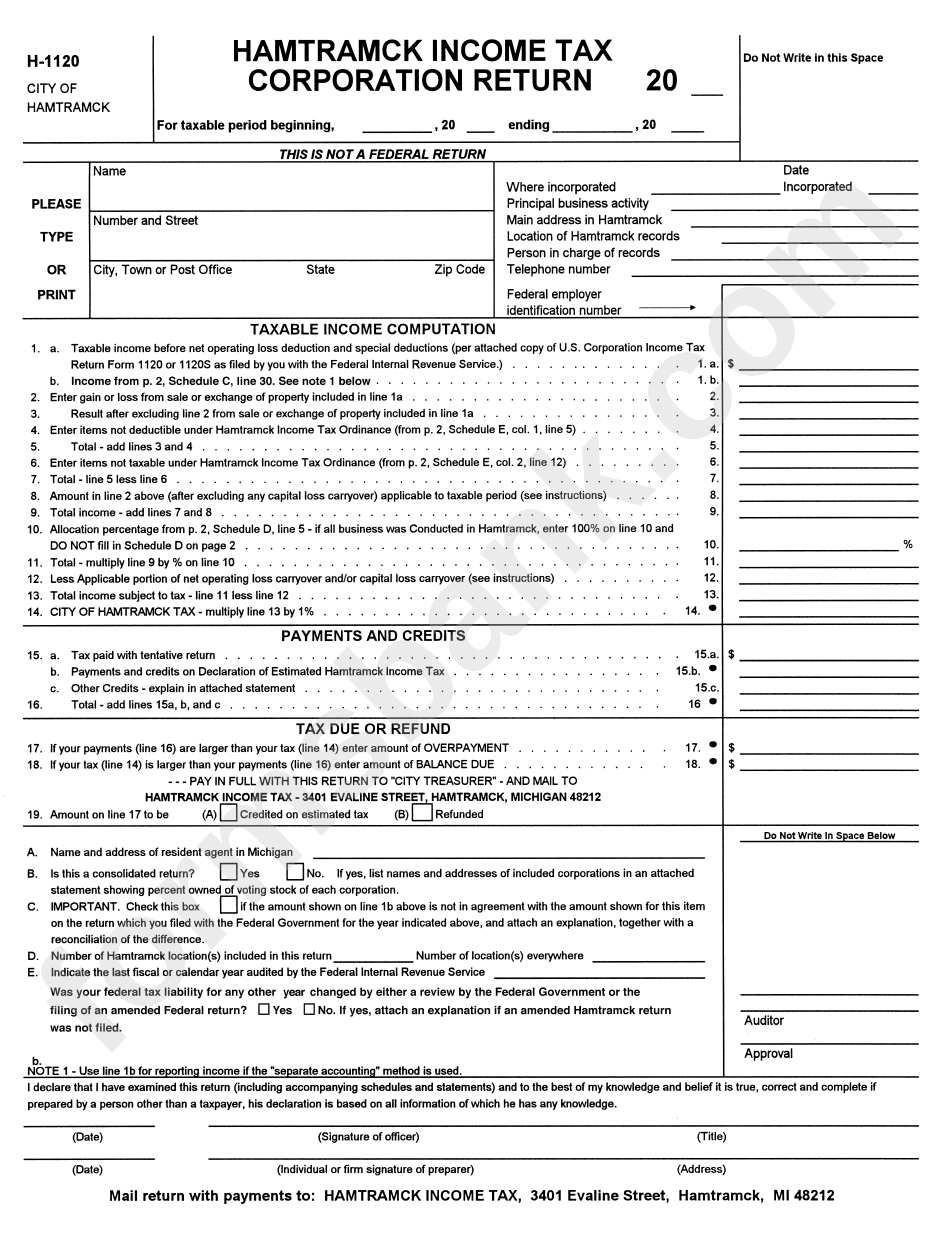

Form H1120 Hamtramck Tax Corporation Return printable pdf

If the association's principal business or office is located in. Click basic information in the federal quick q&a topics menu to expand, then click special filings. It will often provide a lower audit risk than the alternative form 1120. The tax rate for timeshare associations is 32%. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the.

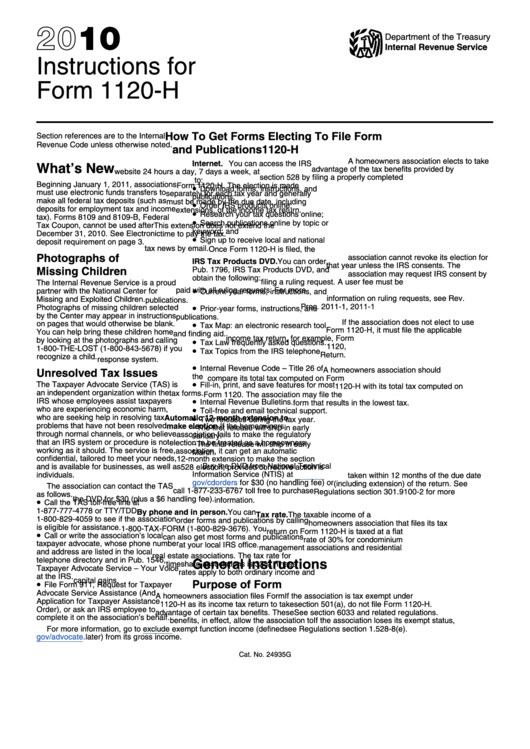

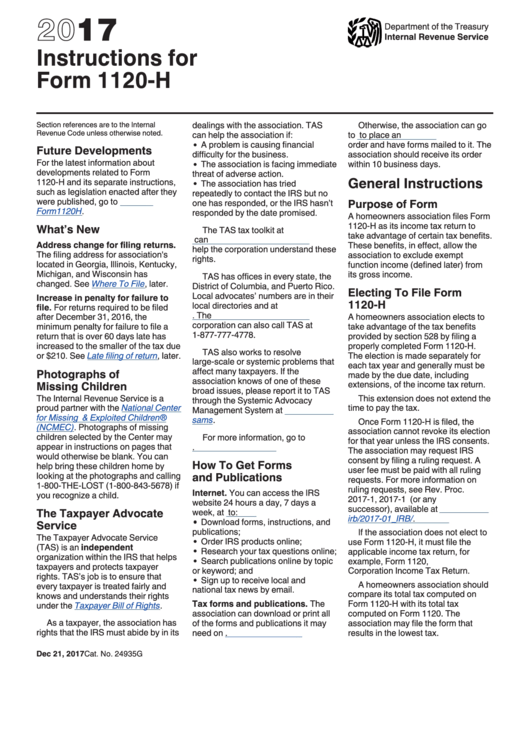

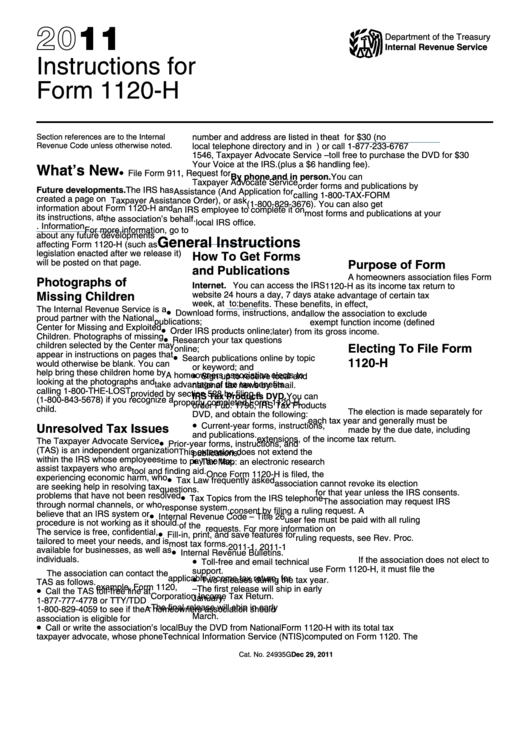

Instructions For Form 1120H U.s. Tax Return For Homeowners

For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. These benefits, in effect, allow the association to exclude exempt function income from its. Income tax return for homeowners associations. If the association's principal business or office is.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

Web it appears you don't have a pdf plugin for this browser. The tax rate for timeshare associations is 32%. Number, street, and room or suite no. If the association's principal business or office is located in. Use the following irs center address.

2010 Form IRS 1120H Fill Online, Printable, Fillable, Blank PDFfiller

Compared to form 1120, this form allows for a more simplified hoa tax filing process. Number, street, and room or suite no. The form requests information related to amount of money received and spent on. This form is specifically designated for “qualifying” homeowners’ associations. If the association's principal business or office is located in.

Instructions For Form 1120H U.s. Tax Return For Homeowners

These rates apply to both ordinary income and capital gains. It's an important tax form because it provides several specific tax benefits. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. If.

Instructions For Form 1120H U.s. Tax Return For Homeowners

This form is specifically designated for “qualifying” homeowners’ associations. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the.

Gallery of 1120 H Tax form Awesome This is How Dmv Driver Medical

It's an important tax form because it provides several specific tax benefits. Number, street, and room or suite no. Use the following irs center address. The form requests information related to amount of money received and spent on. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code.

Use The Following Irs Center Address.

The form requests information related to amount of money received and spent on. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Compared to form 1120, this form allows for a more simplified hoa tax filing process. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print.

It Will Often Provide A Lower Audit Risk Than The Alternative Form 1120.

It's an important tax form because it provides several specific tax benefits. The tax rate for timeshare associations is 32%. Click basic information in the federal quick q&a topics menu to expand, then click special filings. Income tax return for homeowners associations.

Income Tax Return For Homeowners Associations Go To Www.irs.gov/Form1120H For Instructions And The Latest Information.

It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. If the association's principal business or office is located in. Number, street, and room or suite no. A homeowners association files this form as its income tax return to take advantage of certain tax benefits.

From Within Your Taxact Return ( Online Or Desktop), Click Federal.

This form is specifically designated for “qualifying” homeowners’ associations. Web it appears you don't have a pdf plugin for this browser. These benefits, in effect, allow the association to exclude exempt function income from its. These rates apply to both ordinary income and capital gains.