1120 S Form 2020

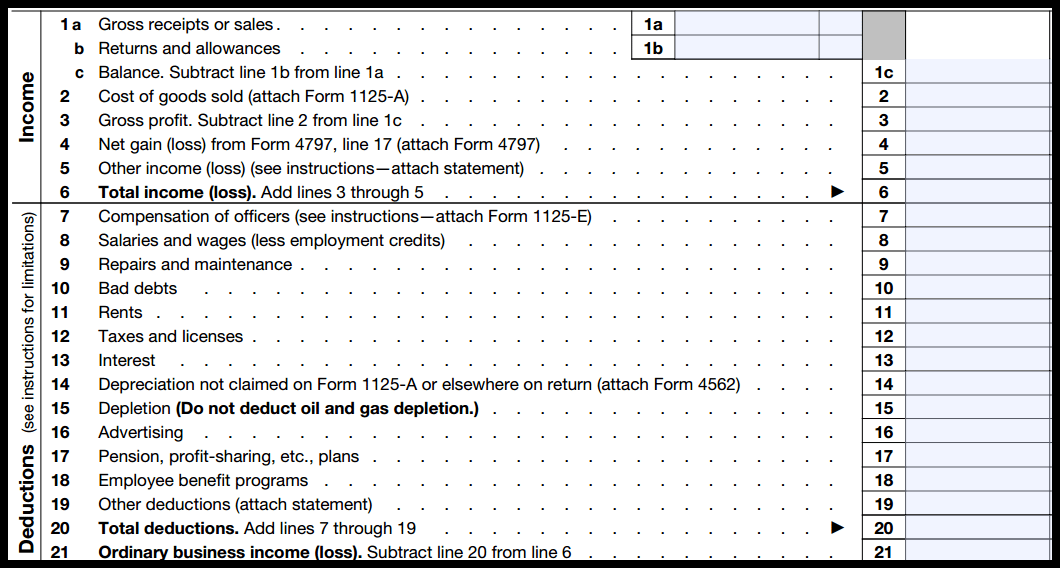

1120 S Form 2020 - Web form 1120s (u.s. Upload, modify or create forms. Web form 1120 s is crucial for several reasons. Complete, edit or print tax forms instantly. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. Try it for free now! Web what’s new increase in penalty for failure to file. Get everything done in minutes. Start completing the fillable fields and. Web for taxable years beginning on or after january 1, 2014, the internal revenue service (irs) allows corporations with at least $10 million but less than $50 million in total assets at tax.

Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has increased to the. First, it reports your income. 8/27/20) due by the 15th day of the third month following the close of the taxable year. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Get everything done in minutes. Second, it lets the irs in on what percentage of the operation belongs to company. Start completing the fillable fields and. Upload, modify or create forms. Income tax return for an s corporation) is available in turbotax business.

For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has increased to the. When you first start a return in turbotax business, you'll be asked. Use the following irs center address:. 3095 state of south carolina s corporation income tax. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Try it for free now! 8/27/20) due by the 15th day of the third month following the close of the taxable year. Income tax return for an s corporation) is available in turbotax business. Web for taxable years beginning on or after january 1, 2014, the internal revenue service (irs) allows corporations with at least $10 million but less than $50 million in total assets at tax. Web form 1120s (u.s.

2020 Form IRS 1120S Fill Online, Printable, Fillable, Blank pdfFiller

Web what’s new increase in penalty for failure to file. 8/27/20) due by the 15th day of the third month following the close of the taxable year. Complete, edit or print tax forms instantly. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Upload, modify or create forms.

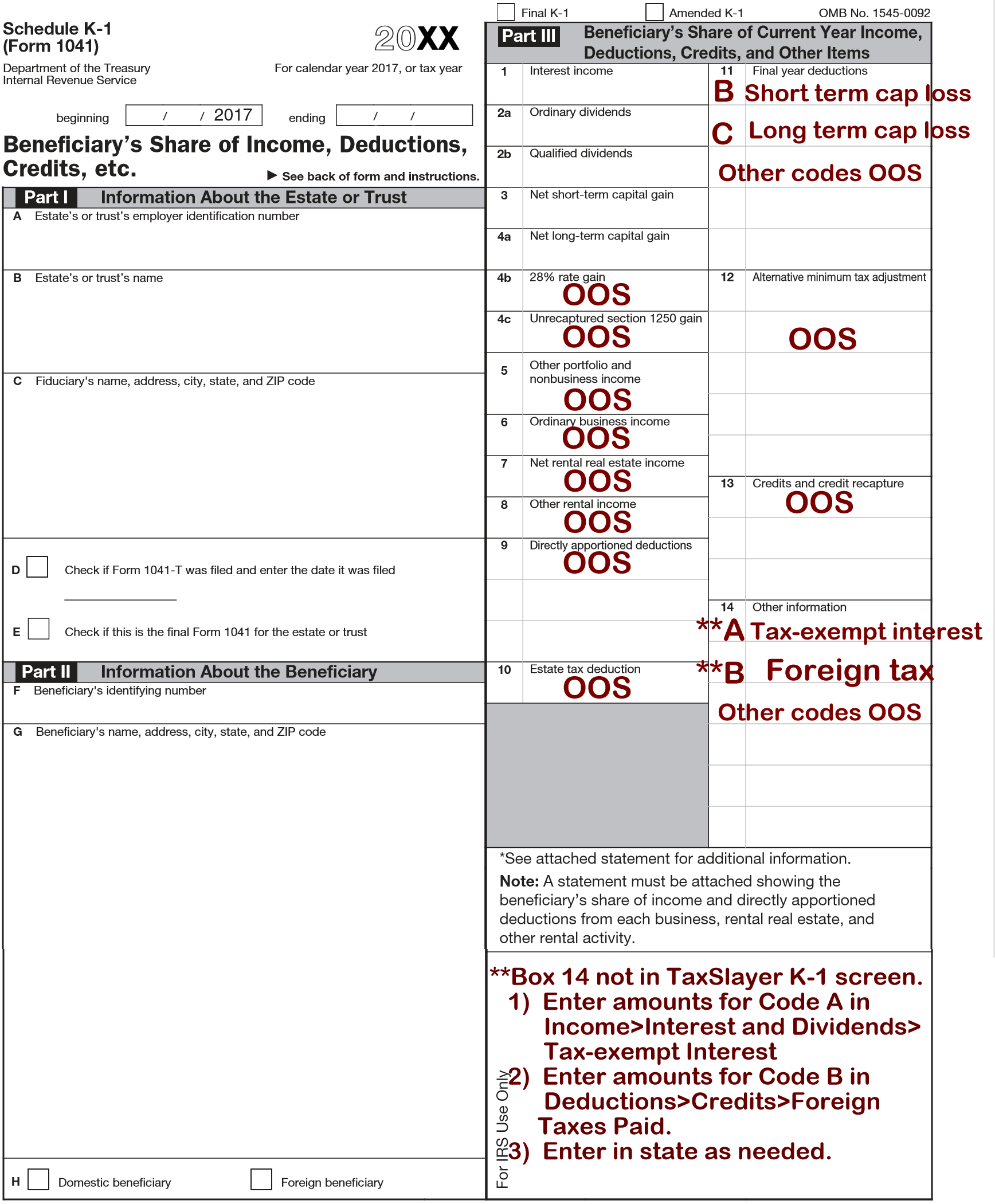

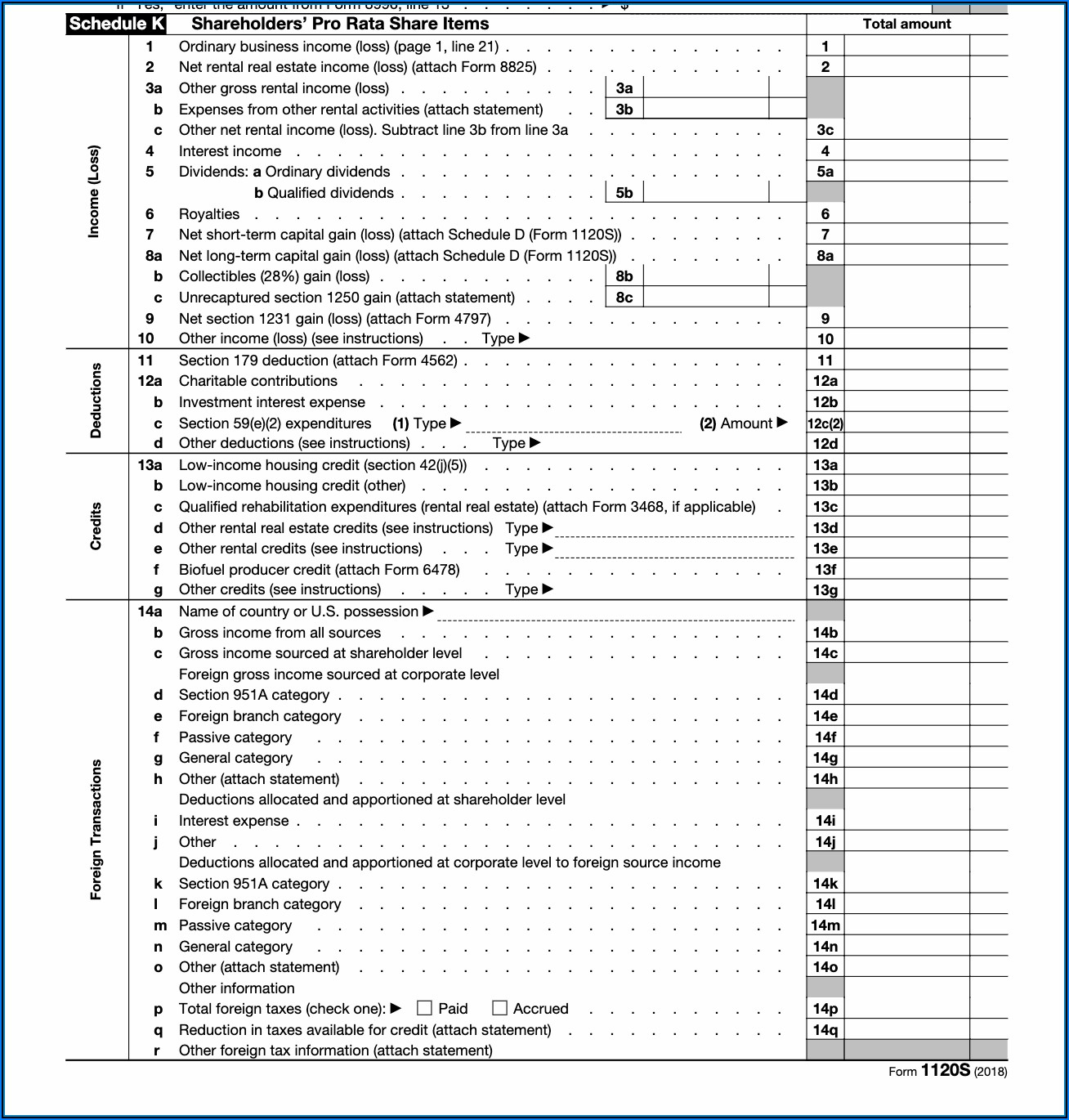

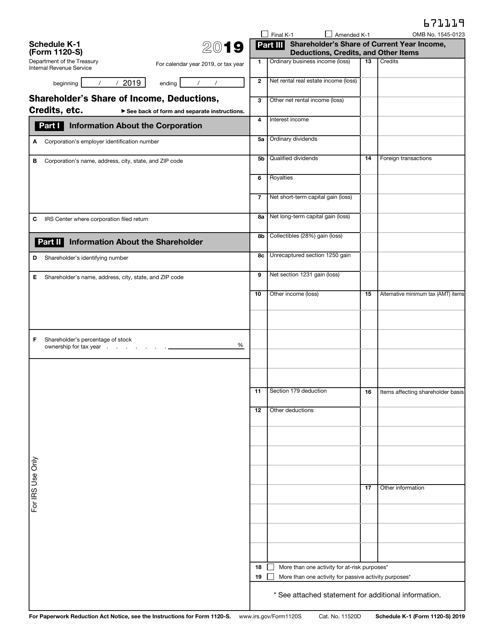

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

Get everything done in minutes. Income tax return for an s corporation) is available in turbotax business. Ad easy guidance & tools for c corporation tax returns. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web form 1120s (u.s.

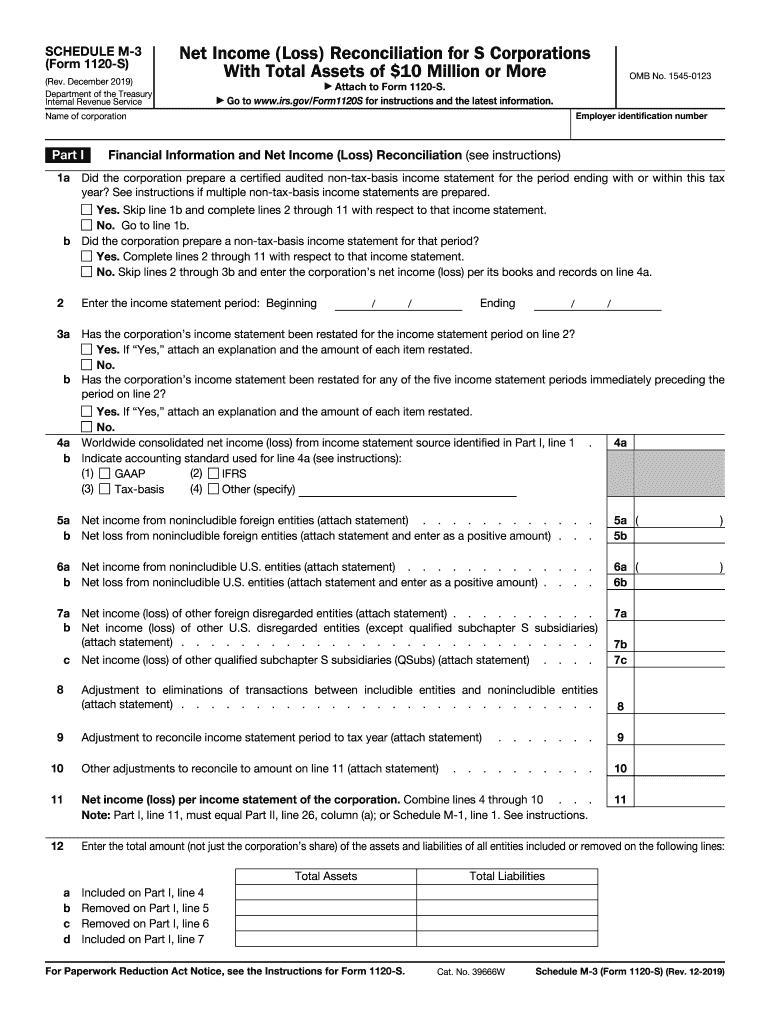

20192021 Form IRS 1120S Schedule M3 Fill Online, Printable

Income tax return for an s corporation) is available in turbotax business. Web what’s new increase in penalty for failure to file. Start completing the fillable fields and. Use get form or simply click on the template preview to open it in the editor. 3095 state of south carolina s corporation income tax.

1120s 2014 Form Form Resume Examples goVLr409va

First, it reports your income. Income tax return for an s corporation by the 15th day of the third month after the end of its tax year. Upload, modify or create forms. Ad easy guidance & tools for c corporation tax returns. Income tax return for an s corporation do not file this form unless the corporation has filed or.

2014 Form 1120s K 1 Form Resume Examples goVLaee2va

3095 state of south carolina s corporation income tax. Web generally, the credit for qualified sick and family leave wages as enacted under the families first coronavirus response act (the ffcra), as amended and extended by the covid. Use the following irs center address:. Web what’s new increase in penalty for failure to file. Use get form or simply click.

IRS Form 1120S (2020)

If the corporation's principal business, office, or agency is located in: For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has increased to the. When you first start a return in turbotax business, you'll be asked. Complete, edit or print tax forms instantly. Income tax return for an.

IRS Form 1120S Definition, Download, & 1120S Instructions

Web what’s new increase in penalty for failure to file. If the corporation's principal business, office, or agency is located in: Use the following irs center address:. Get everything done in minutes. Web form 1120s (u.s.

File 1120 Extension Online Corporate Tax Extension Form for 2020

3095 state of south carolina s corporation income tax. 8/27/20) due by the 15th day of the third month following the close of the taxable year. Ad easy guidance & tools for c corporation tax returns. Income tax return for an s corporation by the 15th day of the third month after the end of its tax year. Web generally,.

2020 Form IRS Instructions 1120 Fill Online, Printable, Fillable, Blank

Web what’s new increase in penalty for failure to file. And the total assets at the end of the tax year are: Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. When you first start.

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. Benefits of electronic filing convenience •. Check out how easy it is to complete and esign documents online using fillable templates and a powerful.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Web form 1120 s is crucial for several reasons. Get everything done in minutes. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. And the total assets at the end of the tax year are:

For Returns Due In 2023, The Minimum Penalty For Failure To File A Return That Is More Than 60 Days Late Has Increased To The.

Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Benefits of electronic filing convenience •. Complete, edit or print tax forms instantly. This form is for income.

Try It For Free Now!

Income tax return for an s corporation) is available in turbotax business. Income tax return for an s corporation by the 15th day of the third month after the end of its tax year. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. Upload, modify or create forms.

Start Completing The Fillable Fields And.

Web what’s new increase in penalty for failure to file. Web form 1120s (u.s. Ad easy guidance & tools for c corporation tax returns. If the corporation's principal business, office, or agency is located in: