1120S Form 2020

1120S Form 2020 - How you can submit the irs 1120s online: Ad get ready for tax season deadlines by completing any required tax forms today. Easy guidance & tools for c corporation tax returns. We offer fillable and editable templates for different years. Web follow these tips to accurately and quickly submit irs 1120s. Web the 2020 form 100s may also be used if both of the following apply: Web generally, the credit for qualified sick and family leave wages as enacted under the families first coronavirus response act (the ffcra), as amended and extended by the covid. 1) a shareholder that is a. Complete, edit or print tax forms instantly. Web irs form 1120s is the tax return used by domestic corporations that have made an election to be treated as s corporations for that tax year.

Web generally, the credit for qualified sick and family leave wages as enacted under the families first coronavirus response act (the ffcra), as amended and extended by the covid. Select the button get form to open it and start modifying. Get the needed blank, complete it in pdf format and instantly submit online! Get the essential forms to prepare and file form 1120s. How you can submit the irs 1120s online: (i) if the llc is to be treated as a. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Income tax return for an s corporation) is available in turbotax business. 1) a shareholder that is a. We offer fillable and editable templates for different years.

Complete, edit or print tax forms instantly. Income tax return for an s corporation) is available in turbotax business. Web for calendar year ending december 31, 2020 or other tax year beginning 2020 and ending check box if amended. Web form 1120s department of the treasury internal revenue service u.s. Income tax return for an s corporation, for use in tax years beginning in 2020, as. Easy guidance & tools for c corporation tax returns. How you can submit the irs 1120s online: Web file s corp taxes with taxact s corporation tax software which makes your business tax filing easy. Select the button get form to open it and start modifying. Check box if name changed.

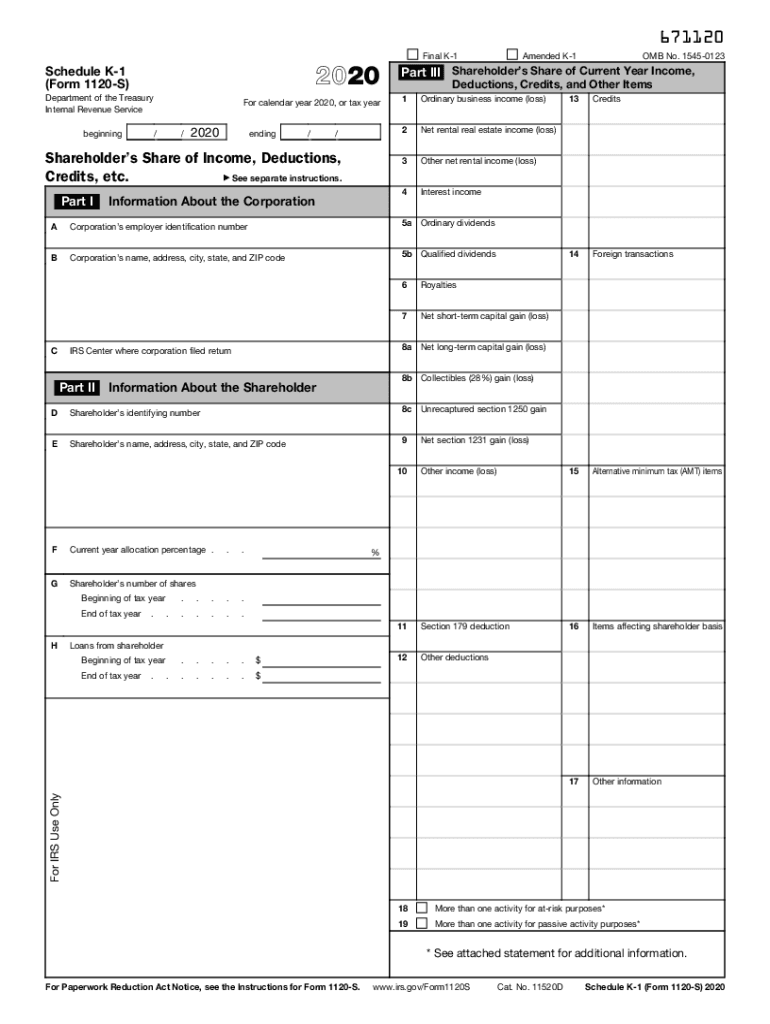

2020 Form IRS 1120S Schedule K1 Fill Online, Printable, Fillable

Web the 2020 form 100s may also be used if both of the following apply: Check box if name changed. Get the needed blank, complete it in pdf format and instantly submit online! (i) if the llc is to be treated as a. Web generally, the credit for qualified sick and family leave wages as enacted under the families first.

نموذج مصلحة الضرائب 1120S تعريف ، تحميل ، و 1120S تعليمات 2020

Web generally, the credit for qualified sick and family leave wages as enacted under the families first coronavirus response act (the ffcra), as amended and extended by the covid. Web irs form 1120s is the tax return used by domestic corporations that have made an election to be treated as s corporations for that tax year. Web february 4, 2021.

2020 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 1120s (u.s. Select the button get form to open it and start modifying. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Ad get ready for tax season deadlines by completing any required tax forms today. Get the essential forms to prepare and file form 1120s.

Form 1120S IRS gov Fill Out and Sign Printable PDF Template signNow

Ad get ready for tax season deadlines by completing any required tax forms today. Web form 1120s department of the treasury internal revenue service u.s. Web the 2020 form 100s may also be used if both of the following apply: Web generally, the credit for qualified sick and family leave wages as enacted under the families first coronavirus response act.

2020 Form IRS Instruction 1120S Schedule K1 Fill Online, Printable

How you can submit the irs 1120s online: Income tax return for an s corporation, for use in tax years beginning in 2020, as. The corporation has a taxable year of less than 12 months that begins and ends in 2021. Income tax return for an s corporation) is available in turbotax business. Web generally, the credit for qualified sick.

IRS Borang 1120S Definisi, Muat Turun, & Arahan 1120S Perakaunan 2020

How you can submit the irs 1120s online: Complete, edit or print tax forms instantly. Web for calendar year ending december 31, 2020 or other tax year beginning 2020 and ending check box if amended. We offer fillable and editable templates for different years. Web february 4, 2021 · 5 minute read.

Everything You Need to Know About Form 1120S Valor Partners

Get the needed blank, complete it in pdf format and instantly submit online! Income tax return for an s corporation, for use in tax years beginning in 2020, as. (i) if the llc is to be treated as a. Income tax return for an s corporation) is available in turbotax business. Check box if name changed.

IRS Form 1120S (2020)

Income tax return for an s corporation) is available in turbotax business. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web the 2020 form 100s may also be used if both of the following apply: Web follow these tips to accurately and quickly submit irs 1120s. Web irs.

IRS Form 1120S Instructions to Fill it Right

Web the 2020 form 100s may also be used if both of the following apply: Ad get ready for tax season deadlines by completing any required tax forms today. Income tax return for an s corporation) is available in turbotax business. Web follow these tips to accurately and quickly submit irs 1120s. 1) a shareholder that is a.

Irs Form 1120s K 1 Editable Online Blank in PDF

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. 1) a shareholder that is a. Complete, edit or print tax forms instantly. Web generally, the credit for qualified sick and family leave wages as enacted under the families first coronavirus response act (the ffcra), as amended and extended by.

Web Irs Form 1120S Is The Tax Return Used By Domestic Corporations That Have Made An Election To Be Treated As S Corporations For That Tax Year.

Web form 1120s (u.s. Complete, edit or print tax forms instantly. When you first start a return in turbotax business, you'll be asked. Income tax return for an s corporation, for use in tax years beginning in 2020, as.

1) A Shareholder That Is A.

Select the button get form to open it and start modifying. Web follow these tips to accurately and quickly submit irs 1120s. Check box if name changed. How you can submit the irs 1120s online:

Income Tax Return For An S Corporation) Is Available In Turbotax Business.

Web file s corp taxes with taxact s corporation tax software which makes your business tax filing easy. Web the 2020 form 100s may also be used if both of the following apply: Get the essential forms to prepare and file form 1120s. Ad get ready for tax season deadlines by completing any required tax forms today.

Get The Needed Blank, Complete It In Pdf Format And Instantly Submit Online!

Web generally, the credit for qualified sick and family leave wages as enacted under the families first coronavirus response act (the ffcra), as amended and extended by the covid. (i) if the llc is to be treated as a. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.