13873-E Form

13873-E Form - Generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. I thick that that this is a scam since it included a copy of 4506 from a refinance that i just filled out and cancelled. What can i do to fix this? Web there are several versions of irs form 13873 (e.g. Irs has no record of a tax return. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. There are several versions of irs form 13873 (e.g. 13873 of may 15, 2019 e.o. Also, i recently received a form.

Any version of irs form 13873 that clearly states that the form is. Web there are several versions of irs form 13873 (e.g. Web what is irs form 13873 e? What can i do to fix this? I thick that that this is a scam since it included a copy of 4506 from a refinance that i just filled out and cancelled. Any version of irs form 13873 that clearly states that the form is provided to the. 13873 of may 15, 2019 e.o. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. Web there are several versions of irs form 13873 (e.g. Any version of irs form 13873 that clearly states that the form is provided to the individual as.

A business activity code b product or product line c check the applicable box to. Web taxfiler an irs form 13873. There are several versions of irs form 13873 (e.g. What can i do to fix this? Eo 13636, february 12, 2013 document citation: Generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the. Irs has no record of a tax return. Web what is irs form 13873 e? Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g.

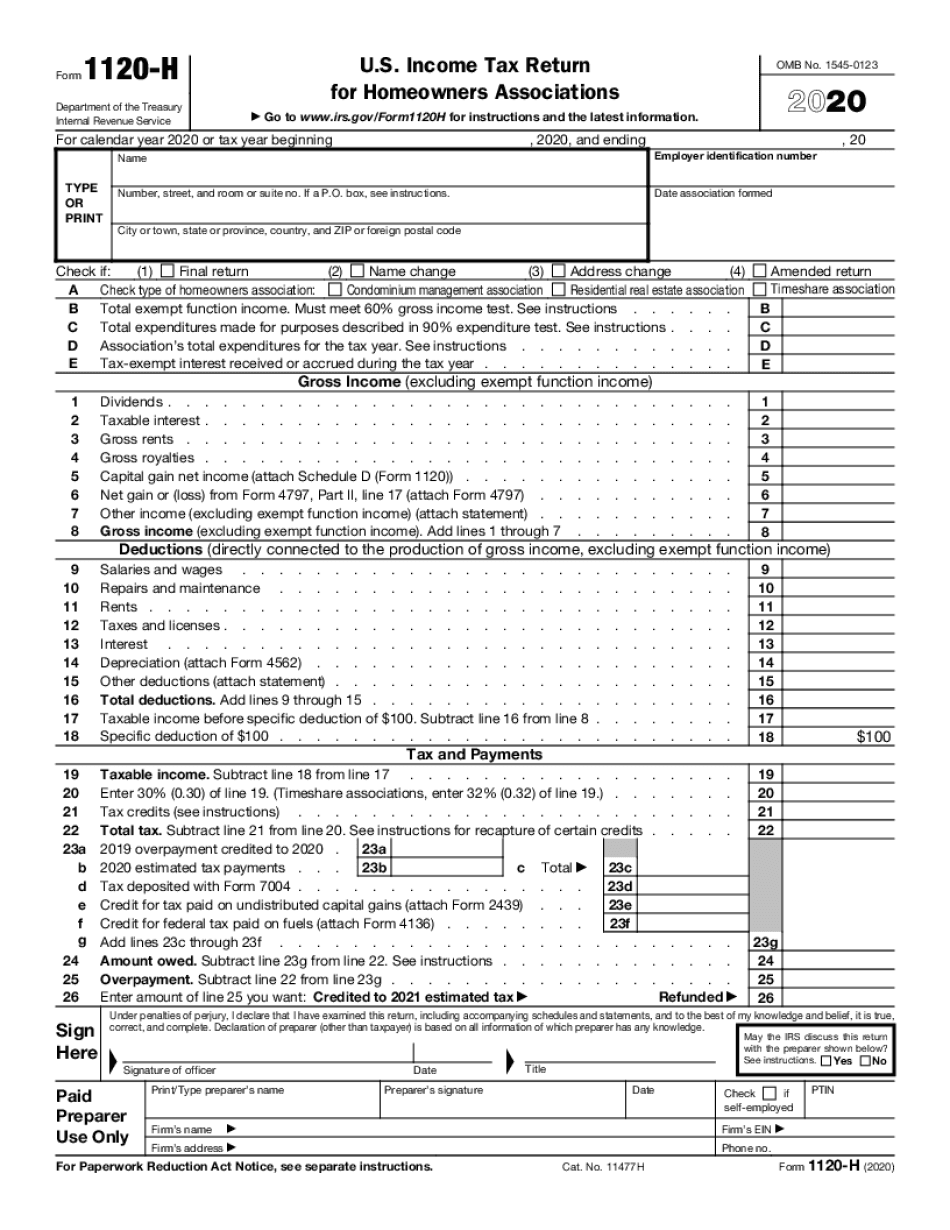

Edit Document Form 1120 With Us Fastly, Easyly, And Securely

Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. Web there are several versions of irs form 13873 (e.g. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a.

13873 E Fortuna Palms Dr, Yuma, AZ 85367 2 Bed, 1 Bath Mobile

Web there are several versions of irs form 13873 (e.g. There are several versions of irs form 13873 (e.g. Web what is irs form 13873 e? Generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the. 13873 of may 15, 2019 e.o.

Part Number 13873

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. I thick that that this is a scam since it included a copy of 4506 from a refinance that i just filled out and cancelled. Web sale and leasing income method (i.e., line 44.

Electronic Form software Component, Electronic Form Solution, EForm

Also, i recently received a form. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. Web what is irs form 13873 e? Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and.

하자, 감액, 지체상금확인서 샘플, 양식 다운로드

There are several versions of irs form 13873 (e.g. A business activity code b product or product line c check the applicable box to. Web irs form 13873 clearly stating that the form is provided as verification of nonfiling, or stating that the irs has no record of a tax return for the individual for the tax year. Any version.

EDGAR Filing Documents for 000075068620000052

Any version of irs form 13873 that clearly states that the form is. 13873 of may 15, 2019 e.o. Any version of irs form 13873 that clearly states that the form is provided to the. Web irs form 13873 clearly stating that the form is provided as verification of nonfiling, or stating that the irs has no record of a.

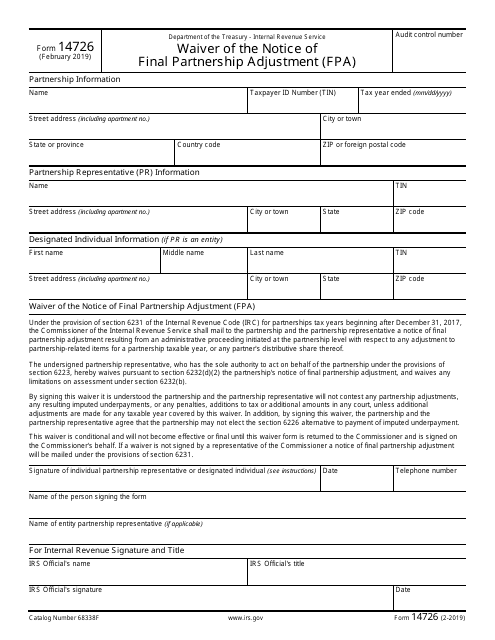

IRS Form 14726 Download Fillable PDF or Fill Online Waiver of the

Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g. What can i do to fix this? Web sale and leasing income method (i.e., line 44 equals line 45), complete only lines 5a and 5c(1). I thick that that this is a scam since.

80GK13873 USS LCT514

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. Any version of irs form 13873 that clearly states that the form is provided to the. 13873 of may 15, 2019 e.o. Web sale and leasing income method (i.e., line 44 equals line 45),.

Form 4506t Printable

Web taxfiler an irs form 13873. What can i do to fix this? I thick that that this is a scam since it included a copy of 4506 from a refinance that i just filled out and cancelled. Also, i recently received a form. Web there are several versions of irs form 13873 (e.g.

2014 Form IRS 14653 Fill Online, Printable, Fillable, Blank pdfFiller

There are several versions of irs form 13873 (e.g. Eo 13636, february 12, 2013 document citation: Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. Web there are several versions of irs form 13873 (e.g. What can i do to fix this?

Any Version Of Irs Form 13873 That Clearly States That The Form Is Provided To The Individual As.

Web qualifying foreign trade income. I thick that that this is a scam since it included a copy of 4506 from a refinance that i just filled out and cancelled. 13873 of may 15, 2019 e.o. What can i do to fix this?

Irs Has No Record Of A Tax Return.

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. Web there are several versions of irs form 13873 (e.g. Web what is irs form 13873 e? Web sale and leasing income method (i.e., line 44 equals line 45), complete only lines 5a and 5c(1).

Web Information About Form 8843, Statement For Exempt Individuals And Individuals With A Medical Condition, Including Recent Updates, Related Forms, And Instructions On How To.

Web there are several versions of irs form 13873 (e.g. Also, i recently received a form. A business activity code b product or product line c check the applicable box to. Web taxfiler an irs form 13873.

Any Version Of Irs Form 13873 That Clearly States That The Form Is.

There are several versions of irs form 13873 (e.g. Web on may 15, 2019, the president issued executive order on securing the information and communications technology and services supply chain (e.o. Eo 13636, february 12, 2013 document citation: Generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the.