163 J Form

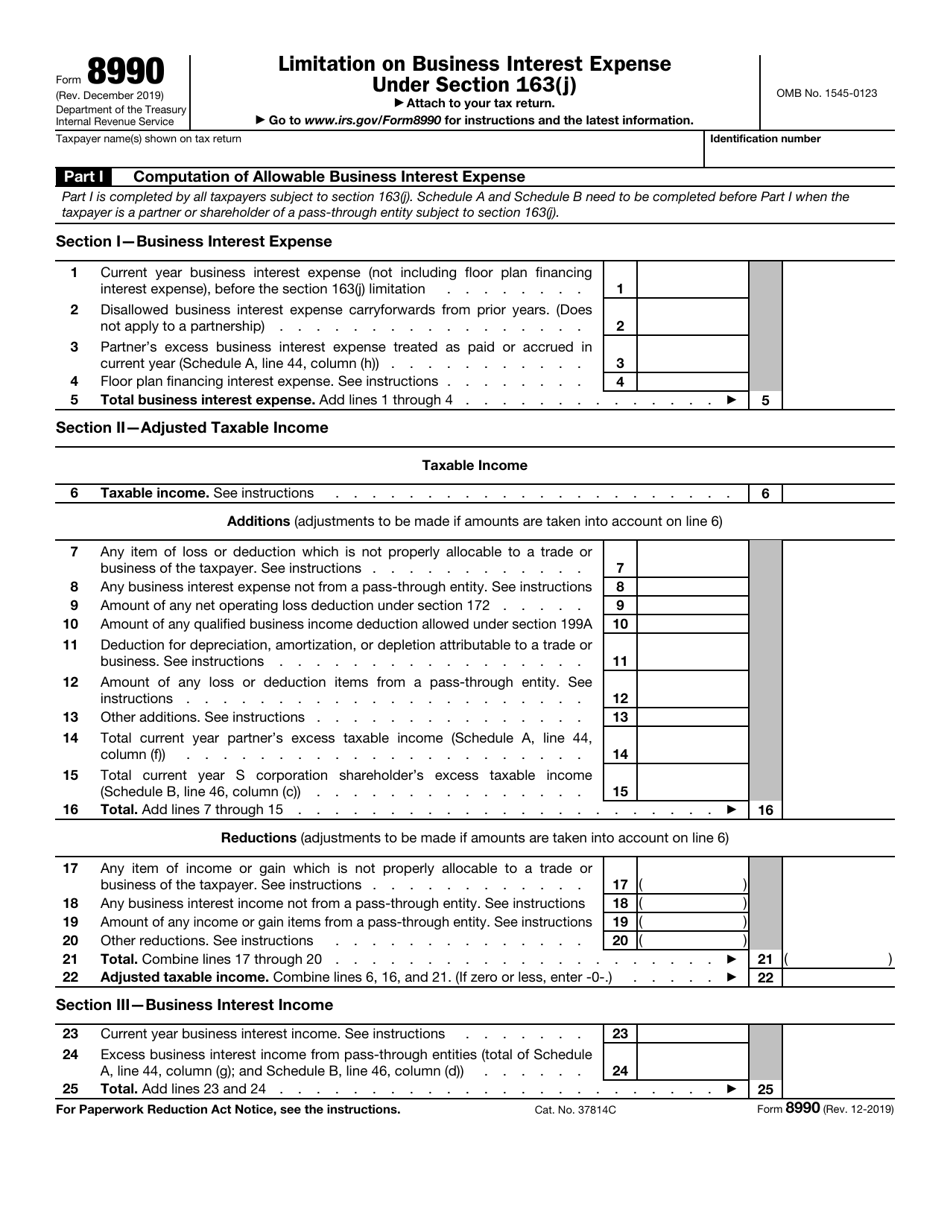

163 J Form - Web after providing some background on the sec. The form calculates the section 163(j) limitation on. 163(j) business interest expense limitation was the. The new section 163(j) business interest expense deduction and carryover amounts are reported on form 8990. 30% of the adjusted taxable. Web treasury and the irs on january 5 released final regulations under section 163 (j) (the 2021 final regulations). 163(j) business interest limitation, this item discusses how the rules for calculating ati have changed for 2022. 163(j) provides that the amount allowed as a deduction under [chapter 1] for business interest expense may not exceed the sum of: Web on july 28, 2020, the us department of the treasury and the internal revenue service (irs) issued final regulations confirming the application of section 163. For a discussion of the general.

163(j) business interest expense limitation was the. Web section 163(j), which was amended by the 2017 tax reform legislation and by the cares act, generally limits us business interest expense deductions to the sum of business. Web irs issues guidance for section 163 (j) elections. Business interest income for a taxable. A taxpayer that is a u.s. Web if section 163(j) applies to you, the business interest expense deduction allowed for the tax year is limited to the sum of: For a discussion of the general. Web after providing some background on the sec. Web treasury and the irs on january 5 released final regulations under section 163 (j) (the 2021 final regulations). Web this report provides initial impressions and observations about the 163 (j) package’s key concepts—interest and adjusted taxable income.

Web the table excerpts from form 8990 (below) presents excerpts from form 8990, limitation on business interest expense under section 163(j), under two. Web one of the most notable elements of the final regulations the irs and treasury issued last summer on the sec. 163(j) provides that the amount allowed as a deduction under [chapter 1] for business interest expense may not exceed the sum of: Web irs issues guidance for section 163 (j) elections. Web section 163(j), which was amended by the 2017 tax reform legislation and by the cares act, generally limits us business interest expense deductions to the sum of business. 163(j) business interest limitation, this item discusses how the rules for calculating ati have changed for 2022. Business interest income for a taxable. The irs has released guidance ( rev. For a discussion of the general. Web on july 28, 2020, the us department of the treasury and the internal revenue service (irs) issued final regulations confirming the application of section 163.

Download Instructions for IRS Form 8990 Limitation on Business Interest

30% of the adjusted taxable. Web section 163(j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest expense deductions to the sum of business interest. Web the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. Web section 163 (j) provides elective exceptions for.

IRS Provides Guidance on Section 163(J) Election Graves Dougherty

The regulations finalize, with certain key changes and reservations,. A taxpayer that is a u.s. Web irs issues guidance for section 163 (j) elections. Web if section 163(j) applies to you, the business interest expense deduction allowed for the tax year is limited to the sum of: Web after providing some background on the sec.

The New Section 163(j) Interest Expense Deduction YouTube

Web section 163(j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest expense deductions to the sum of business interest. 163(j) business interest limitation, this item discusses how the rules for calculating ati have changed for 2022. For a discussion of the general background and. Effective date and reliance clarifications and.

What Is Federal Carryover Worksheet

30% of the adjusted taxable. Web irs issues guidance for section 163 (j) elections. Web section 163(j), which was modified by the 2017 tax reform act and the cares act, limits us business interest expense deductions to the sum of business interest income, 30%. Web section 163(j), which was modified by the 2017 tax reform legislation and the cares act,.

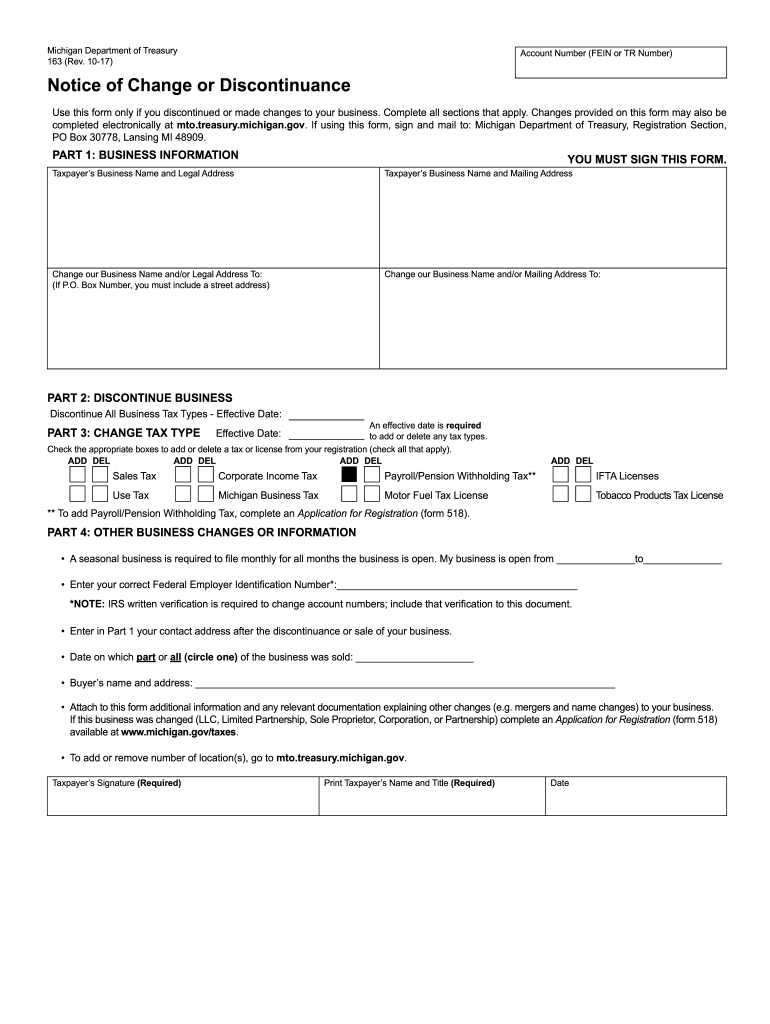

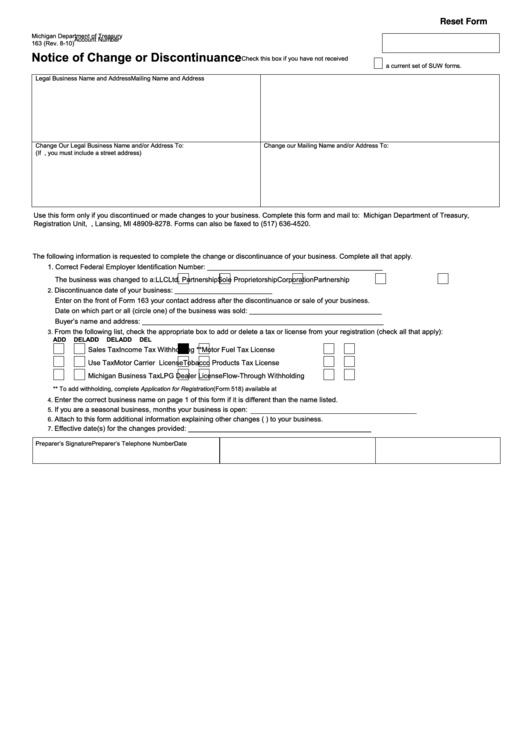

20172019 Form MI DoT 163 Fill Online, Printable, Fillable, Blank

Effective date and reliance clarifications and changes. Web on july 28, 2020, the us department of the treasury and the internal revenue service (irs) issued final regulations confirming the application of section 163. Web irs issues guidance for section 163 (j) elections. Business interest income for a taxable. 163(j) business interest limitation, this item discusses how the rules for calculating.

IRS Form 8990 Download Fillable PDF or Fill Online Limitation on

Web after providing some background on the sec. The regulations finalize, with certain key changes and reservations,. Web section 163(j), which was modified by the 2017 tax reform act and the cares act, limits us business interest expense deductions to the sum of business interest income, 30%. The irs has released guidance ( rev. The new section 163(j) business interest.

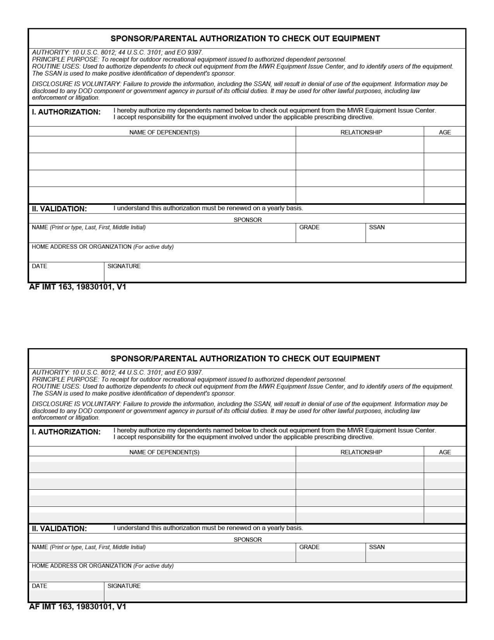

AF IMT Form 163 Download Fillable PDF or Fill Online Sponsor/Parental

The form calculates the section 163(j) limitation on. 163(j) business interest expense limitation was the. Web section 163(j), which was modified by the 2017 tax reform act and the cares act, limits us business interest expense deductions to the sum of business interest income, 30%. Web this report provides initial impressions and observations about the 163 (j) package’s key concepts—interest.

Fillable Form 8926 Disqualified Corporate Interest Expense Disallowed

Web section 163(j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest expense deductions to the sum of business interest. Web if section 163(j) applies to you, the business interest expense deduction allowed for the tax year is limited to the sum of: The form calculates the section 163(j) limitation on..

1040NJ Data entry guidelines for a New Jersey partnership K1

For a discussion of the general. A taxpayer that is a u.s. Web irs issues guidance for section 163 (j) elections. For a discussion of the general background and. Effective date and reliance clarifications and changes.

Fillable Form 163 Notice Of Change Or Discontinuance Form 2010

For a discussion of the general. 30% of the adjusted taxable. 163(j) provides that the amount allowed as a deduction under [chapter 1] for business interest expense may not exceed the sum of: The final regulations provide applicable rules and. 163(j) business interest expense limitation was the.

Effective Date And Reliance Clarifications And Changes.

Web section 163(j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest expense deductions to the sum of business interest. Business interest income for a taxable. For a discussion of the general. 163(j) business interest expense limitation was the.

For A Discussion Of The General Background And.

Web this report provides initial impressions and observations about the 163 (j) package’s application to passthrough entities. Web the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. Web after providing some background on the sec. Web this report provides initial impressions and observations about the 163 (j) package’s key concepts—interest and adjusted taxable income.

Web Treasury And The Irs On January 5 Released Final Regulations Under Section 163 (J) (The 2021 Final Regulations).

The new section 163(j) business interest expense deduction and carryover amounts are reported on form 8990. The irs has released guidance ( rev. Web one of the most notable elements of the final regulations the irs and treasury issued last summer on the sec. The final regulations provide applicable rules and.

Web Section 163 (J) Provides Elective Exceptions For Certain Real Property Trades Or Businesses And For Certain Farming Businesses.

163(j) business interest limitation, this item discusses how the rules for calculating ati have changed for 2022. Web the table excerpts from form 8990 (below) presents excerpts from form 8990, limitation on business interest expense under section 163(j), under two. Web on july 28, 2020, the us department of the treasury and the internal revenue service (irs) issued final regulations confirming the application of section 163. The regulations finalize, with certain key changes and reservations,.