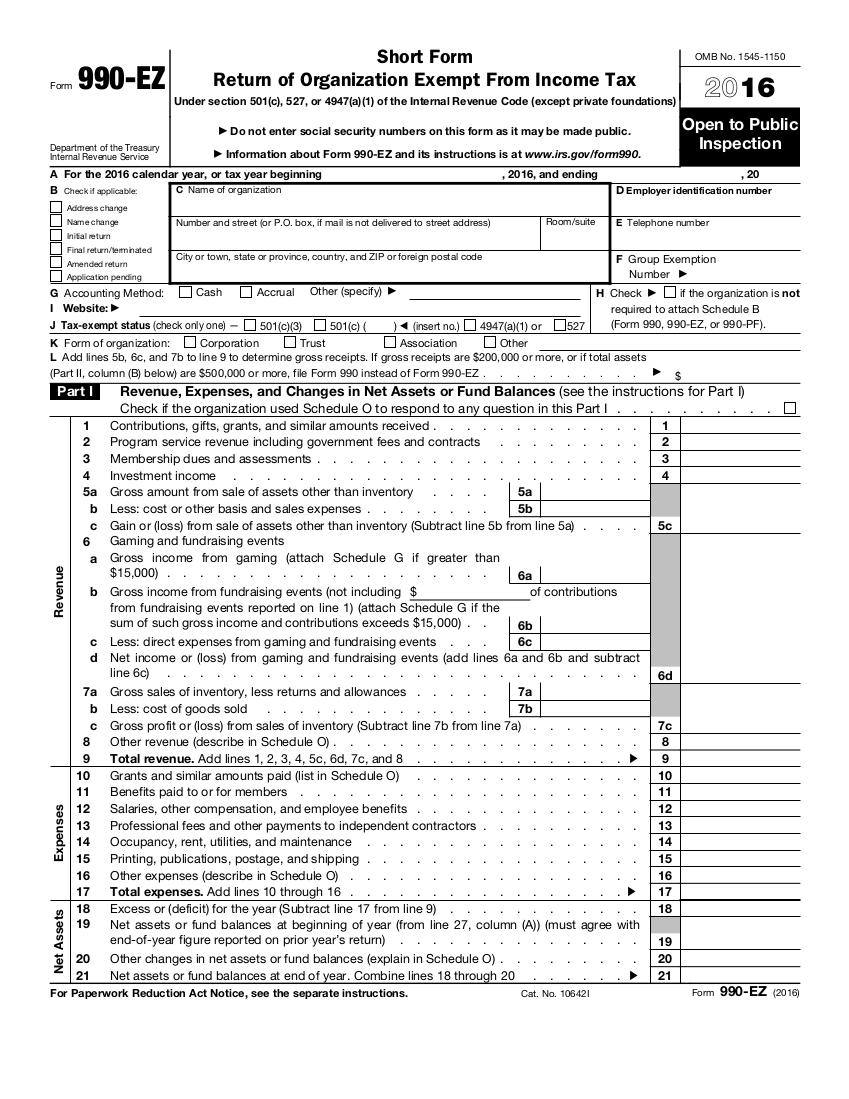

2016 Form 990 Ez

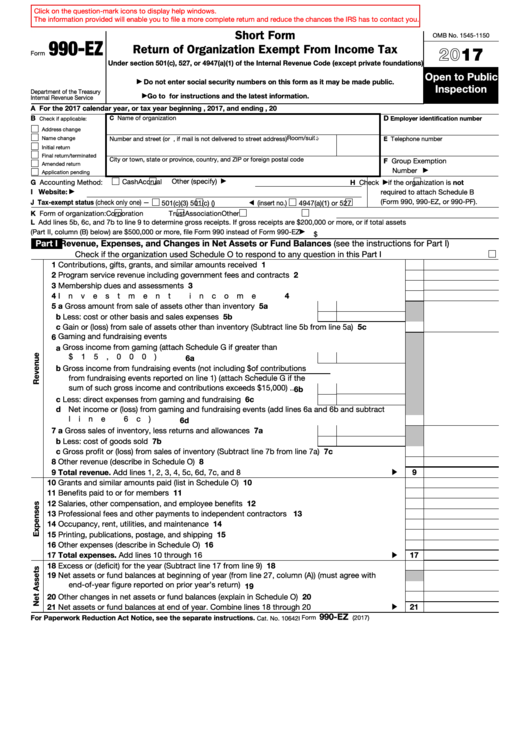

2016 Form 990 Ez - Ad download or email irs 990ez & more fillable forms, register and subscribe now! A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web short form returnoforganization exemptfromincometax undersection 501(c), 527, or4947(a)(1) ofthe internal revenuecode(exceptprivatefoundations) donotenter social. Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). Web 2016 departmentofthe un internal reyenue senice donot entersocial security numbersonthisformasit maybemadepublic. Web a section 501(d) religious and apostolic organization files form 1065. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. On this page you may download the 990 series filings on record from 2016. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Do not enter social security numbers on this form as it may be made public.

Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). Web 2016 departmentofthe un internal reyenue senice donot entersocial security numbersonthisformasit maybemadepublic. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. The download files are organized by month. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web short form returnoforganization exemptfromincometax undersection 501(c), 527, or4947(a)(1) ofthe internal revenuecode(exceptprivatefoundations) donotenter social. Do not enter social security numbers on this form as it may be made public. Ad download or email irs 990ez & more fillable forms, register and subscribe now! On this page you may download the 990 series filings on record from 2016. Web a section 501(d) religious and apostolic organization files form 1065.

Web 2016 departmentofthe un internal reyenue senice donot entersocial security numbersonthisformasit maybemadepublic. Web short form returnoforganization exemptfromincometax undersection 501(c), 527, or4947(a)(1) ofthe internal revenuecode(exceptprivatefoundations) donotenter social. Ad download or email irs 990ez & more fillable forms, register and subscribe now! On this page you may download the 990 series filings on record from 2016. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Do not enter social security numbers on this form as it may be made public. The download files are organized by month. Ad download or email irs 990ez & more fillable forms, register and subscribe now!

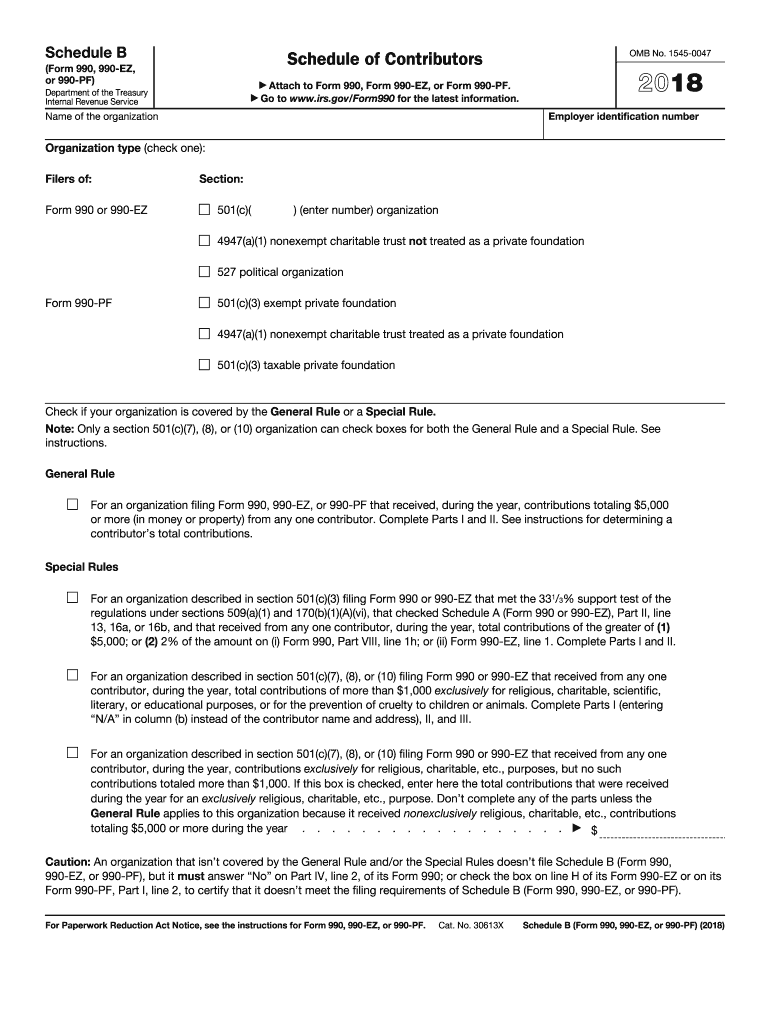

2018 Form IRS 990 Schedule B Fill Online, Printable, Fillable, Blank

Web a section 501(d) religious and apostolic organization files form 1065. Web short form returnoforganization exemptfromincometax undersection 501(c), 527, or4947(a)(1) ofthe internal revenuecode(exceptprivatefoundations) donotenter social. On this page you may download the 990 series filings on record from 2016. Do not enter social security numbers on this form as it may be made public. Excess benefit transactions (section 501(c)(3), section.

Top 18 Form 990 Ez Templates free to download in PDF format

Ad download or email irs 990ez & more fillable forms, register and subscribe now! 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Web 2016 departmentofthe un internal reyenue senice donot entersocial security numbersonthisformasit maybemadepublic. Do not enter social security.

What Is A 990 Ez Form Merteberte

Web 2016 departmentofthe un internal reyenue senice donot entersocial security numbersonthisformasit maybemadepublic. Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). Do not enter social security numbers on this form as it may be made public. The download files are organized by month. Web a section 501(d) religious and apostolic organization files form 1065.

990EZ (2016) Edit Forms Online PDFFormPro

Web a section 501(d) religious and apostolic organization files form 1065. Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Ad download or email irs 990ez & more fillable forms, register.

Fillable IRS Form 990EZ Free Printable PDF Sample FormSwift

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Ad download or email irs 990ez & more fillable forms, register and subscribe now! The download files are organized by month. Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). Web 2016 departmentofthe un internal reyenue senice donot entersocial security numbersonthisformasit maybemadepublic.

Form 990 Schedule A Edit, Fill, Sign Online Handypdf

Do not enter social security numbers on this form as it may be made public. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Ad download or email irs 990ez & more fillable forms, register and subscribe now! On this.

Form 990EZ Reporting for Smaller TaxExempt Organizations

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. The download files are organized by month. Web a section 501(d) religious and apostolic organization files form 1065. Ad download or email irs 990ez & more fillable forms, register and subscribe now! On this page you may download the 990 series filings on record.

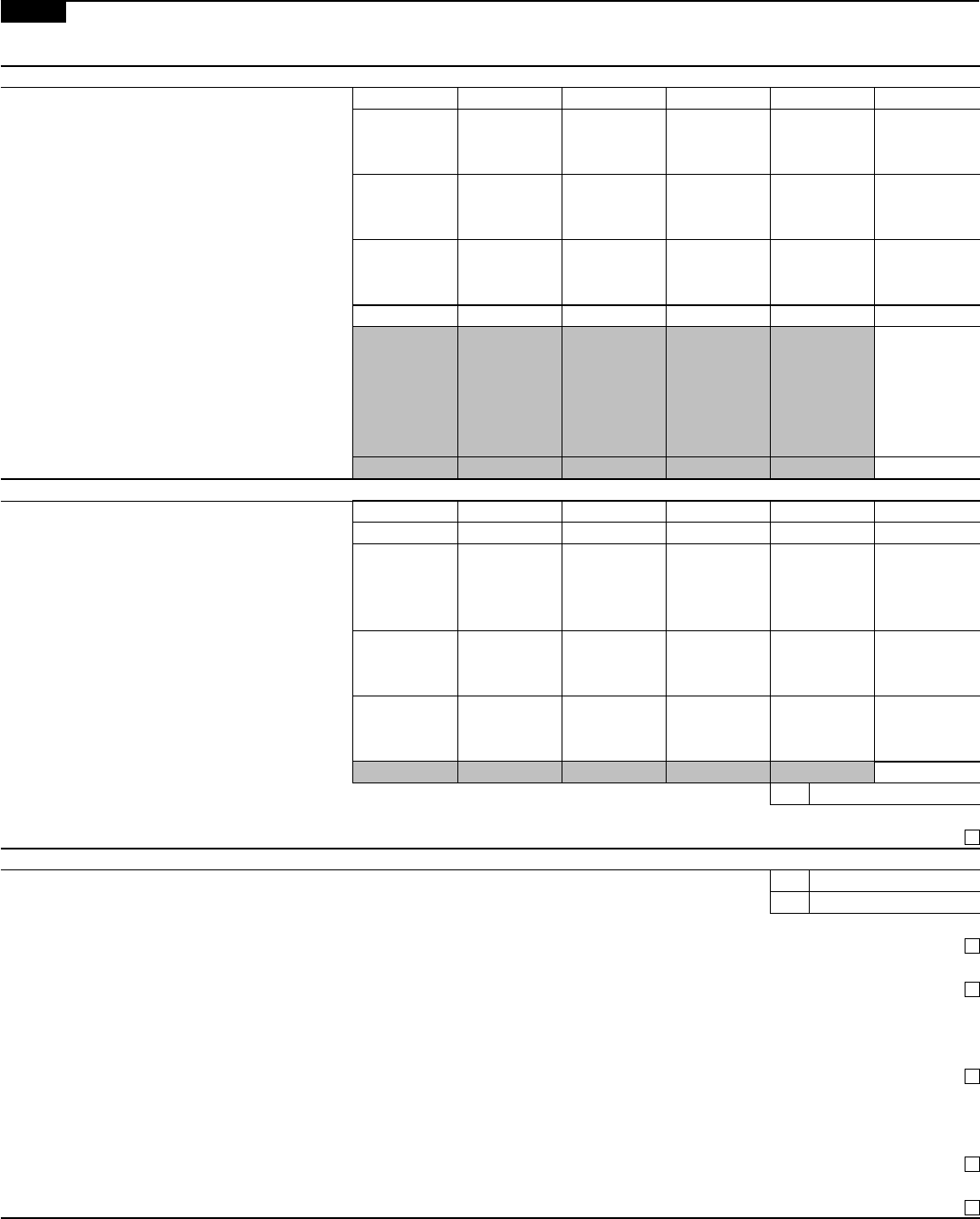

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

The download files are organized by month. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web a section 501(d) religious and apostolic organization files form 1065. Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). On this page you may download the 990 series filings on record from 2016.

How to Complete Part I of IRS Form 990EZ

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web short form returnoforganization exemptfromincometax undersection 501(c), 527, or4947(a)(1) ofthe internal revenuecode(exceptprivatefoundations) donotenter social. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Excess benefit transactions (section 501(c)(3), section 501(c)(4), and 501(c)(29). Web 2016 departmentofthe un internal reyenue senice.

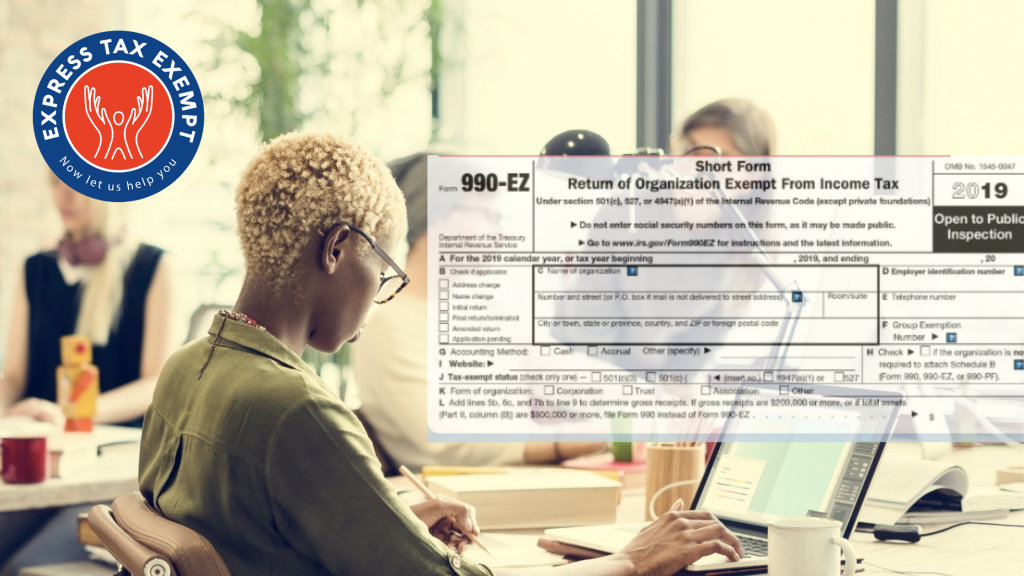

2016 Form IRS 990 or 990EZ Schedule E Fill Online, Printable

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Ad download or email irs 990ez & more fillable forms, register and subscribe now! Do not enter social security numbers on this form as it may be made public. Web a section 501(d) religious and apostolic organization files form 1065. The download files are organized by.

Web 2016 Departmentofthe Un Internal Reyenue Senice Donot Entersocial Security Numbersonthisformasit Maybemadepublic.

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web a section 501(d) religious and apostolic organization files form 1065. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under.

Excess Benefit Transactions (Section 501(C)(3), Section 501(C)(4), And 501(C)(29).

On this page you may download the 990 series filings on record from 2016. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web short form returnoforganization exemptfromincometax undersection 501(c), 527, or4947(a)(1) ofthe internal revenuecode(exceptprivatefoundations) donotenter social. Do not enter social security numbers on this form as it may be made public.