2021 Form 941 Pdf

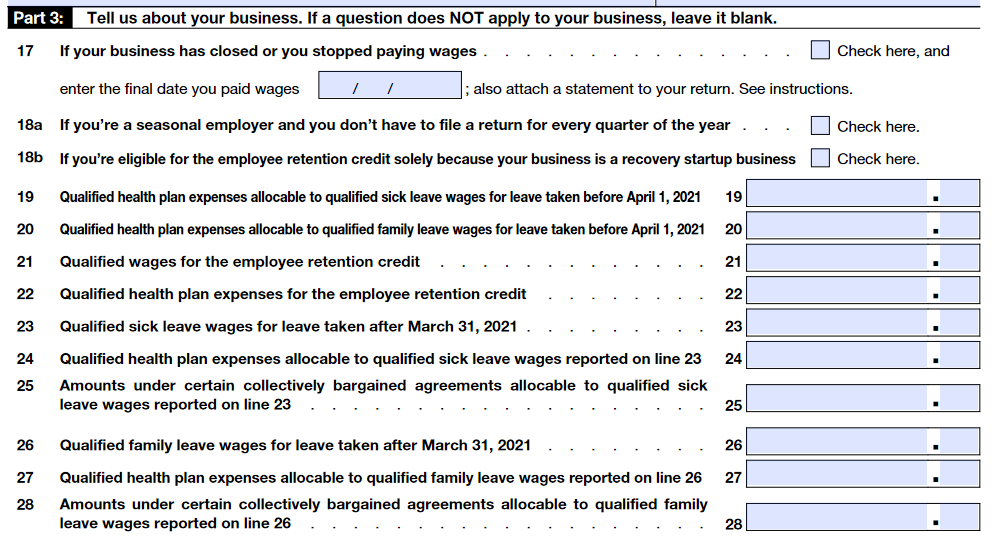

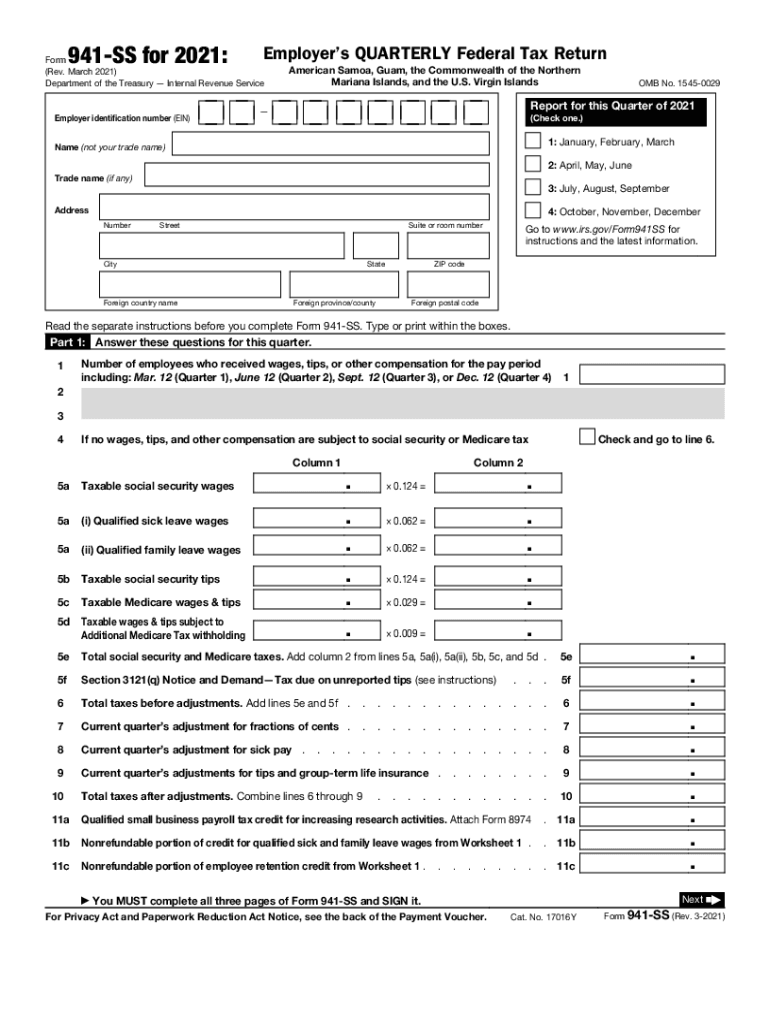

2021 Form 941 Pdf - See deposit penalties in section 8 of pub. These credits apply to qualified wages paid for sick leave and family leave taken after march 31, 2021, and before october 1, 2021. Form 941 is used to determine For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. We need it to figure and collect the right amount of tax. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Reminders don't use an earlier revision of form 941 to report taxes for 2021.

If you don’t have an ein, you may apply for one online by Instructions for form 941 (2021) pdf. Employer s quarterly federal tax return created date: Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Web report for this quarter of 2021 (check one.) 1: For instructions and the latest information. A credit for sick leave, and. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Type or print within the boxes. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding.

If you don’t have an ein, you may apply for one online by We need it to figure and collect the right amount of tax. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. See deposit penalties in section 8 of pub. Web 01 fill and edit template 02 sign it online 03 export or print immediately can i still fill out form 941 for 2021? For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). A credit for sick leave, and. You can still fill out form 941 for tax year 2021. Web report for this quarter of 2021 (check one.) 1: Type or print within the boxes.

How to fill out IRS Form 941 2019 PDF Expert

Read the separate instructions before you complete form 941. Type or print within the boxes. For instructions and the latest information. Employer s quarterly federal tax return created date: Specific instructions box 1—employer identification number (ein).

[Solved] Form 941 for 2021 Employer's QUARTERLY Federal Tax Return

For instructions and the latest information. Read the separate instructions before you complete form 941. Type or print within the boxes. Reminders don't use an earlier revision of form 941 to report taxes for 2021. See deposit penalties in section 8 of pub.

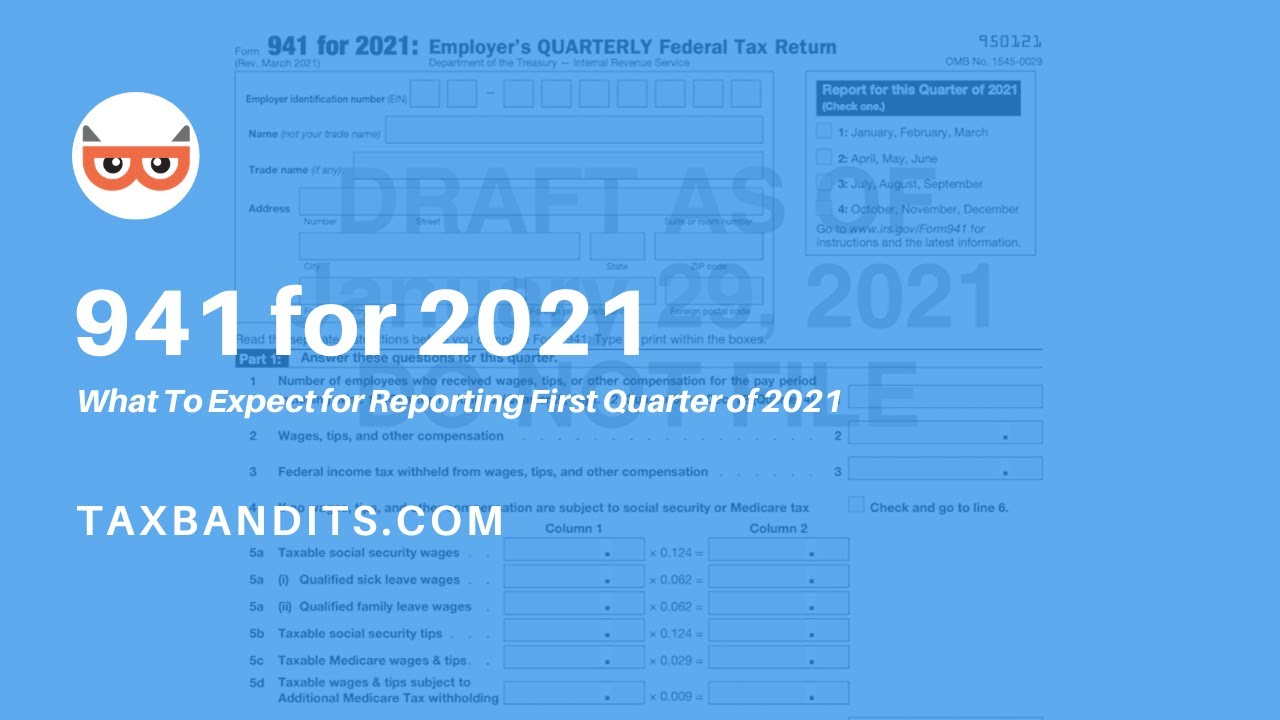

Changes in Form 941 for 1st Quarter 2021 TaxBandits YouTube

Specific instructions box 1—employer identification number (ein). Read the separate instructions before you complete form 941. You can still fill out form 941 for tax year 2021. These credits apply to qualified wages paid for sick leave and family leave taken after march 31, 2021, and before october 1, 2021. For instructions and the latest information.

IRS Form 941 Instructions for 2021 How to fill out Form 941

Read the separate instructions before you complete form 941. However, you will need to file a separate form 941 for each quarter. These credits apply to qualified wages paid for sick leave and family leave taken after march 31, 2021, and before october 1, 2021. Specific instructions box 1—employer identification number (ein). Instructions for form 941 (2021) pdf.

Form 941 Fill Out and Sign Printable PDF Template signNow

A credit for sick leave, and. These credits apply to qualified wages paid for sick leave and family leave taken after march 31, 2021, and before october 1, 2021. The june 2021 revision of form 941. Type or print within the boxes. You can still fill out form 941 for tax year 2021.

How to fill out IRS form 941 20222023 PDF Expert

Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. These credits apply to qualified wages paid for sick leave and family leave taken after march 31, 2021, and before october 1, 2021. Reminders don't use an earlier revision of form 941 to report.

Printable 941 Form 2021 Printable Form 2022

A form 941 is a tax form used by employers to report their quarterly federal tax liability. See deposit penalties in section 8 of pub. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. The june 2021 revision of form 941. Reminders don't use an earlier revision of form 941.

Printable 941 Form Printable Form 2021

Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Web the form 941 changes reflect two new credits against the employer’s share of employment taxes: Web we ask for the information on form 941 to carry out the internal revenue laws of the.

941x Worksheet 2 Excel

See deposit penalties in section 8 of pub. Type or print within the boxes. Web 01 fill and edit template 02 sign it online 03 export or print immediately can i still fill out form 941 for 2021? Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Form 941 is.

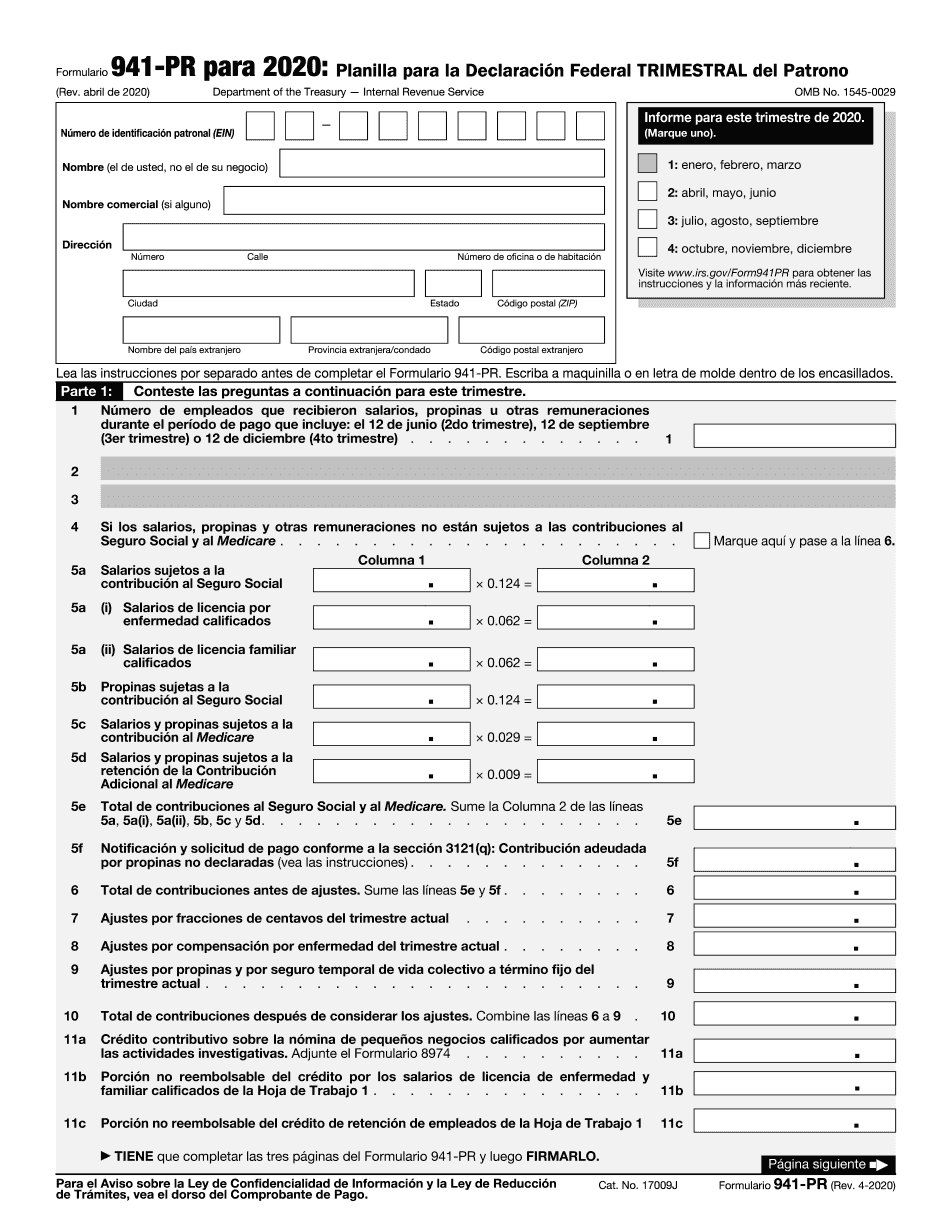

2021 Form 941 Pr Fill Online, Printable, Fillable, Blank pdfFiller

We need it to figure and collect the right amount of tax. Reminders don't use an earlier revision of form 941 to report taxes for 2021. Web report for this quarter of 2021 (check one.) 1: A credit for family leave. For instructions and the latest information.

A Credit For Family Leave.

A form 941 is a tax form used by employers to report their quarterly federal tax liability. Web the form 941 changes reflect two new credits against the employer’s share of employment taxes: We need it to figure and collect the right amount of tax. Read the separate instructions before you complete form 941.

For Instructions And The Latest Information.

However, you will need to file a separate form 941 for each quarter. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. If you don’t have an ein, you may apply for one online by A credit for sick leave, and.

Use The March 2021 Revision Of Form 941 Only To Report Taxes For The Quarter Ending March 31, 2021.

Web employer's quarterly federal tax return for 2021. Web report for this quarter of 2021 (check one.) 1: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. See deposit penalties in section 8 of pub.

Web The Advance Payment On Form 941, Part 1, Line 13H, For The Fourth Quarter Of 2021 And Paying Any Balance Due By January 31, 2022.

Reminders don't use an earlier revision of form 941 to report taxes for 2021. Specific instructions box 1—employer identification number (ein). Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. The june 2021 revision of form 941.