2021 Schedule Se Form

2021 Schedule Se Form - Easily fill out pdf blank, edit, and sign them. You must pay the social security and medicare. This rate consists of 12.4% for social security and 2.9% for medicare taxes. August social security checks are getting disbursed this week for recipients who've. You can find it here. If line 4c is zero, skip lines 18 through 20,. Save or instantly send your ready documents. Specifically, schedule se is used to calculate the amount of social. Medicare tax isn’t capped, and there. Department of the treasury internal revenue service.

Specifically, schedule se is used to calculate the amount of social. Web there is a short schedule se form, which is an abbreviated form to the normal schedule. July 29, 2023 5:00 a.m. You can find it here. Department of the treasury internal revenue service. It is filed with form 1040. This rate consists of 12.4% for social security and 2.9% for medicare taxes. Save or instantly send your ready documents. August social security checks are getting disbursed this week for recipients who've. The social security administration uses the information from schedule se to tax.

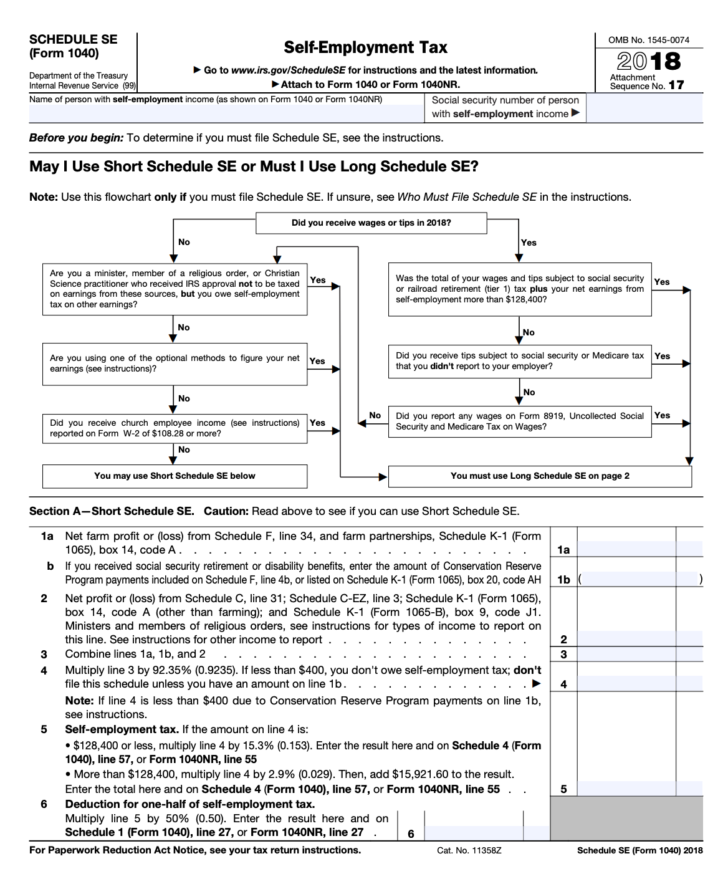

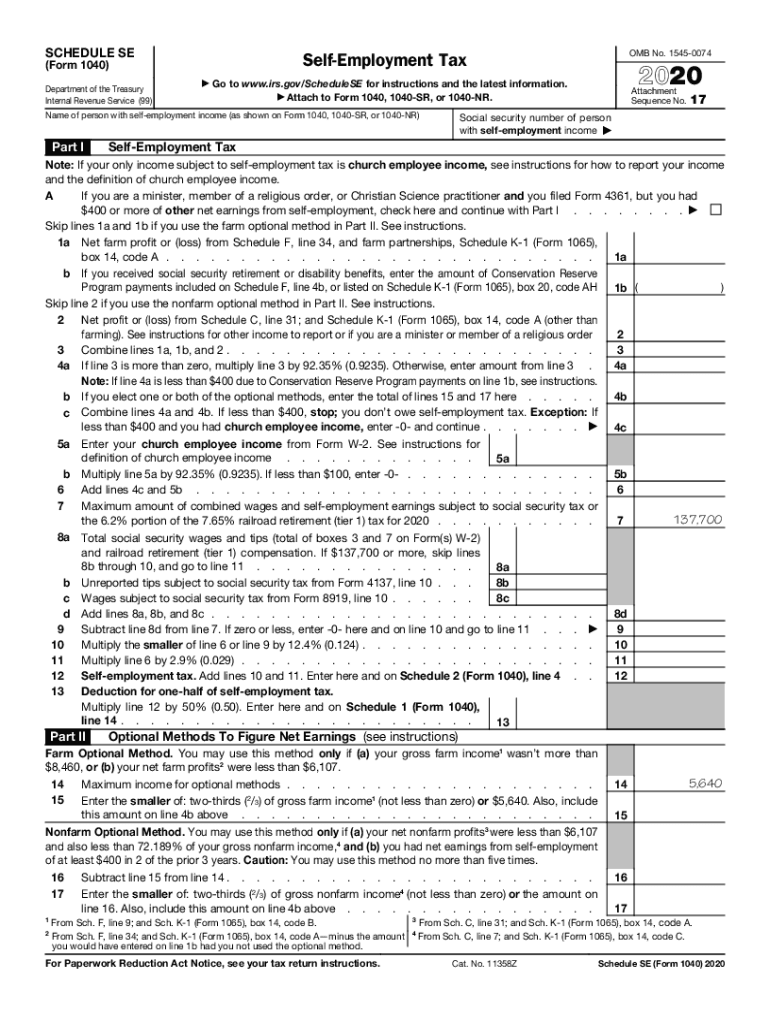

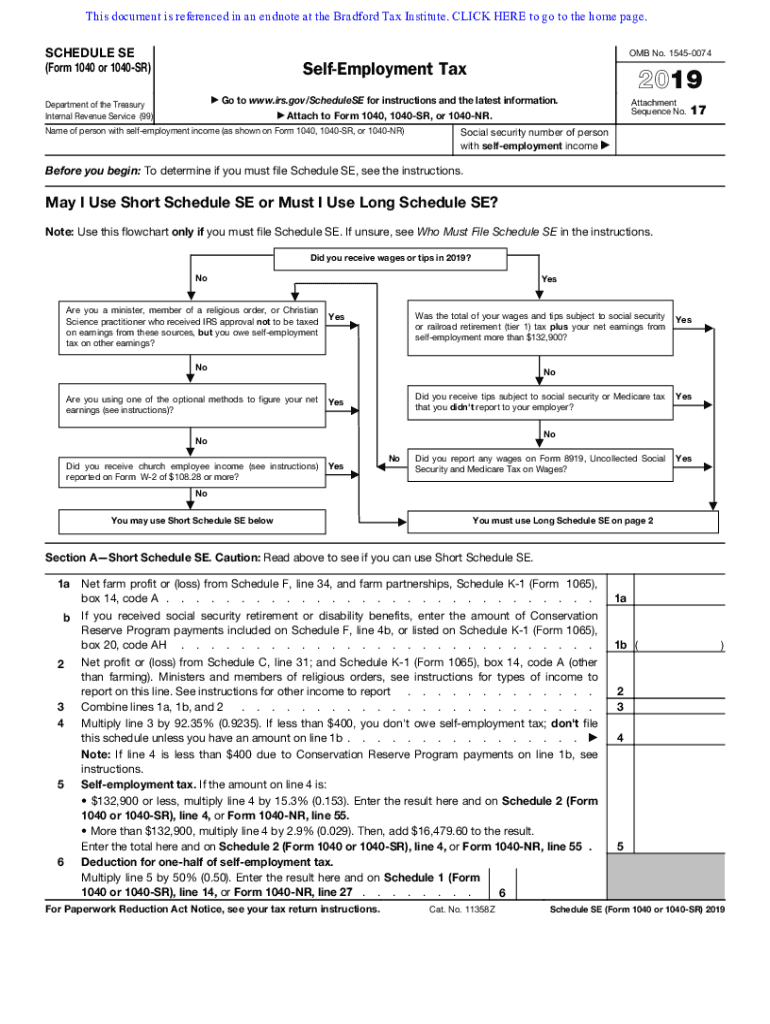

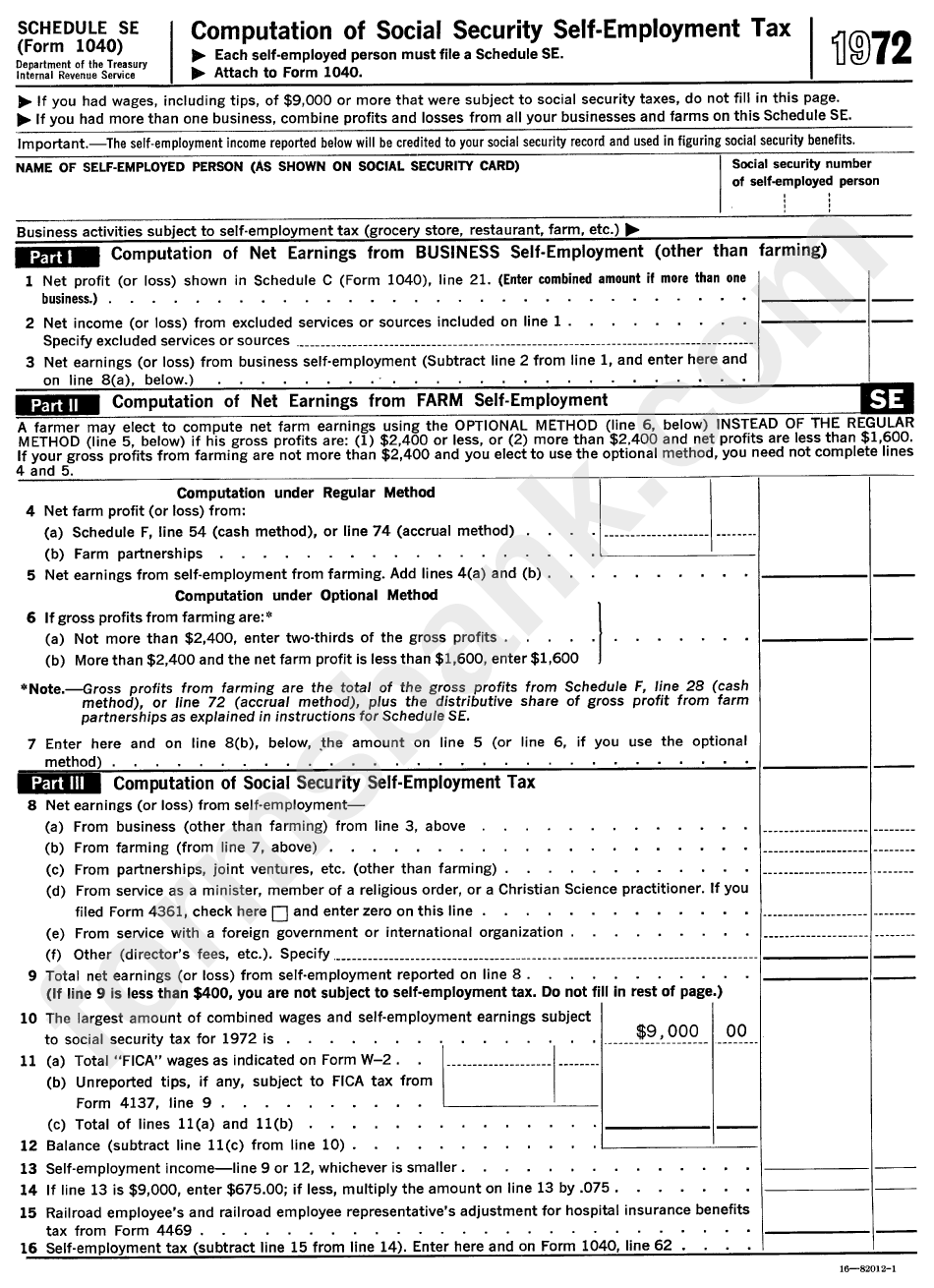

Web the flowchart (displayed below) is on schedule se, page 1. Department of the treasury internal revenue service. This rate consists of 12.4% for social security and 2.9% for medicare taxes. It is filed with form 1040. Web schedule se (form 1040) 2020. Please use the link below to. Your net earnings from self. Web the maximum for 2021 is $137,700 for all social security tax on income from employment and income from business ownership. Save or instantly send your ready documents. The social security administration uses the information from schedule se to tax.

Schedule SE A Simple Guide To Filing The Self Employment 2021 Tax

The social security administration uses the information from schedule se to tax. Please use the link below to. You can find it here. Specifically, schedule se is used to calculate the amount of social. Your net earnings from self.

2020 Form IRS 1040 Schedule SE Fill Online, Printable, Fillable

July 29, 2023 5:00 a.m. Department of the treasury internal revenue service. Specifically, schedule se is used to calculate the amount of social. Save or instantly send your ready documents. August social security checks are getting disbursed this week for recipients who've.

Schedule SE Form 1040. Self Employment Tax Fill and Sign Printable

Web the flowchart (displayed below) is on schedule se, page 1. You must pay the social security and medicare. Easily fill out pdf blank, edit, and sign them. This rate consists of 12.4% for social security and 2.9% for medicare taxes. Please use the link below to.

Schedule Se (Form 1040) Computation Of Social Security Self

August social security checks are getting disbursed this week for recipients who've. The application automatically determines which form (short vs long) to use. Medicare tax isn’t capped, and there. Web there is a short schedule se form, which is an abbreviated form to the normal schedule. Web the flowchart (displayed below) is on schedule se, page 1.

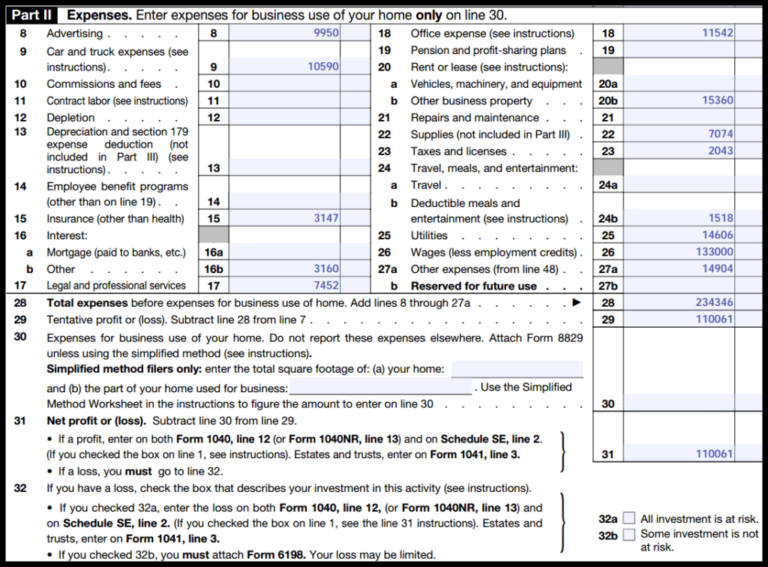

How To Complete Schedule C Profit And Loss From A Business 2021 Tax

Easily fill out pdf blank, edit, and sign them. July 29, 2023 5:00 a.m. Web the flowchart (displayed below) is on schedule se, page 1. Save or instantly send your ready documents. Department of the treasury internal revenue service.

Fillable Online apps irs 2011 Schedule SE (Form 1040) IRS.gov

Web where do i find schedule se? Easily fill out pdf blank, edit, and sign them. Web the flowchart (displayed below) is on schedule se, page 1. Department of the treasury internal revenue service. Medicare tax isn’t capped, and there.

[Solved] ames Jones is the owner of a small retail business operated as

Web where do i find schedule se? Web the maximum for 2021 is $137,700 for all social security tax on income from employment and income from business ownership. Medicare tax isn’t capped, and there. Web there is a short schedule se form, which is an abbreviated form to the normal schedule. Web schedule se (form 1040) 2020.

How To File Schedule C Form 1040 Bench Accounting in 2021 Profit

August social security checks are getting disbursed this week for recipients who've. The social security administration uses the information from schedule se to tax. Medicare tax isn’t capped, and there. July 29, 2023 5:00 a.m. This rate consists of 12.4% for social security and 2.9% for medicare taxes.

Irs Tax Forms For 2021 Printable Calendar Template Printable

Web the maximum for 2021 is $137,700 for all social security tax on income from employment and income from business ownership. Web schedule se (form 1040) 2020. Medicare tax isn’t capped, and there. August social security checks are getting disbursed this week for recipients who've. Save or instantly send your ready documents.

2020 2021 Form 1040 Individual Tax Return 1040 Form

Web the flowchart (displayed below) is on schedule se, page 1. July 29, 2023 5:00 a.m. The application automatically determines which form (short vs long) to use. If line 4c is zero, skip lines 18 through 20,. Easily fill out pdf blank, edit, and sign them.

If Line 4C Is Zero, Skip Lines 18 Through 20,.

Web there is a short schedule se form, which is an abbreviated form to the normal schedule. Easily fill out pdf blank, edit, and sign them. Your net earnings from self. Medicare tax isn’t capped, and there.

Please Use The Link Below To.

Specifically, schedule se is used to calculate the amount of social. You can find it here. Save or instantly send your ready documents. Web where do i find schedule se?

August Social Security Checks Are Getting Disbursed This Week For Recipients Who've.

Web the maximum for 2021 is $137,700 for all social security tax on income from employment and income from business ownership. Web schedule se (form 1040) 2020. This rate consists of 12.4% for social security and 2.9% for medicare taxes. It is filed with form 1040.

The Application Automatically Determines Which Form (Short Vs Long) To Use.

July 29, 2023 5:00 a.m. Department of the treasury internal revenue service. Web the flowchart (displayed below) is on schedule se, page 1. You must pay the social security and medicare.