2022 Form 5471 Instructions

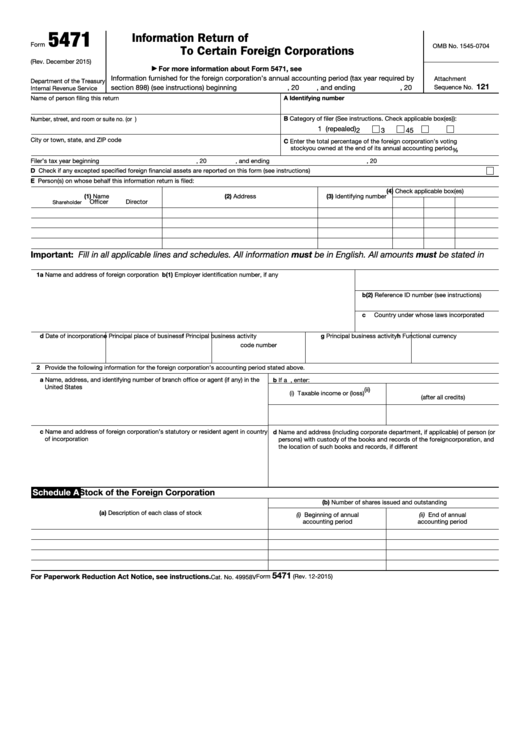

2022 Form 5471 Instructions - Shareholder to determine the amount of foreign currency gain or loss on the ptep that the u.s. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. The december 2021 revision of. Web instructions for form 5471 (rev. Shareholder must provide copies of u.s. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. December 2021) department of the treasury internal revenue service. Web instructions for form 5471(rev. Web for calendar year 2022 or taxable year beginning 2022 and ending the u.s.

Web instructions for form 5471department of the treasury internal revenue service rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web information about form 5471, information return of u.s. Web the instructions to form 5471 describes a category 5a filer as a u.s. December 2021) department of the treasury internal revenue service. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Web instructions for form 5471 (rev. Dollar basis is used by the u.s. So, a 5a filer is an unrelated section. The december 2021 revision of.

Dollar basis is used by the u.s. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the. December 2021) department of the treasury internal revenue service. The december 2021 revision of. Web instructions for form 5471department of the treasury internal revenue service rev. Transactions between controlled foreign corporation and shareholders or other. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Shareholder who doesn't qualify as either a category 5b or 5c filer. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022.

2020 Form 5471 Instructions

Web instructions for form 5471department of the treasury internal revenue service rev. The december 2021 revision of separate. Dollar basis is used by the u.s. If you aren’t sure if you. The december 2021 revision of.

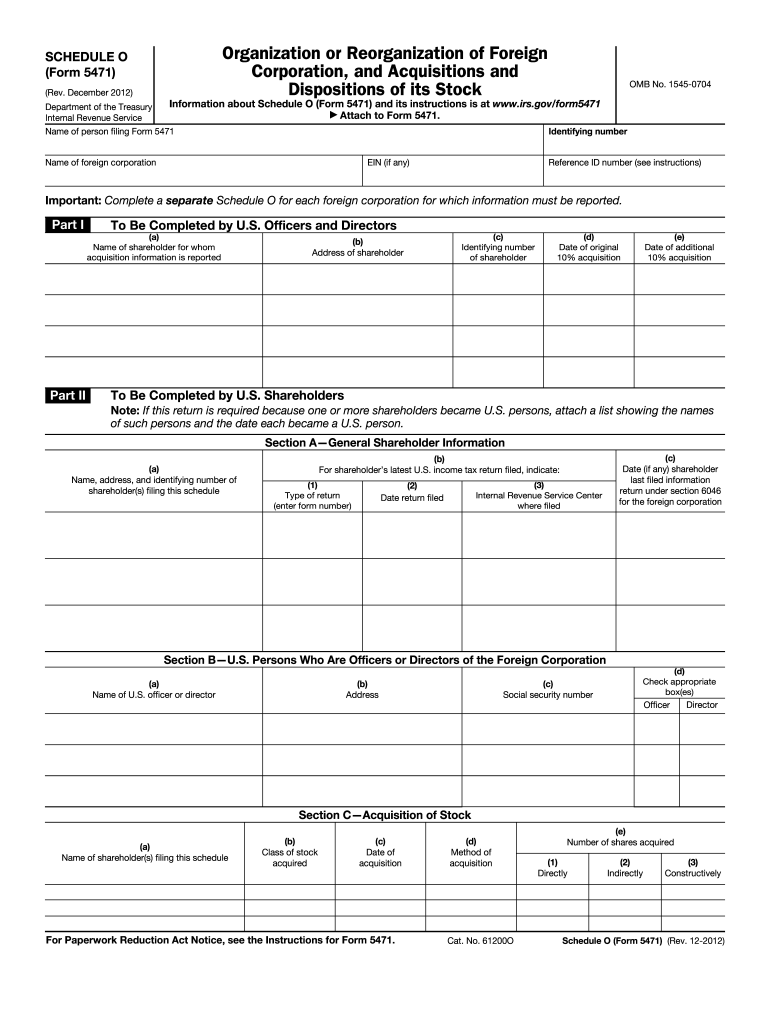

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Web information about form 5471, information return of u.s. Web instructions for form 5471 (rev. If you aren’t sure if you. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Shareholder who doesn't qualify as either a category 5b or 5c filer.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

January 2022)(use with the december 2021 revision of form 5471 and separate. Web instructions for form 5471 (rev. If you aren’t sure if you. Web instructions for form 5471department of the treasury internal revenue service rev. Web instructions for form 5471 (rev.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web video instructions and help with filling out and completing 5471 instructions 2022 make use of our fast video guideline for completing form in your browser. Web instructions for form 5471(rev. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how. If you aren’t sure if you. Dollar basis is used by the u.s.

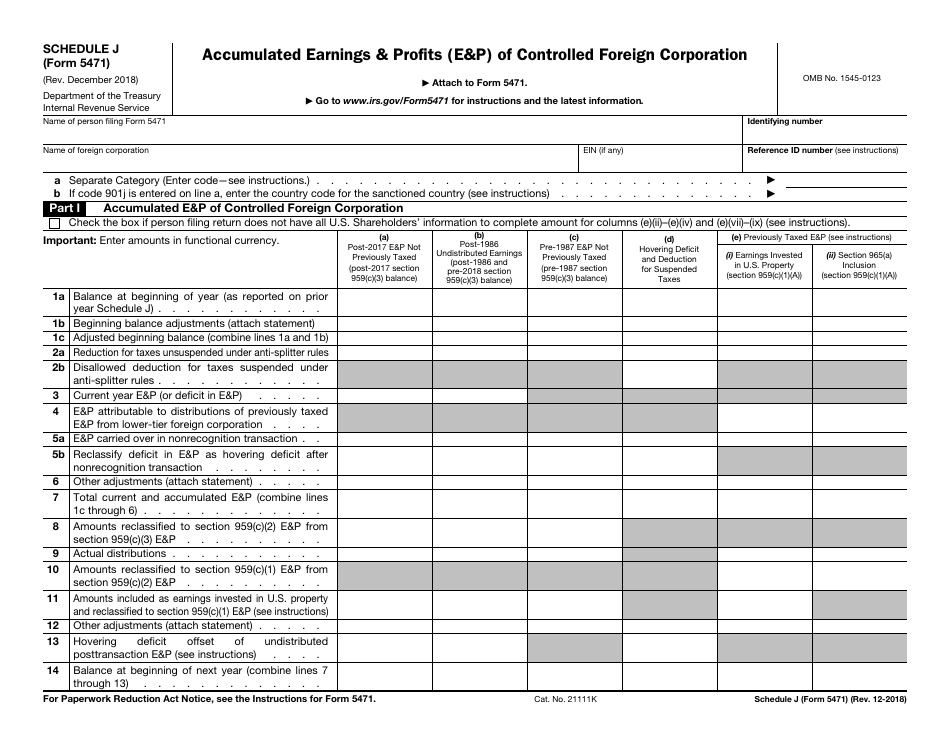

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

This article will help you generate form 5471 and any required schedules. Dollar basis is used by the u.s. Web video instructions and help with filling out and completing 5471 instructions 2022 make use of our fast video guideline for completing form in your browser. Web instructions for form 5471(rev. Web instructions for form 5471 (rev.

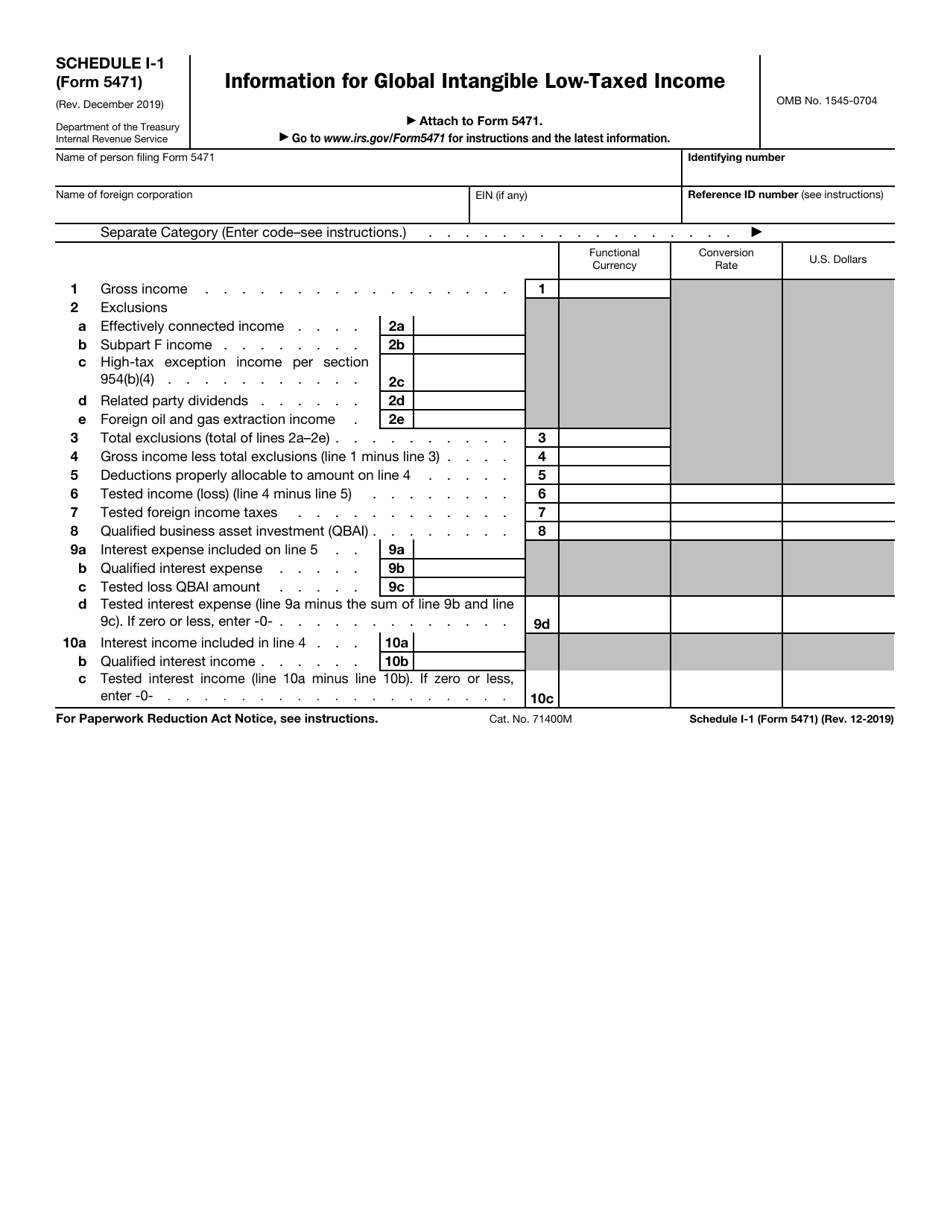

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

Transactions between controlled foreign corporation and shareholders or other. Web for calendar year 2022 or taxable year beginning 2022 and ending the u.s. So, a 5a filer is an unrelated section. Web follow these steps to generate and complete form 5471 in the program: Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation,.

Form 5471 (Schedule O) Foreign Corporation, and Acquisitions and

The december 2021 revision of. Shareholder who doesn't qualify as either a category 5b or 5c filer. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; E organization or reorganization of foreign corporation. Dollar basis is used by the u.s.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; This article will help you generate form 5471 and any required schedules. Web for calendar year 2022 or taxable year beginning 2022 and ending the u.s. So, a 5a filer is an unrelated section. January 2022)(use with the december 2021 revision of form 5471 and.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; If you aren’t sure if you. The december 2021 revision of separate. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web information about form 5471, information return of u.s.

2012 form 5471 instructions Fill out & sign online DocHub

The december 2021 revision of separate. This article will help you generate form 5471 and any required schedules. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web unlike the fbar or form.

The December 2021 Revision Of Separate.

So, a 5a filer is an unrelated section. This article will help you generate form 5471 and any required schedules. Web follow these steps to generate and complete form 5471 in the program: If you aren’t sure if you.

Shareholder Who Doesn't Qualify As Either A Category 5B Or 5C Filer.

Transactions between controlled foreign corporation and shareholders or other. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Shareholder must provide copies of u.s. E organization or reorganization of foreign corporation.

Shareholder To Determine The Amount Of Foreign Currency Gain Or Loss On The Ptep That The U.s.

Web instructions for form 5471(rev. December 2021) department of the treasury internal revenue service. Web instructions for form 5471department of the treasury internal revenue service rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q;

Web For Calendar Year 2022 Or Taxable Year Beginning 2022 And Ending The U.s.

The december 2021 revision of. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Web the instructions to form 5471 describes a category 5a filer as a u.s.