2553 Form Mailing Address

2553 Form Mailing Address - The country is basically divided in half. There are two different mailing addresses depending on the state you live in. Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center where you file your. Web how to file form 2553 via online fax. By mail to the address specified in the. It must contain the name, address, and ein of the corporation. Web there are two department of the treasury internal revenue service center locations. Web there are several steps to file form 2553: Department of the treasury, internal revenue service, cincinnati, oh 45999. Effective june 18, 2019, the filing address has.

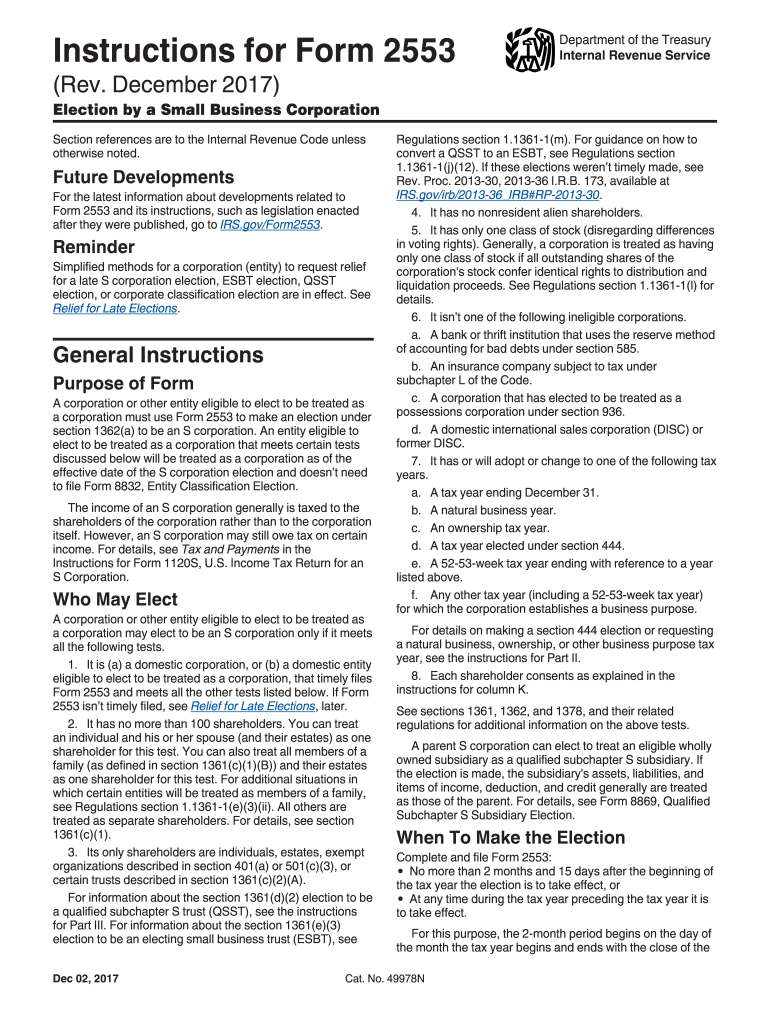

Web if you choose to mail your form 2553, you send it to this address: Effective june 18, 2019, the filing address has. Web instructions for form 2553 department of the treasury internal revenue service (rev. If you need more rows, use additional copies of page 2. Department of the treasury, internal revenue service, cincinnati, oh 45999. Which location you send it to depends on your corporation’s principal. Form 2553, get ready for tax deadlines by filling online any tax form for free. Web if you need a continuation sheet or use a separate consent statement, attach it to form 2553. The organization receives so much mail that it has its own zip. The country is basically divided in half.

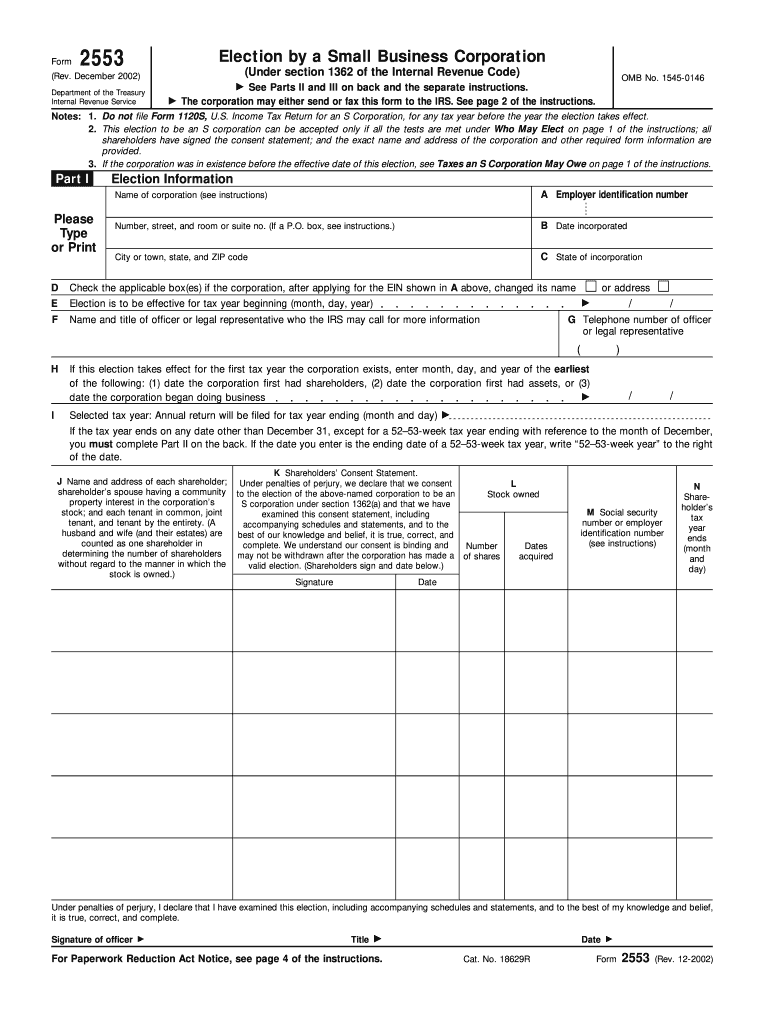

Web instructions for form 2553 department of the treasury internal revenue service (rev. The organization receives so much mail that it has its own zip. Web if you choose to mail your form 2553, you send it to this address: Web where to mail form 2553. If you need more rows, use additional copies of page 2. The country is basically divided in half. It must contain the name, address, and ein of the corporation. Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs. December 2020) (for use with the december 2017 revision of form 2553, election by a. Ad download, print or email irs 2553 tax form on pdffiller for free.

IRS Instruction 2553 2017 Fill and Sign Printable Template Online

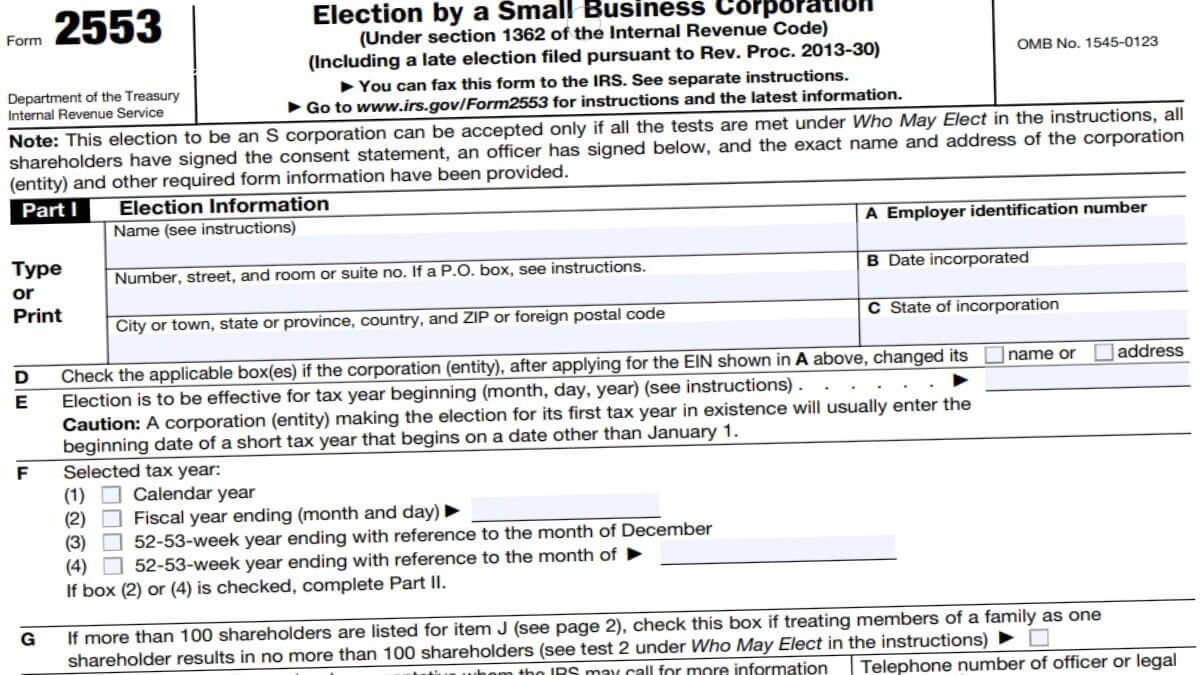

By mail to the address specified in the. Web if you choose to mail your form 2553, you send it to this address: Web instructions for form 2553 department of the treasury internal revenue service (rev. Web there are several steps to file form 2553: Web part i election information (continued) note:

Form 2553 Election by a Small Business Corporation (2014) Free Download

Name and address of each shareholder or former shareholder required to. By mail to the address specified in the. Effective june 18, 2019, the filing address has. Web there are two department of the treasury internal revenue service center locations. You can file form 2553 in the following ways:

Ssurvivor Form 2553 Irs Mailing Address

Web where to mail form 2553. If you need more rows, use additional copies of page 2. Download the form from the irs website. Web part i election information (continued) note: Department of the treasury, internal revenue service, cincinnati, oh 45999.

2553 Form 2021 Zrivo

If you need more rows, use additional copies of page 2. Effective june 18, 2019, the filing address has. Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs. Department of the treasury, internal revenue service, cincinnati, oh 45999. How to fax form.

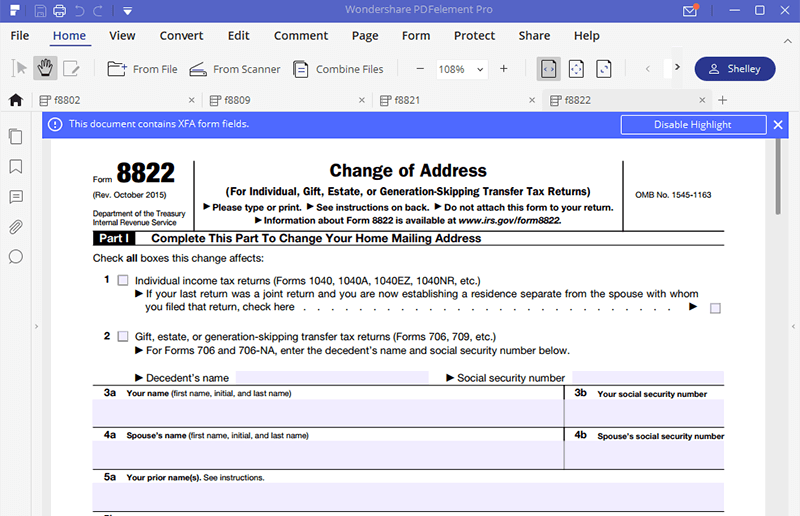

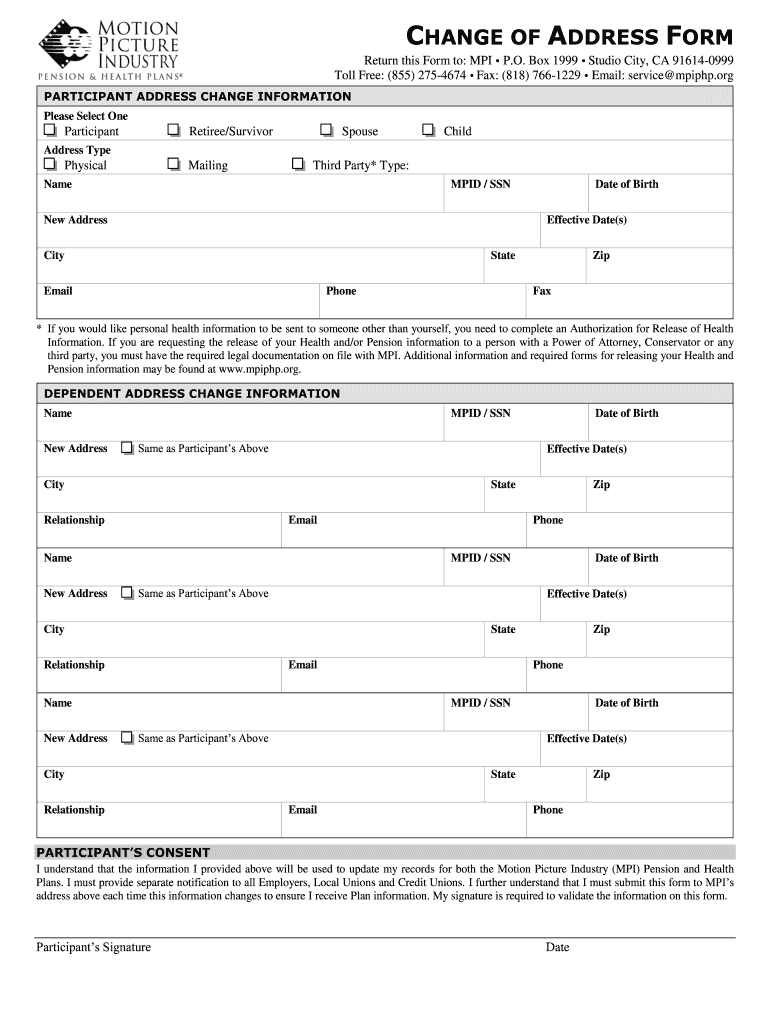

Post Office Change Of Address Form Fill Online, Printable, Fillable

By mail to the address specified in the. Web the irs doesn’t have a street address for either its kansas city, mo, or its ogden, ut, locations: The organization receives so much mail that it has its own zip. Department of the treasury, internal revenue service, cincinnati, oh 45999. Web instructions for form 2553 department of the treasury internal revenue.

Irs Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

Fill out your company’s contact information in part i and select your tax year. Web how to file form 2553 via online fax. Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center where you file your. Web if you need a continuation sheet or use.

Form 2553 Form Pros

Name and address of each shareholder or former shareholder required to. Fill out your company’s contact information in part i and select your tax year. Web there are several steps to file form 2553: Which location you send it to depends on your corporation’s principal. Web the irs doesn’t have a street address for either its kansas city, mo, or.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

Web there are several steps to file form 2553: How to fax form 2553 online with efax you. There are two different mailing addresses depending on the state you live in. Department of the treasury, internal revenue service, cincinnati, oh 45999. Web how to file form 2553 via online fax.

Form 2553 Election by a Small Business Corporation (2014) Free Download

Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center where you file your. The organization receives so much mail that it has its own zip. Download the form from the irs website. Name and address of each shareholder or former shareholder required to. Which location.

IRS Form 2553 Instructions How and Where to File This Tax Form

Form 2553, get ready for tax deadlines by filling online any tax form for free. Name and address of each shareholder or former shareholder required to. Web the irs doesn’t have a street address for either its kansas city, mo, or its ogden, ut, locations: Web where to mail form 2553. Web how to file form 2553 via online fax.

Ad Download, Print Or Email Irs 2553 Tax Form On Pdffiller For Free.

You can file form 2553 in the following ways: Input the business’s mailing address in the appropriate lines. It must contain the name, address, and ein of the corporation. Web there are two department of the treasury internal revenue service center locations.

How To Fax Form 2553 Online With Efax You.

Web how to file form 2553 via online fax. Input the business’s employer identification number (ein) obtained from the irs. If you need more rows, use additional copies of page 2. Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center where you file your.

Web There Are Several Steps To File Form 2553:

The country is basically divided in half. December 2020) (for use with the december 2017 revision of form 2553, election by a. Web if you need a continuation sheet or use a separate consent statement, attach it to form 2553. Form 2553, get ready for tax deadlines by filling online any tax form for free.

Effective June 18, 2019, The Filing Address Has.

Web instructions for form 2553 department of the treasury internal revenue service (rev. There are two different mailing addresses depending on the state you live in. Fill out your company’s contact information in part i and select your tax year. Web the irs doesn’t have a street address for either its kansas city, mo, or its ogden, ut, locations: