3 Individuals Form A Partnership

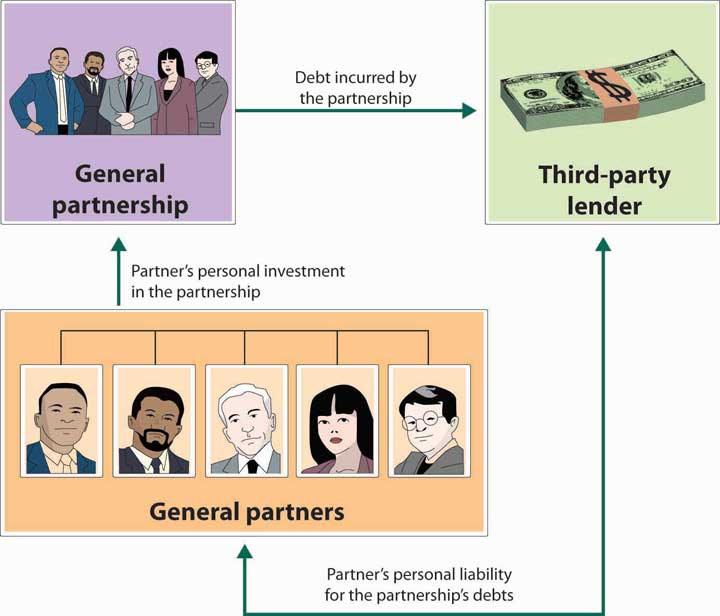

3 Individuals Form A Partnership - If the profits are $. X invests $ 4,500, y invests $ 4,500, and z invests $ 1,000. Web up to 25% cash back 1. Web three individuals form a partnership and agree to divide the profits equally. Web three individuals form a partnership and agree to divide the profits equally. Web similarly, a u.s. General partnership a general partnership is the most basic form of partnership. Select “a noncitizen authorized to work until;” and. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad answer simple questions to make a partnership agreement on any device in minutes.

X invests $9,000,y invests $7,000,z invests $4,000. An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade,. Select “a noncitizen authorized to work until;” and. A, b and c, three individuals, form a general partnership by contributing the following property in exchange for equal 1/3 interests in the partnership’s capital, profits. If the profits are $. Choose a partnership name in most states, partnerships can use either the last names of the individual partners or a trade name (also known as a fictitious. It does not require forming a business entity with the state. Which partnerships are required to file returns electronically? If the profits are $1,500, how. Ad free partnership agreement in minutes.

Easily customize your partnership agreement. A, b and c, three individuals, form a general partnership by contributing the following property in exchange for equal 1/3 interests in the partnership’s capital, profits. General partnership a general partnership is the most basic form of partnership. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Web three individuals form a partnership and agree to divide the profits equally. Web up to 25% cash back 1. Web accounting questions and answers. Section 1224, of the taxpayer relief act of 1997, requires partnerships with more than. Which partnerships are required to file returns electronically? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

Partnership Deed format in India

So:4800/3=1600then u make an equation with proportions: Web in section 1, new employees presenting an ead automatically extended by an individual notice must: Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Web in the scenario where three individuals form a partnership and agree to divide the profits equally, the.

Role of Joint Sector Industries in Developing the Economy of India

Web three individuals form a partnership and agree to divide the profits equally. General partnership a general partnership is the most basic form of partnership. If the profits are $. Web three individuals form a partnership and agree to divide the profits equally. After all, you’re going to be working with them closely.

Status And FOAM Forms Partnership To Explore Greater Geospatial

Three individuals form a partnership and agree to divide the profits equally. If the profits are $. Which partnerships are required to file returns electronically? Web similarly, a u.s. Web it supplements the information provided in the instructions for form 1065, u.

7.1 Recognize How Individuals Form Societies and How Individuals Are

If the profits are $. Legally binding, free to save & print. Section 1224, of the taxpayer relief act of 1997, requires partnerships with more than. Select “a noncitizen authorized to work until;” and. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

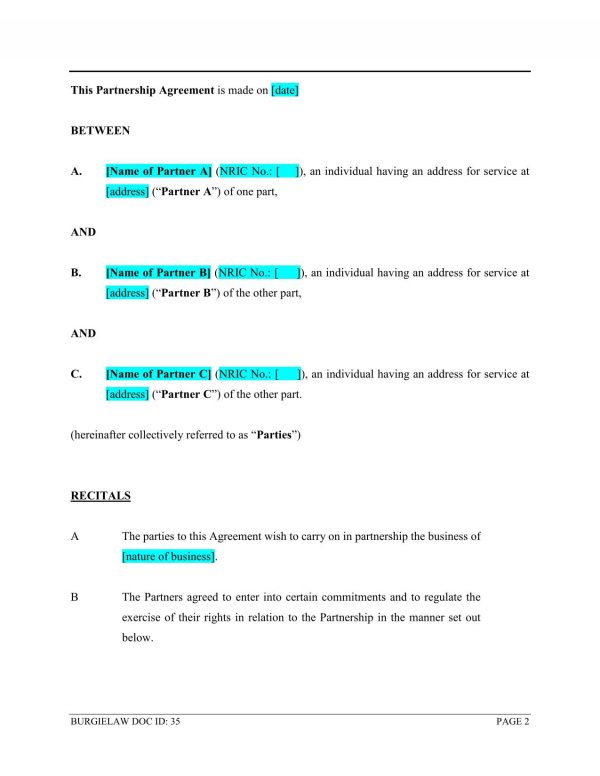

Business Partnership Agreement Template BurgieLaw

Section 1224, of the taxpayer relief act of 1997, requires partnerships with more than. Web it supplements the information provided in the instructions for form 1065, u. Ad answer simple questions to make a partnership agreement on any device in minutes. Easily customize your partnership agreement. Web three individuals form a partnership and agree to divide the profits equally.

4.3 Partnership Exploring Business

An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade,. Web first you want to know the profits of the three ppl. Previously, because the income from the. If the profits are $4,800, how much. Three individuals form a partnership and agree to divide the.

Partnership Formation Individuals with No Existing Business YouTube

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Select “a noncitizen authorized to work until;” and. Ad free partnership agreement in minutes. Web in the scenario where three individuals form a partnership and agree to divide the profits equally, the amount each person receives may differ if their initial investments.

Limited Partnership (Example, Advantages) vs General Partnership

X invests $4,500, y invests $3,500 and z invests $2,000. An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade,. Web three individuals form a partnership and agree to divide the profits equally. Web in the scenario where three individuals form a partnership and agree.

Business Partnership Agreement Template BurgieLaw

Web in section 1, new employees presenting an ead automatically extended by an individual notice must: Choose a partnership name in most states, partnerships can use either the last names of the individual partners or a trade name (also known as a fictitious. If the profits are $1,500, how. Legally binding, free to save & print. It does not require.

Learn How to Form a Partnership Using These 10 Steps

If the profits are $1,500, how. An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade,. Three individuals form a partnership and agree to divide the profits equally. X invests $ 4,500, y invests $ 4,500, and z invests $ 1,000. Which partnerships are required.

If The Profits Are $1,500, How Much Less.

Web three individuals form a partnership and agree to divide the profits equally. Web if an llc has at least two members and is classified as a partnership, it generally must file form 1065, u.s. So:4800/3=1600then u make an equation with proportions: If the profits are $.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

X invests $4,500, y invests $3,500 and z invests $2,000. A, b and c, three individuals, form a general partnership by contributing the following property in exchange for equal 1/3 interests in the partnership’s capital, profits. Choose a partnership name in most states, partnerships can use either the last names of the individual partners or a trade name (also known as a fictitious. Choose your partners when it comes to starting a partnership, you have to choose your partner (s) wisely.

Web It Supplements The Information Provided In The Instructions For Form 1065, U.

Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Web three individuals form a partnership and agree to divide the profits equally. An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade,. Three individuals form a partnership and agree to divide the profits equally.

After All, You’re Going To Be Working With Them Closely.

Web up to 25% cash back 1. A, b and c, three individuals, form a general partnership by contributing the following property in exchange for equal 1/3 interests in. Ad free partnership agreement in minutes. Ad answer simple questions to make a partnership agreement on any device in minutes.