433 D Form

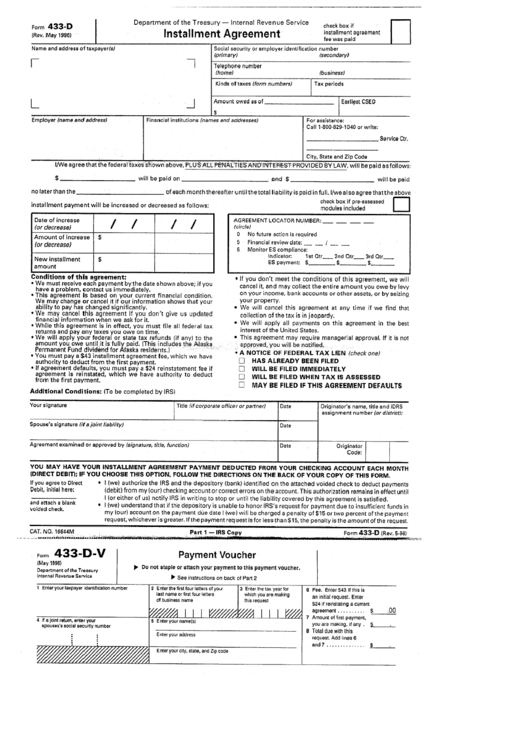

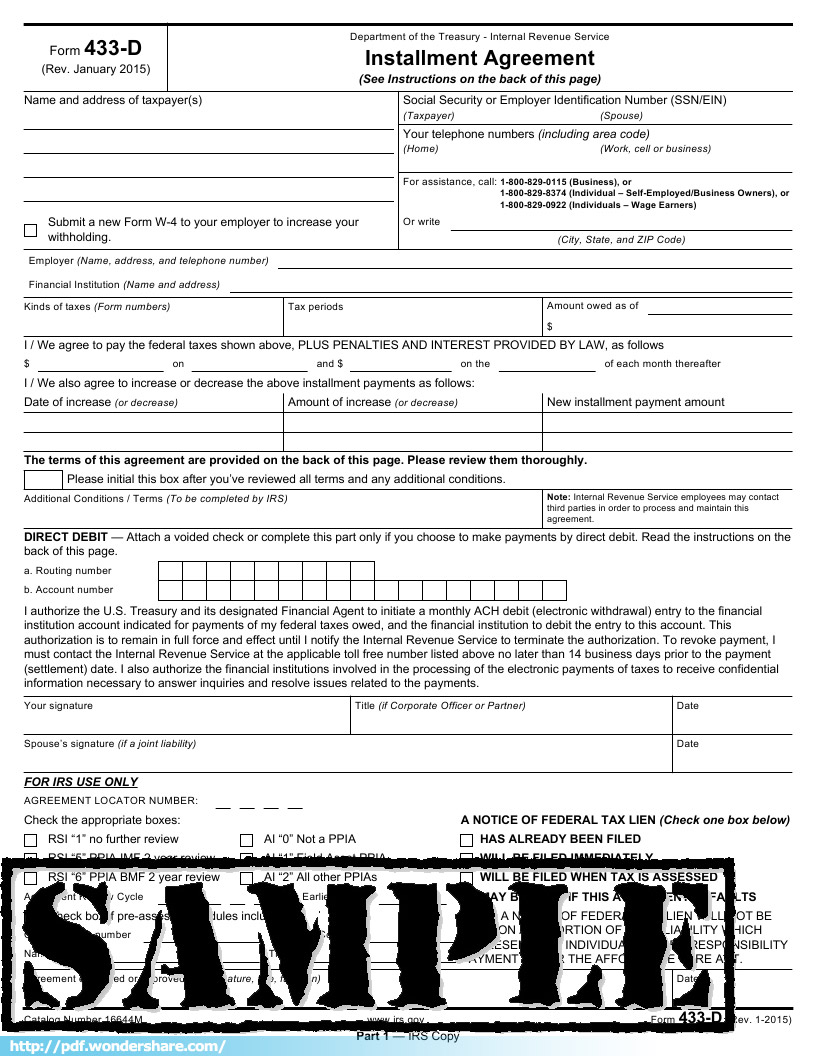

433 D Form - However, you need a form 9465 from the irs to initiate the tax resolution. El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Table of contents what is irs form 433 d? The document finalizes the agreement between an individual or a business and the irs. This form is used by the united states internal revenue service. Web what is an irs form 433d? Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. It shows the amount of your initial payment plus the date and amount of your regular monthly payment. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes.

El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito. This form is used by the united states internal revenue service. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. Web what is an irs form 433d? However, you need a form 9465 from the irs to initiate the tax resolution. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. It shows the amount of your initial payment plus the date and amount of your regular monthly payment. The document finalizes the agreement between an individual or a business and the irs. It is a form taxpayers can submit to authorize a direct debit payment method.

Web what is an irs form 433d? This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. It is a form taxpayers can submit to authorize a direct debit payment method. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. Table of contents what is irs form 433 d? This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. The document finalizes the agreement between an individual or a business and the irs. However, you need a form 9465 from the irs to initiate the tax resolution. This form is used by the united states internal revenue service. It shows the amount of your initial payment plus the date and amount of your regular monthly payment.

Form 433 D Pdf Fillable Form Resume Examples a6YngoxVBg

This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. It shows the amount of your initial payment plus the date and amount of your regular monthly payment. The.

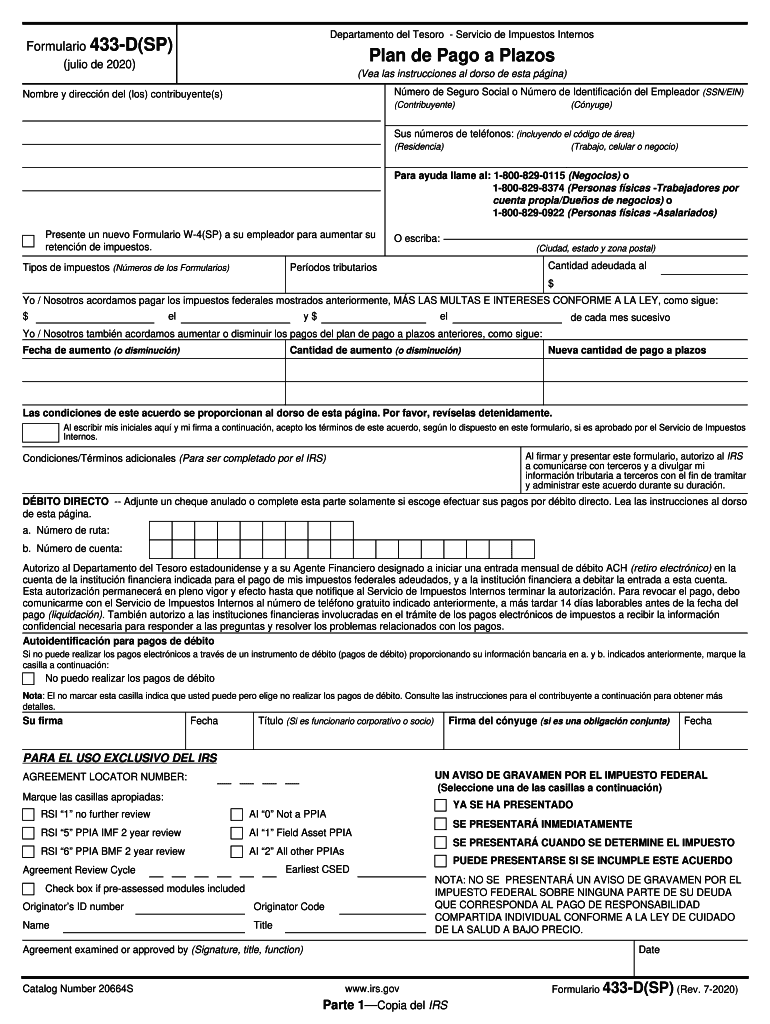

IRS 433D (SP) 20202022 Fill out Tax Template Online US Legal Forms

This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. It shows the amount of your initial payment plus the date and amount of your regular monthly payment. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web.

Fill Free fillable Form 433D Installment Agreement 2018 PDF form

El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito. The document finalizes the agreement between an individual or a business and the irs. Table of contents what is irs form 433 d? This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance.

Irs.gov Form 941 Mailing Address Form Resume Examples w950jQVkor

Table of contents what is irs form 433 d? It is a form taxpayers can submit to authorize a direct debit payment method. The document finalizes the agreement between an individual or a business and the irs. It shows the amount of your initial payment plus the date and amount of your regular monthly payment. El cargo de restauración reducido.

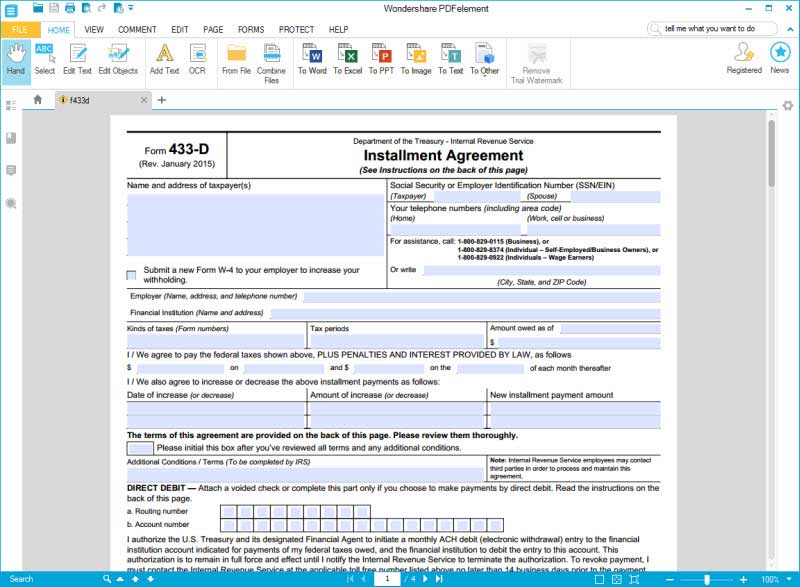

IRS Form 433D Fill Out With Wondershare PDFelement

This form is used by the united states internal revenue service. Web what is an irs form 433d? The document finalizes the agreement between an individual or a business and the irs. However, you need a form 9465 from the irs to initiate the tax resolution. This form will be used to help formulate and finalize payment plans and installments.

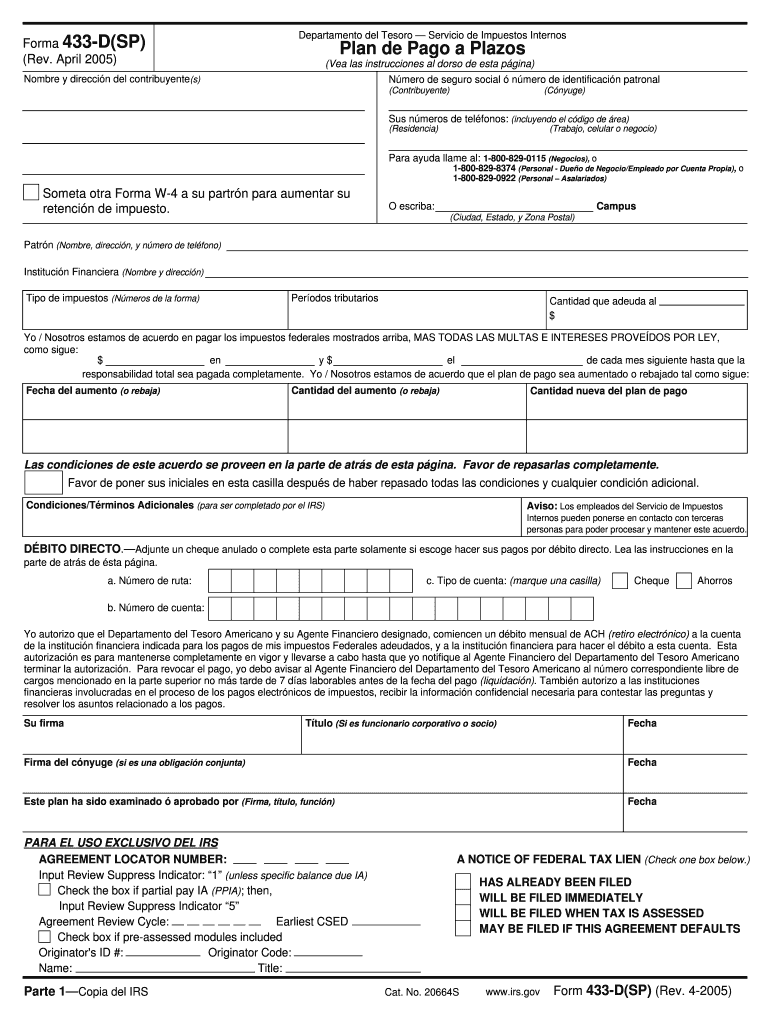

Where To Fax Form 433 D 2005 2005 Fill and Sign Printable Template

This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. It shows the amount of your initial payment plus the date and amount of your regular monthly payment. The.

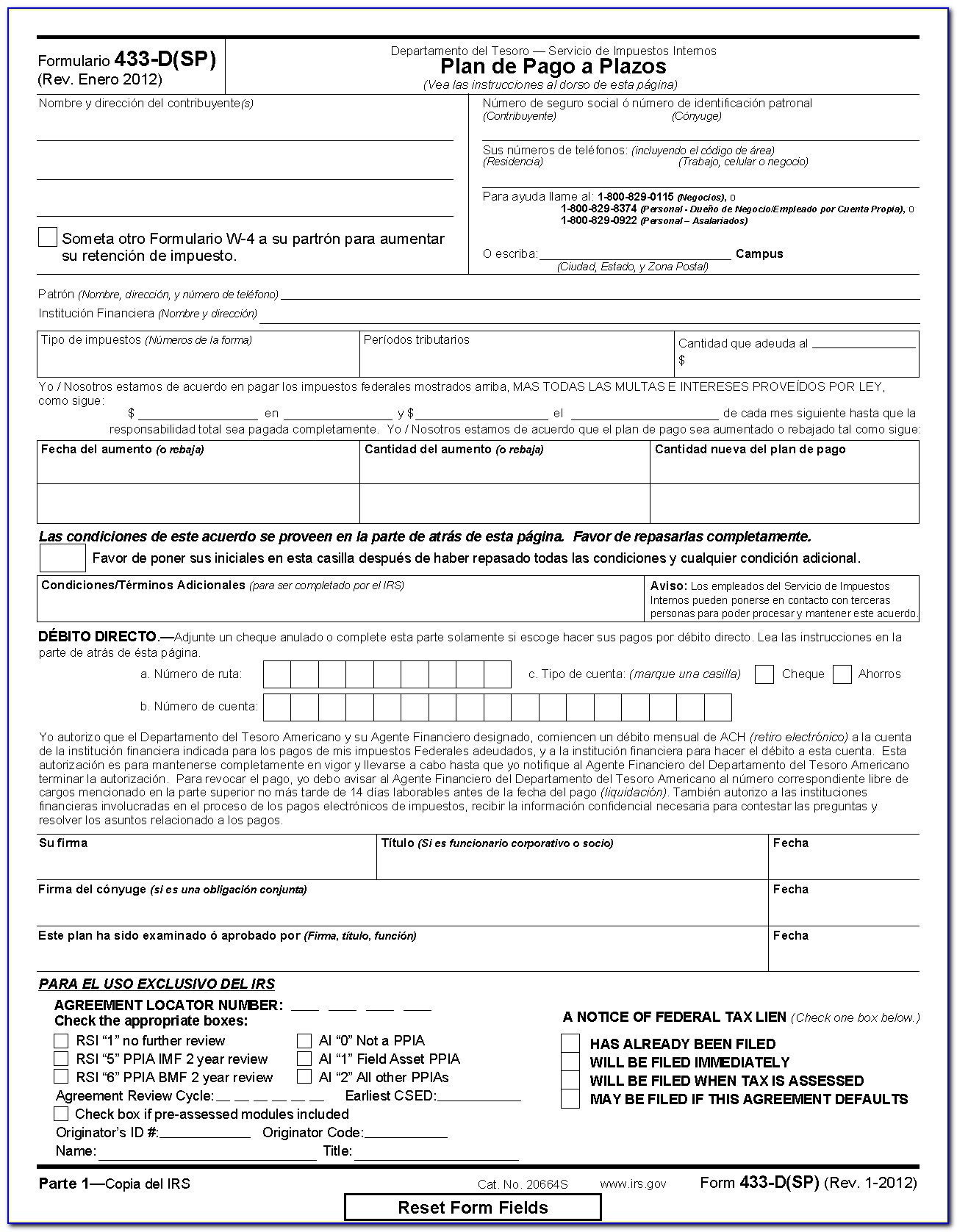

Form 433D Installment Agreement printable pdf download

This form is used by the united states internal revenue service. Web what is an irs form 433d? El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito. The document finalizes the agreement between an individual or a business and the irs. It is a form taxpayers can submit to authorize.

How to Complete an IRS Form 433D Installment Agreement

It shows the amount of your initial payment plus the date and amount of your regular monthly payment. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. This form is used by the united states internal revenue service. Web para los contribuyentes de bajos ingresos (igual o.

Form 433 d Fill out & sign online DocHub

This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. However, you need a form 9465 from the irs to initiate the.

IRS Form 433D Free Download, Create, Edit, Fill and Print

This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Web what is an irs form 433d? It is a form taxpayers can submit to authorize a direct debit payment method. However, you need a form 9465 from the irs to initiate the tax resolution. Table of contents.

It Is A Form Taxpayers Can Submit To Authorize A Direct Debit Payment Method.

The document finalizes the agreement between an individual or a business and the irs. El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito. Table of contents what is irs form 433 d? Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43.

It Shows The Amount Of Your Initial Payment Plus The Date And Amount Of Your Regular Monthly Payment.

This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. However, you need a form 9465 from the irs to initiate the tax resolution. Web what is an irs form 433d?