4952 Tax Form

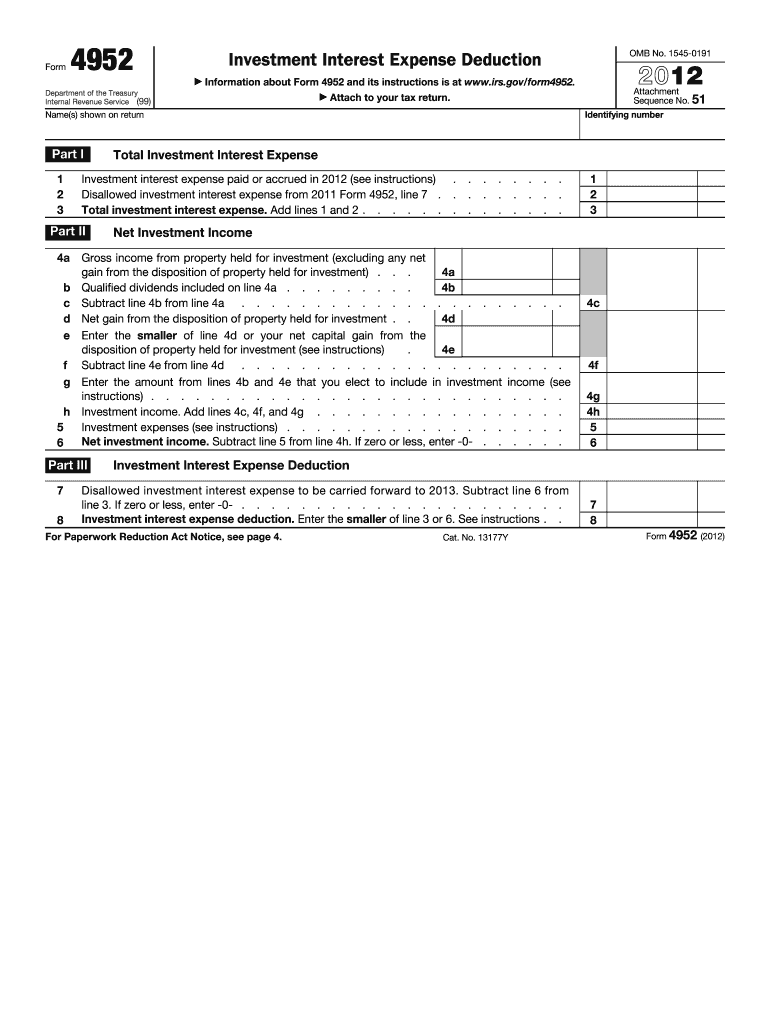

4952 Tax Form - This form is for income earned in tax year 2022, with tax returns due in april. *permanent residents of guam or the virgin islands cannot use form 9465. Web must file form 4952 to claim a deduction for your investment interest expense. You do not have to file form 4952 if all of the following apply. Complete, edit or print tax forms instantly. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web internal revenue service. Web federal investment interest expense deduction form 4952 pdf form content report error it appears you don't have a pdf plugin for this browser. Please use the link below. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service.

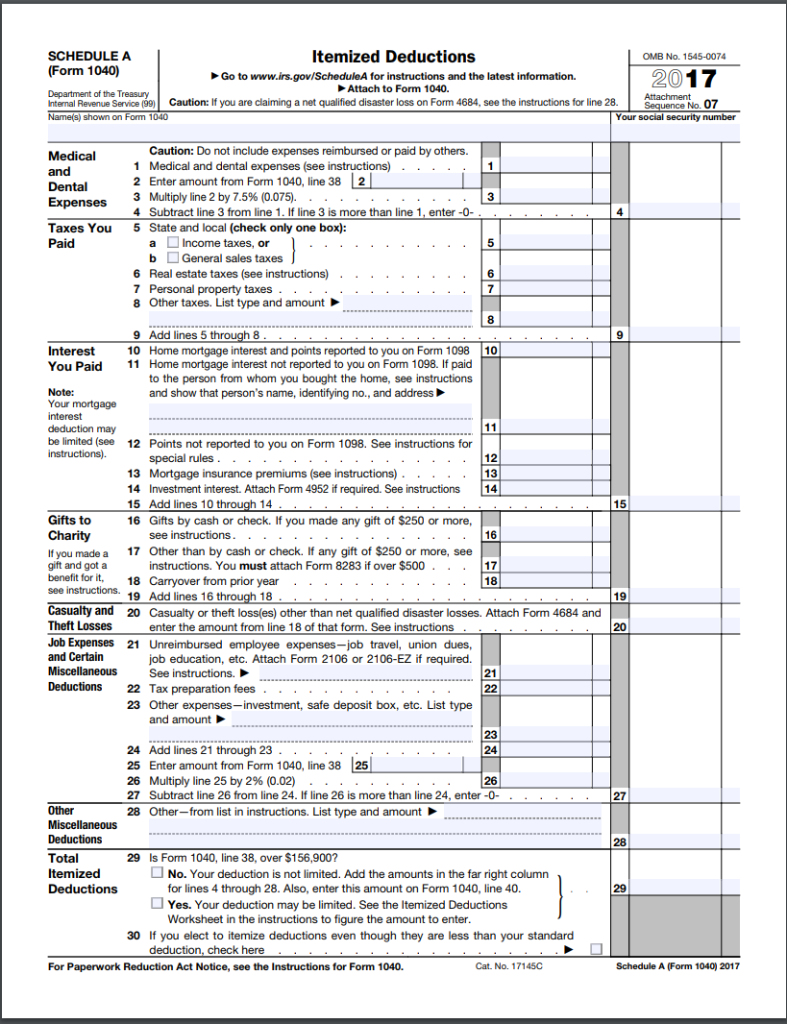

Reporting investment interest expense on fo. Please use the link below. Web investment (margin) interest deduction is claimed on form 4952 investment interest expense deduction and the allowable deduction will flow to schedule a (form 1040). Web internal revenue service. Web form 4952 can be filed by individuals, trusts and estates that wish to deduct interest expense that was paid on money you borrowed to buy property to be held as an. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction a go to www.irs.gov/form4952 for the latest information. This form is for income earned in tax year 2022, with tax returns due in april. Web must file form 4952 to claim a deduction for your investment interest expense. Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment. Web see below for answers to frequently asked questions about form 4952, the investment interest expense deduction.

Taxpayers who wish to claim investment interest expenses as a tax deduction generally must file form 4952 with their income tax. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. Web must file form 4952 to claim a deduction for your investment interest expense. Ad access irs tax forms. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Ad access irs tax forms. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future. You do not have to file form 4952 if all of the following apply. Web see below for answers to frequently asked questions about form 4952, the investment interest expense deduction. Complete, edit or print tax forms instantly.

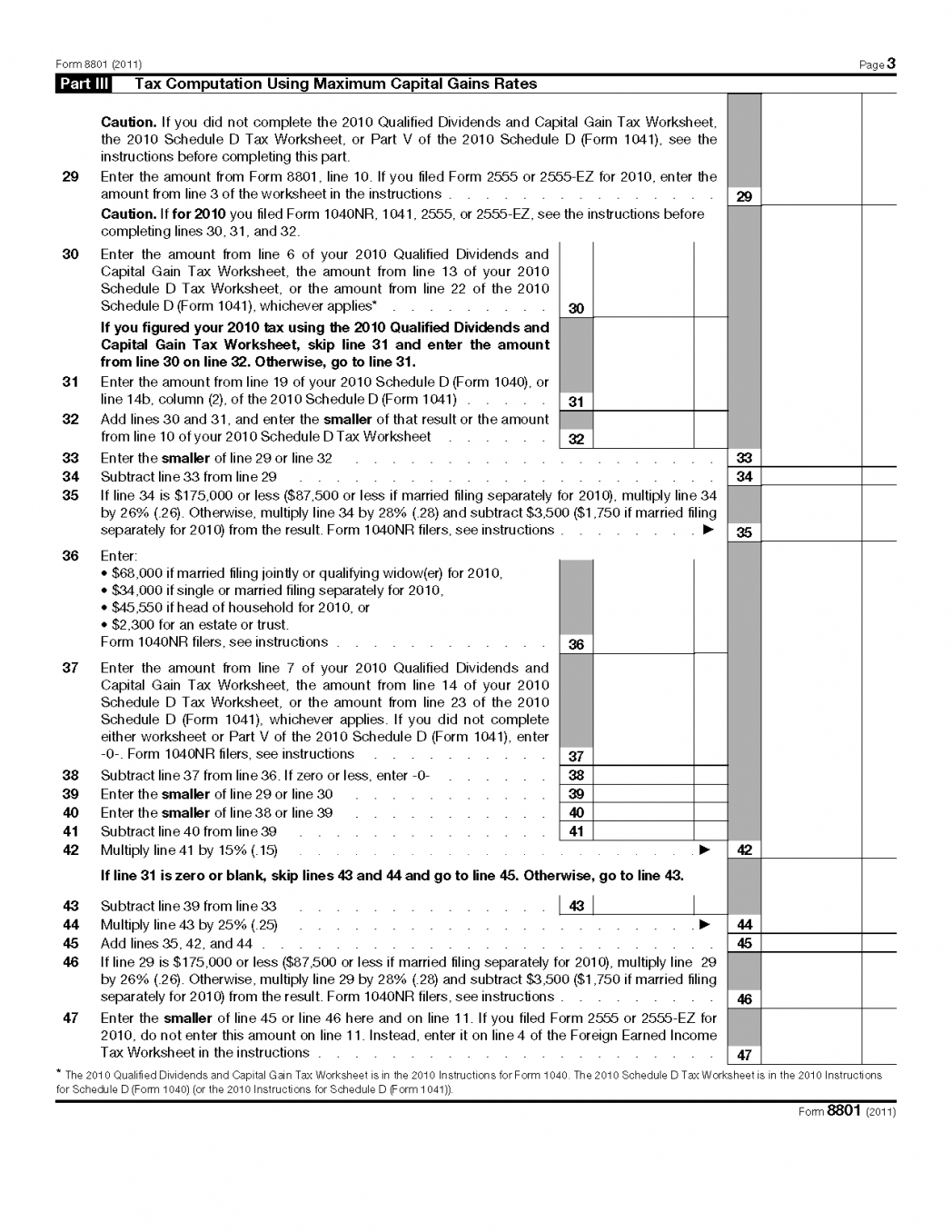

Capital Gains Worksheet For 2021 02/2022

Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. Investment (margin) interest deduction is claimed on form 4952 and the allowable deduction will. Complete, edit or print tax forms instantly. *permanent residents of guam or the virgin islands cannot use form 9465. Ad access irs tax forms.

Solved Leah, a 35 year old single taxpayer, has had similar

Ad access irs tax forms. Web must file form 4952 to claim a deduction for your investment interest expense. Investment (margin) interest deduction is claimed on form 4952 and the allowable deduction will. Web form 4952 can help you lower your tax bill. If using a private delivery service, send your returns to the street.

Question about a tax case, I think I have the right answer just wanted

Web internal revenue service. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information. Download or email irs 4952 & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns due in april. Investment interest expense deduction is.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. This form is for income earned in tax year 2022, with tax returns due in april. Web general instructions purpose of form use form 4952 to figure the amount of.

Form 4952Investment Interest Expense Deduction

Web form 4952 can be filed by individuals, trusts and estates that wish to deduct interest expense that was paid on money you borrowed to buy property to be held as an. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry.

Form 4952, Investment Interest Expense Deduction 1040 com Fill Out

Web form 4952 can help you lower your tax bill. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for.

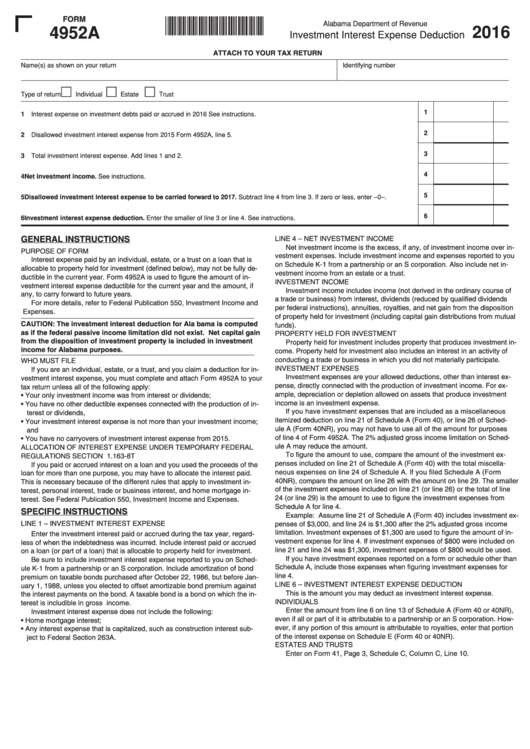

Form 4952a Investment Interest Expense Deduction 2016 printable pdf

Web federal investment interest expense deduction form 4952 pdf form content report error it appears you don't have a pdf plugin for this browser. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. If using a private delivery service, send your returns to the street. Web form 4952 is used to determine the amount of investment interest.

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Ad access irs tax forms. If using a private delivery service, send your returns to the street. Web internal revenue service. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction a go to www.irs.gov/form4952 for the latest information.

Tax ReturnIndividual Project Three (after Chapter 8) Instructions

Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. Reporting investment interest expense on fo. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Sharpton Group Reports Deficits, Tax Debt Plan The Smoking Gun

*permanent residents of guam or the virgin islands cannot use form 9465. Complete, edit or print tax forms instantly. Web form 4952 can help you lower your tax bill. Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment. You do not have to file form 4952 if.

Complete, Edit Or Print Tax Forms Instantly.

Investment (margin) interest deduction is claimed on form 4952 and the allowable deduction will. Please use the link below. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction a go to www.irs.gov/form4952 for the latest information. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service.

Web Must File Form 4952 To Claim A Deduction For Your Investment Interest Expense.

Taxpayers who wish to claim investment interest expenses as a tax deduction generally must file form 4952 with their income tax. Ad access irs tax forms. Web see below for answers to frequently asked questions about form 4952, the investment interest expense deduction. Web form 4952 can help you lower your tax bill.

Web Internal Revenue Service.

Web form 4952 can be filed by individuals, trusts and estates that wish to deduct interest expense that was paid on money you borrowed to buy property to be held as an. If using a private delivery service, send your returns to the street. Ad access irs tax forms. *permanent residents of guam or the virgin islands cannot use form 9465.

Web Form 4952 Is Used To Determine The Amount Of Investment Interest Expense You Can Deduct For The Current Year And The Amount You Can Carry Forward To Future Years.

Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future. This form is for income earned in tax year 2022, with tax returns due in april. Web investment (margin) interest deduction is claimed on form 4952 investment interest expense deduction and the allowable deduction will flow to schedule a (form 1040). You do not have to file form 4952 if all of the following apply.