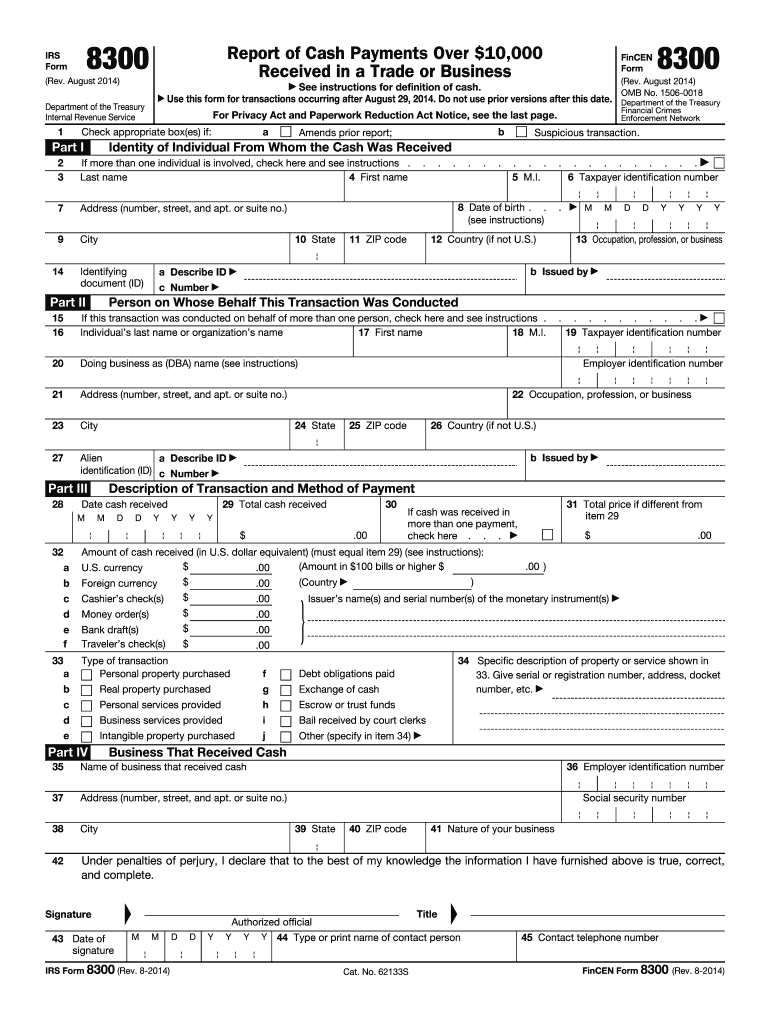

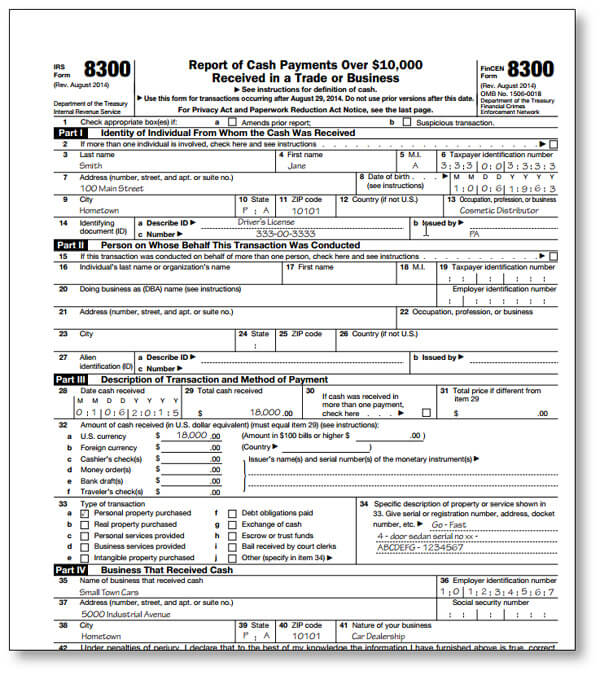

8300 Form Example

8300 Form Example - Web report of cash payments over $10,000 received in a trade or business (fincen form 8300) important: Web using the 8300 form is not optional for auto dealerships — it is the law. A wire transfer does not constitute cash for form 8300 reporting. Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and instructions on how to file. Web general instructions who must file. Web for example, if a landlord accepts cash payments for a lease of property, or if a contractor or retail business accepts cash in a lump sum or in installment payments for goods or services, a form 8300 filing may be required. Web the fincen form 8300 batch xml should be familiar with fincen regulations, extensible markup language (xml) and the fincen xml schemas. Web for example, a customer gives you $3,000 in u.s. This section asks the business name, address, nature of your business, employee id, and social security number. You would show eleven thousand five hundred ($11,500) in item 29 and the.

Transactions that require form 8300 include, but are not limited to: There will be boxes in this section that you can check to describe the details of your transaction. For example, an exempt organization that receives more than $10,000 in cash for renting part of its building must report the transaction. Web the organization must report noncharitable cash payments on form 8300. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. Web for example, items or services negotiated during the original purchase are related to the original purchase. Currency, a $4,000 cashier’s check, a $2,000 bank draft, and money orders in the amount of $2,500. Cash is not required to be reported if it is received: Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related transactions, must file form 8300. Web the fincen form 8300 batch xml should be familiar with fincen regulations, extensible markup language (xml) and the fincen xml schemas.

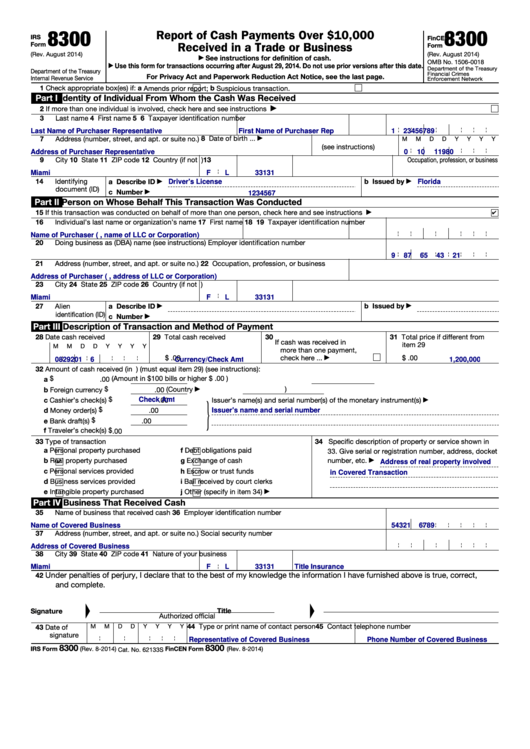

Web report of cash payments over $10,000 received in a trade or business (fincen form 8300) important: Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. A customer wired $7,000 from his bank account to the dealership's bank account and also presented a $4,000 cashier’s check. The university must give a written statement to each person named on a required form 8300 on or before january 31 of the following calendar year in which the cash is received. See publication 1544, reporting cash Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. • check the box for item 2, • include information for one of the individuals in part one on page 1 and • include information for two of the other individuals in part one on page 2. A wire transfer does not constitute cash for form 8300 reporting. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related transactions, must file form 8300.

IRS 8300 2014 Fill and Sign Printable Template Online US Legal Forms

A nonresident alien with no ssn or itin makes a purchase requiring form 8300 reporting and presents a mexican driver's license to verify his name and address. Web for example, if a landlord accepts cash payments for a lease of property, or if a contractor or retail business accepts cash in a lump sum or in installment payments for goods.

IRS Form 8300 It's Your Yale

Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and.

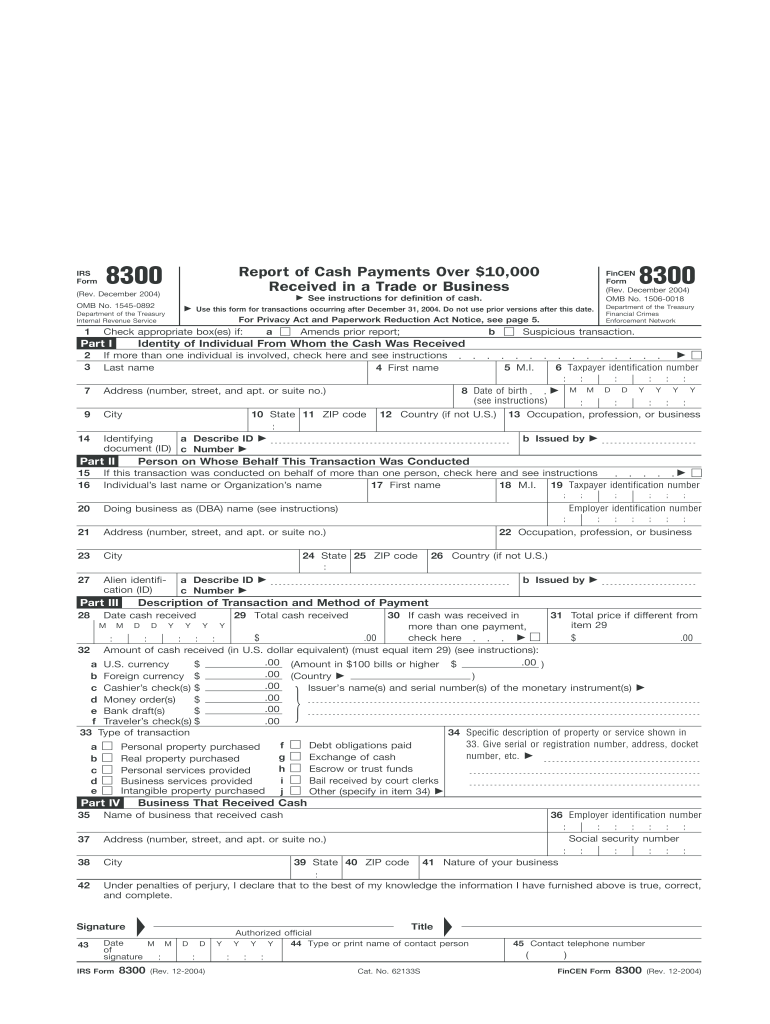

2004 Form IRS 8300 Fill Online, Printable, Fillable, Blank PDFfiller

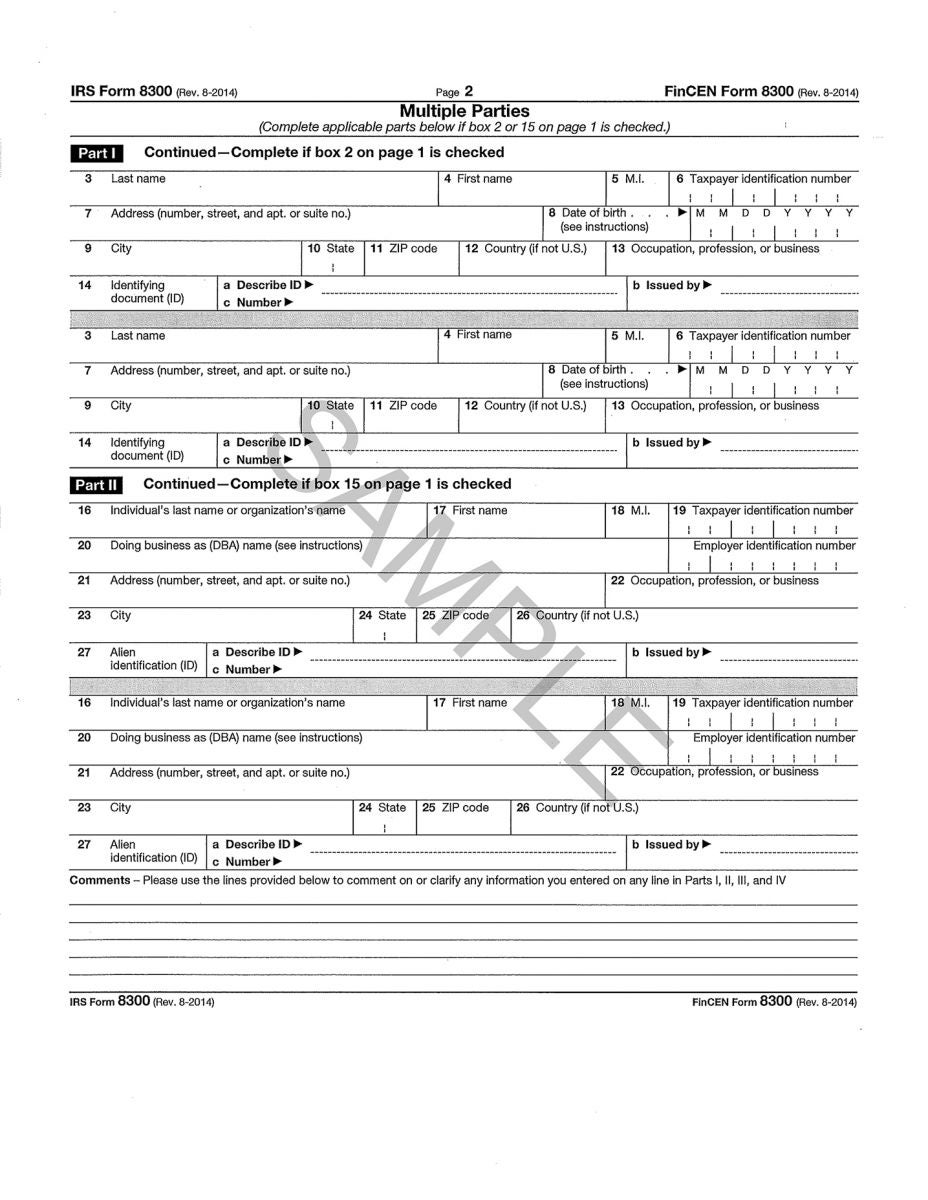

Page two of form 8300 must be completed when there are multiple parties to the transaction. You would show eleven thousand five hundred ($11,500) in item 29 and the. A driver's license issued by a foreign government would be acceptable documentation for name and address verification purposes. For more information, please go to bsaefiling.fincen.treas.gov. Insurance companies and travel agencies are.

The IRS Form 8300 and How it Works

Web one such example of trade or business income for a university would be tuition payments. August 2014) department of the treasury internal revenue service. Does the dealership complete form 8300? Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Report of cash payments over $10,000 received in a trade or business. Web the fincen form 8300 batch xml should be familiar with fincen regulations, extensible markup language (xml) and the fincen xml schemas. Caused, or attempted to cause, a trade or business to fail to file a required report. • check the box for item 2, • include information.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

See publication 1544, reporting cash Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related transactions, must file form 8300. See instructions for definition of cash. Web information about form 8300, report of cash payments over $10,000 received.

If I am paying cash for a car, why do they need to run a credit report

Web voluntary use of form 8300. Web one such example of trade or business income for a university would be tuition payments. Web as provided by the irs: See publication 526, charitable contributions, for details. See instructions for definition of cash.

Fillable Form 8300 Fincen printable pdf download

This person must then sign and date the form and indicate his/her university title and phone number. Use this form for transactions occurring after august 29, 2014. Web for example, if a landlord accepts cash payments for a lease of property, or if a contractor or retail business accepts cash in a lump sum or in installment payments for goods.

Why car dealers want to check your background when you pay cash

Report of cash payments over $10,000 received in a trade or business. See publication 1544, reporting cash Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and instructions on how to file. The university must give a written statement to each person named on a required form.

Form 8300 Report of Cash Payments over 10,000 Received in a Trade or

Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. Web as provided by the irs: There will be boxes in this section that you can check to describe the details of your.

See Publication 526, Charitable Contributions, For Details.

Form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. • check the box for item 2, • include information for one of the individuals in part one on page 1 and • include information for two of the other individuals in part one on page 2. The university must give a written statement to each person named on a required form 8300 on or before january 31 of the following calendar year in which the cash is received. For more information, please go to bsaefiling.fincen.treas.gov.

You Would Show Eleven Thousand Five Hundred ($11,500) In Item 29 And The.

Web for example, a customer gives you $3,000 in u.s. The business that received cash: Web for example, $1350 in us currency for business service provided. A wire transfer does not constitute cash for form 8300 reporting.

Web The Form 8300, Report Of Cash Payments Over $10,000 In A Trade Or Business, Provides Valuable Information To The Internal Revenue Service And The Financial Crimes Enforcement Network (Fincen) In Their Efforts To Combat Money Laundering.

Web general instructions who must file. See publication 1544, reporting cash This person must then sign and date the form and indicate his/her university title and phone number. A driver's license issued by a foreign government would be acceptable documentation for name and address verification purposes.

Web For Example, Dealers In Jewelry, Furniture, Boats, Aircraft Or Automobiles;

Form 8300 is due the 15th day after the date the cash was received. Web report of cash payments over $10,000 received in a trade or business (fincen form 8300) important: See instructions for definition of cash. • in a transaction occurring entirely outside the united states.