8582 Form Instructions

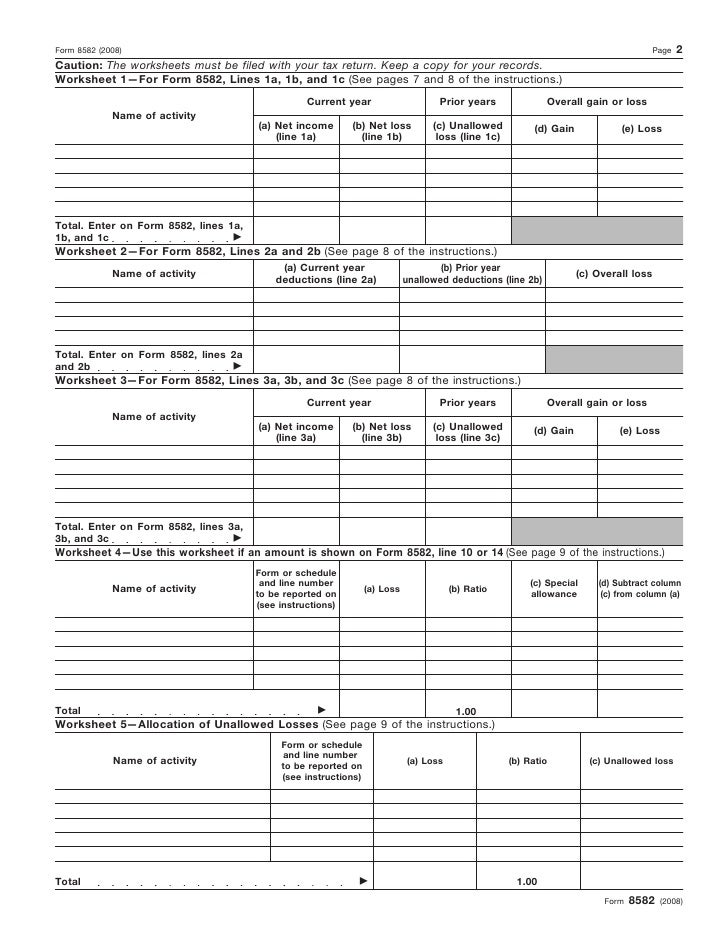

8582 Form Instructions - In the left menu, select tax tools and then tools. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web detailed instructions before entering an ipc in the hhsc data system, the form 8582 must be completed and signed by the required spt members. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Press f6 to bring up open forms. The worksheets must be filed with your tax. Name as shown on return identifying number as shown on return see the instructions.

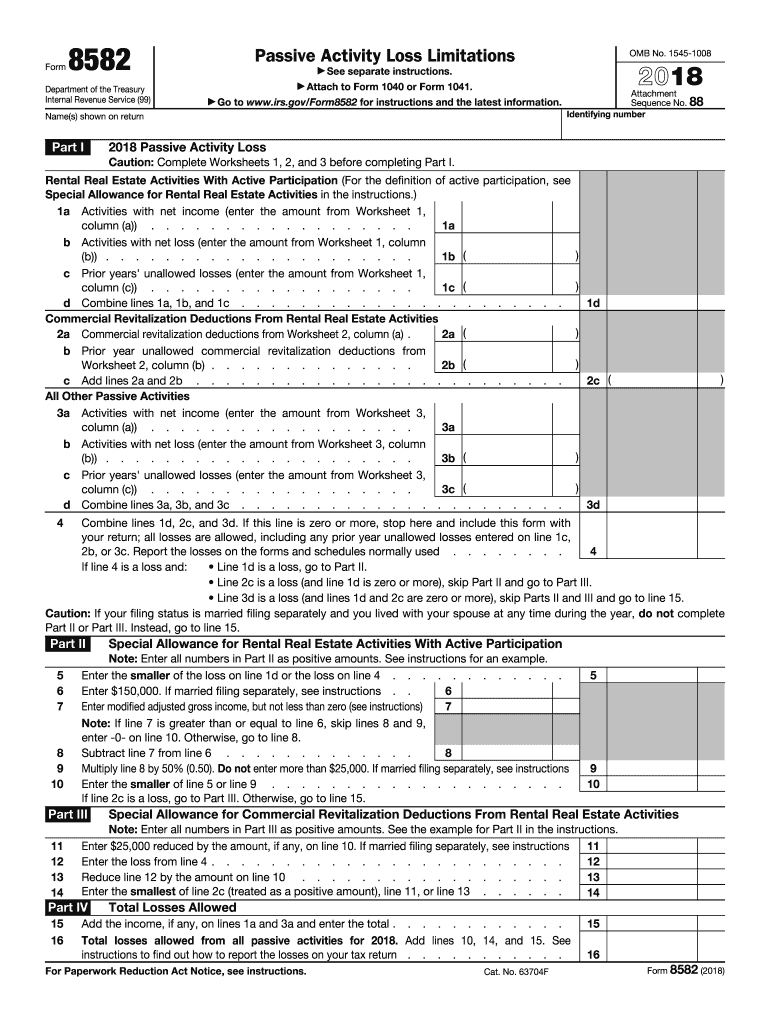

No manual entries are allowed on the 8582 and any. Web for paperwork reduction act notice, see instructions. Open or continue your return in turbotax. Name as shown on return identifying number as shown on return see the instructions. However, for purposes of the donor’s. In the left menu, select tax tools and then tools. 8582 (2018) form 8582 (2018) page. Web follow these steps to delete form 8582. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Ad register and subscribe now to work on your irs 8582 & more fillable forms.

Web open the client's tax return. Web for paperwork reduction act notice, see instructions. Taxpayer with an ownership interest in a partnership, s corporation, or trust, you need to be careful about what is a passive loss vs. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. See the instructions for federal form 8582 for specific line instructions and examples for completing the worksheets. Complete, edit or print tax forms instantly. Open or continue your return in turbotax. The worksheets must be filed with your tax. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed.

Irs Form 8582 Fill Out and Sign Printable PDF Template signNow

This form also allows the taxpayer. See the instructions for federal form 8582 for specific line instructions and examples for completing the worksheets. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Web from 8582, passive activity loss limitations, is filed by.

8582 Tax Fill Out and Sign Printable PDF Template signNow

In the left menu, select tax tools and then tools. Ad register and subscribe now to work on your irs 8582 & more fillable forms. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: The hard copy of the ipc. Irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the.

Download Instructions for IRS Form 8582CR Passive Activity Credit

Web detailed instructions before entering an ipc in the hhsc data system, the form 8582 must be completed and signed by the required spt members. Web follow these steps to delete form 8582. However, for purposes of the donor’s. Name as shown on return identifying number as shown on return see the instructions. Irs form 8582 is used by noncorporate.

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. Press f6 to bring up open forms. Web form 8582 is used by noncorporate taxpayers.

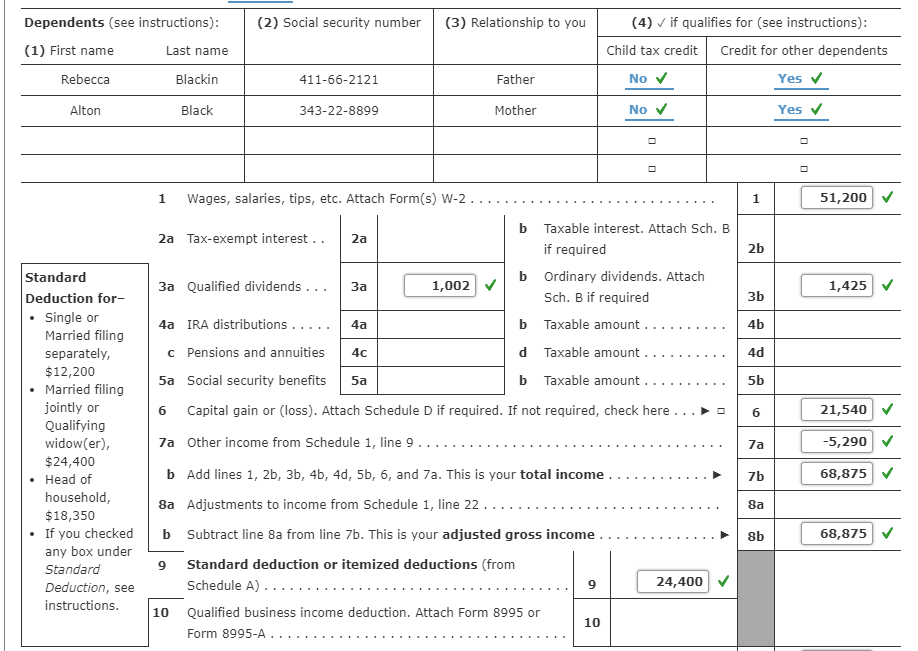

Instructions Comprehensive Problem 41 Skylar and

Web follow these steps to delete form 8582. 8582 (2018) form 8582 (2018) page. In the left menu, select tax tools and then tools. The hard copy of the ipc. If you actively participated in a passive rental real estate activity, you.

Fill Free fillable form 8582 passive activity loss limitations pdf

Web detailed instructions before entering an ipc in the hhsc data system, the form 8582 must be completed and signed by the required spt members. This form also allows the taxpayer. Name as shown on return identifying number as shown on return see the instructions. If you actively participated in a passive rental real estate activity, you. The worksheets must.

Form 8582Passive Activity Loss Limitations

A pal happens when the total losses of. However, for purposes of the donor’s. Web in the columns indicated. Web detailed instructions before entering an ipc in the hhsc data system, the form 8582 must be completed and signed by the required spt members. If you actively participated in a passive rental real estate activity, you.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

You can download or print current. Irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web we last updated.

Download Instructions for IRS Form 8582CR Passive Activity Credit

Web follow these steps to delete form 8582. You can download or print current. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Complete, edit or print tax forms instantly. Web open the client's tax return.

Instructions for Form 8582CR (01/2012) Internal Revenue Service

Web for paperwork reduction act notice, see instructions. Press f6 to bring up open forms. This form also allows the taxpayer. In the left menu, select tax tools and then tools. Web detailed instructions before entering an ipc in the hhsc data system, the form 8582 must be completed and signed by the required spt members.

Name As Shown On Return Identifying Number As Shown On Return See The Instructions.

Web if you're a u.s. A pal happens when the total losses of. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web in the columns indicated.

Web We Last Updated The Passive Activity Loss Limitations In December 2022, So This Is The Latest Version Of Form 8582, Fully Updated For Tax Year 2022.

8582 (2018) form 8582 (2018) page. This form also allows the taxpayer. The hard copy of the ipc. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed.

Open Or Continue Your Return In Turbotax.

No manual entries are allowed on the 8582 and any. Press f6 to bring up open forms. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web open the client's tax return.

However, For Purposes Of The Donor’s.

In the left menu, select tax tools and then tools. Web detailed instructions before entering an ipc in the hhsc data system, the form 8582 must be completed and signed by the required spt members. Web for paperwork reduction act notice, see instructions. If you actively participated in a passive rental real estate activity, you.