8938 Tax Form

8938 Tax Form - Web definition irs form 8938 is a tax form used by some u.s. Web irs mailing addresses by residence & form. Before viewing it, please see the important update information below. To get to the 8938 section in turbotax, refer to the following instructions: In recent years, the irs has increased offshore enforcement of foreign. Over $1,121 but not over $2,242. Get started form 8938 penalties. Web general instructions purpose of form use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Create a blank & editable 8938 form,. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain.

Here’s everything you need to know about this form: Web general instructions purpose of form use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Complete, edit or print tax forms instantly. Ad sovos combines tax automation with a human touch. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web up to $40 cash back easily complete a printable irs 8938 form 2021 online. Get ready for this year's tax season quickly and safely with pdffiller! Web irs mailing addresses by residence & form. Web filing form 8938 is only available to those using turbotax deluxe or higher. Reach out to learn how we can help you!

Get started form 8938 penalties. Ad sovos combines tax automation with a human touch. Before viewing it, please see the important update information below. You will be mailing your returns to specific addresses based on the type of. Reach out to learn how we can help you! Create a blank & editable 8938 form,. Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Below, find tables with addresses by residency. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web form 8938 each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form.

USCs and LPRs residing outside the U.S. and IRS Form 8938 « Tax

Ad sovos combines tax automation with a human touch. 1.5% of the missouri taxable income. Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Reach out to learn how we can help you! Web the irs requires u.s.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Web get started fatca reporting by over 110 countries more than 110 countries and over 300,000 foreign financial institutions report to the us. Create a blank & editable 8938 form,. In recent years, the irs has increased offshore enforcement of foreign. Complete, edit or print tax forms instantly. Get ready for this year's tax season quickly and safely with pdffiller!

Form 8938 IRS RJS LAW International Tax Tax Attorney San Diego

Web filing form 8938 is only available to those using turbotax deluxe or higher. Web irs mailing addresses by residence & form. Get ready for this year's tax season quickly and safely with pdffiller! Ad sovos combines tax automation with a human touch. Reach out to learn how we can help you!

1098 Form 2021 IRS Forms Zrivo

Over $1,121 but not over $2,242. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Get ready for tax season deadlines by completing any required tax forms today. Get started form 8938 penalties. 1.5% of the missouri taxable income.

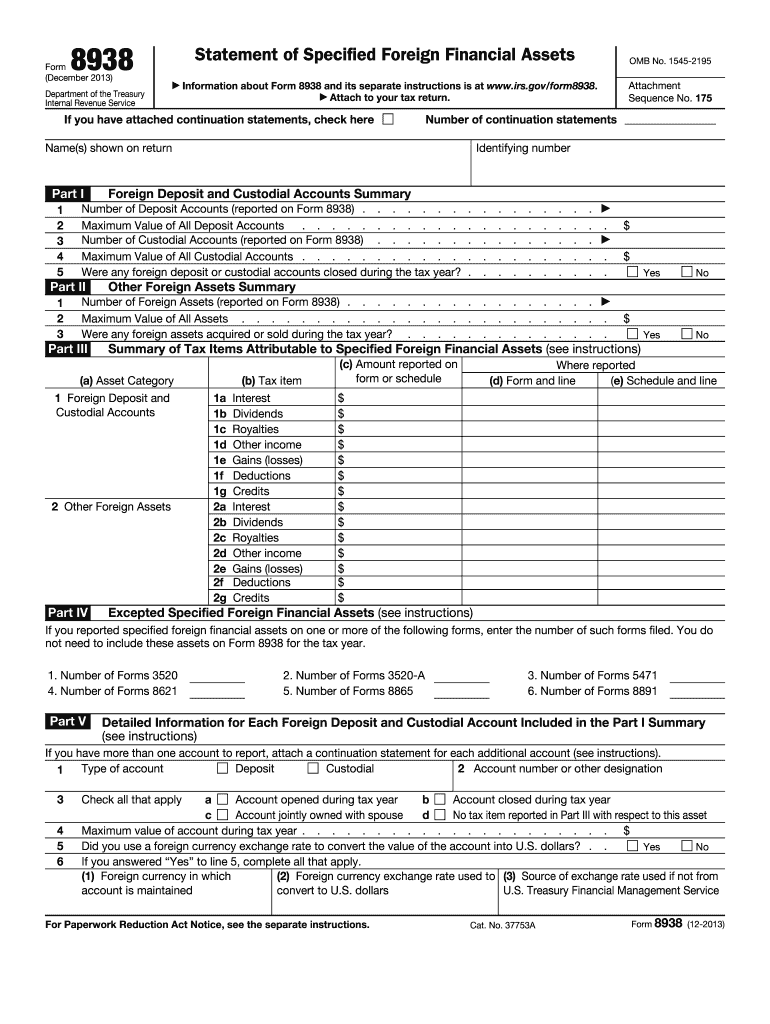

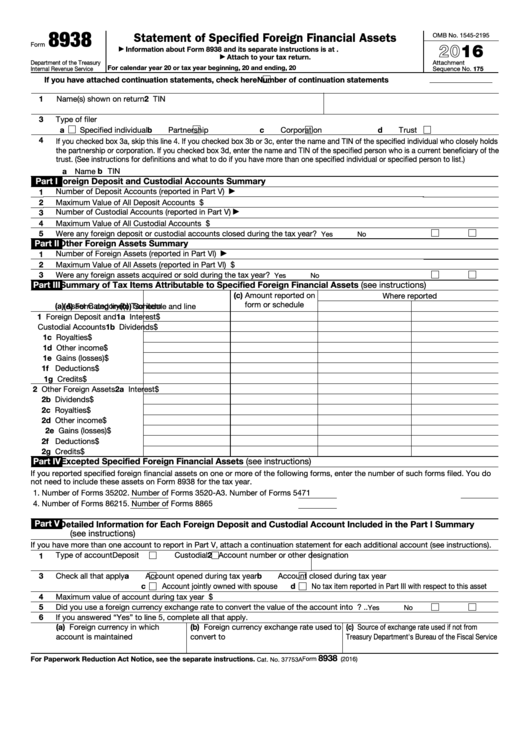

2013 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web if the missouri taxable income is: Web up to $40 cash back easily complete a printable irs 8938 form 2021 online. Over $1,121 but not over $2,242. Web filing form 8938 is only available to those using turbotax deluxe or higher. Below, find tables with addresses by residency.

IRS Form 8938 How to Fill it with the Best Form Filler

Web get started fatca reporting by over 110 countries more than 110 countries and over 300,000 foreign financial institutions report to the us. Taxpayers to report specified foreign financial assets each year on a form 8938. Web definition irs form 8938 is a tax form used by some u.s. Get ready for this year's tax season quickly and safely with.

Final Regulations on Reporting Foreign Financial Assets Form 8938

Web there are several ways to submit form 4868. Get ready for this year's tax season quickly and safely with pdffiller! Web the irs requires u.s. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. To get to the 8938 section in turbotax, refer to the following instructions:

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web definition irs form 8938 is a tax form used by some u.s. Create a blank & editable 8938 form,. Web if the missouri taxable income is: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad sovos combines tax automation with a human touch.

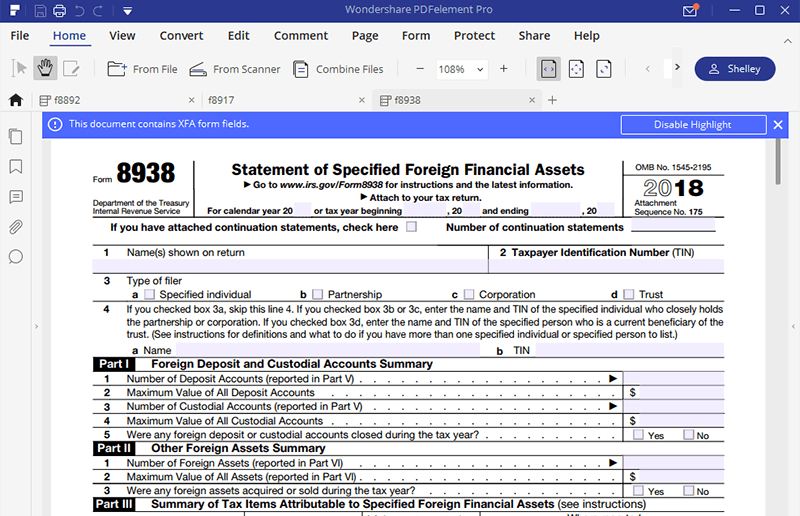

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

Define irs form 8938 on. At least $112 but not over $1,121. Ad sovos combines tax automation with a human touch. Web up to $40 cash back easily complete a printable irs 8938 form 2021 online. Web general instructions purpose of form use form 8938 to report your specified foreign financial assets if the total value of all the specified.

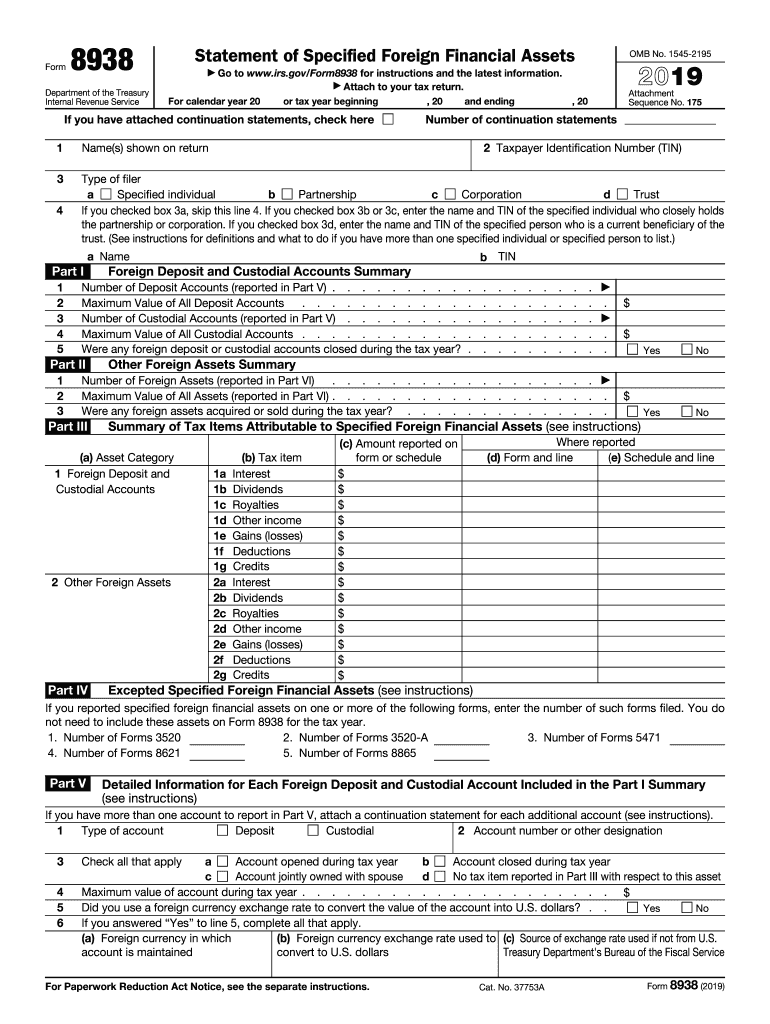

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

In recent years, the irs has increased offshore enforcement of foreign. Below, find tables with addresses by residency. Edit, sign and save irs 8938 instructions form. Web get started fatca reporting by over 110 countries more than 110 countries and over 300,000 foreign financial institutions report to the us. Get ready for tax season deadlines by completing any required tax.

Web Form 8938 Each Year, The Us Government Requires Us Taxpayers Who Own Foreign Assets, Investments And Accounts To Disclose This Information On Internal Revenue Service Form.

Over $1,121 but not over $2,242. Web filing form 8938 is only available to those using turbotax deluxe or higher. Ad sovos combines tax automation with a human touch. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

In Recent Years, The Irs Has Increased Offshore Enforcement Of Foreign.

Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Define irs form 8938 on. Below, find tables with addresses by residency. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain.

Taxpayers To Report Specified Foreign Financial Assets Each Year On A Form 8938.

Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. At least $112 but not over $1,121. Before viewing it, please see the important update information below. Get started form 8938 penalties.

Edit, Sign And Save Irs 8938 Instructions Form.

Web the irs requires u.s. 1.5% of the missouri taxable income. Create a blank & editable 8938 form,. You will be mailing your returns to specific addresses based on the type of.