940 Form 2021 Printable

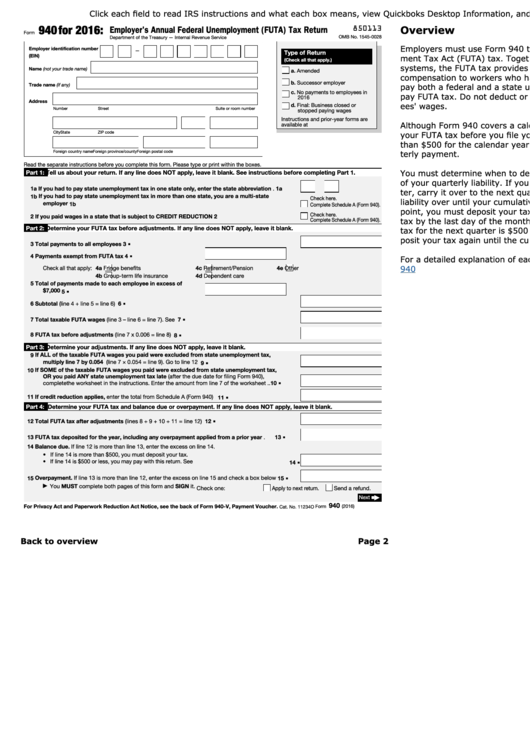

940 Form 2021 Printable - The 2021 form 940, employer’s annual federal unemployment (futa) tax return, was released dec. The streamlined template is filed by employers who use the annual wage base to calculate the tax, have had no significant changes in employment, and have no current or prior year futa tax liability. Complete, edit or print tax forms instantly. Get the current filing year’s forms, instructions, and publications for free from the irs. For more information about a cpeo’s requirement to file electronically, see rev. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Web we last updated the employer's annual federal unemployment (futa) tax return in december 2022, so this is the latest version of form 940, fully updated for tax year 2022. The 2021 form 940 was not substantially changed from the 2020 version. Futa is different from fica as employees don’t contribute towards this tax. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically.

The 2021 form 940 was not substantially changed from the 2020 version. Complete, edit or print tax forms instantly. Web employment tax forms: Web use printable form 940 in 2023 to report your annual federal unemployment tax act (futa) tax. Most employers pay both a federal and a state unemployment tax. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Therefore, this tax isn’t reflected on an employee’s paycheck. Form 940, employer's annual federal unemployment tax return. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Get the current filing year’s forms, instructions, and publications for free from the irs.

Upload, modify or create forms. Complete, edit or print tax forms instantly. Web get federal tax forms. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. You can print other federal tax forms here. Complete, edit or print tax forms instantly. Futa is different from fica as employees don’t contribute towards this tax. Form 940, employer's annual federal unemployment tax return. Web we last updated the employer's annual federal unemployment (futa) tax return in december 2022, so this is the latest version of form 940, fully updated for tax year 2022. For more information about a cpeo’s requirement to file electronically, see rev.

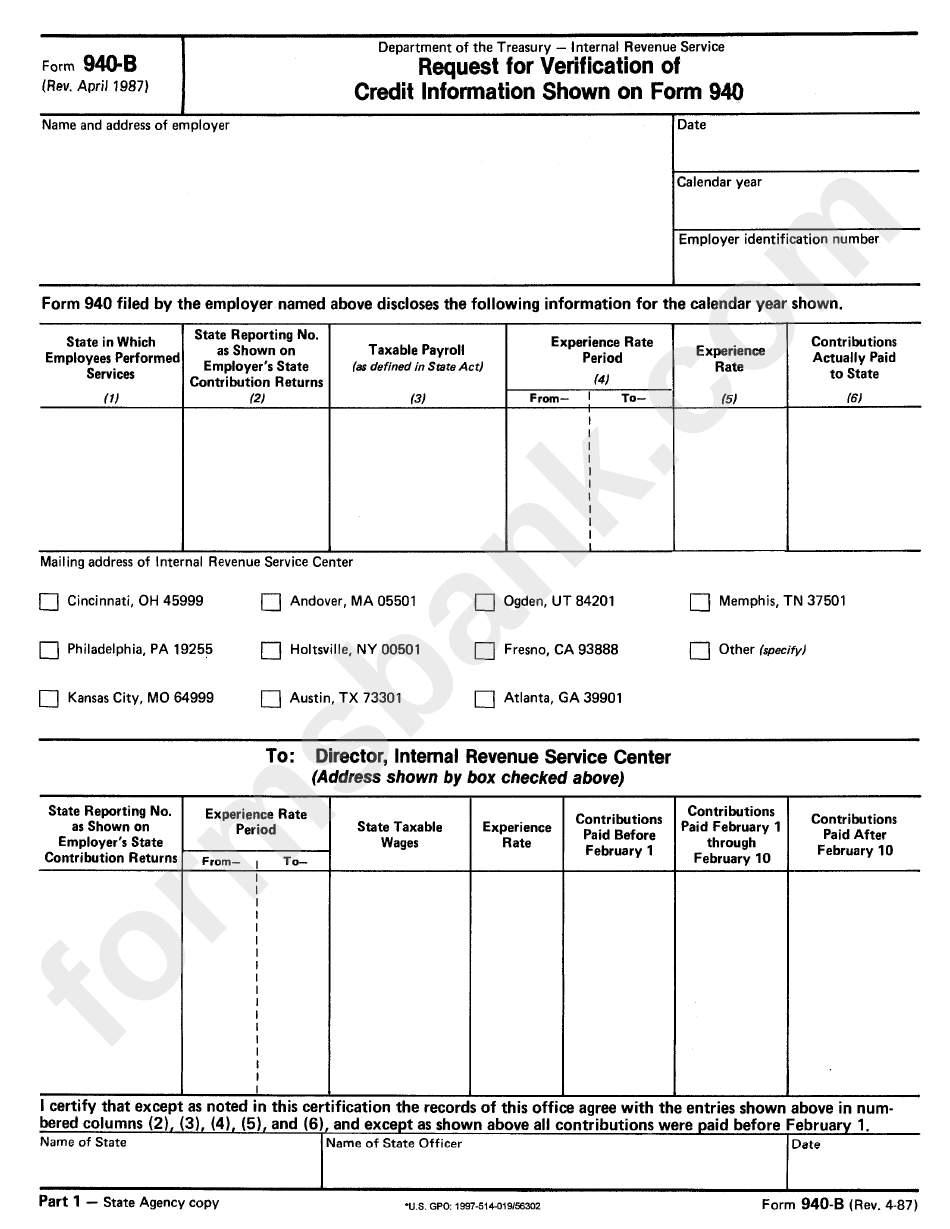

Form 940B Request For Verification Of Credit Information Shown On

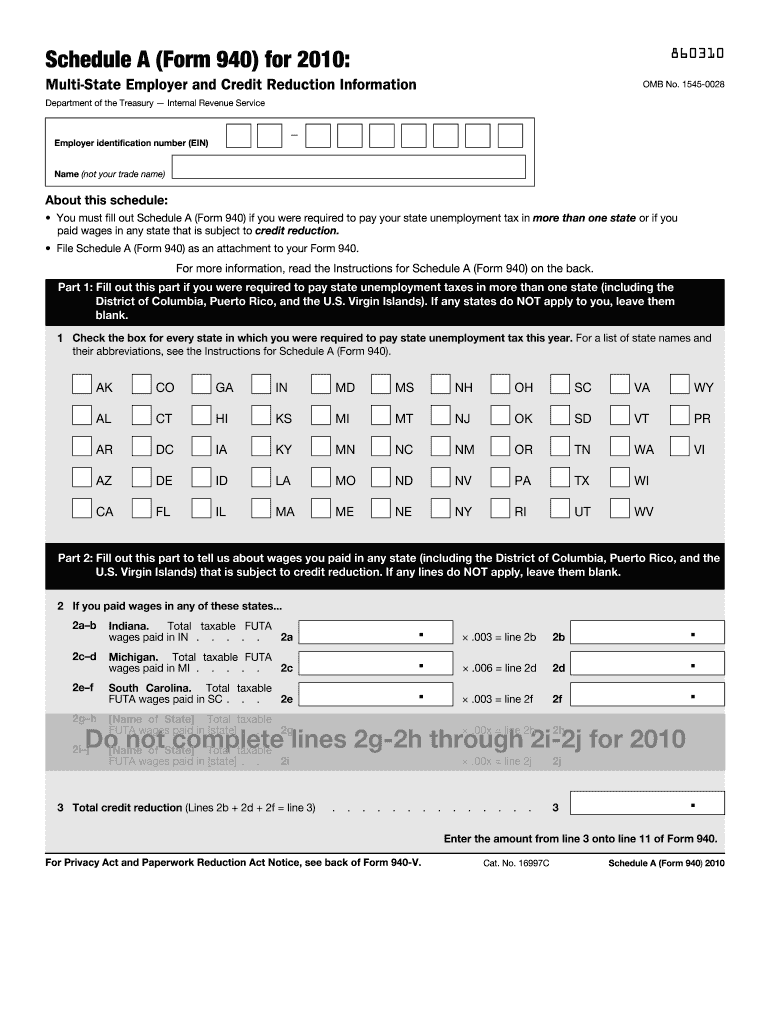

Get the current filing year’s forms, instructions, and publications for free from the irs. Try it for free now! Web schedule a (form 940) for 2021: Complete, edit or print tax forms instantly. Form 941, employer's quarterly federal tax return.

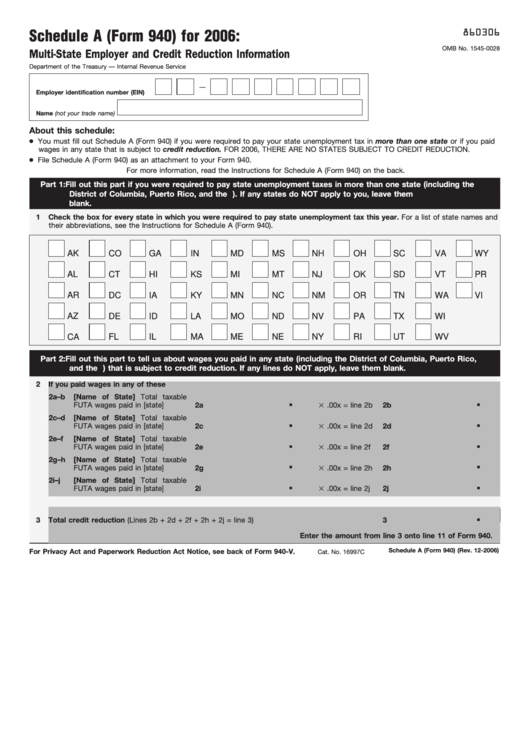

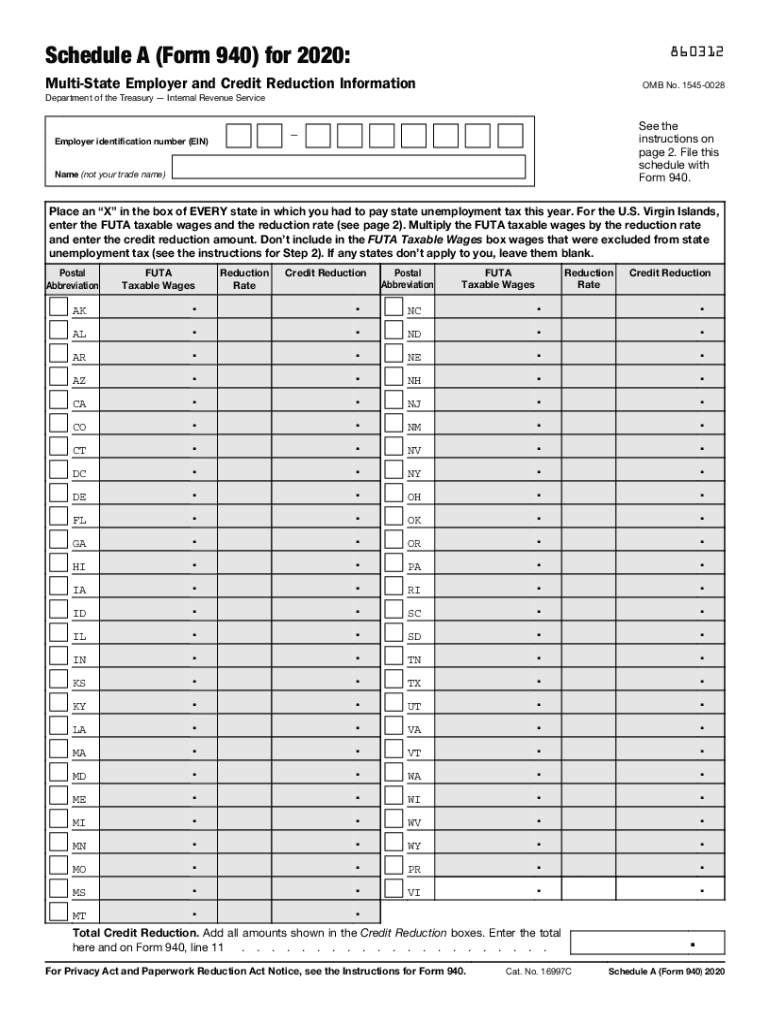

Fillable Schedule A (Form 940) MultiState Employer And Credit

Web get federal tax forms. Most employers pay both a federal and a state unemployment tax. Futa is different from fica as employees don’t contribute towards this tax. The 2021 form 940, employer’s annual federal unemployment (futa) tax return, was released dec. Web use form 940 to report your annual federal unemployment tax act (futa) tax.

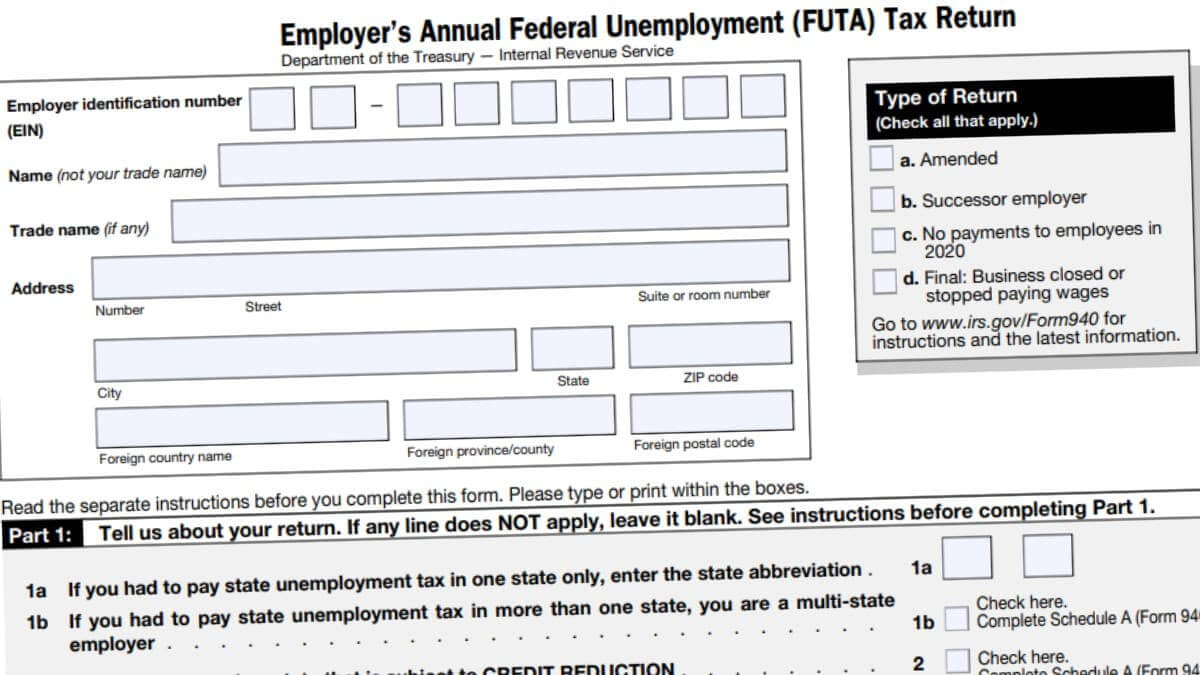

940 Form 2021

Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. If any line does not apply, leave it blank. File this schedule with form 940. The 2021 form 940, employer’s annual federal unemployment (futa) tax return, was released dec. Complete, edit or print tax forms instantly.

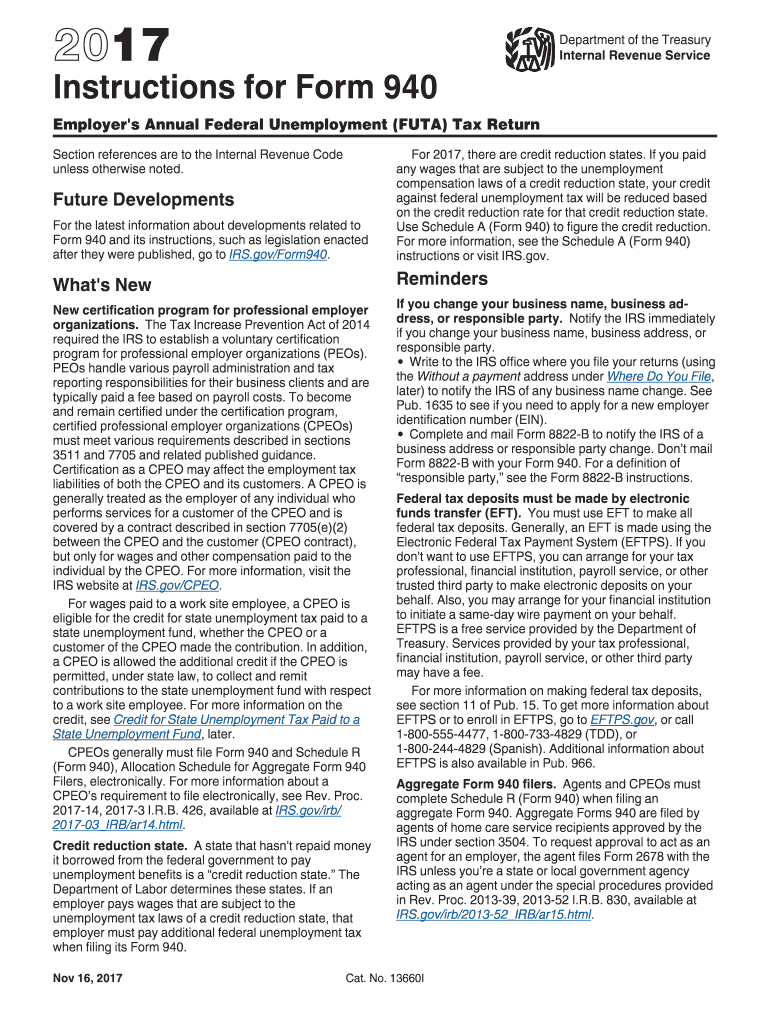

Instruction 940 Form Fill Out and Sign Printable PDF Template signNow

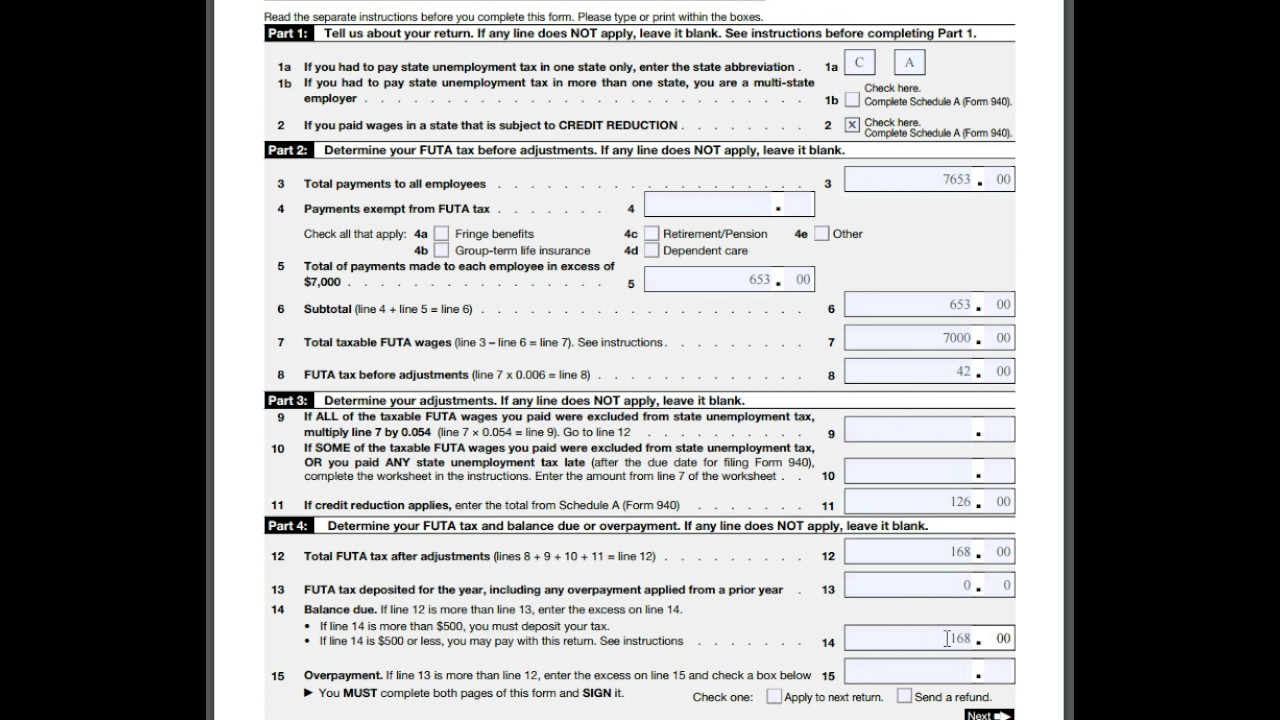

Web schedule a (form 940) for 2021: Futa is different from fica as employees don’t contribute towards this tax. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Determine your futa tax before adjustments. Total payments to all employees.

where to file 940 pr 2021 Fill Online, Printable, Fillable Blank

Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Determine your futa tax before adjustments. Therefore, this tax isn’t reflected on an employee’s paycheck. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web employment tax forms:

940 Form Employer's Annual Federal Unemployment TAX Return FUTA YouTube

Web use form 940 to report your annual federal unemployment tax act (futa) tax. Total payments to all employees. Determine your futa tax before adjustments. Ad upload, modify or create forms. The streamlined template is filed by employers who use the annual wage base to calculate the tax, have had no significant changes in employment, and have no current or.

940 Schedule a Form Fill Out and Sign Printable PDF Template signNow

Total payments to all employees. Form 940, employer's annual federal unemployment tax return. Web we last updated the employer's annual federal unemployment (futa) tax return in december 2022, so this is the latest version of form 940, fully updated for tax year 2022. Determine your futa tax before adjustments. You can print other federal tax forms here.

Fillable Form 940 Employer's Annual Federal Unemployment (futa) Tax

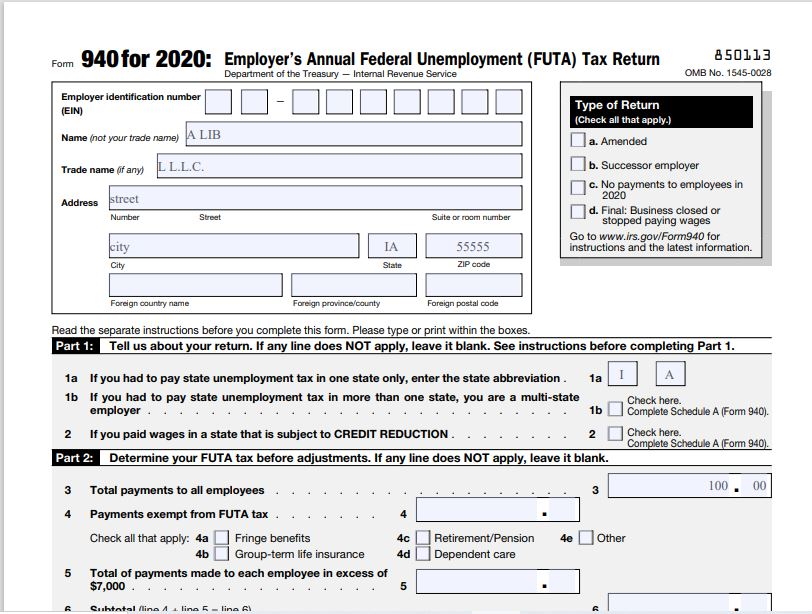

If you paid wages in a state that is subject to credit reduction. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Edit, sign and print tax forms on any device with signnow. Web we last updated the employer's annual federal unemployment (futa) tax return in december 2022, so.

How to Complete 2020 Form 940 FUTA Tax Return Nina's Soap

For more information about a cpeo’s requirement to file electronically, see rev. Web schedule a (form 940) for 2021: The 2021 form 940, employer’s annual federal unemployment (futa) tax return, was released dec. Complete, edit or print tax forms instantly. Therefore, this tax isn’t reflected on an employee’s paycheck.

2020 Form IRS 940 Schedule A Fill Online, Printable, Fillable, Blank

Edit, sign and print tax forms on any device with signnow. The streamlined template is filed by employers who use the annual wage base to calculate the tax, have had no significant changes in employment, and have no current or prior year futa tax liability. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation.

Try It For Free Now!

Form 940, employer's annual federal unemployment tax return. File this schedule with form 940. The 2021 form 940, employer’s annual federal unemployment (futa) tax return, was released dec. Determine your futa tax before adjustments.

Web Use Form 940 To Report Your Annual Federal Unemployment Tax Act (Futa) Tax.

The 2021 form 940 was not substantially changed from the 2020 version. Upload, modify or create forms. Form 941, employer's quarterly federal tax return. Web we last updated the employer's annual federal unemployment (futa) tax return in december 2022, so this is the latest version of form 940, fully updated for tax year 2022.

Try It For Free Now!

If any line does not apply, leave it blank. Web employment tax forms: Most employers pay both a federal and a state unemployment tax. Futa is different from fica as employees don’t contribute towards this tax.

Ad Upload, Modify Or Create Forms.

The streamlined template is filed by employers who use the annual wage base to calculate the tax, have had no significant changes in employment, and have no current or prior year futa tax liability. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Web use printable form 940 in 2023 to report your annual federal unemployment tax act (futa) tax. For more information about a cpeo’s requirement to file electronically, see rev.