941 Form 2023 Schedule B

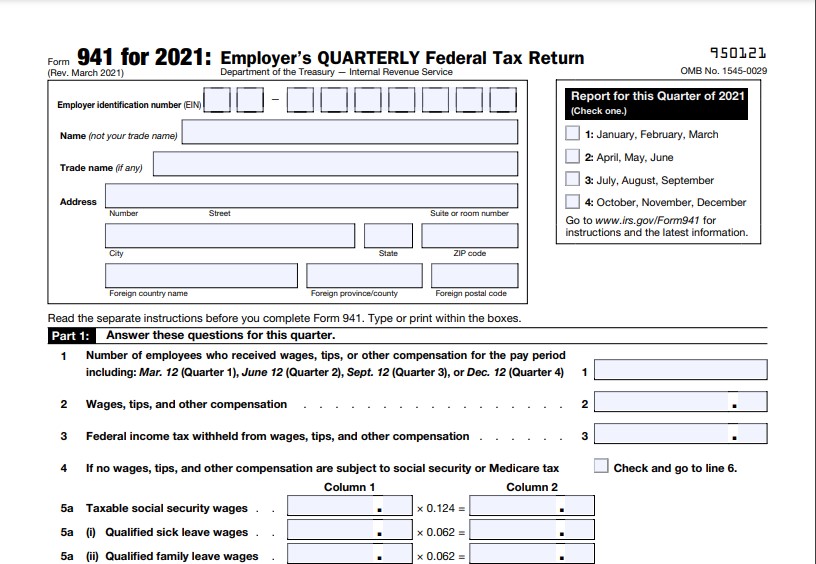

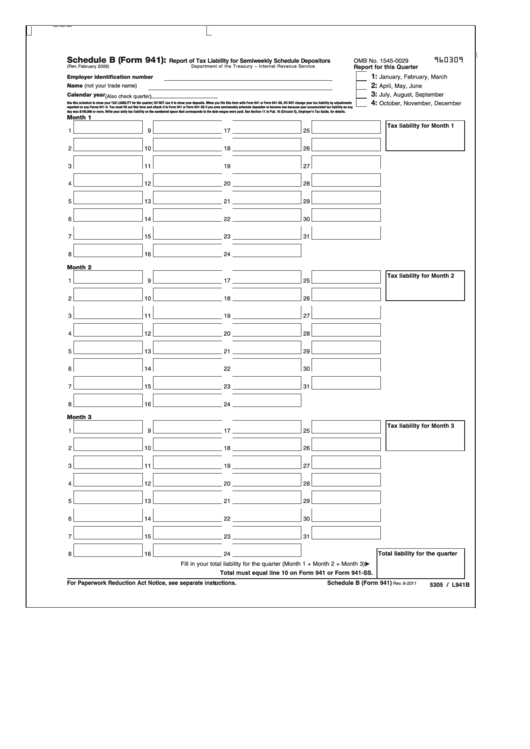

941 Form 2023 Schedule B - The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability for semiweekly schedule depositors schedule r, allocation schedule for aggregate form 941 filers, and its instructions the form 941 for 2023 contains no major changes. Web file schedule b (form 941) if you are a semiweekly schedule depositor. This means that the majority of. Report of tax liability for semiweekly schedule depositors (rev. Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Web schedule b (form 941): Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this schedule. It includes the filing requirements and tips on reconciling and balancing the two forms. Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end of the first quarter of the 2023 tax year.

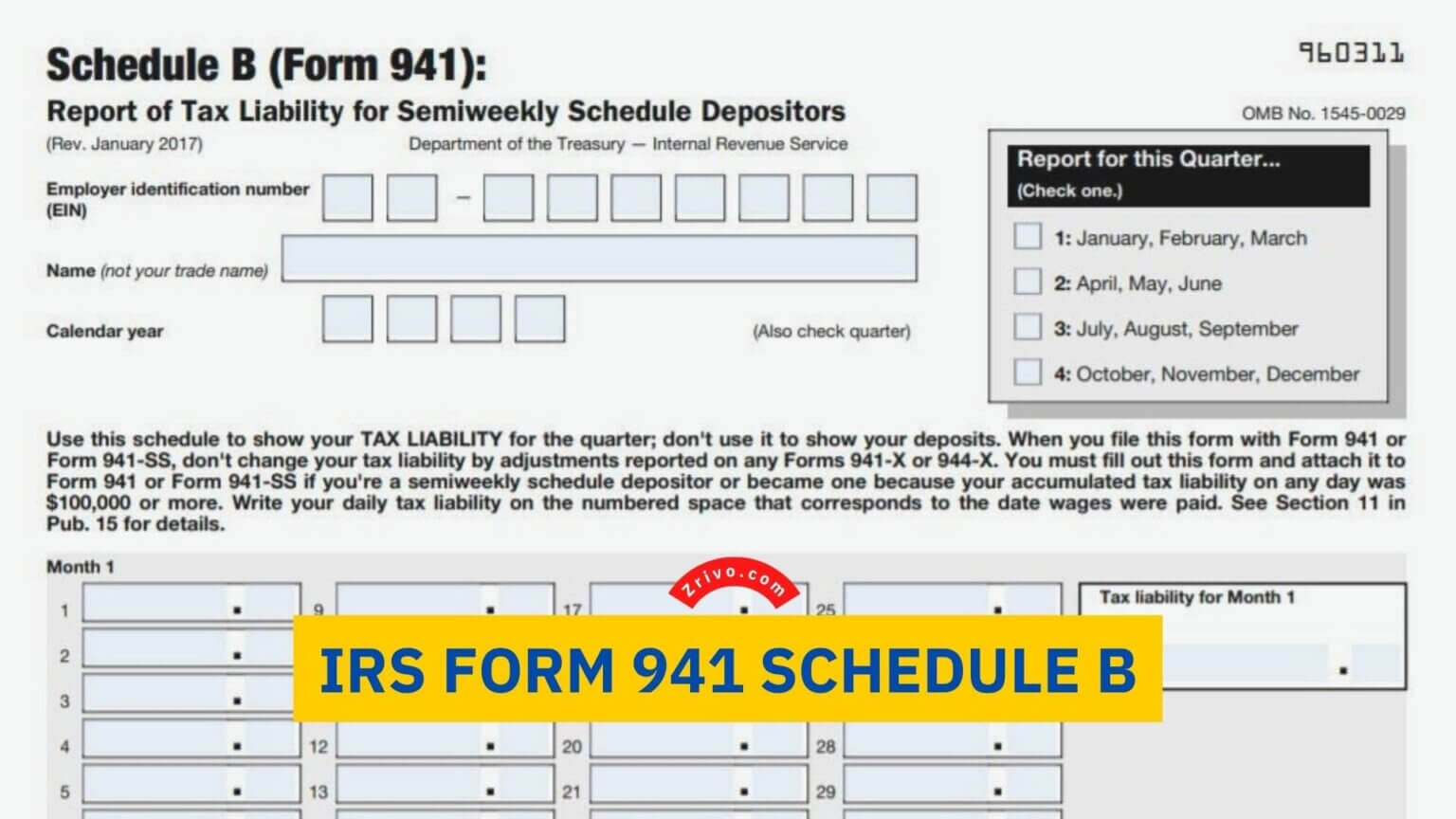

Reported more than $50,000 of employment taxes in the lookback period. Schedule b (form 941) pdf instructions for schedule b. Report of tax liability for semiweekly schedule depositors (rev. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Web the irs has released: (check one.) employer identification number (ein) — 1: You are a semiweekly depositor if you: The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability for semiweekly schedule depositors schedule r, allocation schedule for aggregate form 941 filers, and its instructions the form 941 for 2023 contains no major changes. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

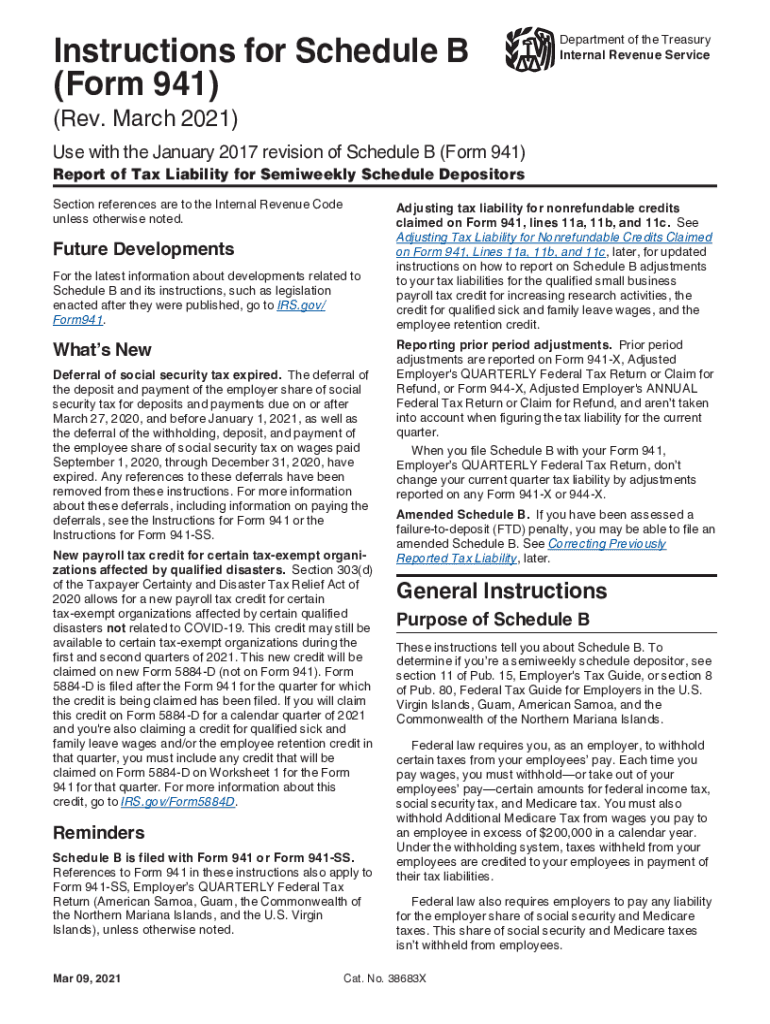

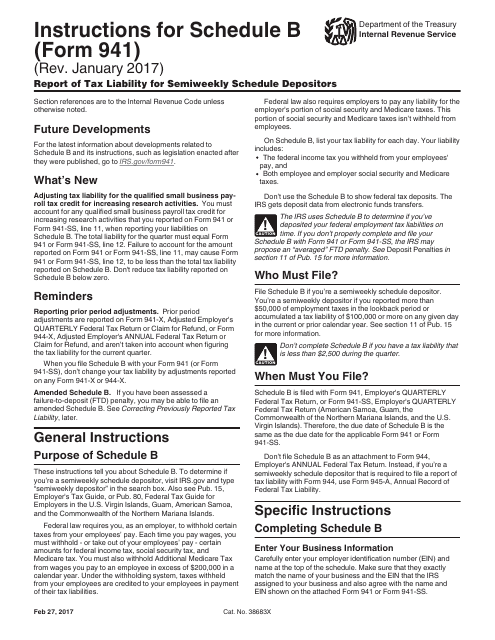

Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. It includes the filing requirements and tips on reconciling and balancing the two forms. Report of tax liability for semiweekly schedule depositors (rev. Web the irs has released: Reported more than $50,000 of employment taxes in the lookback period. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this schedule. Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end of the first quarter of the 2023 tax year. You are a semiweekly depositor if you: Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes.

IRS Form 941 Schedule B 2023

It includes the filing requirements and tips on reconciling and balancing the two forms. This means that the majority of. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social.

941 schedule b 2021 Fill out & sign online DocHub

(check one.) employer identification number (ein) — 1: You are a semiweekly depositor if you: Report of tax liability for semiweekly schedule depositors (rev. It discusses what is new for this version as well as the requirements for completing each form line by line. This means that the majority of.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

(check one.) employer identification number (ein) — 1: Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

This means that the majority of. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Schedule b (form 941) pdf instructions for schedule b. It discusses what is new.

IRS Form 941X Complete & Print 941X for 2021

Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end of the first quarter of the 2023 tax year. Web the irs form 941.

Download Instructions for IRS Form 941 Schedule B Report of Tax

Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this schedule. January 2017) department of the treasury — internal revenue service 960311 omb no. Schedule b.

Form 941 Printable & Fillable Per Diem Rates 2021

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. This means that the majority of. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Web this webinar covers the irs form 941 and its accompanying.

Form 941 Schedule B YouTube

January 2017) department of the treasury — internal revenue service 960311 omb no. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Schedule b (form 941) pdf instructions for schedule b. Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code 950122.

How to File Schedule B for Form 941

Web schedule b (form 941): Qualified small business payroll tax credit for increasing research activities. Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end of the first quarter of the 2023 tax year. Report of tax liability for semiweekly schedule depositors (rev..

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Schedule b (form 941) pdf instructions for schedule b. Qualified small business payroll tax credit for increasing research activities. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security.

The 2023 Form 941, Employer’s Quarterly Federal Tax Return, And Its Instructions The Instructions For Schedule B, Report Of Tax Liability For Semiweekly Schedule Depositors Schedule R, Allocation Schedule For Aggregate Form 941 Filers, And Its Instructions The Form 941 For 2023 Contains No Major Changes.

Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Reported more than $50,000 of employment taxes in the lookback period. Report of tax liability for semiweekly schedule depositors (rev. Schedule b (form 941) pdf instructions for schedule b.

Web Street Suite Or Room Number City State Zip Code Foreign Country Name Foreign Province/County Foreign Postal Code 950122 Omb No.

Web schedule b (form 941): Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. You are a semiweekly depositor if you: Web the irs has released:

Web Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

This means that the majority of. (check one.) employer identification number (ein) — 1: Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023.

Businesses That Acquire More Than $100,000 In Liabilities During A Single Day In The Tax Year Are Also Required To Begin Filing This Schedule.

It discusses what is new for this version as well as the requirements for completing each form line by line. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Qualified small business payroll tax credit for increasing research activities. It includes the filing requirements and tips on reconciling and balancing the two forms.