990 Form Instructions

990 Form Instructions - Web do not enter social security numbers on this form as it may be made public. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Political campaign and lobbying activities. A for the 2022 calendar year, or tax year beginning, 2022, and ending, 20b. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Information relevant to paper filing. Public charity status and public support. Intended for organizations that need to report their unrelated business income of $1000 or more to the irs important note: Short form return of organization exempt from income tax.

Short form return of organization exempt from income tax. Return of organization exempt from income tax. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Public charity status and public support. Instructions for these schedules are combined with the schedules. Information relevant to paper filing. Web do not enter social security numbers on this form as it may be made public. Web review a list of form 990 schedules with instructions. For instructions and the latest information.

Intended for private foundations, regardless of gross receipts; A for the 2022 calendar year, or tax year beginning, 2022, and ending, 20b. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Short form return of organization exempt from income tax. Web review a list of form 990 schedules with instructions. Instructions for these schedules are combined with the schedules. The documents are searchable and include bookmarks to assist with navigation. Political campaign and lobbying activities. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web do not enter social security numbers on this form as it may be made public.

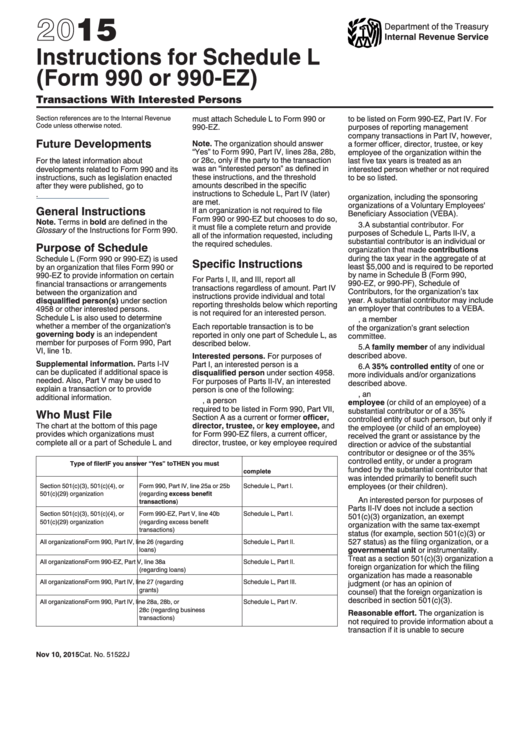

Instructions For Schedule L (Form 990 Or 990Ez) Transactions With

Information relevant to paper filing. Instructions for these schedules are combined with the schedules. Web review a list of form 990 schedules with instructions. Short form return of organization exempt from income tax. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Return of organization exempt from income tax. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Public charity status and public support. Gross receipts when acting as an.

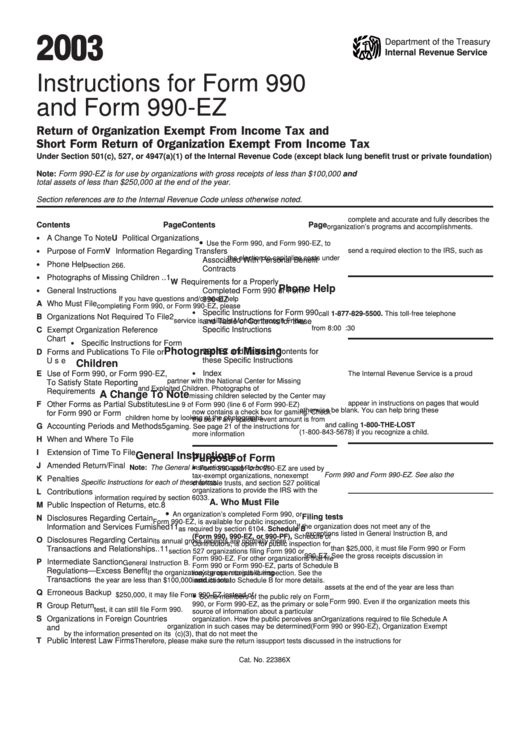

Instructions For Form 990 And Form 990Ez 2003 printable pdf download

How to determine whether an organization's gross receipts are normally $50,000 (or $5,000) or less. Short form return of organization exempt from income tax. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. The documents include pwc’s highlights of and comments on key changes for 2021..

Editable IRS Instructions 990PF 2018 2019 Create A Digital Sample

The documents are searchable and include bookmarks to assist with navigation. Intended for private foundations, regardless of gross receipts; A for the 2022 calendar year, or tax year beginning, 2022, and ending, 20b. Web review a list of form 990 schedules with instructions. Information relevant to paper filing.

irs form 990 instructions Fill Online, Printable, Fillable Blank

Public charity status and public support. Intended for organizations that need to report their unrelated business income of $1000 or more to the irs important note: How to determine whether an organization's gross receipts are normally $50,000 (or $5,000) or less. The documents are searchable and include bookmarks to assist with navigation. Short form return of organization exempt from income.

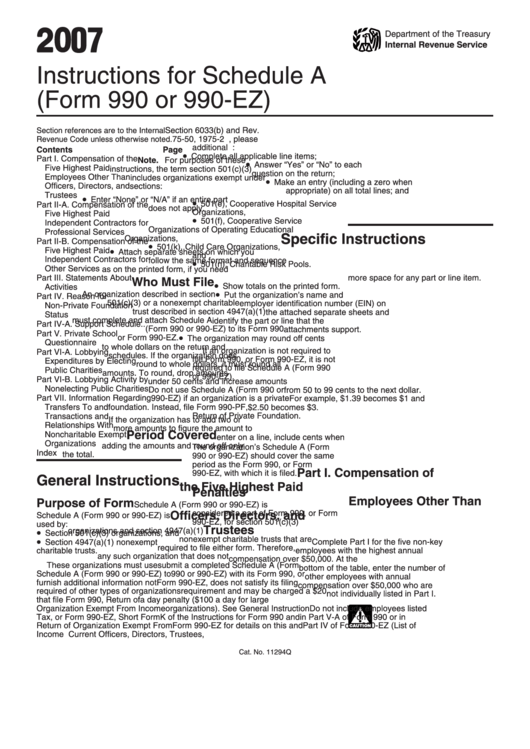

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

The documents include pwc’s highlights of and comments on key changes for 2021. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Public charity status and public.

Instructions to file your Form 990PF A Complete Guide

Web review a list of form 990 schedules with instructions. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. The documents are searchable and include bookmarks to assist with navigation. Instructions for these schedules are combined with the schedules. Public charity status and public support.

Form 990EZ Short Form Return of Organization Exempt from Tax

How to determine whether an organization's gross receipts are normally $50,000 (or $5,000) or less. For instructions and the latest information. Information relevant to paper filing. Return of organization exempt from income tax. Web review a list of form 990 schedules with instructions.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Information relevant to paper filing. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Short form return of organization exempt from income tax. Return of organization exempt from income.

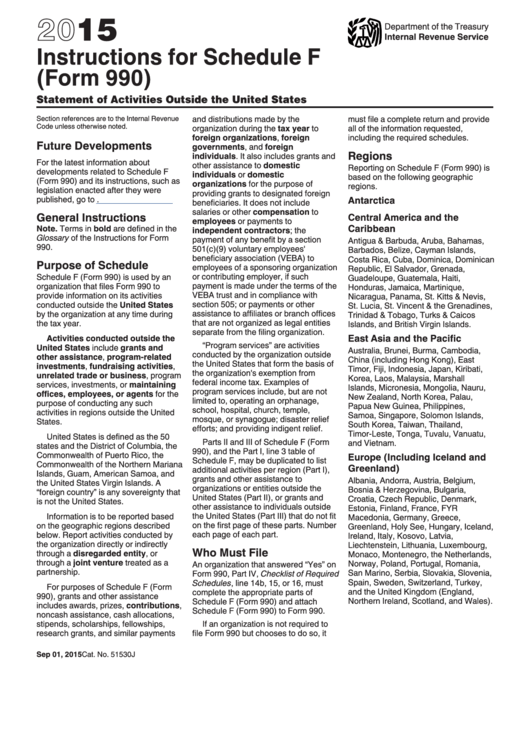

Form 990 Instructions For Schedule F (2015) printable pdf download

Return of organization exempt from income tax. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Web review a list of form 990 schedules with instructions. A for the 2022 calendar year, or tax year beginning, 2022, and ending, 20b. Gross receipts when acting as an agent.

Information Relevant To Paper Filing.

Web do not enter social security numbers on this form as it may be made public. Intended for private foundations, regardless of gross receipts; Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Certain exempt organizations file this form to provide the irs with the information required by section 6033.

The Documents Are Searchable And Include Bookmarks To Assist With Navigation.

For instructions and the latest information. Instructions for these schedules are combined with the schedules. A for the 2022 calendar year, or tax year beginning, 2022, and ending, 20b. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990.

Web Information About Form 990, Return Of Organization Exempt From Income Tax, Including Recent Updates, Related Forms And Instructions On How To File.

Web review a list of form 990 schedules with instructions. Gross receipts when acting as an agent. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Short form return of organization exempt from income tax.

Intended For Organizations That Need To Report Their Unrelated Business Income Of $1000 Or More To The Irs Important Note:

Return of organization exempt from income tax. Public charity status and public support. The documents include pwc’s highlights of and comments on key changes for 2021. Political campaign and lobbying activities.