A-4 Form 2023 Arizona

A-4 Form 2023 Arizona - You can use your results from the formula to help you complete the form and adjust your income tax withholding. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Choose either box 1 or box 2: Withhold from the taxable amount of distribution at the percentage checked (check only one percentage): Annuitant's request for voluntary arizona income tax. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Request for reduced withholding to designate for tax credits. 1 withhold from gross taxable wages at the percentage checked (check only one. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. By january 31, 2023, every arizona employer is required to make this form available to its arizona employees.

By january 31, 2023, every arizona employer is required to make this form available to its arizona employees. Withhold from the taxable amount of distribution at the percentage checked (check only one percentage): Choose either box 1 or box 2: 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. Request for reduced withholding to designate for tax credits. 1 withhold from gross taxable wages at the percentage checked (check only one. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources You can use your results from the formula to help you complete the form and adjust your income tax withholding. Annuitant's request for voluntary arizona income tax. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5%

Withhold from the taxable amount of distribution at the percentage checked (check only one percentage): Choose either box 1 or box 2: 1 withhold from gross taxable wages at the percentage checked (check only one. Annuitant's request for voluntary arizona income tax. By january 31, 2023, every arizona employer is required to make this form available to its arizona employees. Request for reduced withholding to designate for tax credits. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5%

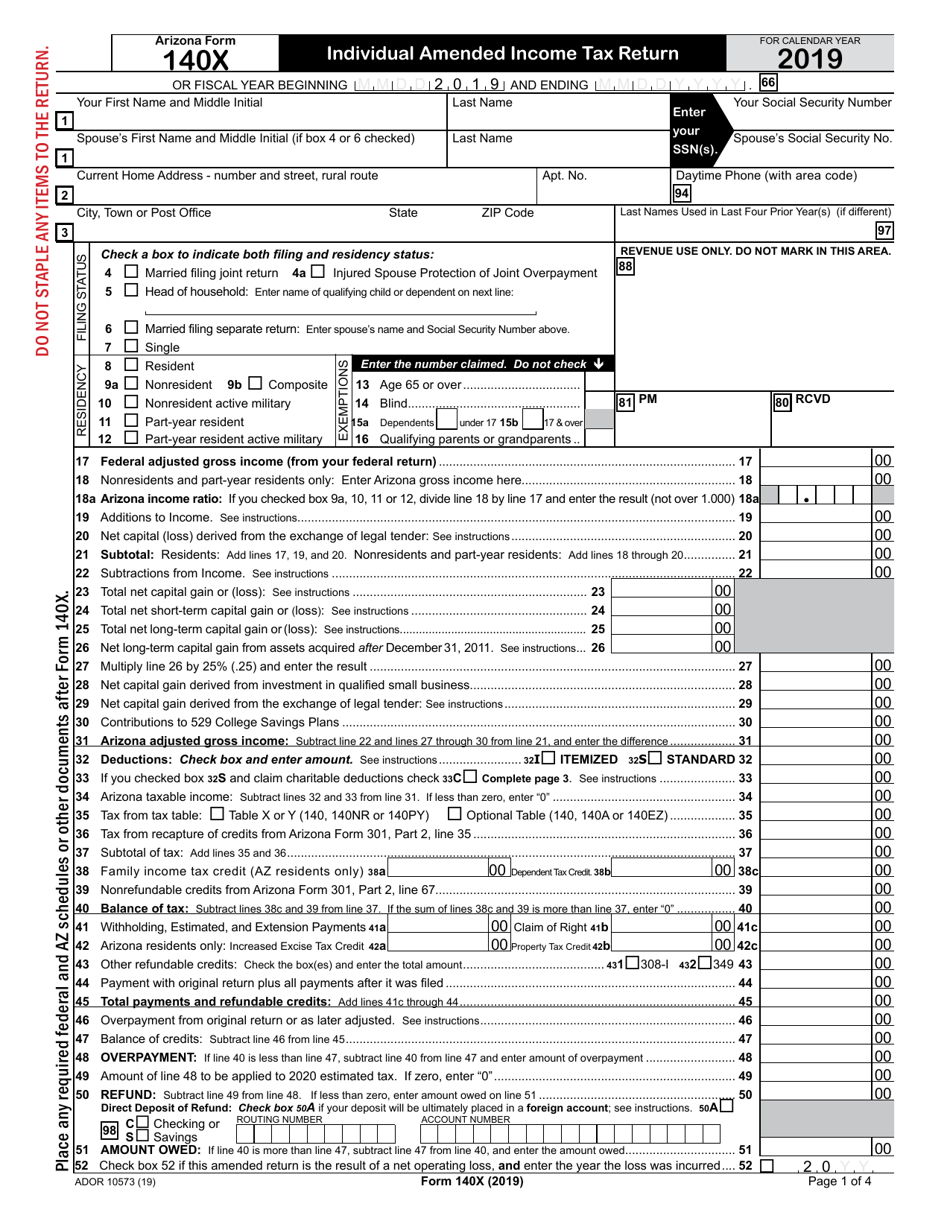

Arizona Form 140X (ADOR10573) Download Fillable PDF or Fill Online

New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Choose either box 1 or box 2: You can use your results from the formula to help you complete the form and adjust your income tax withholding. Withhold from the taxable amount of distribution at the percentage checked (check only.

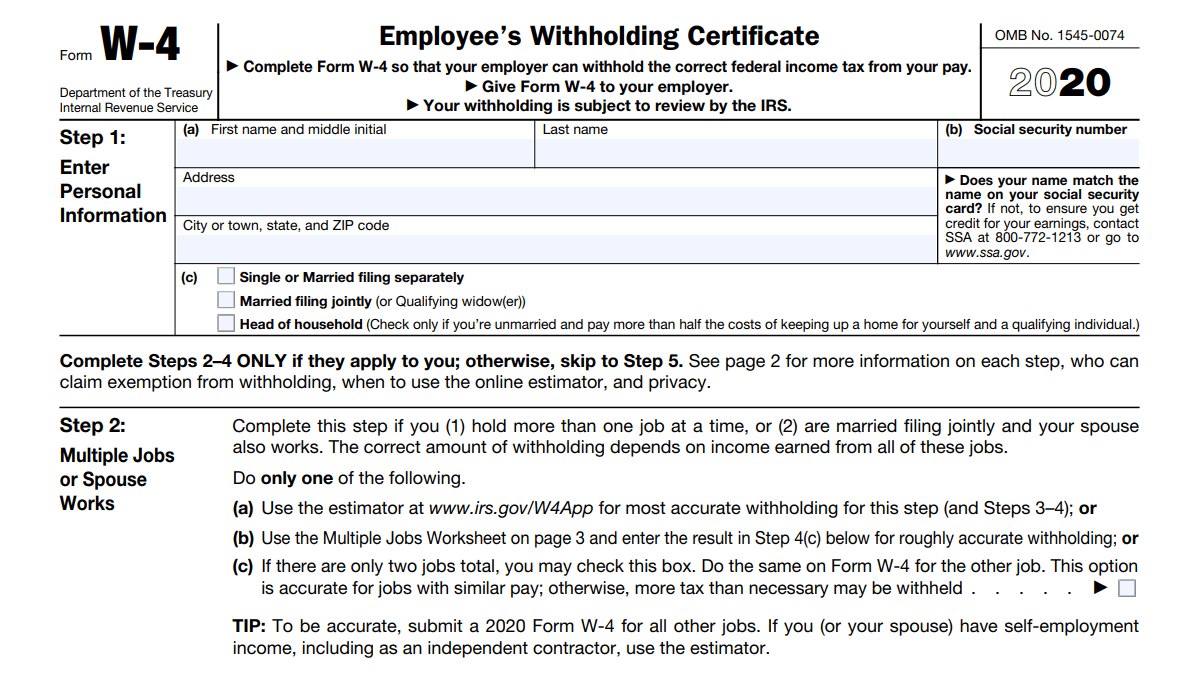

Ms Printable W4 Forms 2021 2022 W4 Form

By january 31, 2023, every arizona employer is required to make this form available to its arizona employees. Annuitant's request for voluntary arizona income tax. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Choose either box 1 or box 2: Withhold from the taxable amount of distribution at.

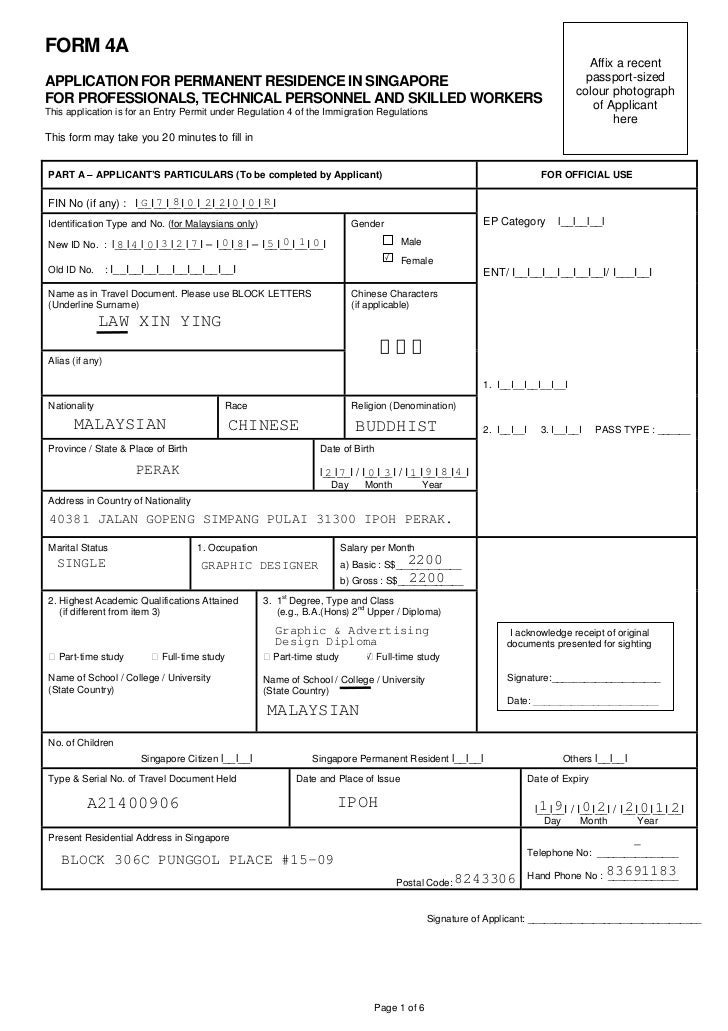

Form4 a 4

Annuitant's request for voluntary arizona income tax. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. You can use your results from the formula to help you complete the form and adjust.

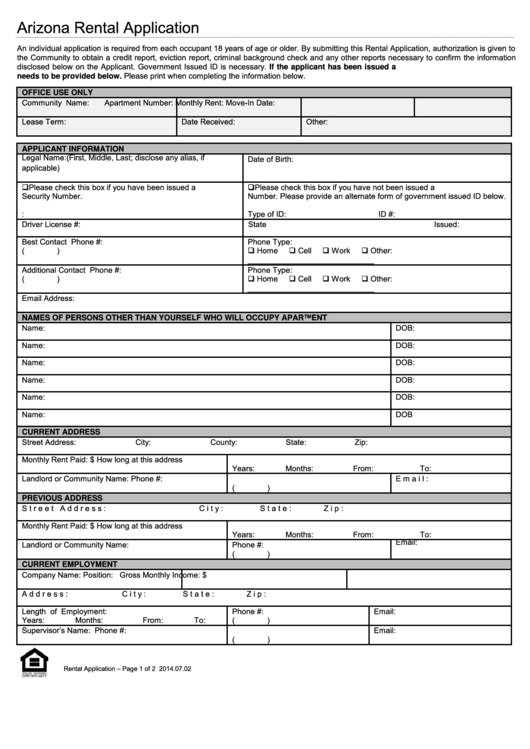

Top 38 Apartment Rental Application Form Templates free to download in

You can use your results from the formula to help you complete the form and adjust your income tax withholding. Annuitant's request for voluntary arizona income tax. Choose either box 1 or box 2: 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Request for reduced withholding to designate for tax credits.

A4 form Fill out & sign online DocHub

Choose either box 1 or box 2: You can use your results from the formula to help you complete the form and adjust your income tax withholding. Annuitant's request for voluntary arizona income tax. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. By january 31, 2023, every arizona employer is required.

Download Arizona Form A4 (2013) for Free FormTemplate

Annuitant's request for voluntary arizona income tax. You can use your results from the formula to help you complete the form and adjust your income tax withholding. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources By january 31, 2023, every arizona employer is required to make this form.

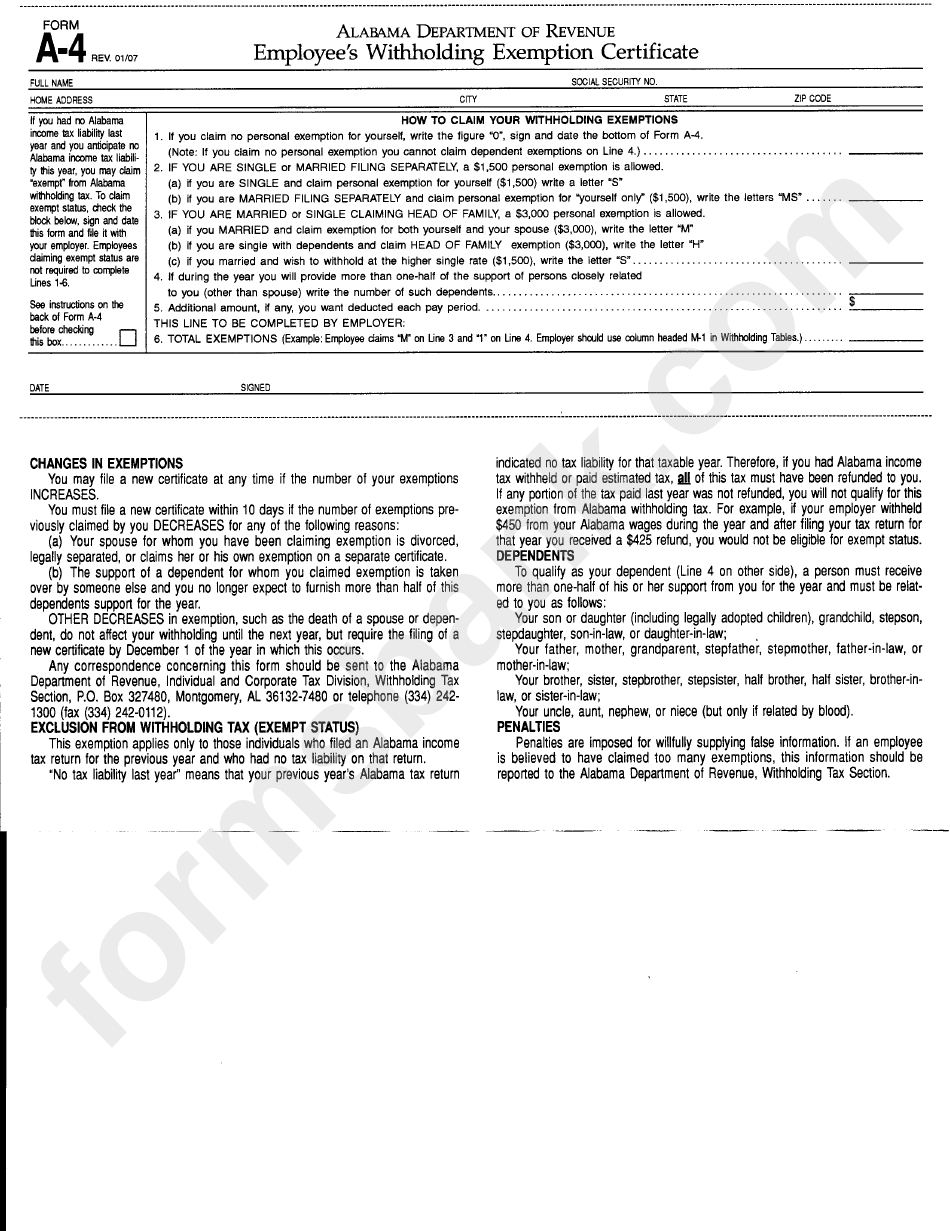

Form A4 Employee'S Withholding Exemption Certificate Alabama

Annuitant's request for voluntary arizona income tax. 1 withhold from gross taxable wages at the percentage checked (check only one. Request for reduced withholding to designate for tax credits. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s.

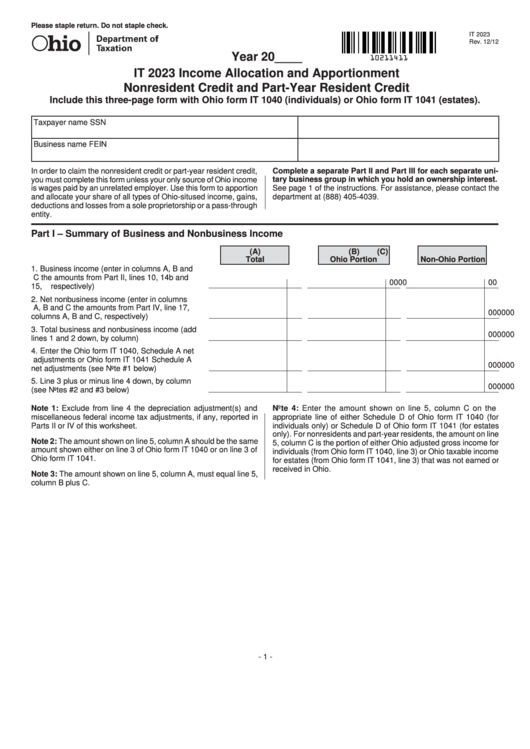

Fillable Form It 2023 Allocation And Apportionment Nonresident

1 withhold from gross taxable wages at the percentage checked (check only one. You can use your results from the formula to help you complete the form and adjust your income tax withholding. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Request for reduced withholding to designate for.

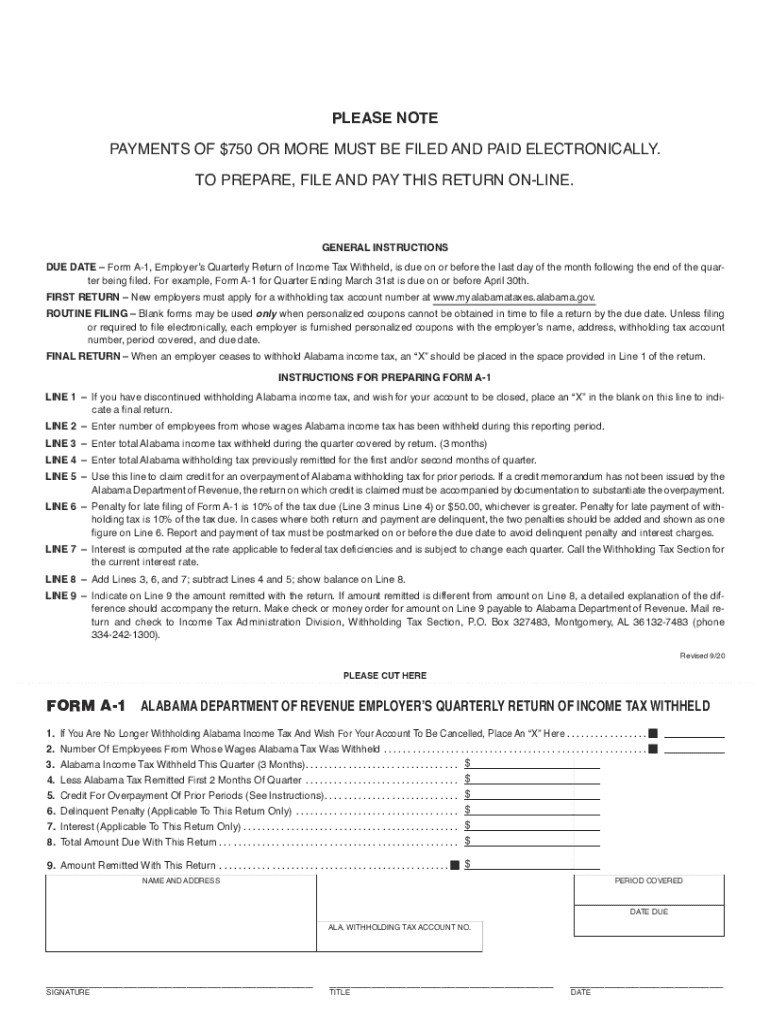

20202022 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller

You can use your results from the formula to help you complete the form and adjust your income tax withholding. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Annuitant's request for voluntary arizona income tax. Choose either box 1 or box 2: 1 withhold from gross taxable wages.

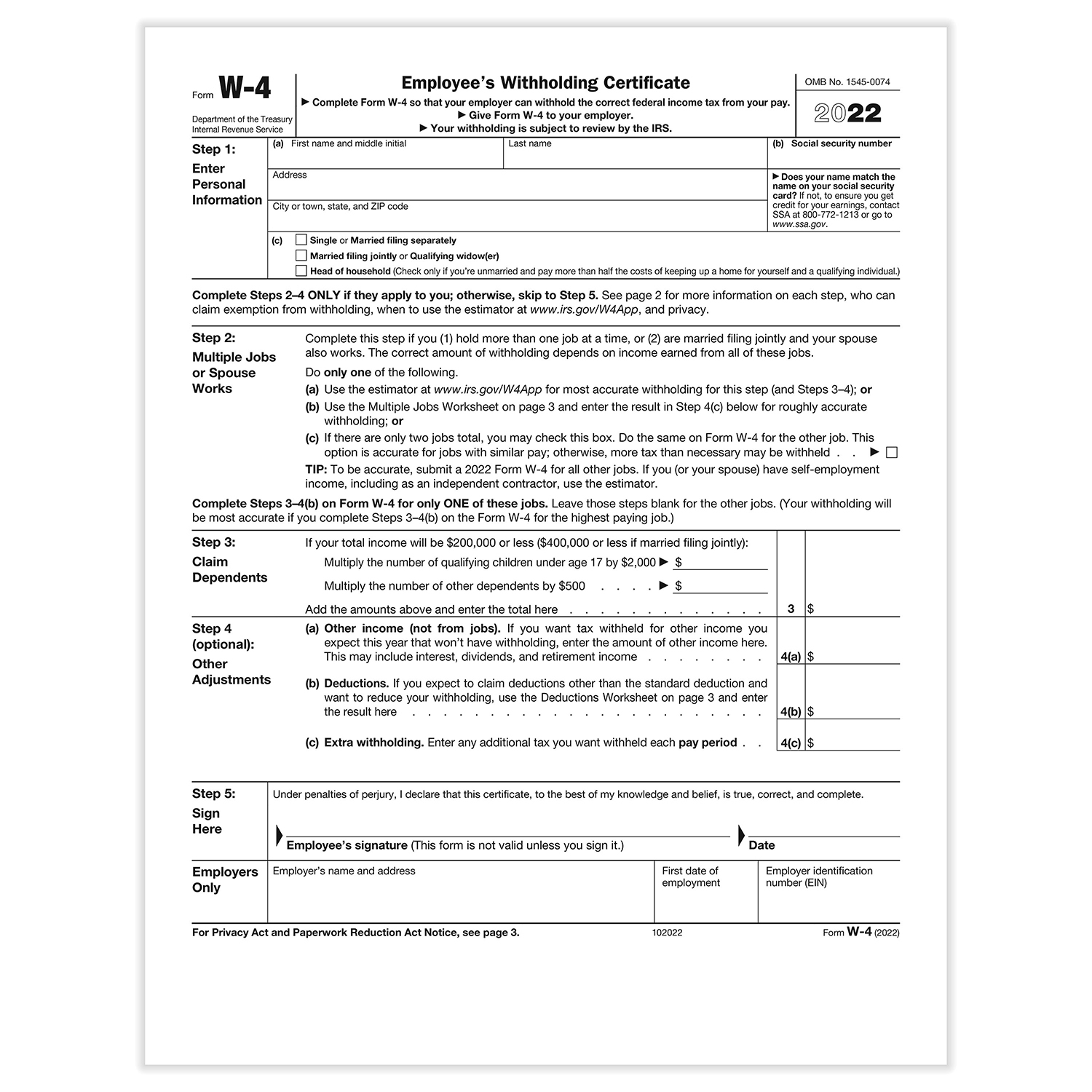

2023 IRS W 4 Form HRdirect Fillable Form 2023

Withhold from the taxable amount of distribution at the percentage checked (check only one percentage): Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. By january 31, 2023, every arizona employer is required to make this form available to its arizona employees. 1 withhold from gross taxable wages at the percentage checked.

Withhold From The Taxable Amount Of Distribution At The Percentage Checked (Check Only One Percentage):

1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. Annuitant's request for voluntary arizona income tax. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Choose either box 1 or box 2:

Request For Reduced Withholding To Designate For Tax Credits.

New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources By january 31, 2023, every arizona employer is required to make this form available to its arizona employees. You can use your results from the formula to help you complete the form and adjust your income tax withholding. 1 withhold from gross taxable wages at the percentage checked (check only one.