Administrator Of Estate Form

Administrator Of Estate Form - Medicaid recipient’s social security number. The legal representative may be a surviving spouse, other family member, executor named in the will or an attorney. Web to appoint administrators, most probate courts have what’s called a priority of appointment. Administrators settle the estate of a deceased person, known as. Findlaw shows you how to file for executor of an estate without a will. They can be filled out electronically, then printed. In general, the estate administrator: An administrator, or personal representative, is typically named within the estate plan. If the deceased did not have a will or estate plan, the administrator will be nominated by the court. Web the forms may be obtained from the issue desk on the 9.

Medicaid recipient’s social security number. Web the forms may be obtained from the issue desk on the 9. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Web to appoint administrators, most probate courts have what’s called a priority of appointment. Web file an estate tax income tax return. I understand that my estate may be subject to recovery of any funds expended by medicaid pursuant to 42 u.s.c. File a “petition of administration” at probate court. An administrator, or personal representative, is typically named within the estate plan. Income tax on income generated by assets of the estate of the deceased. The types of taxes a deceased taxpayer's estate can owe are:

Web an estate administrator is the appointed legal representative of the deceased. Floor of the probate court, 230 e. The legal representative may be a surviving spouse, other family member, executor named in the will or an attorney. This is a list of people, descending in priority, who could be called upon to serve as administrator. Web file an estate tax income tax return. In probate law, the terms executor, administrator and personal representative are often used interchangeably. File a “petition of administration” at probate court. Web the forms may be obtained from the issue desk on the 9. If the deceased did not have a will or estate plan, the administrator will be nominated by the court. In general, the estate administrator:

Business Forms Archives Free Printable Legal Forms

Review the deceased’s assets and estimate their value. An administrator, or personal representative, is typically named within the estate plan. Web the forms may be obtained from the issue desk on the 9. Web the administrator of an estate is the person in charge of compiling assets and managing the estate through probate court. If the deceased did not have.

Real Estate Administrator Resume Samples QwikResume

Web the forms may be obtained from the issue desk on the 9. Petition for letters of administration. I understand that my estate may be subject to recovery of any funds expended by medicaid pursuant to 42 u.s.c. Income tax on income generated by assets of the estate of the deceased. Findlaw shows you how to file for executor of.

Executor Letter Estate Form Template, european pattern letter of

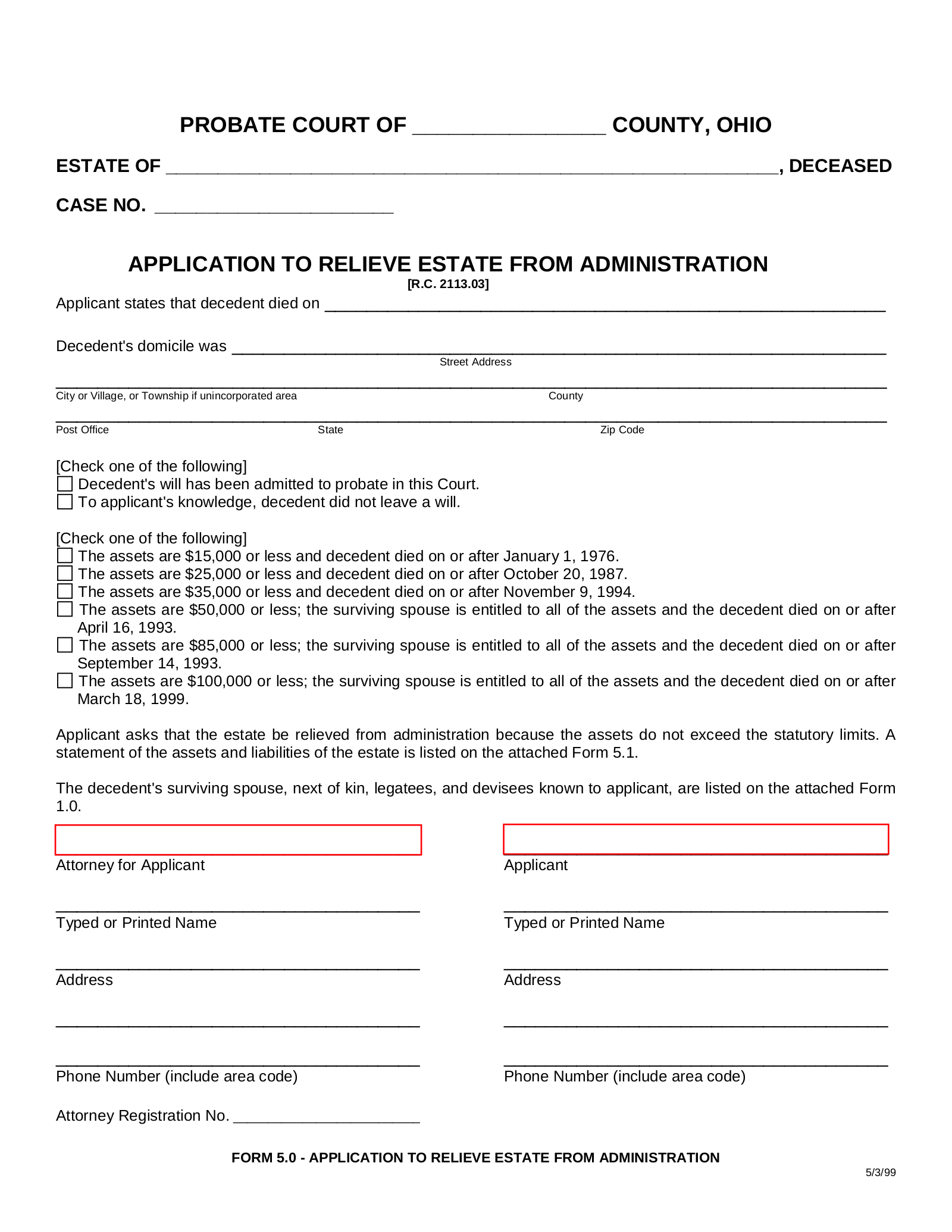

Surviving spouse, next of kin, legatees and devisees (1.0) [r.c. Web how to apply as an administrator of an estate. File a “petition of administration” at probate court. Floor of the probate court, 230 e. They however can not be submitted online, or saved.

arkansas executor Doc Template pdfFiller

Surviving spouse, next of kin, legatees and devisees (1.0) [r.c. Income tax on income generated by assets of the estate of the deceased. Web file an estate tax income tax return. Web modify this form and designate another adult next of kin to receive the monies held in my patient/resident trust account. Web how to apply as an administrator of.

Free Ohio Small Estate Affidavit Form PDF eForms

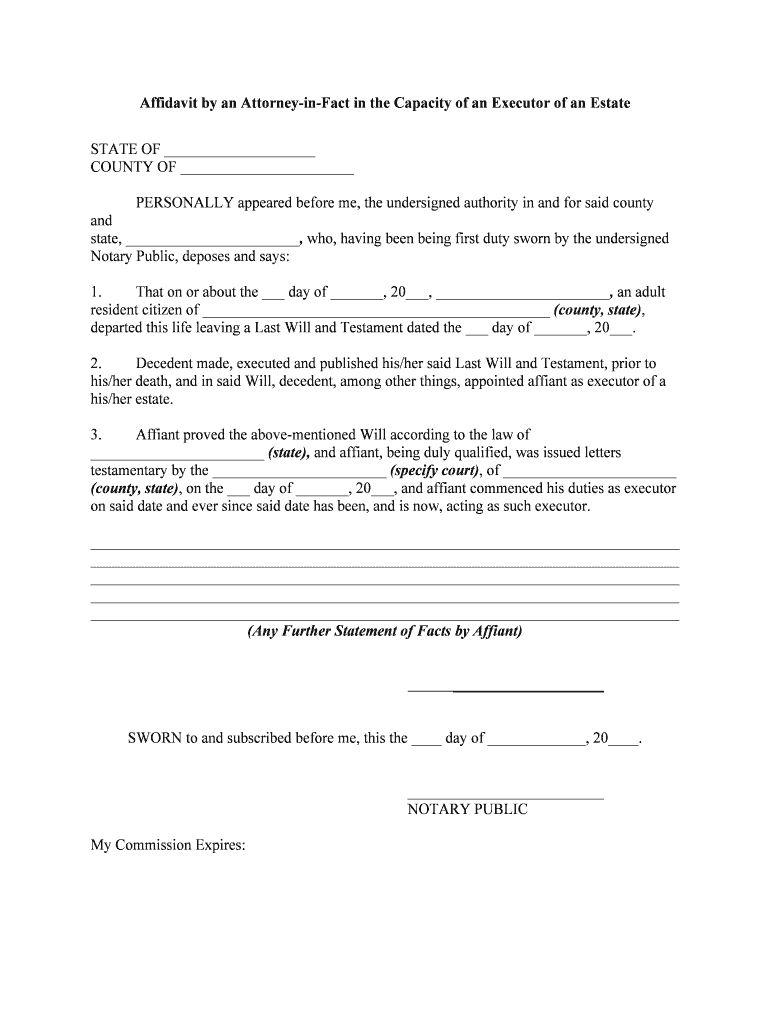

Ask the probate court where the estate will be processed how to file a petition. I understand that my estate may be subject to recovery of any funds expended by medicaid pursuant to 42 u.s.c. Findlaw shows you how to file for executor of an estate without a will. File a “petition of administration” at probate court. In probate law,.

Executor Of Estate Form Fill Online, Printable, Fillable, Blank

An administrator, or personal representative, is typically named within the estate plan. Web modify this form and designate another adult next of kin to receive the monies held in my patient/resident trust account. In probate law, the terms executor, administrator and personal representative are often used interchangeably. The legal representative may be a surviving spouse, other family member, executor named.

executor of estate form substitutework Release, Form, First resume

They however can not be submitted online, or saved. In probate law, the terms executor, administrator and personal representative are often used interchangeably. Web the forms may be obtained from the issue desk on the 9. Gather required documents and information. Surviving spouse, next of kin, legatees and devisees (1.0) [r.c.

Real Estate Administrator Resume Samples QwikResume

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Administrators settle the estate of a deceased person, known as. Medicaid recipient’s social security number. The types of taxes a deceased taxpayer's estate can owe are: Procedural steps statutory time limit.

Agent Appointment Letter 16+ Samples, Formats, Examples Dotxes

Web to appoint administrators, most probate courts have what’s called a priority of appointment. Surviving spouse, next of kin, legatees and devisees (1.0) [r.c. The legal representative may be a surviving spouse, other family member, executor named in the will or an attorney. Web the forms may be obtained from the issue desk on the 9. Web the administrator of.

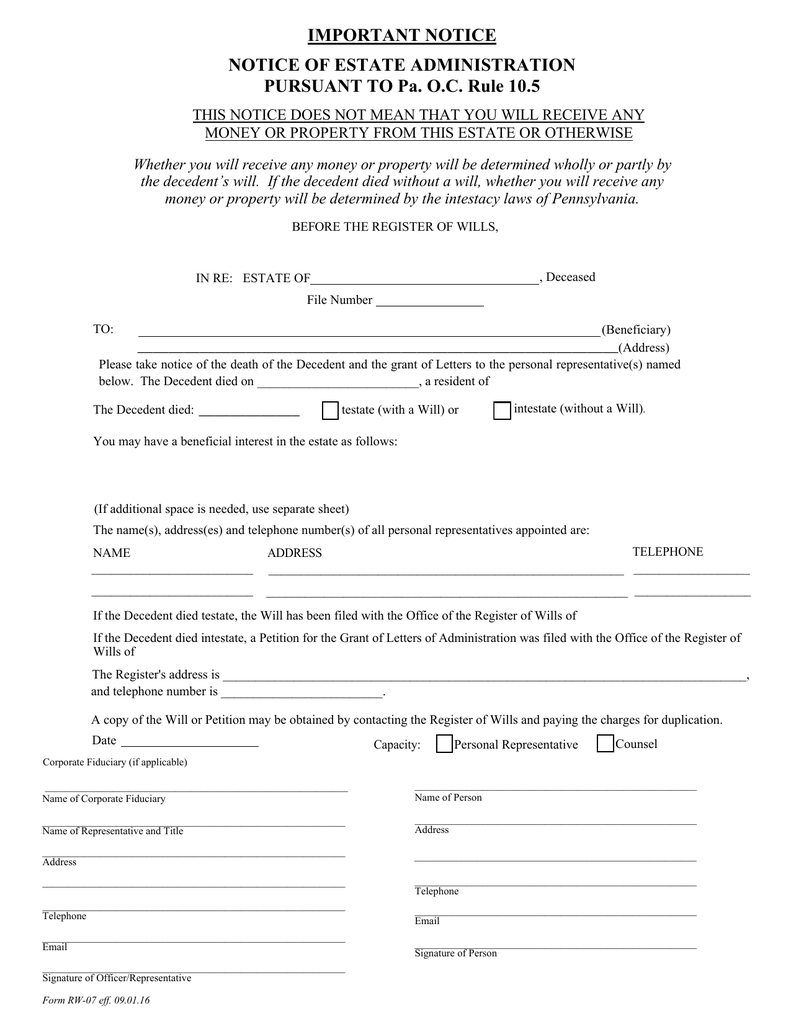

IMPORTANT NOTICE NOTICE OF ESTATE ADMINISTRATION

Petition for letters of administration. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Administrators settle the estate of a deceased person, known as. Medicaid recipient’s social security number. They can be filled out electronically, then printed.

Different States Vary, But Surviving Spouses Are Typically Given High Priority, Then Children, Then Other Family Members.

Administrators settle the estate of a deceased person, known as. Web the forms may be obtained from the issue desk on the 9. In probate law, the terms executor, administrator and personal representative are often used interchangeably. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

Web An Estate Administrator Is The Appointed Legal Representative Of The Deceased.

Review the deceased’s assets and estimate their value. Income tax on income generated by assets of the estate of the deceased. The types of taxes a deceased taxpayer's estate can owe are: Findlaw shows you how to file for executor of an estate without a will.

This Is A List Of People, Descending In Priority, Who Could Be Called Upon To Serve As Administrator.

Surviving spouse, next of kin, legatees and devisees (1.0) [r.c. I understand that my estate may be subject to recovery of any funds expended by medicaid pursuant to 42 u.s.c. The legal representative may be a surviving spouse, other family member, executor named in the will or an attorney. An administrator, or personal representative, is typically named within the estate plan.

Web To Serve As An Estate Administrator, You Must Follow These Steps:

Medicaid recipient’s social security number. Collects all the assets of the deceased. Web modify this form and designate another adult next of kin to receive the monies held in my patient/resident trust account. File a “petition of administration” at probate court.