Adp 401K Transfer Form

Adp 401K Transfer Form - You must file form 5329 to show that the distribution is qualified. Web follow the steps to enter your registration code, verify your identity, get your user id and password, select your security questions, enter your contact information, and enter your activation code. Access and manage your account online. For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Using a direct rollover, $55,000. Rollover adp 401k into a rollover ira. Complete the contribution + earnings = total amount section. You may also need to file form 8606. Roth assets from an employer sponsored plan. Web adp will proactively waive any transaction fees associated with these actions for participants in the impacted areas.

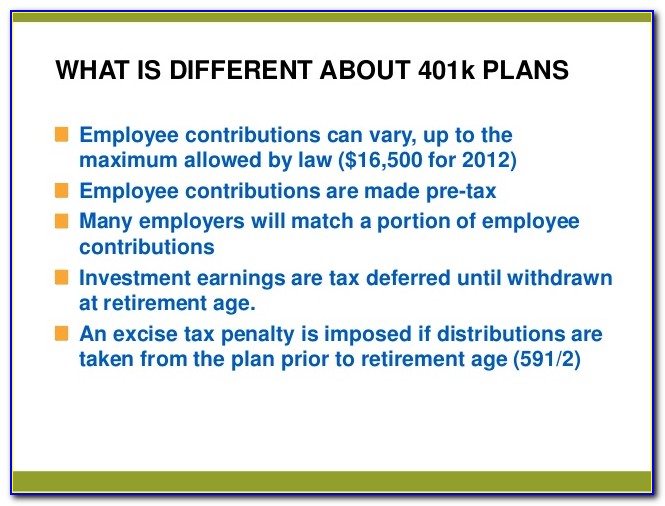

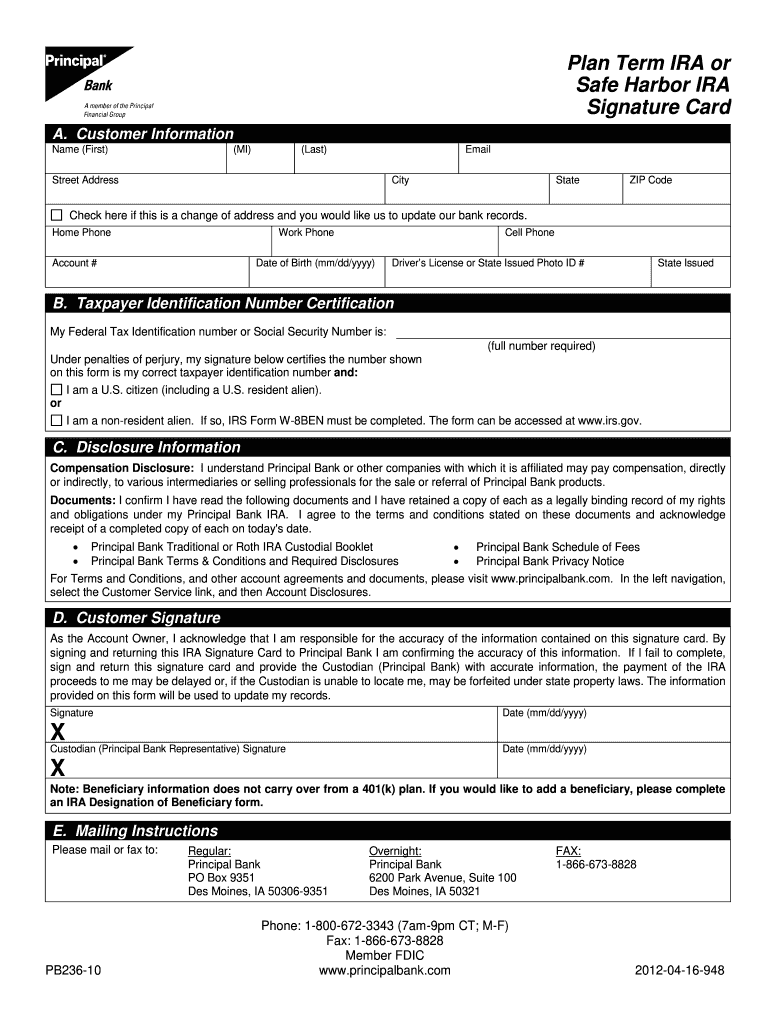

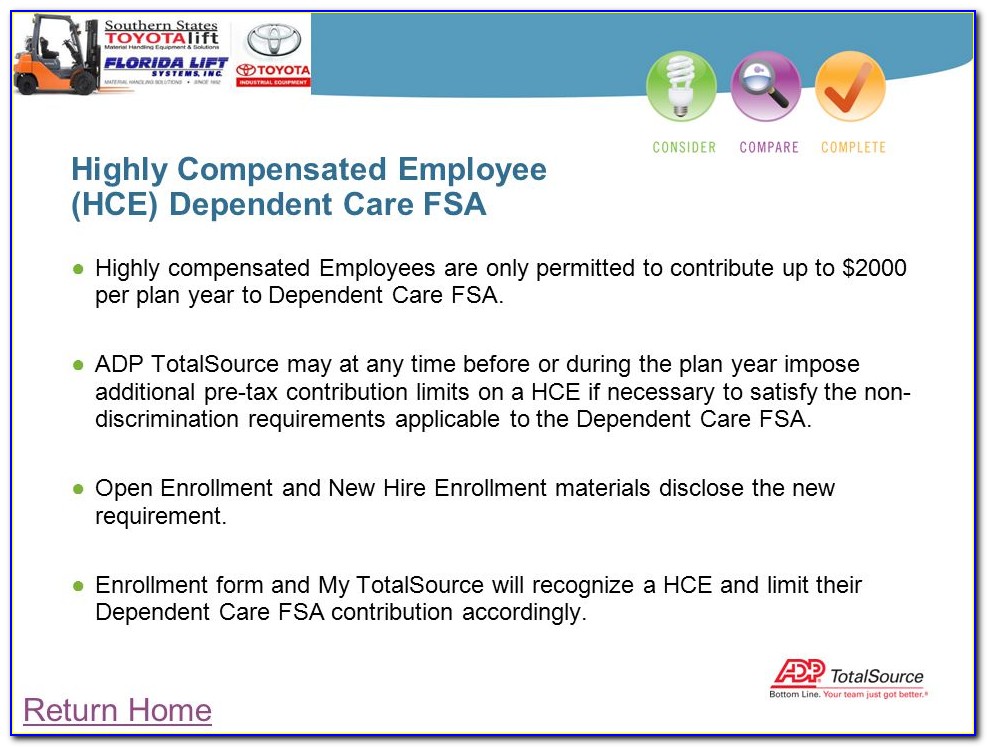

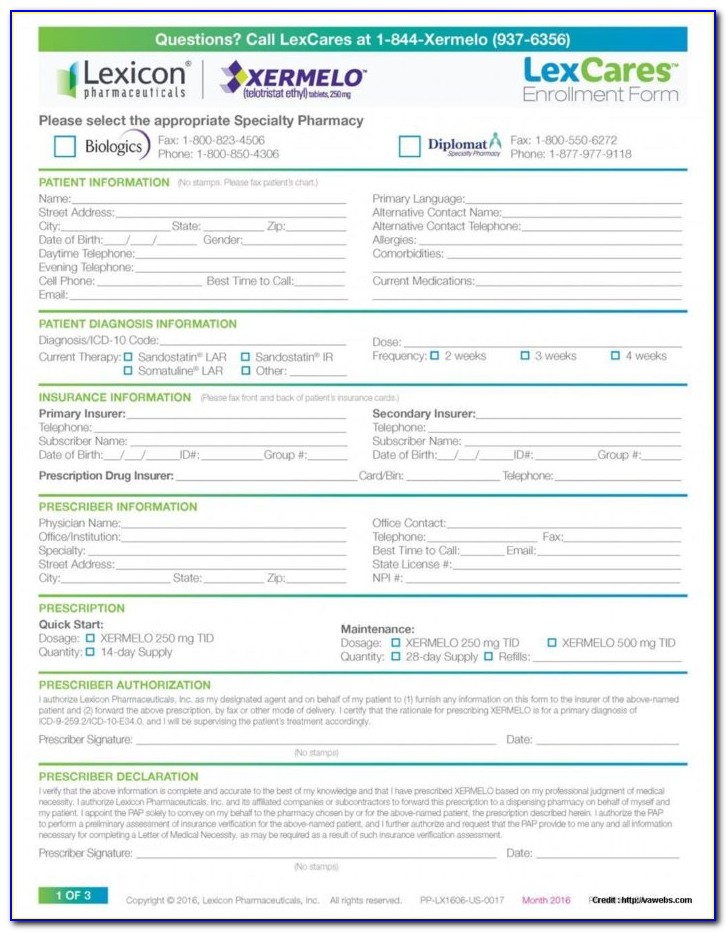

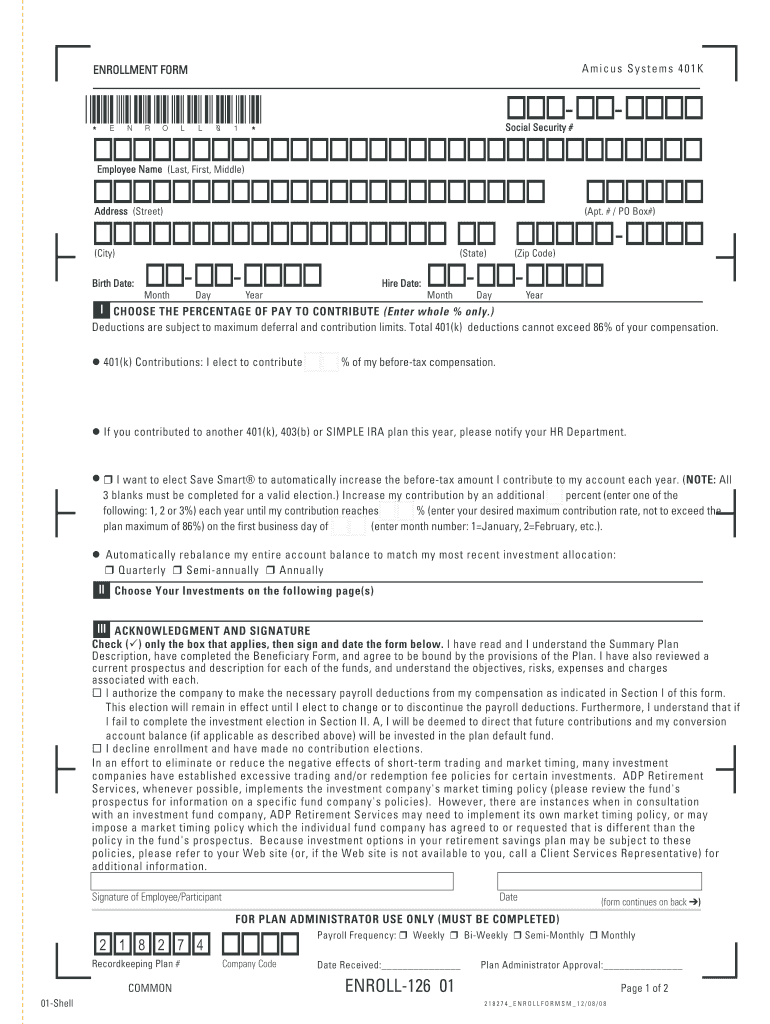

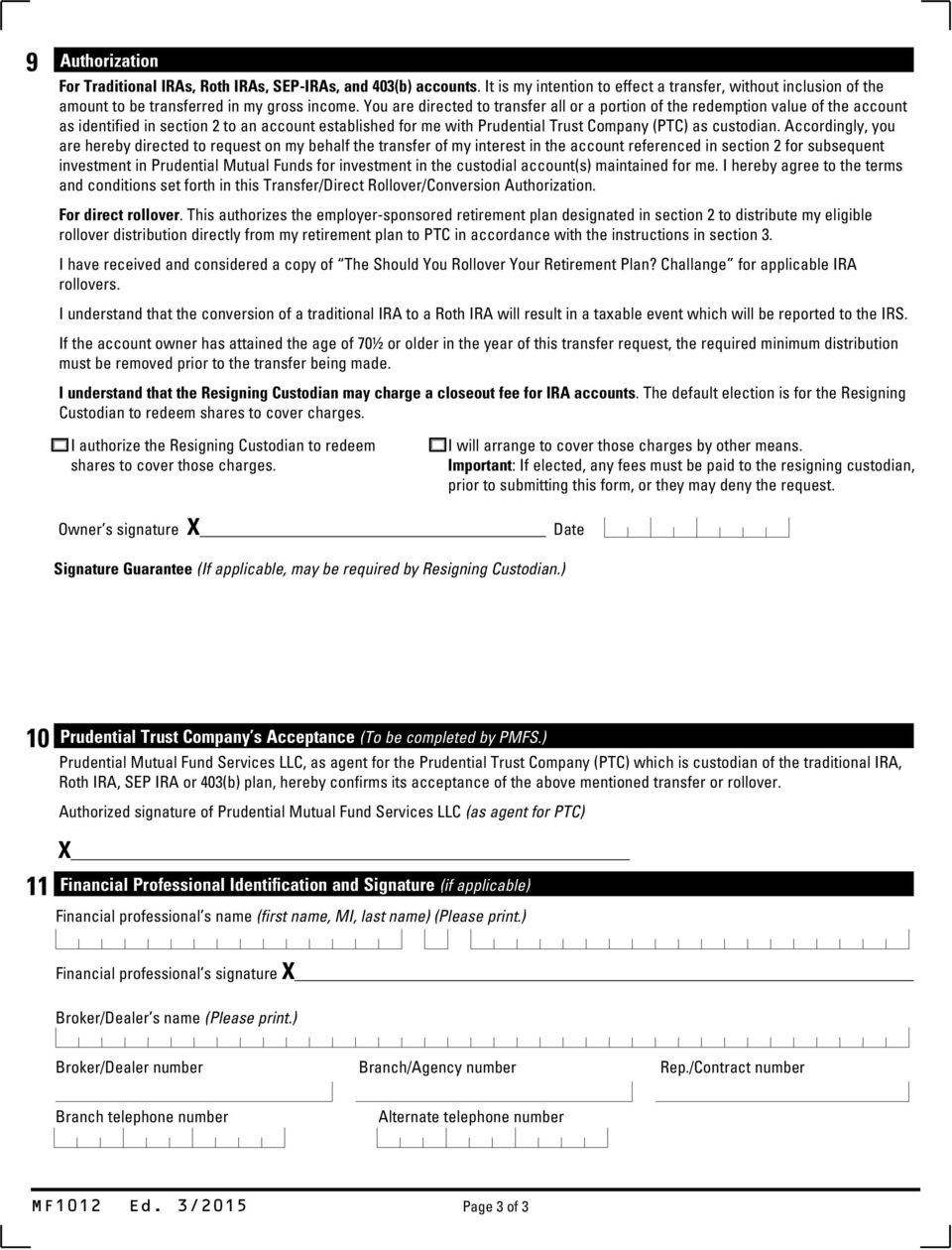

Web please use this form to authorize the fidelity advisor traditional ira, rollover ira, roth ira, simple ira, sep ira, or sarsep ira custodian (or its agent) to initiate a transfer of your existing ira directly from another ira custodian and to invest the transferred assets. Web how to transfer 401k from adp to fidelity by rick w january 30, 2022 0 214 don't miss how are 401k withdrawals taxed august 2, 2022 how to get your 401k without penalty september 13, 2021 can i move a 401k to a roth ira november 22,. You must file form 5329 to show that the distribution is qualified. You may get locked out of your account if you incorrectly enter login or security information a specified number of consecutive times. If you cannot wait for your account to be automatically. Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to. Web enrolling in your retirement plan takes just minutes, and it’s one of the smartest things you can do for your financial future. You will be locked for a period of time at which time you may try again. Web whether you have questions about what a 401(k) plan is or are looking for ways to enhance your saving strategies, the adp 401(k) resource library can provide you with the information and resources to keep you on the road to retirement readiness. • indicate the year your roth 401(k) contributions began.

Adp helps organizations of all types and sizes unlock their potential. Web adp will proactively waive any transaction fees associated with these actions for participants in the impacted areas. Please refer to the distribution statement provided by prior 401(k) provider for this information. Web enrolling in your retirement plan takes just minutes, and it’s one of the smartest things you can do for your financial future. For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Web you need to enable javascript to run this app. Using a direct rollover, $55,000. Web • for roth 401(k) rollover amounts: Web please use this form to authorize the fidelity advisor traditional ira, rollover ira, roth ira, simple ira, sep ira, or sarsep ira custodian (or its agent) to initiate a transfer of your existing ira directly from another ira custodian and to invest the transferred assets. Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to.

Adp 401k Loan Payoff Form Form Resume Examples qQ5MYwZ5Xg

You will then have the ability to review your information and complete. Web what is a 401(k) plan? • indicate the year your roth 401(k) contributions began. Web • for roth 401(k) rollover amounts: You must file form 5329 to show that the distribution is qualified.

Adp 401k Loan Payoff Form Form Resume Examples 9x8ra09V3d

For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Web follow the steps to enter your registration code, verify your identity, get your user id and password, select your security questions, enter your contact information, and enter your activation code. Adp helps organizations of all types and sizes unlock their potential. Web.

Adp 401k Loan Payoff Form Form Resume Examples qQ5MYwZ5Xg

Adp helps organizations of all types and sizes unlock their potential. Roth assets from an employer sponsored plan. Adp 401(k) enrollment it’s easy to save for retirement. Please consult your tax advisor for further assistance. Please refer to the distribution statement provided by prior 401(k) provider for this information.

Plan term for safe harbor ira signature card fill up in form ira owner

Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to. If you cannot wait for your account to be automatically. Web how to complete a rollover follow these steps to complete the roll over process and move your account assets into your current plan. Web you need to.

You And ADP 401k

Web whether you have questions about what a 401(k) plan is or are looking for ways to enhance your saving strategies, the adp 401(k) resource library can provide you with the information and resources to keep you on the road to retirement readiness. Rollover adp 401k into a rollover ira. Web enrolling in your retirement plan takes just minutes, and.

Adp 401k Loan Payoff Form Form Resume Examples qQ5MYwZ5Xg

You will then have the ability to review your information and complete. You will be locked for a period of time at which time you may try again. We provide payroll, global hcm and outsourcing services in more than 140 countries. Adp 401k rollover kit contents: You may get locked out of your account if you incorrectly enter login or.

John Hancock 401k Hardship Withdrawal Form Form Resume Examples

You will be locked for a period of time at which time you may try again. Adp 401k rollover kit contents: Adp 401k rollover certification forms retirement plan distribution guide retirement plans. Web enrolling in your retirement plan takes just minutes, and it’s one of the smartest things you can do for your financial future. Web adp will proactively waive.

ADP20190212.pdf Irs Tax Forms 401(K)

We provide payroll, global hcm and outsourcing services in more than 140 countries. Access and manage your account online. • indicate the year your roth 401(k) contributions began. Please consult your tax advisor for further assistance. Web what is a 401(k) plan?

Adp 401K Login Fill Out and Sign Printable PDF Template signNow

You may also need to file form 8606. Web whether you have questions about what a 401(k) plan is or are looking for ways to enhance your saving strategies, the adp 401(k) resource library can provide you with the information and resources to keep you on the road to retirement readiness. Adp helps organizations of all types and sizes unlock.

Adp 401K Rollover Certification Forms Retirement Plan Distribution Guide Retirement Plans.

You will be locked for a period of time at which time you may try again. Contact your previous employer to find out the steps you need to take and the paperwork required to roll your retirement assets into. For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Web you need to enable javascript to run this app.

Please Consult Your Tax Advisor For Further Assistance.

Complete the contribution + earnings = total amount section. If you cannot wait for your account to be automatically. Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to. You will then have the ability to review your information and complete.

Adp 401K Rollover Kit Contents:

Using a direct rollover, $55,000. You must file form 5329 to show that the distribution is qualified. You may get locked out of your account if you incorrectly enter login or security information a specified number of consecutive times. Access and manage your account online.

Rollover Adp 401K Into A Rollover Ira.

Adp 401(k) enrollment it’s easy to save for retirement. Web follow the steps to enter your registration code, verify your identity, get your user id and password, select your security questions, enter your contact information, and enter your activation code. Roth assets from an employer sponsored plan. Web • for roth 401(k) rollover amounts: