Alabama Form Bpt-V

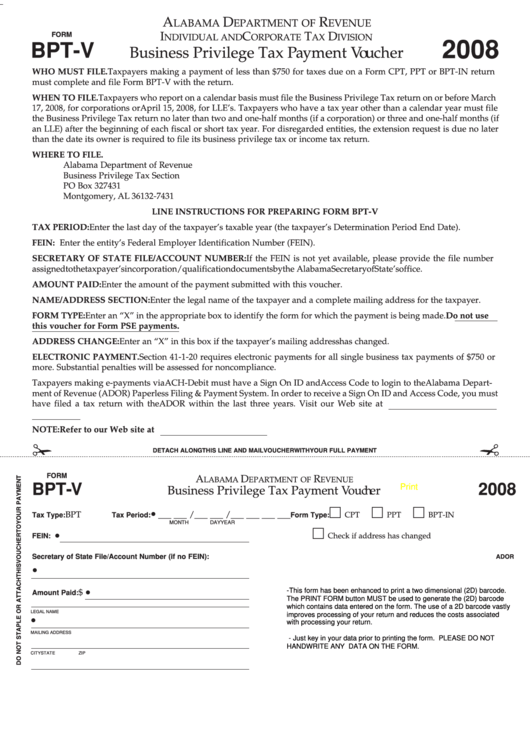

Alabama Form Bpt-V - Web follow the simple instructions below: Fields marked with an *are required. Minimum privilege tax is $100; File and pay business privilege tax online Web at least $2,500,000, the tax rate shall be $1.75 per $1,000. Business privilege tax payment voucher. All other mat questions click on the following link,. Enjoy smart fillable fields and interactivity. The fein field is required. Taxable/form year 2023 taxpayers making a payment of less than $750 for taxes due on a form.

Getting a legal specialist, creating a scheduled appointment and going to the office for a private conference makes finishing a alabama form bpt v from beginning to end exhausting. Follow the simple instructions below: Experience all the key benefits of completing and submitting legal. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of another state or country). Privilege tax is filed and paid for the upcoming tax year, so the forms are dated for. The fein field is required. Web alabama has changed the minimum tax due on the alabama privilege tax forms. The privilege tax due field is required. Use special code 1 or 2 to generate the. All other mat questions click on the following link,.

Use special code 1 or 2 to generate the. The payment method field is required. Web alabama has changed the minimum tax due on the alabama privilege tax forms. Follow the simple instructions below: The privilege tax due field is required. Plus the $10 secretary of state annual report fee for corporations. Web as automatic extension payments. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. The fein field is required. Web follow the simple instructions below:

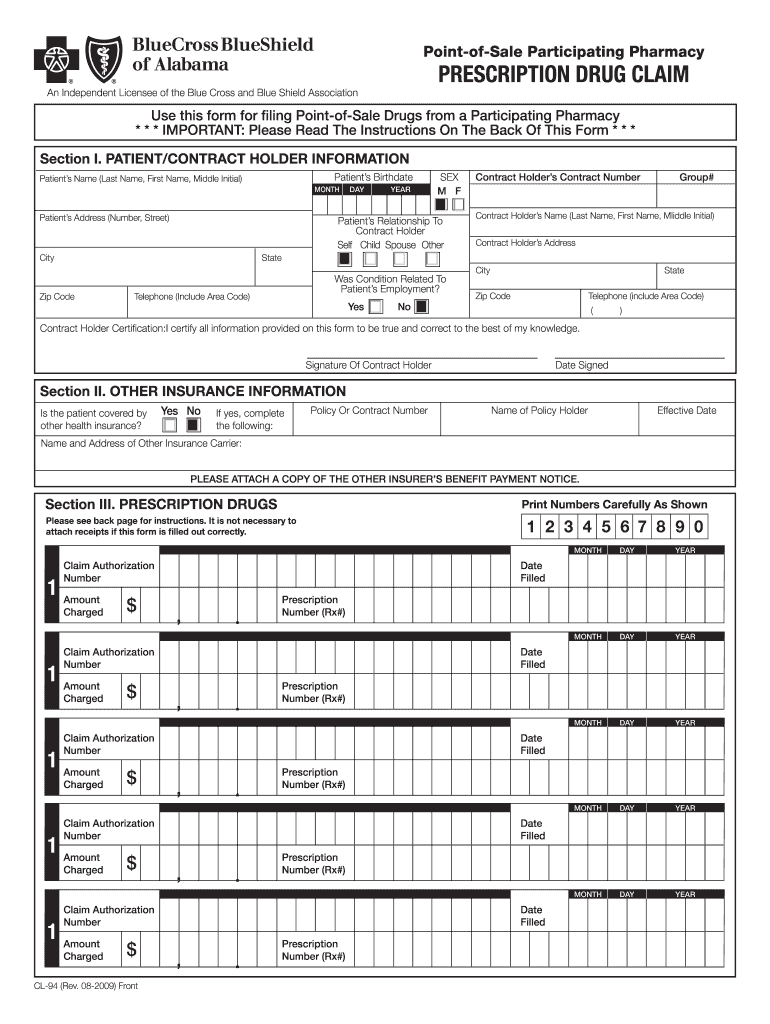

Cl 94 Fill Out and Sign Printable PDF Template signNow

Web 2022 business privilege tax payment voucher who must file: Us legal forms allows you to rapidly. It is generated when eft is not selected and a payment is due on these forms. Fields marked with an *are required. The fein field is required.

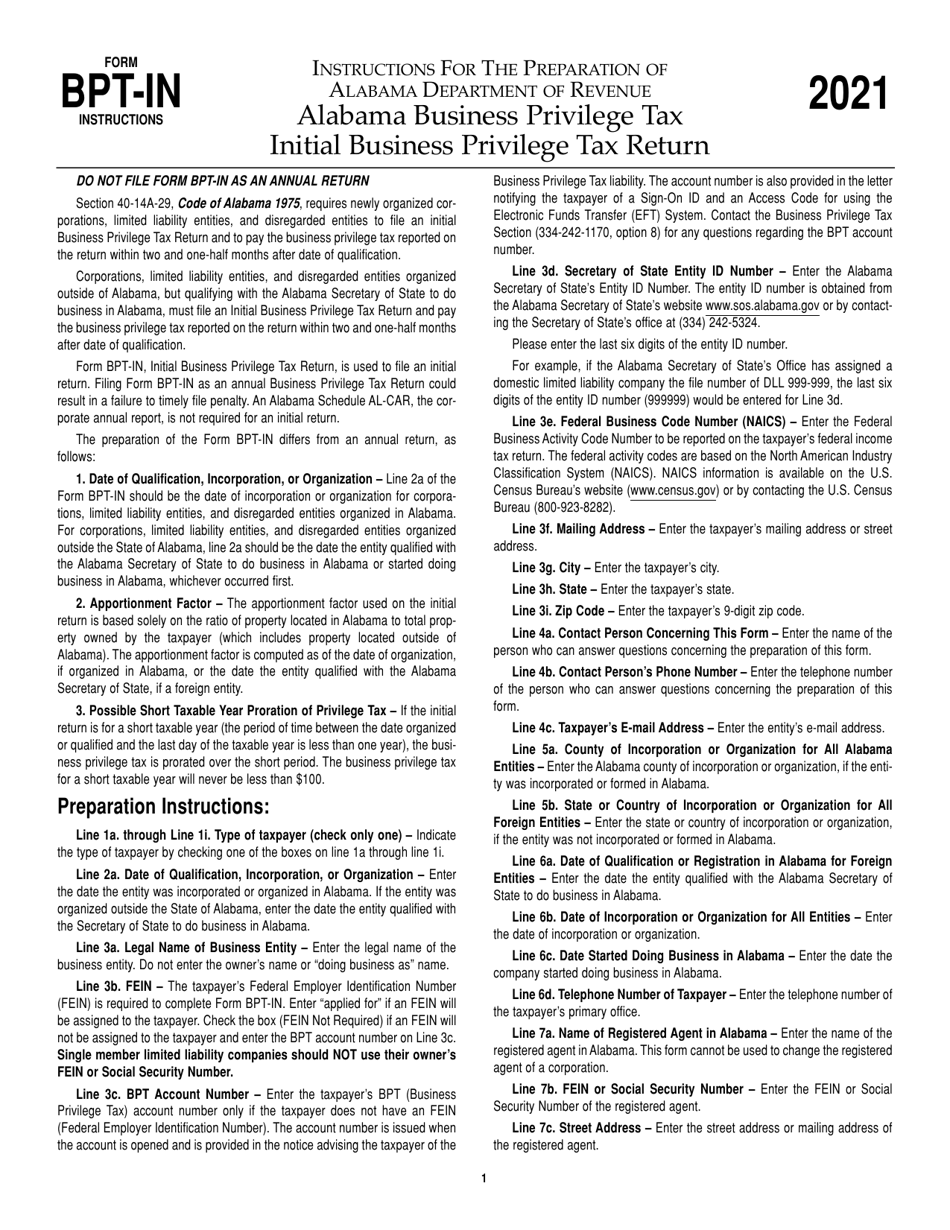

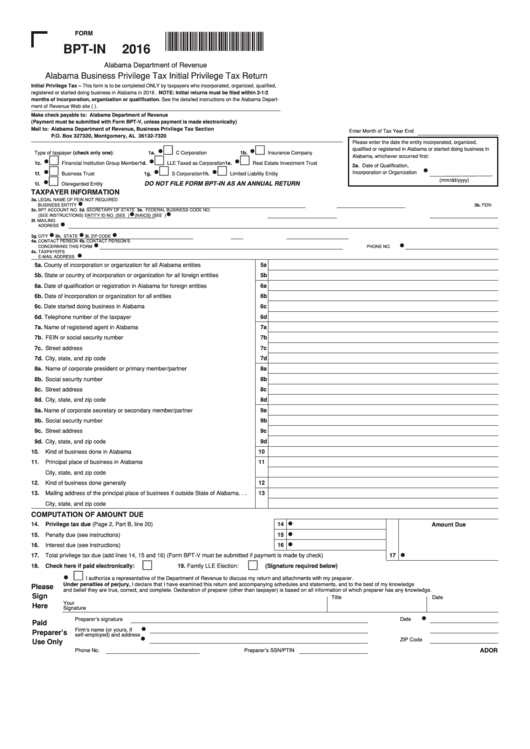

Download Instructions for Form BPTIN Alabama Business Privilege Tax

Privilege tax is filed and paid for the upcoming tax year, so the forms are dated for. Getting a legal specialist, creating a scheduled appointment and going to the office for a private conference makes finishing a alabama form bpt v from beginning to end exhausting. Edit your bpt v online type text, add images, blackout confidential details, add comments,.

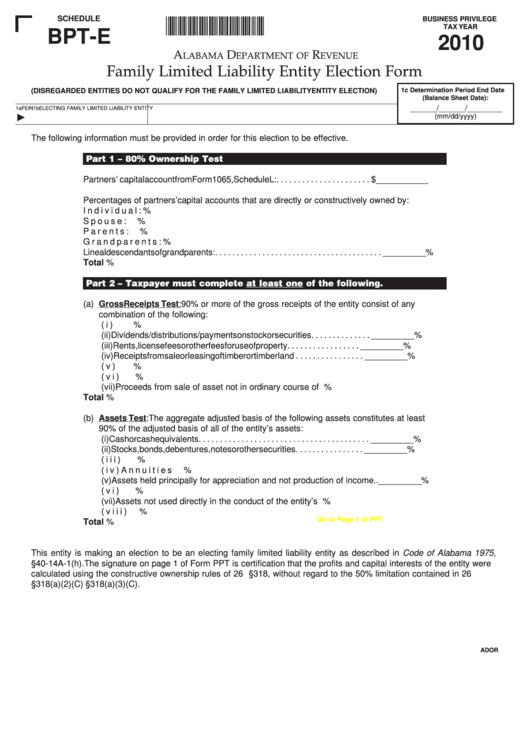

Top Alabama Schedule Bpte Templates free to download in PDF format

03/13/2012), 2010 alabama individual income tax. Enjoy smart fillable fields and interactivity. Edit your bpt v online type text, add images, blackout confidential details, add comments, highlights and more. Web as automatic extension payments. Web how to fill out and sign alabama form bpt v online?

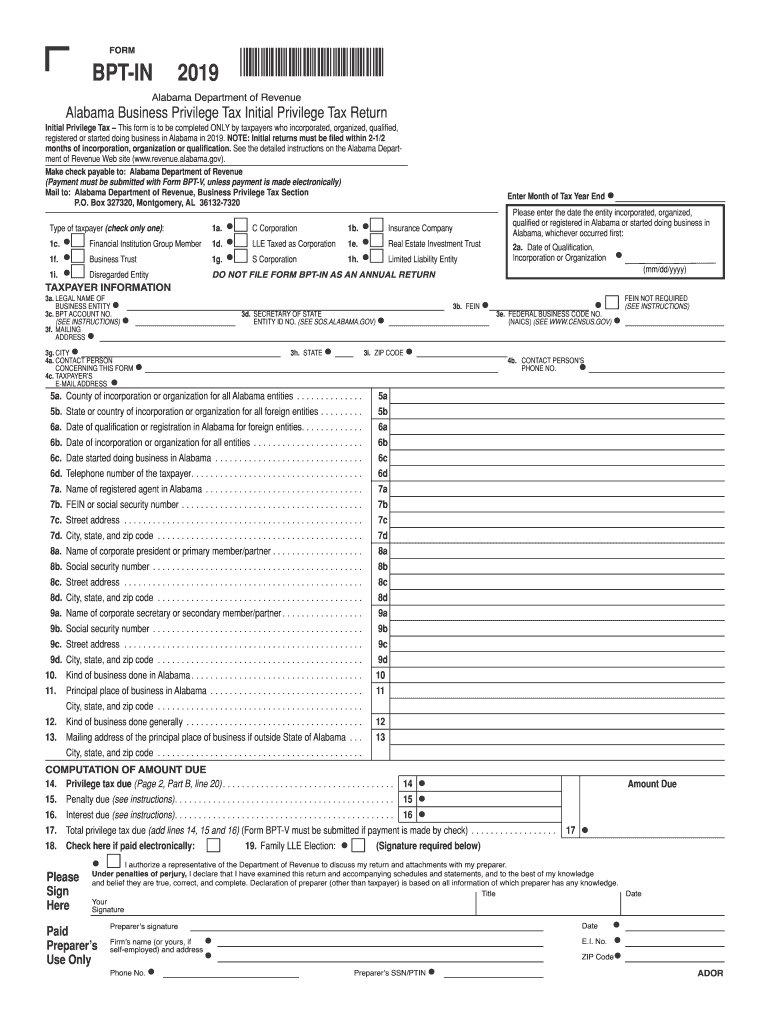

2019 Form AL BPTIN Fill Online, Printable, Fillable, Blank pdfFiller

The payment method field is required. Experience all the key benefits of completing and submitting legal. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of another state or country). Privilege tax is filed and paid for the upcoming tax.

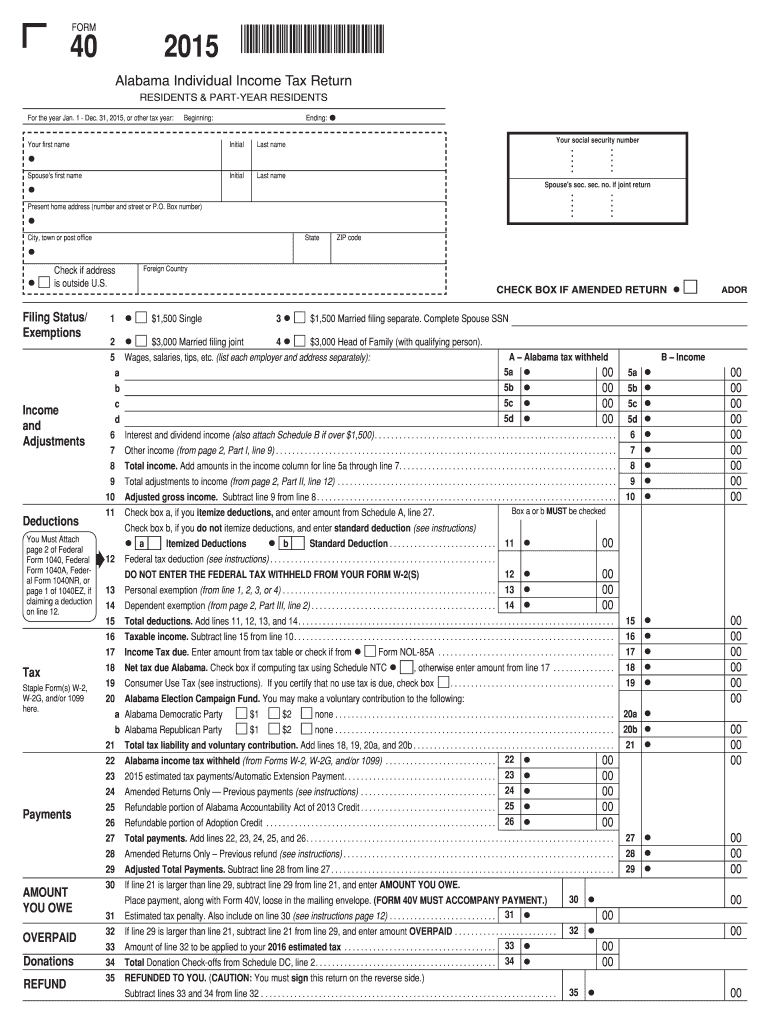

Alabama Form 40 Fill Out and Sign Printable PDF Template signNow

Web alabama has changed the minimum tax due on the alabama privilege tax forms. The fein field is required. Follow the simple instructions below: All other mat questions click on the following link,. Use special code 1 or 2 to generate the.

Alabama Form 40 Instructions 2019 Fill Out and Sign Printable PDF

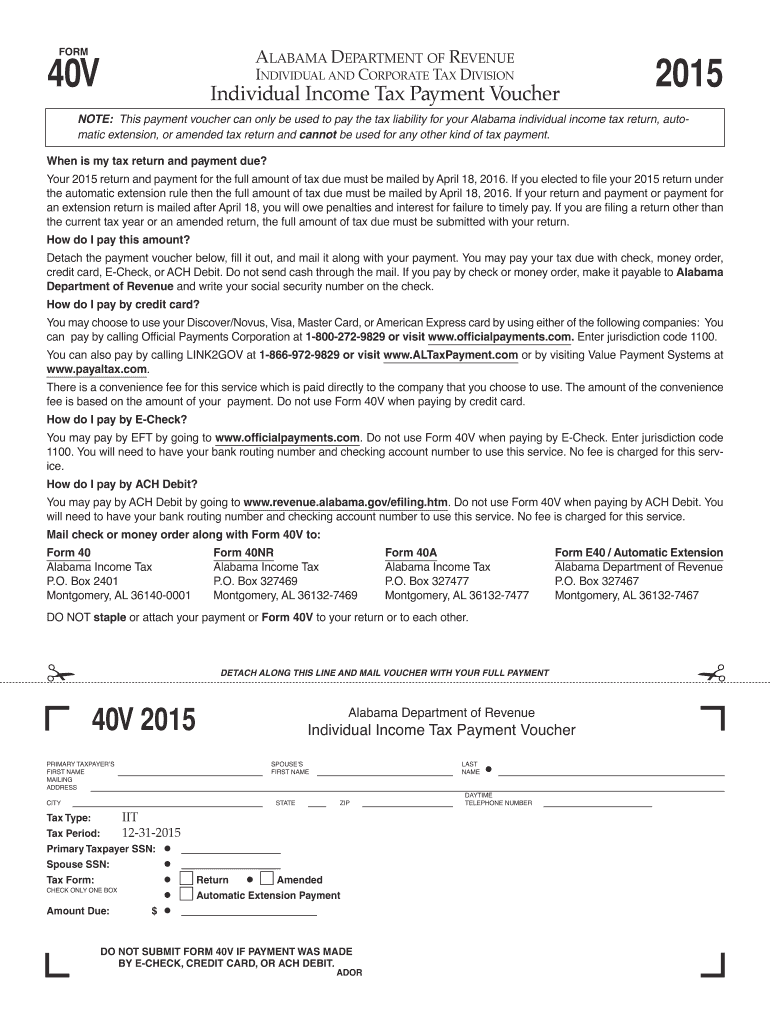

Plus the $10 secretary of state annual report fee for corporations. Web how to fill out and sign alabama form bpt v online? Web 2022 business privilege tax payment voucher who must file: It is generated when eft is not selected and a payment is due on these forms. You can download or print current or past.

Fillable Form BptV Business Privilege Tax Payment Voucher Form

Experience all the key benefits of completing and submitting legal. File and pay business privilege tax online Web as automatic extension payments. The fein field is required. Fields marked with an *are required.

Form BptIn Alabama Business Privilege Tax Initial Privilege Tax

The payment method field is required. Taxable/form year 2023 taxpayers making a payment of less than $750 for taxes due on a form. Get your online template and fill it in using progressive features. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. 03/13/2012), 2010 alabama.

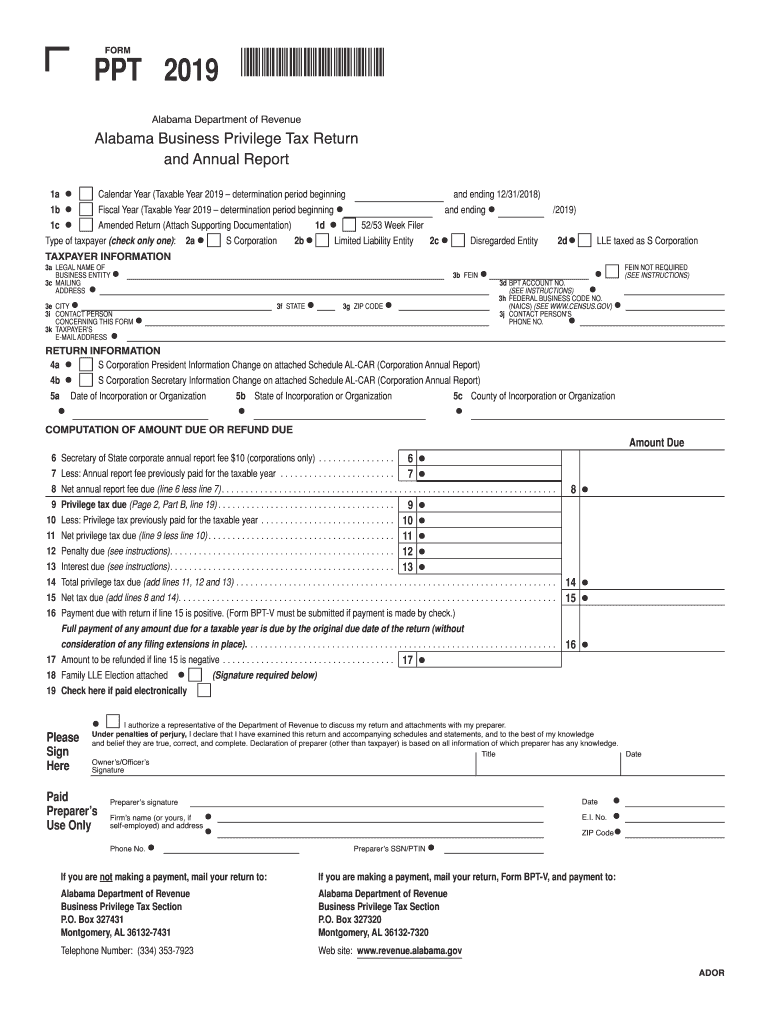

Alabama Form Ppt 2019 Fill Out and Sign Printable PDF Template signNow

Us legal forms allows you to rapidly. Web how to fill out and sign alabama form bpt v online? All other mat questions click on the following link,. The payment method field is required. Getting a legal specialist, creating a scheduled appointment and going to the office for a private conference makes finishing a alabama form bpt v from beginning.

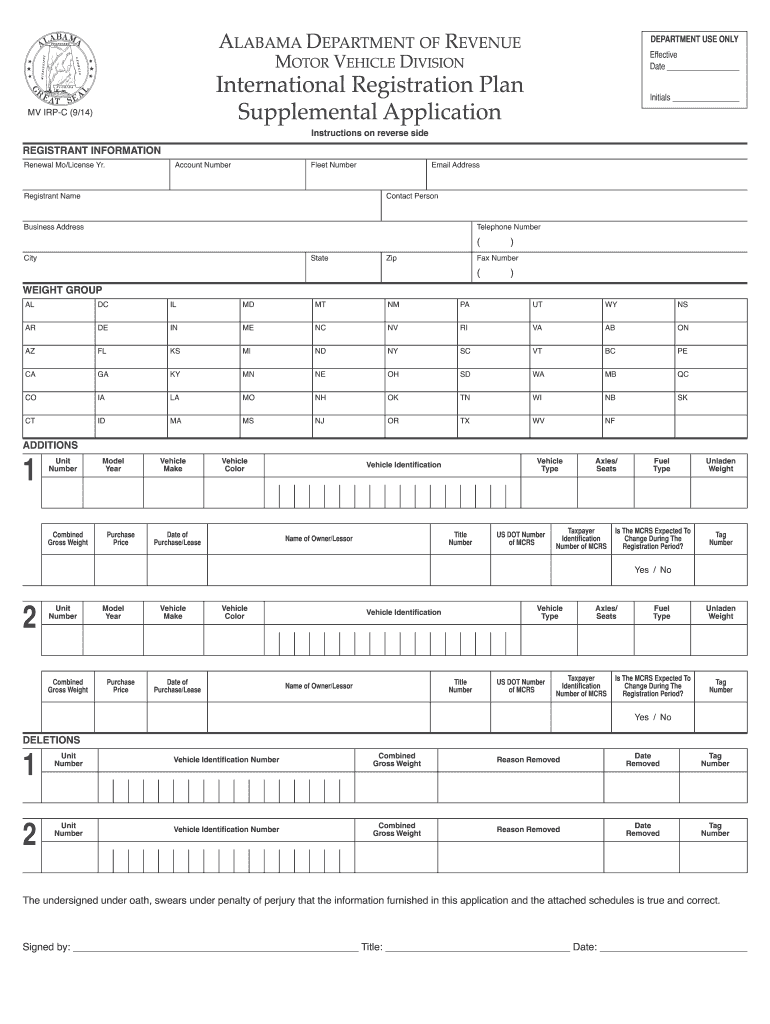

Irp Supplement Fill Out and Sign Printable PDF Template signNow

Enjoy smart fillable fields and interactivity. Edit your bpt v online type text, add images, blackout confidential details, add comments, highlights and more. Web as automatic extension payments. Web follow the simple instructions below: Web 2023 business privilege tax return and annual report.

Sign It In A Few Clicks Draw Your Signature, Type It, Upload Its Image, Or Use Your Mobile Device As A Signature Pad.

The privilege tax due field is required. Web 2022 business privilege tax payment voucher who must file: Business privilege tax payment voucher. All other mat questions click on the following link,.

Enjoy Smart Fillable Fields And Interactivity.

Complete, edit or print tax forms instantly. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of another state or country). Minimum privilege tax is $100; Use special code 1 or 2 to generate the.

Taxable/Form Year 2023 Taxpayers Making A Payment Of Less Than $750 For Taxes Due On A Form.

An extension of time for filing the alabama business privilege. Web follow the simple instructions below: Edit your bpt v online type text, add images, blackout confidential details, add comments, highlights and more. Fields marked with an *are required.

File And Pay Business Privilege Tax Online

Getting a legal specialist, creating a scheduled appointment and going to the office for a private conference makes finishing a alabama form bpt v from beginning to end exhausting. You can download or print current or past. The payment method field is required. Us legal forms allows you to rapidly.