Alabama Income Tax Form 40

Alabama Income Tax Form 40 - Get ready for tax season deadlines by completing any required tax forms today. Complete spouse ssn • • 6 $3,000 married filing joint 4 • 6 $3,000 head of family (with. • 6return • 6amended check only one box • 6automatic extension payment. This tax return package includes form 4952a,. Web 26 rows all forms will download as a pdf. Alabama individual income tax return: Complete, edit or print tax forms instantly. Web we last updated the individual income tax return (short form) in january 2023, so this is the latest version of form 40a, fully updated for tax year 2022. Alabama individual income tax return form 40 (print only) all. This form is for income earned in tax year 2022, with tax returns due in april.

Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web alabama individual income tax return form 40 (print only) download form. 2022 form 40 income tax instruction booklet. Alabama individual income tax return form 40 (print only) all. This form is for income earned in tax year 2022, with tax returns due in april. 1• $1,500 single 3 • $1,500 married filing separate. 2• $3,000 married filing joint 4 • $3,000 head of. Web form 40 tax table. Please refer to the list of mailing addresses for the appropriate forms. Web 26 rows all forms will download as a pdf.

Ad download or email al form 40 & more fillable forms, register and subscribe now! Alabama individual income tax return: 31, 2015, or other tax year:. Web find alabama form 40 instructions at esmart tax today. There are a few variations. Web 26 rows all forms will download as a pdf. This tax return package includes form 4952a,. 2022 form 40 income tax instruction booklet. Web alabama individual income tax return form 40 (print only) download form. Please refer to the list of mailing addresses for the appropriate forms.

Happy tax day Forbes says Alabama is the 10th best state for taxes

2022 † form 40 income tax instruction booklet: There are a few variations. Web form 40 tax table. 2022 form 40 income tax instruction booklet. 31, 2015, or other tax year:.

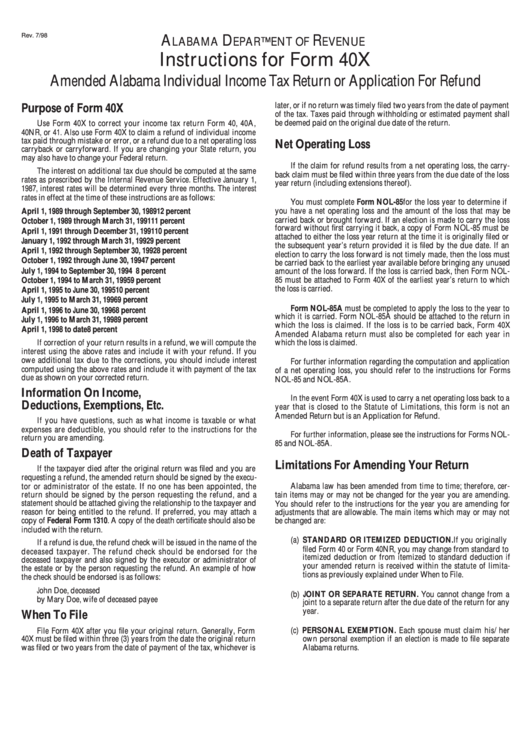

Instructions For Form 40x Amended Alabama Individual Tax

Web *2100014a* • 6 $1,500 single 3 • 6 $1,500 married filing separate. Please refer to the list of mailing addresses for the appropriate forms. 2• $3,000 married filing joint 4 • $3,000 head of. This tax return package includes form 4952a,. 2022 alabama individual income tax return.

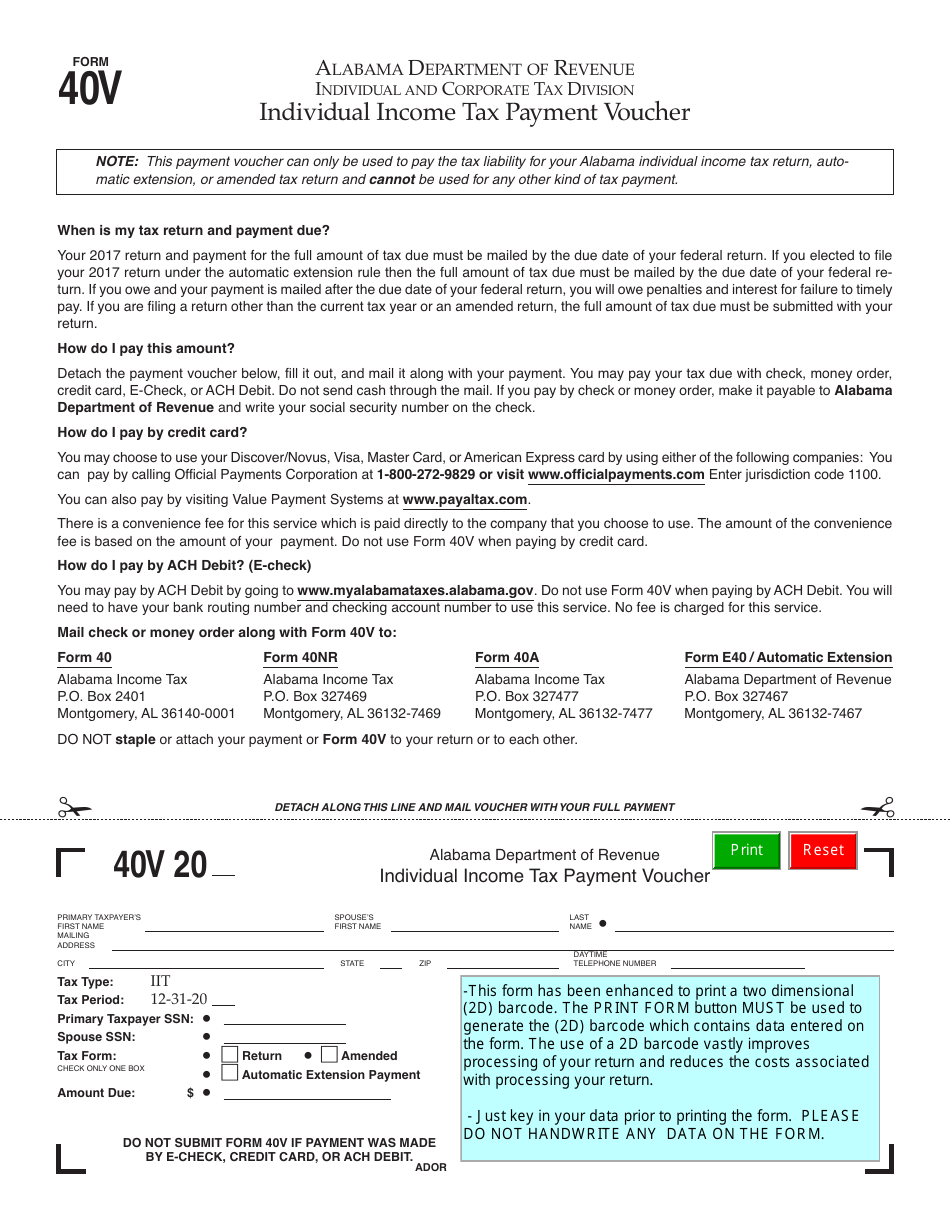

20182020 Form AL DoR 40V Fill Online, Printable, Fillable, Blank

Please refer to the list of mailing addresses for the appropriate forms. 2022 alabama individual income tax return. 2• $3,000 married filing joint 4 • $3,000 head of. This tax return package includes form 4952a,. Web we last updated alabama form 40 in january 2023 from the alabama department of revenue.

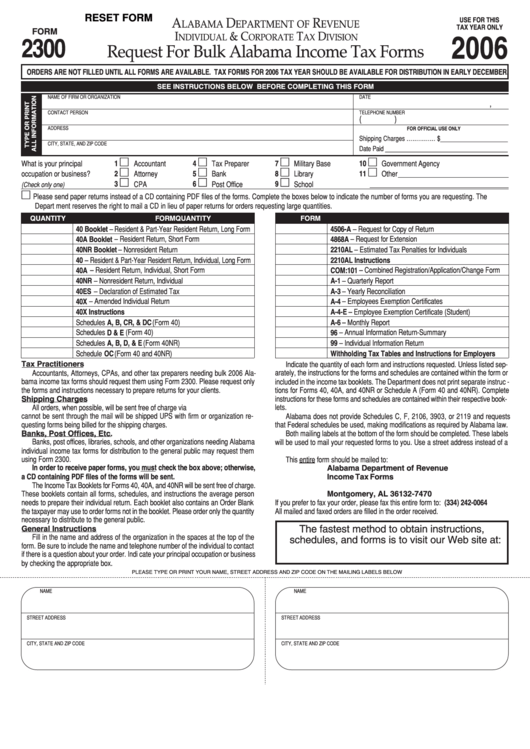

Fillable Form 2300 Request For Bulk Alabama Tax Forms 2006

For income tax form orders, please use this contact form. Alabama individual income tax return form 40 (print only) all. Web find alabama form 40 schedule a, b & dc instructions at esmart tax today. 31, 2015, or other tax year:. This form is for income earned in tax year 2022, with tax returns due in april.

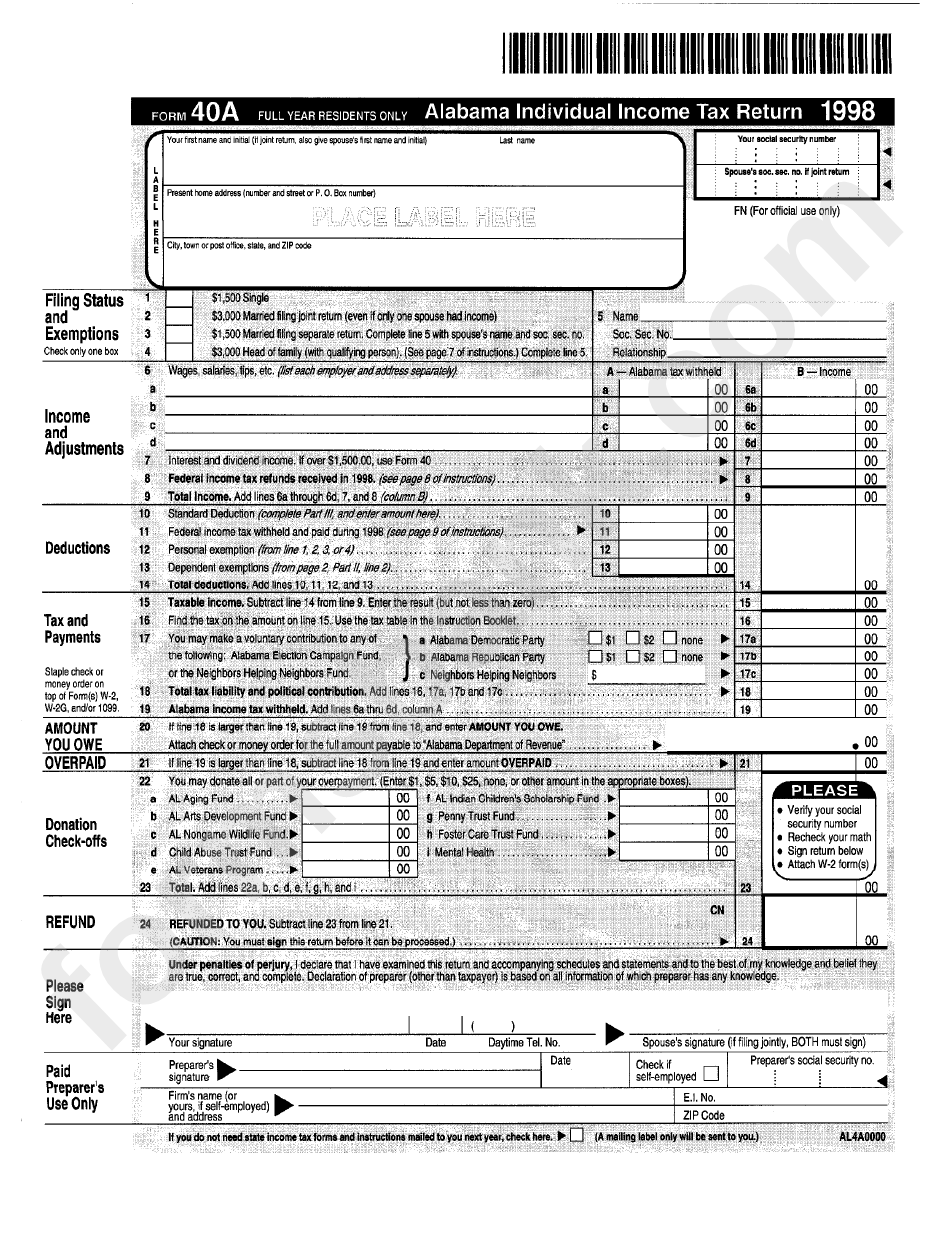

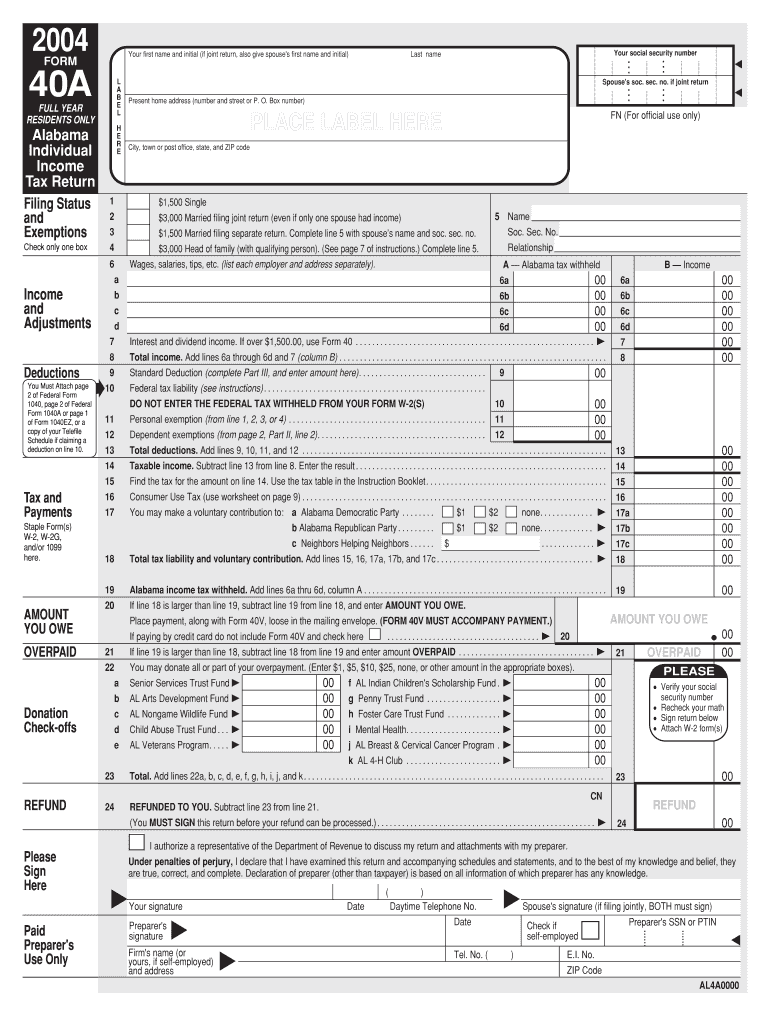

Fillable Form 40a Alabama Individual Tax Return 1998

2022 alabama individual income tax return. Web *2100014a* • 6 $1,500 single 3 • 6 $1,500 married filing separate. Web form 40 tax table. Web alabama individual income tax return form 40 (print only) download form. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button,.

Form 40V Download Printable PDF or Fill Online Individual Tax

Complete spouse ssn • nra. Web we last updated alabama form 40 in january 2023 from the alabama department of revenue. Web alabama individual income tax return form 40 (print only) download form. Complete spouse ssn • • 6 $3,000 married filing joint 4 • 6 $3,000 head of family (with. Web we last updated the individual income tax return.

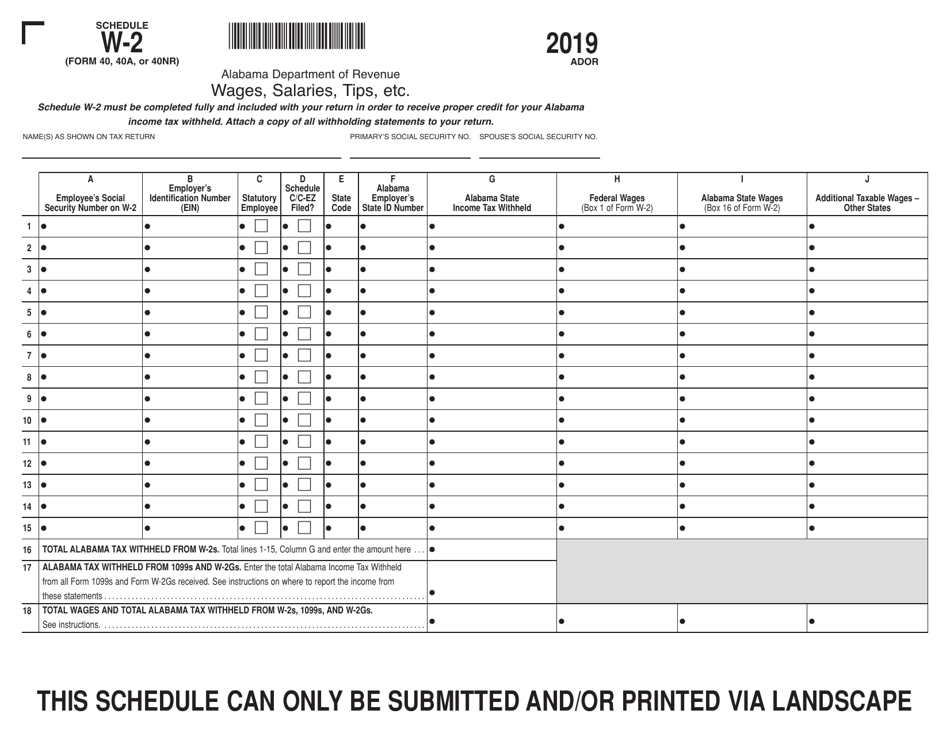

Form 40 (40A; 40NR) Schedule W2 Download Printable PDF or Fill Online

Complete spouse ssn • • 6 $3,000 married filing joint 4 • 6 $3,000 head of family (with. For more information about the. Please refer to the list of mailing addresses for the appropriate forms. 1• $1,500 single 3 • $1,500 married filing separate. 2022 alabama individual income tax.

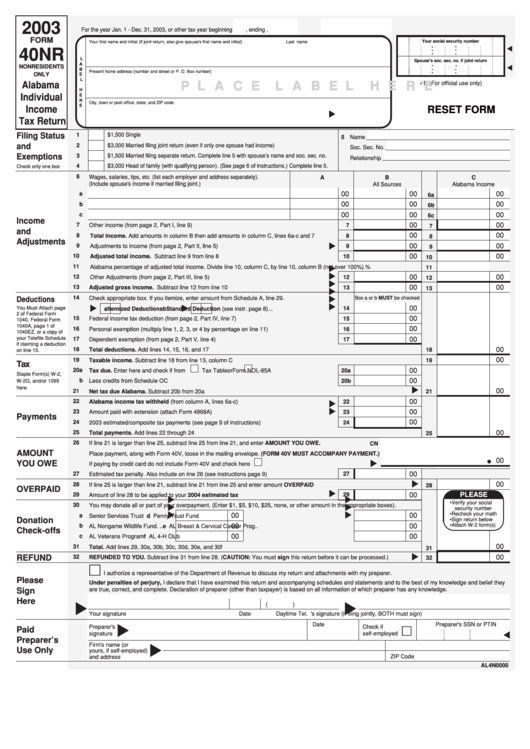

Fillable Form 40nr Alabama Individual Tax Return 2003

Alabama individual income tax return: Web find alabama form 40 instructions at esmart tax today. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. There are a few variations. Web form 40 tax table.

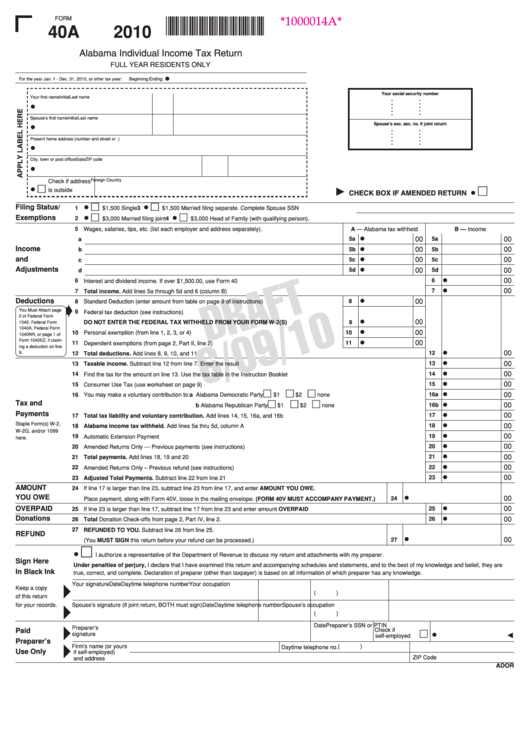

Form 40a Alabama Individual Tax Return 2010 printable pdf

1• $1,500 single 3 • $1,500 married filing separate. For income tax form orders, please use this contact form. For more information about the. Web form 40 tax table. Complete, edit or print tax forms instantly.

Alabama Fillable Tax Form Printable Forms Free Online

For income tax form orders, please use this contact form. Complete spouse ssn • • 6 $3,000 married filing joint 4 • 6 $3,000 head of family (with. Web we last updated the form 40 income tax instruction booklet in march 2023, so this is the latest version of form 40 booklet, fully updated for tax year 2022. Web *2100014a*.

This Form Is Used By Alabama Residents Who File An Individual Income Tax Return.

Alabama individual income tax return form 40 (print only) all. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web *2100014a* • 6 $1,500 single 3 • 6 $1,500 married filing separate. 2022 alabama individual income tax return.

Web Alabama Individual Income Tax Return Form 40 (Print Only) Download Form.

Web find alabama form 40 schedule a, b & dc instructions at esmart tax today. Complete spouse ssn • nra. Web we last updated the individual income tax return (short form) in january 2023, so this is the latest version of form 40a, fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today.

This Tax Return Package Includes Form 4952A,.

1• $1,500 single 3 • $1,500 married filing separate. Web we last updated the form 40 income tax instruction booklet in march 2023, so this is the latest version of form 40 booklet, fully updated for tax year 2022. • 6return • 6amended check only one box • 6automatic extension payment. There are a few variations.

For More Information About The.

Web we last updated alabama form 40 in january 2023 from the alabama department of revenue. Complete spouse ssn • • 6 $3,000 married filing joint 4 • 6 $3,000 head of family (with. Web form 40 tax table. Please refer to the list of mailing addresses for the appropriate forms.