Applicable Check Box On Form 8949

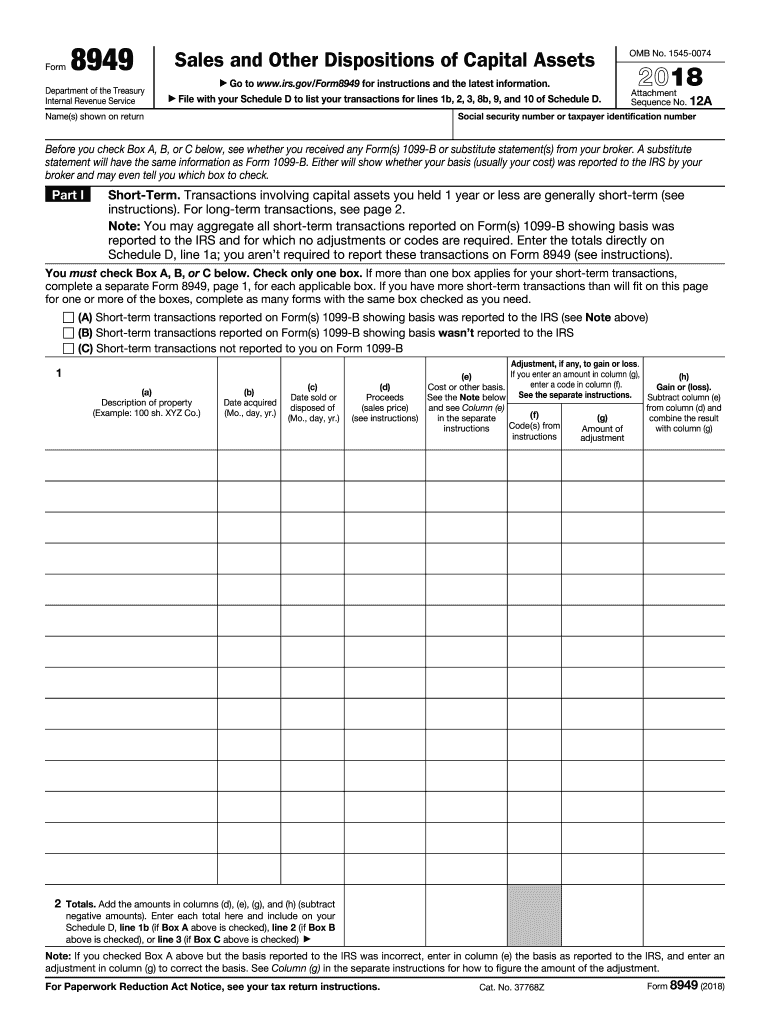

Applicable Check Box On Form 8949 - Sales and other dispositions of capital assets. You aren’t required to report these transactions on form 8949 (see instructions). The applicable check box is typically listed in the fine print just below the. Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates. You must check box d, e, or f below. Web overview of form 8949: Actions > enter transactions > check > distributions tab: It is used to report capital. Enter information on all of your short. Web schedule d, line 1a;

The applicable check box is typically listed in the fine print just below the. Web applicable check box on form 8949. Actions > enter transactions > check > distributions tab: Web how to fill out and read form 8949. Sales and other dispositions of capital assets. Web enter the totals directly on schedule d, line 8a; Checkbox « gui windows forms « c# / csharp tutorial. Web add checkbox to a form : Perfectly acceptable to file a tax return with just a single summary entry in the capital gains and losses section, as long as the brokerage firm or other financial. Applicable check box on form 8949;

Web where do i enter that information on the 8949 screen? Web applicable check box on form 8949. Web add checkbox to a form : Web enter the totals directly on schedule d, line 8a; If box 5 is marked on the taxpayer's. Check box a, b, or. Web on part i of form 8949. Sales and other dispositions of capital assets. Check box a, b, or c in part i, depending on which reporting option applies. Web how to fill out and read form 8949.

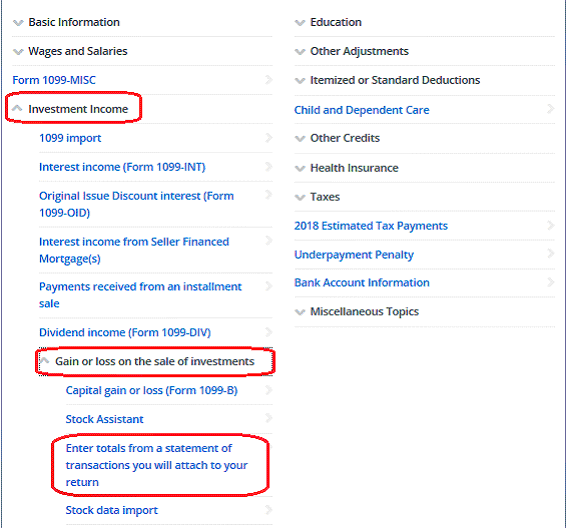

Entering Form 8949 Totals Into TaxACT® TradeLog Software

Web where do i enter that information on the 8949 screen? Actions > enter transactions > check > distributions tab: Web answer (1 of 3): Sales and other dispositions of capital assets. Web check only one box.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web add checkbox to a form : Sales and other dispositions of capital assets. It is used to report capital. Web schedule d, line 1a; Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates.

Form 8949 Fill Out and Sign Printable PDF Template signNow

Web enter the totals directly on schedule d, line 8a; You aren’t required to report these transactions on form 8949 (see instructions). Check box a, b, or c in part i, depending on which reporting option applies. Web use form 8949 to report sales and exchanges of capital assets. Web check only one box.

Online IRS Instructions 8949 2019 Fillable and Editable PDF Template

Actions > enter transactions > check > distributions tab: Web check only one box. Perfectly acceptable to file a tax return with just a single summary entry in the capital gains and losses section, as long as the brokerage firm or other financial. Enter information on all of your short. You aren’t required to report these transactions on form 8949.

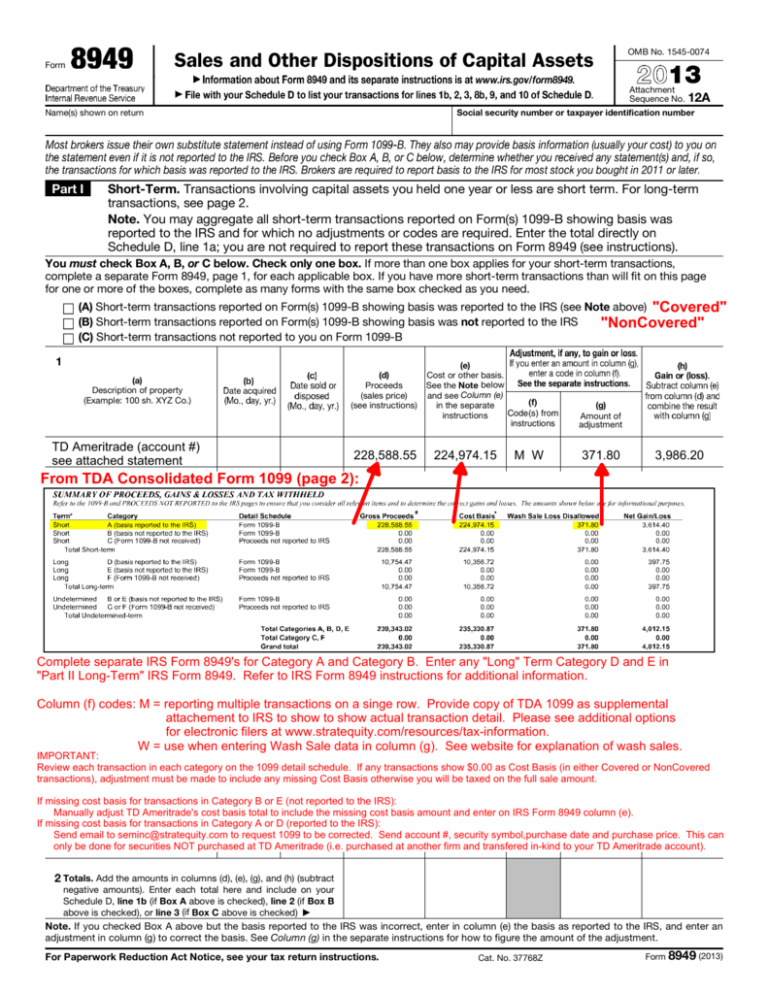

IRS Form 8949 SAMPLE 2013

Web check only one box. Applicable check box on form 8949; Enter information on all of your short. You must check box d, e, or f below. If box 5 is marked on the taxpayer's.

Check Box Form Control, Cell Linking YouTube

The applicable check box is typically listed in the fine print just below the. Web enter the totals directly on schedule d, line 8a; Web on part i of form 8949. You aren’t required to report these transactions on form 8949 (see instructions). Enter information on all of your short.

How to Do Your Coinbase Taxes CryptoTrader.Tax

Actions > enter transactions > check > distributions tab: Web add checkbox to a form : Click the ellipsis button next to the 1099 item. Web schedule d, line 1a; If box 5 is marked on the taxpayer's.

In the following Form 8949 example,the highlighted section below shows

Enter information on all of your short. You aren’t required to report these transactions on form 8949 (see instructions). Web use form 8949 to report sales and exchanges of capital assets. Web where do i enter that information on the 8949 screen? The applicable check box is typically listed in the fine print just below the.

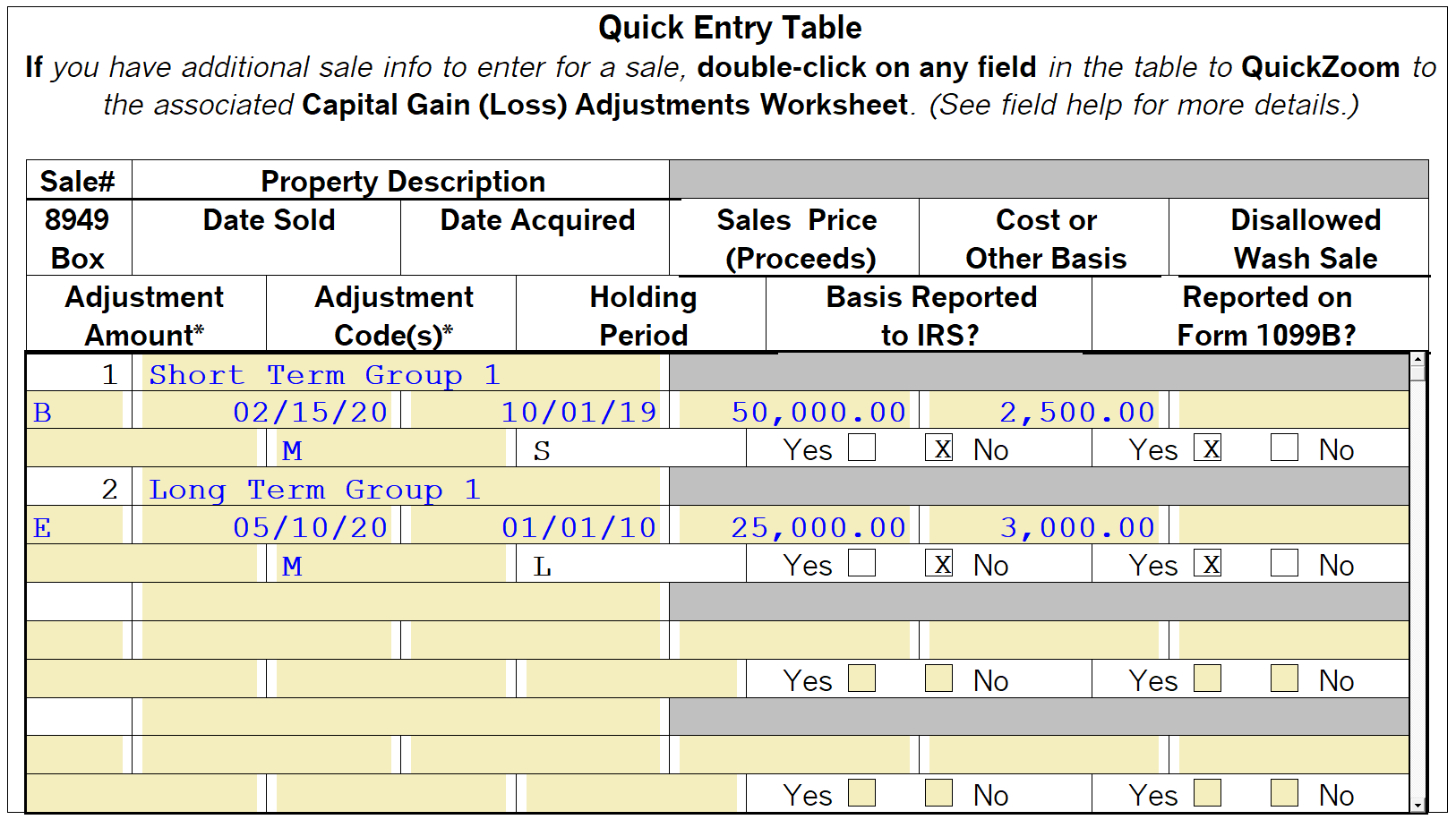

Attach a summary to the Schedule D and Form 8949 in ProSeries

Actions > enter transactions > check > distributions tab: Web where do i enter that information on the 8949 screen? Check box a, b, or. Applicable check box on form 8949. Web overview of form 8949:

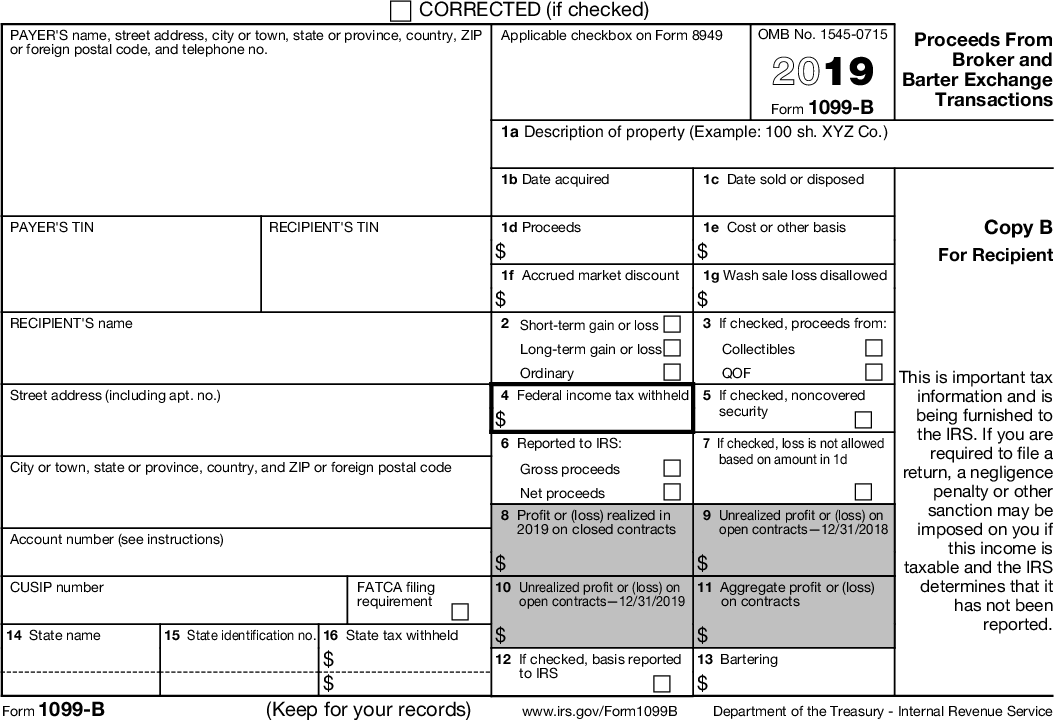

Form 1099B

Check box a, b, or c in part i, depending on which reporting option applies. Perfectly acceptable to file a tax return with just a single summary entry in the capital gains and losses section, as long as the brokerage firm or other financial. Web applicable check box on form 8949. Web how to fill out and read form 8949..

Web Add Checkbox To A Form :

Perfectly acceptable to file a tax return with just a single summary entry in the capital gains and losses section, as long as the brokerage firm or other financial. It is used to report capital. Actions > enter transactions > check > distributions tab: Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates.

Web Applicable Check Box On Form 8949.

Web schedule d, line 1a; Enter information on all of your short. Sales and other dispositions of capital assets. Web check only one box.

Click The Ellipsis Button Next To The 1099 Item.

The applicable check box is typically listed in the fine print just below the. If box 5 is marked on the taxpayer's. You aren’t required to report these transactions on form 8949 (see instructions). Check box a, b, or c in part i, depending on which reporting option applies.

Web Answer (1 Of 3):

Check box a, b, or. Web overview of form 8949: Web how to fill out and read form 8949. Applicable check box on form 8949;