Ar Withholding Form

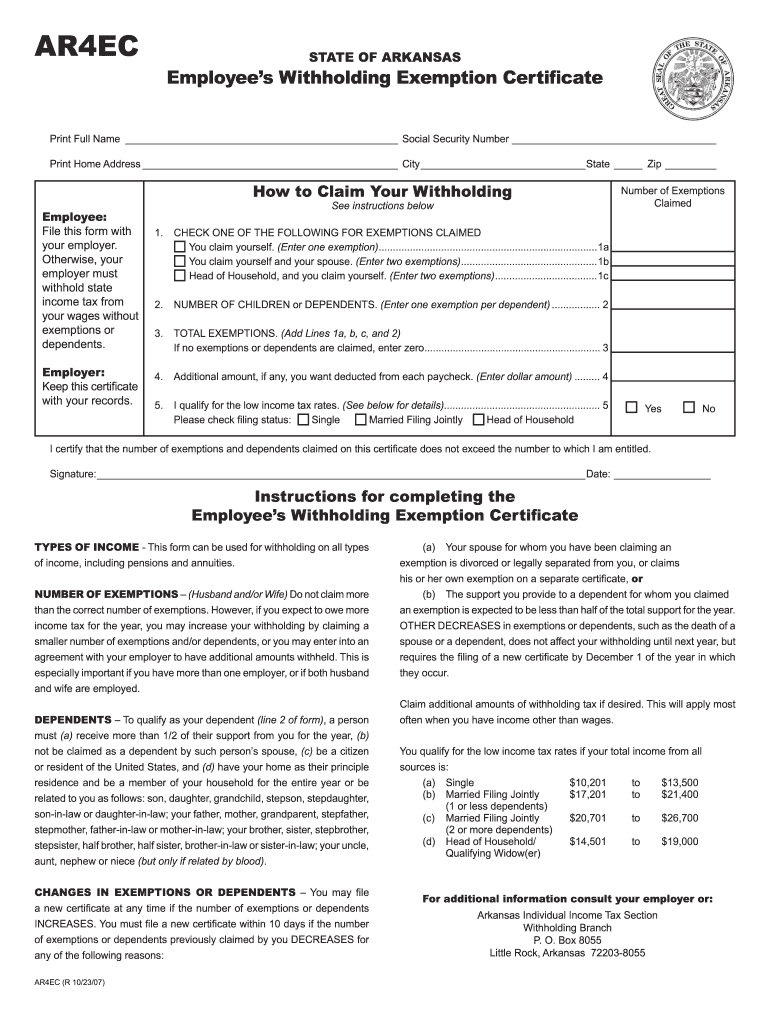

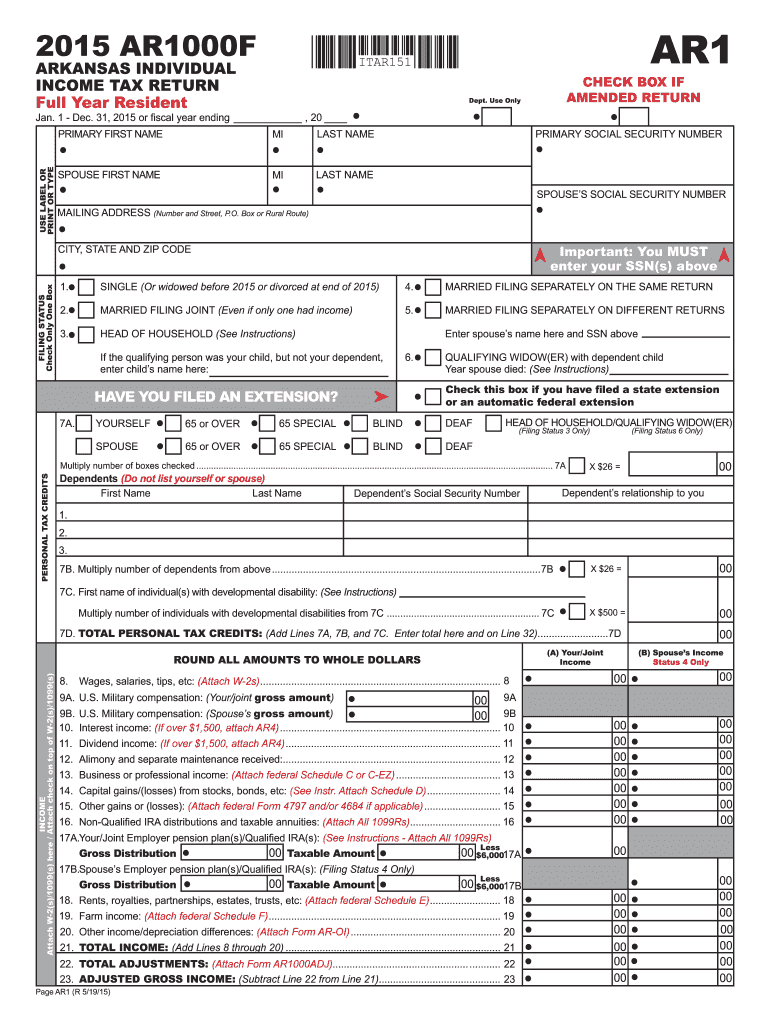

Ar Withholding Form - Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web form ar3mar is your annual reconciliation of monthly withholding. Web state of arkansas withholding tax revised: File this form with your employer. Web withholding tax formula (effective 06/01/2023) 06/05/2023. 04/03/2019 page 8 of 65. [ ] i am single and my gross income from all sources will not exceed $10,200. (b) you claim yourself and your spouse. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. [ ] i am married filing jointly with my spouse.

(b) you claim yourself and your spouse. Keep this certificate with your records. Web form ar3mar is your annual reconciliation of monthly withholding. Web state of arkansas withholding tax revised: File this form with your employer to exempt your earnings from state income tax withholding. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. [ ] i am married filing jointly with my spouse. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Check one of the following for exemptions claimed (a) you claim yourself. Web how to claim your withholding state zip number of exemptions employee:

File this form with your employer to exempt your earnings from state income tax withholding. If too much is withheld, you will generally be due a refund. 04/03/2019 page 8 of 65. [ ] i am married filing jointly with my spouse. Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. (b) you claim yourself and your spouse. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web how to claim your withholding state zip number of exemptions employee:

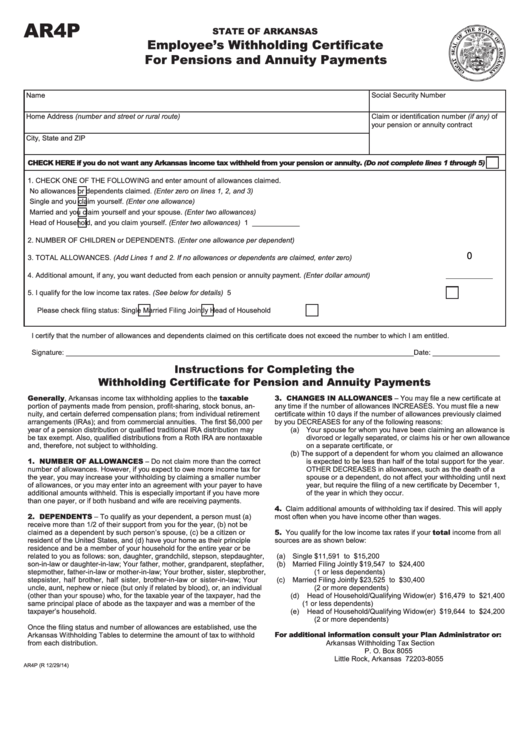

Fillable Form Ar4p Employee'S Withholding Certificate For Pensions

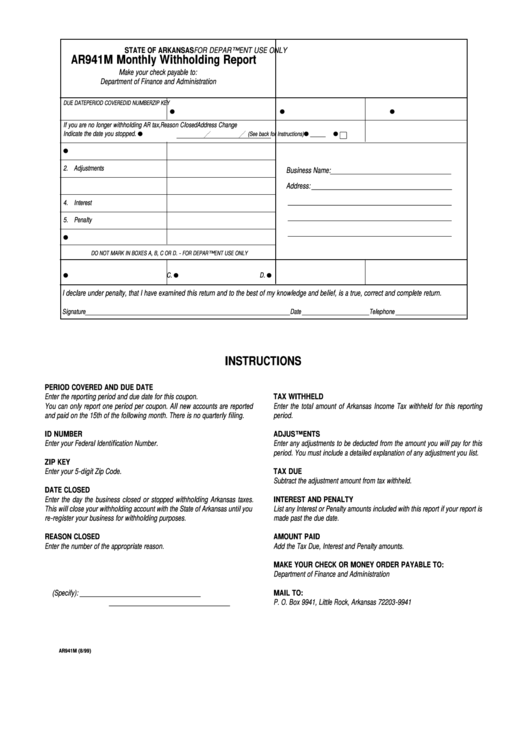

Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. File this form with your employer. Web how to claim your withholding state zip number of exemptions employee: 04/03/2019.

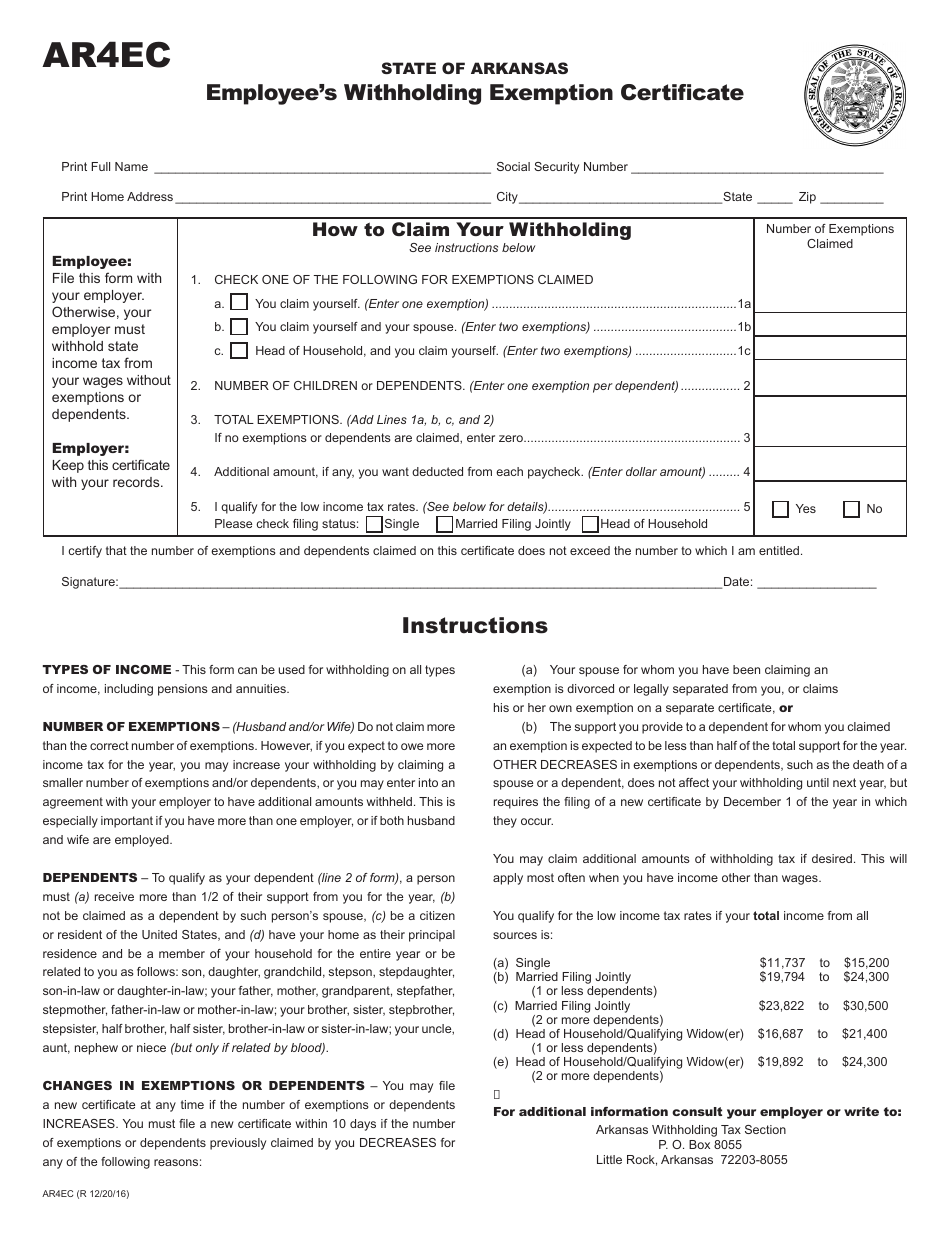

Employee's Withholding Exemption Certificate Arkansas Free Download

Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication. We have one or no dependent, and Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Withholding tax tables for.

Form AR4ec Download Fillable PDF or Fill Online Employee's Withholding

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Web form ar3mar is your annual reconciliation of monthly withholding. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022.

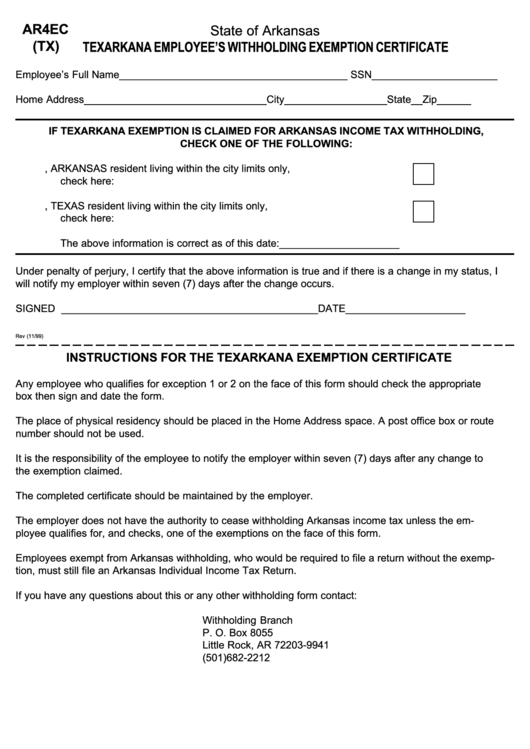

Form Ar4ec (Tx) Texarkana Employee'S Withholding Exemption

File this form with your employer. Web how to claim your withholding state zip number of exemptions employee: We have one or no dependent, and Web withholding tax formula (effective 06/01/2023) 06/05/2023. If too much is withheld, you will generally be due a refund.

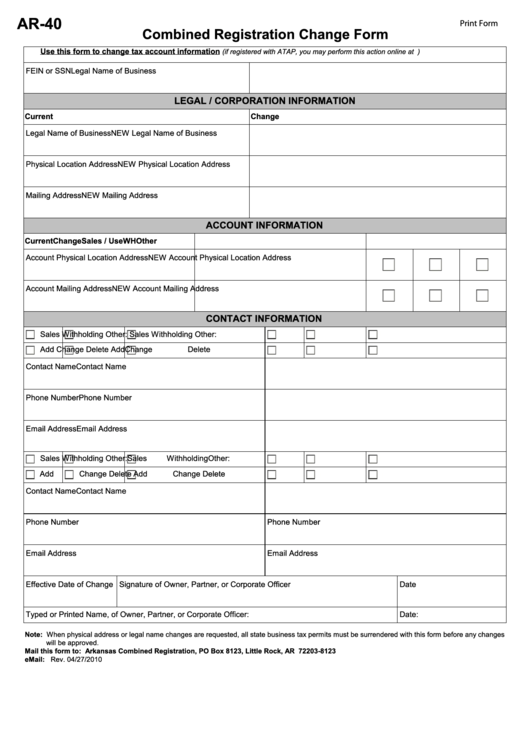

Fillable Form Ar40 Combined Registration Change Form Arkansas

(b) you claim yourself and your spouse. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web how to claim your withholding instructions on the reverse side 1. File this form with your employer. Your withholding is subject to review by the irs.

Ar4ec 20202022 Fill and Sign Printable Template Online US Legal Forms

[ ] i am married filing jointly with my spouse. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication. Keep.

Tax Form Ar Fill Out and Sign Printable PDF Template signNow

Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Check one of the following for exemptions claimed (a) you claim yourself. File this form with your employer to exempt your earnings from state income tax withholding. Withholding tax tables for low income (effective.

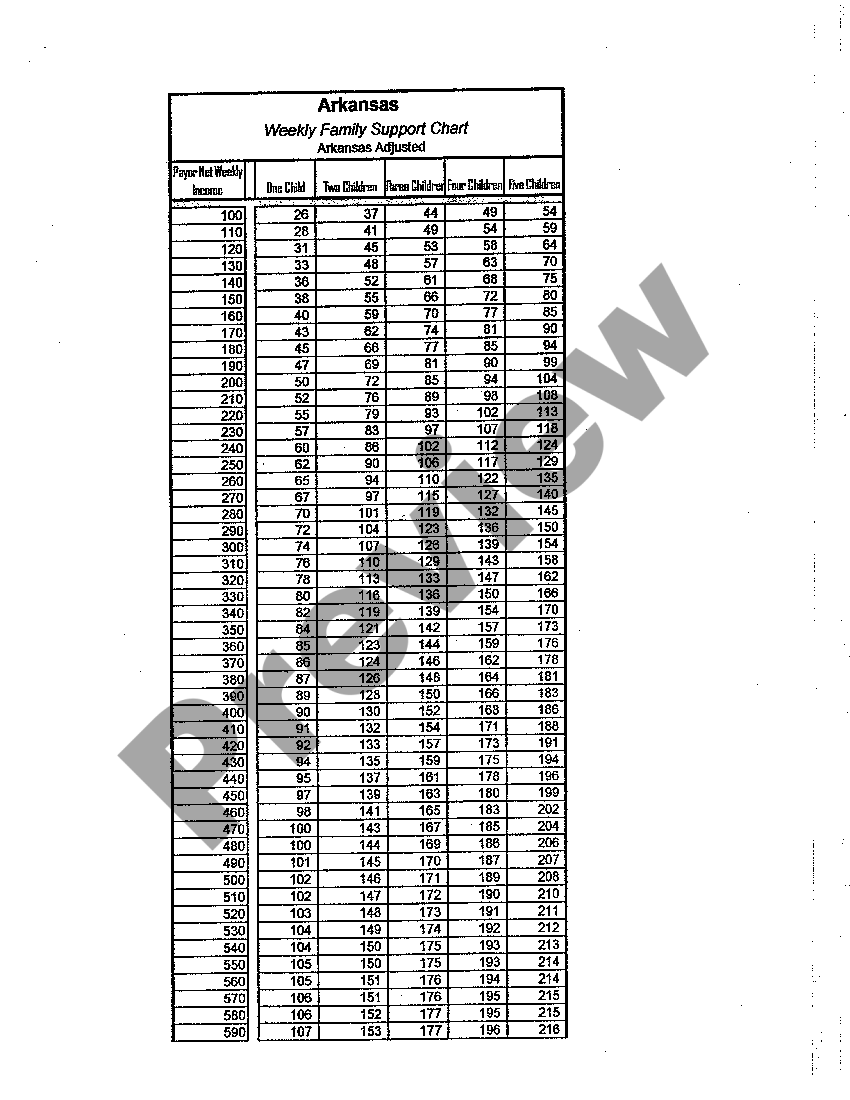

Arkansas Child Support Chart Withholding Limits US Legal Forms

Keep this certificate with your records. Web state of arkansas withholding tax revised: We have one or no dependent, and Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Web withholding tax formula (effective 06/01/2023) 06/05/2023.

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

Web withholding tax formula (effective 06/01/2023) 06/05/2023. 04/03/2019 page 8 of 65. [ ] i am single and my gross income from all sources will not exceed $10,200. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. If too much is withheld, you will generally be due a refund.

Fillable Form Ar1055 Arkansas Request For Extension Of Time For

Web how to claim your withholding instructions on the reverse side 1. (b) you claim yourself and your spouse. File this form with your employer. File this form with your employer to exempt your earnings from state income tax withholding. Web file ar941, employers annual report for income tax withheld and pay any tax due for the previous calendar year.

File This Form With Your Employer.

Computed using the tax tables or tax can be computed using the withholding tax formula, both of which are provided in this publication. [ ] i am married filing jointly with my spouse. Web how to claim your withholding instructions on the reverse side 1. Your withholding is subject to review by the irs.

Withholding Tax Tables For Low Income (Effective 06/01/2023) 06/05/2023.

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Check one of the following for exemptions claimed (a) you claim yourself. Keep this certificate with your records. (b) you claim yourself and your spouse.

Withholding Tax Instructions For Employers (Effective 10/01/2022) 09/02/2022.

04/03/2019 page 8 of 65. We have one or no dependent, and File this form with your employer to exempt your earnings from state income tax withholding. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself.

If Too Much Is Withheld, You Will Generally Be Due A Refund.

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web form ar3mar is your annual reconciliation of monthly withholding. Web how to claim your withholding state zip number of exemptions employee: [ ] i am single and my gross income from all sources will not exceed $10,200.