Ar4Ec Form 2023

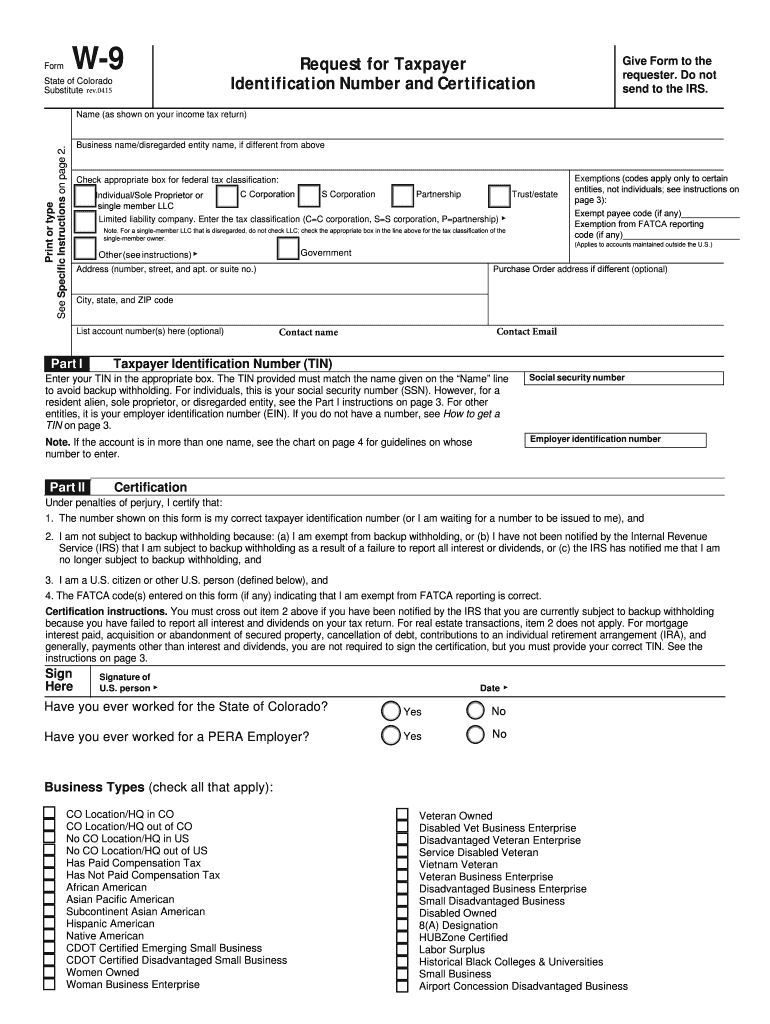

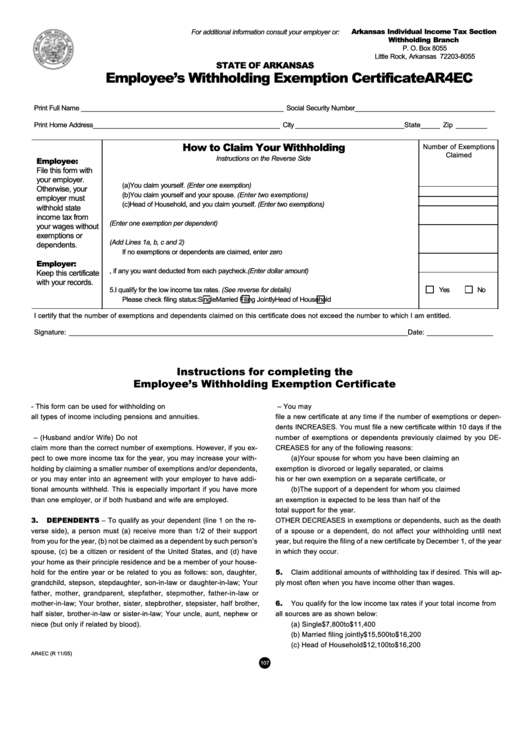

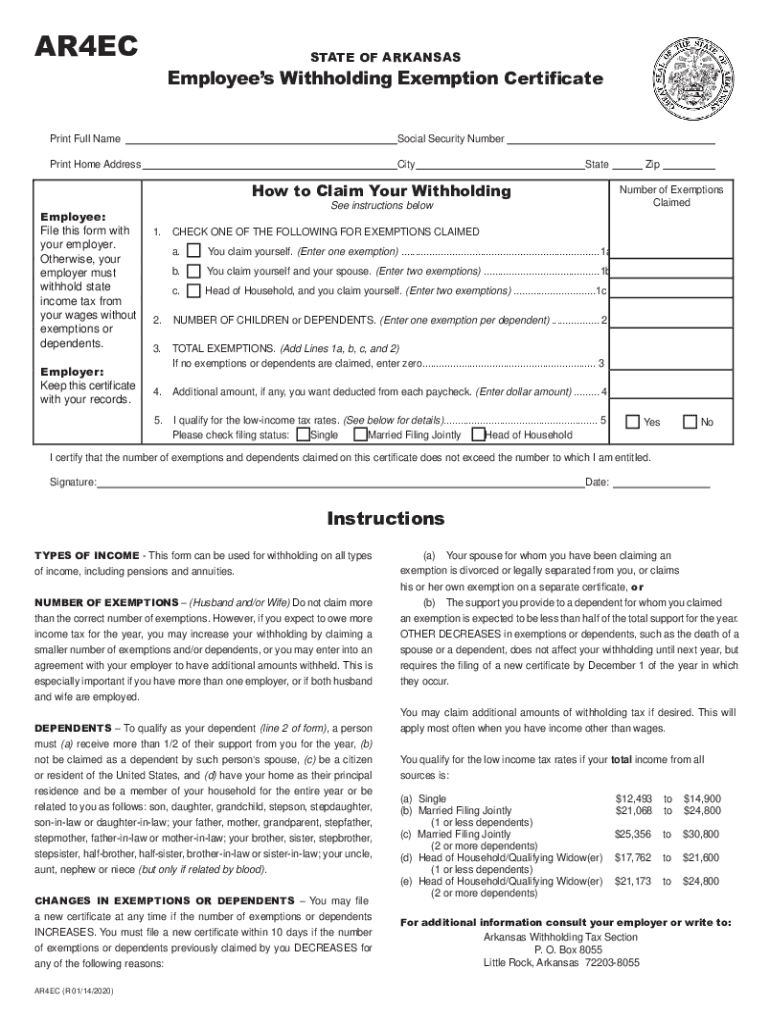

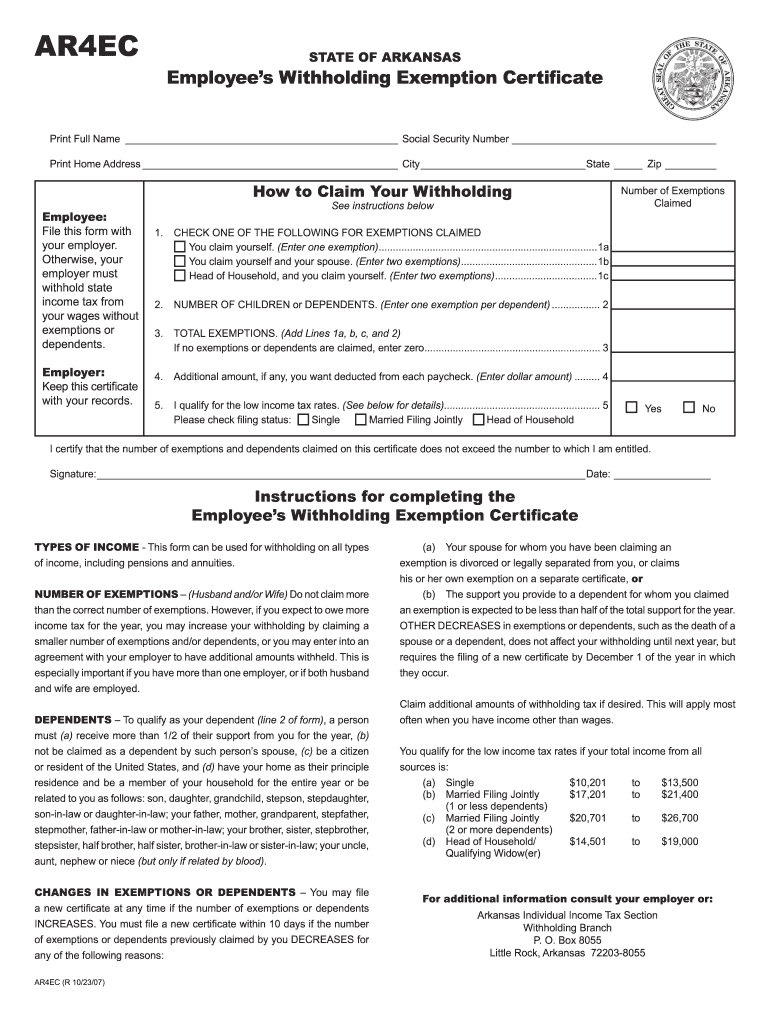

Ar4Ec Form 2023 - Form ar4ec, employee's withholding exemption certificate, or form. When the tax season started unexpectedly or maybe you just misssed it, it could probably create problems for you. A typed, drawn or uploaded signature. Web file this form with your employer. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city how to claim your withholding. Employees earning less than the lower threshold for their filing status can claim exemption from withholding using form ar4ecsp , employee’s special withholding exemption certificate. Ar4p employee's withholding certificate for pensions and. Web how to fill out and sign ar4ec 2023 online? Individual income tax name and address change form. Get everything done in minutes.

Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city how to claim your withholding. When the tax season started unexpectedly or maybe you just misssed it, it could probably create problems for you. Form ar4ec, employee's withholding exemption certificate, or form. Christmas and vacation deduction and withdrawal form. Individual income tax name and address change form. Edit your form ar4ec online. Under penalty of perjury, i certify that the above information is true and if there is a change in my status, i will notify my employer within seven (7) days after the change occurs. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: Ar4p employee's withholding certificate for pensions and. However, if you expect to owe more income tax for the year, you may increase your withholding by claiming a

Ar4ext application for automatic extension of time: Monthly gross pay x 12 = annual gross pay Ar4ecsp employee's special withholding exemption certificate: Christmas and vacation deduction and withdrawal form. Under penalty of perjury, i certify that the above information is true and if there is a change in my status, i will notify my employer within seven (7) days after the change occurs. When the tax season started unexpectedly or maybe you just misssed it, it could probably create problems for you. Multiply the period gross pay by the number of pay periods per year to arrive at the annual gross pay. Web tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. File this form with your employer. Keep this certificate with your records.

I9 Printable Form 2020 Example Calendar Printable

Monthly gross pay x 12 = annual gross pay Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Enjoy smart fillable fields and interactivity. Individual income tax name and address change form. Get your online template and fill it in using progressive features.

Fill Free fillable forms Arkansas Tech University

However, if you expect to owe more income tax for the year, you may increase your withholding by claiming a Employee’s state withholding exemption certificate (form ar4ec) Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Form number wec category withholding forms Web file this form with your employer.

Form Ar4ec Employee'S Withholding Exemption Certificate printable pdf

Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city how to claim your withholding. Web forms withholding forms withholding exemption certificate withholding exemption certificate arizona residents who qualify, complete this form to request to have no arizona income tax withheld from their wages. Enjoy smart fillable fields and interactivity. Ar4ext.

Employee State Tax Withholding Form 2020 Onenow

Keep this certificate with your records. Ar4ext application for automatic extension of time: Under penalty of perjury, i certify that the above information is true and if there is a change in my status, i will notify my employer within seven (7) days after the change occurs. File this form with your employer. Otherwise, your employer must withhold state income.

Arkansas state withholding form 2019 Fill out & sign online DocHub

Web this form can be used for withholding on all types of income, including pensions and annuities. Ar4p employee's withholding certificate for pensions and. Web the ar4ec employee's withholding exemption certificate must be completed by employees so employers know how much state income tax to withhold from wages. A typed, drawn or uploaded signature. File this form with your employer.

Ar4ec 20202022 Fill and Sign Printable Template Online US Legal Forms

Employee’s state withholding exemption certificate (form ar4ec) Instructions for the texarkana exemption. Web file this form with your employer. This form is submitted to the employer, not the department. Monthly gross pay x 12 = annual gross pay

1+ Arkansas Do Not Resuscitate Form Free Download

Ar4ext application for automatic extension of time: When the tax season started unexpectedly or maybe you just misssed it, it could probably create problems for you. This form is submitted to the employer, not the department. Enjoy smart fillable fields and interactivity. Ar4ecsp employee's special withholding exemption certificate:

Form 401 Ontario Fill Online, Printable, Fillable, Blank PDFfiller

Select the document you want to sign and click upload. A typed, drawn or uploaded signature. Applicant name (last, first mi): Web form ar4ec(tx) texarkana employee's withholding exemption certificate state of arkansas. Keep this certificate with your records.

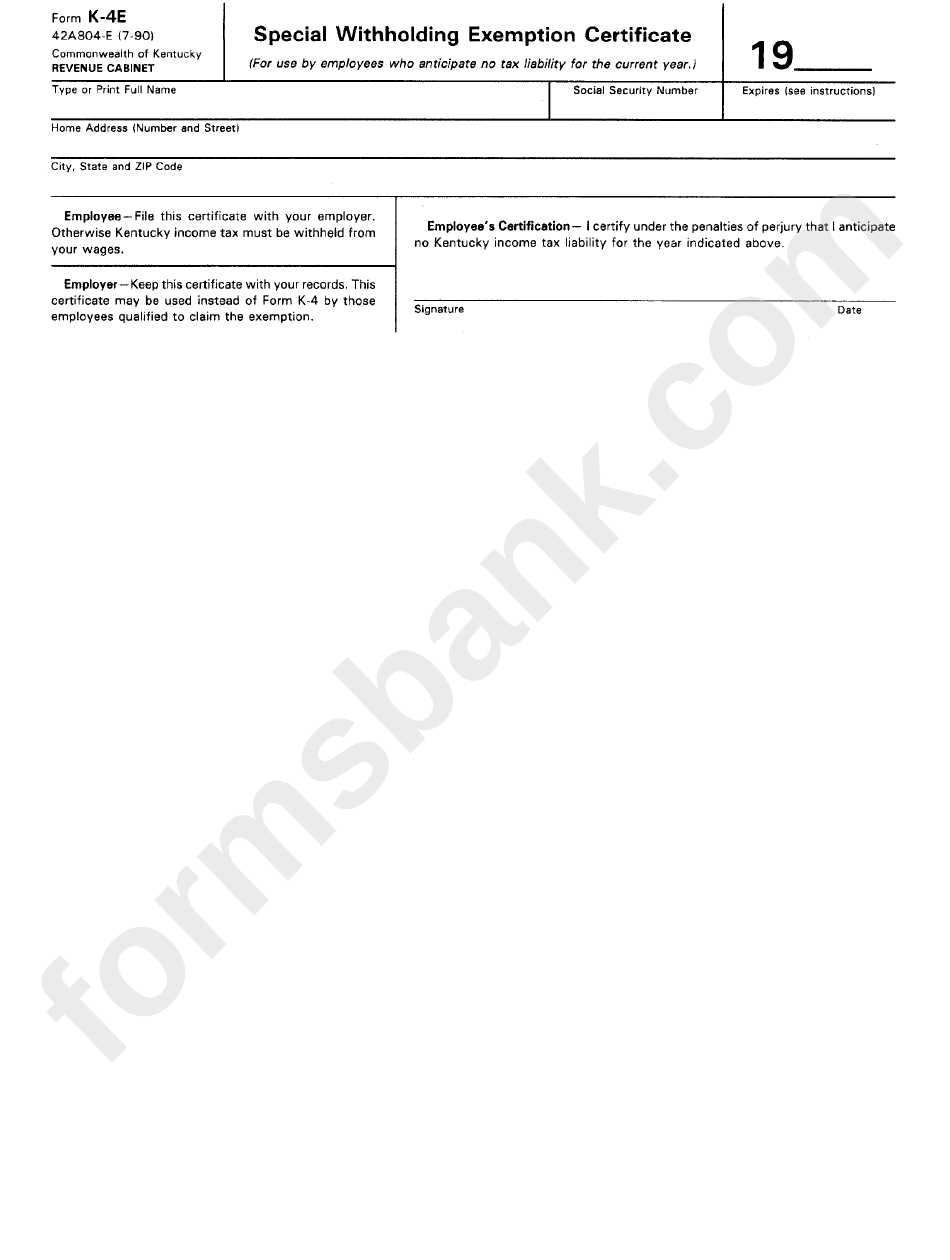

Form K4e Special Withholding Exenption Certificate printable pdf

Check one of the following for exemptions claimed (a) you claim yourself. File this form with your employer. Instructions for the texarkana exemption. Employees earning less than the lower threshold for their filing status can claim exemption from withholding using form ar4ecsp , employee’s special withholding exemption certificate. Applicant name (last, first mi):

State Tax Withholding Forms Template Free Download Speedy Template

Web form ar4ec(tx) texarkana employee's withholding exemption certificate state of arkansas. Web this form can be used for withholding on all types of income, including pensions and annuities. Web ar4ec employee's withholding exemption certificate: Form ar4ec, employee's withholding exemption certificate, or form. Check one of the following for exemptions claimed (a) you claim yourself.

Web Ar4Ec (R 10/23/07) Your Spouse For Whom You Have Been Claiming An Exemption Is Divorced Or Legally Separated From You, Or Claims His Or Her Own Exemption On A Separate Certificate, Or The Support You Provide To A Dependent For Whom You Claimed An Exemption Is Expected To Be Less Than Half Of The Total Support For The Year.

Ar4mec military employee’s withholding exemption certificate: Get everything done in minutes. Ar4ecsp employee's special withholding exemption certificate: Edit your form ar4ec online.

How To Claim Your Withholding Instructions On The Reverse Side 1.

Ar4ext application for automatic extension of time: Web tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. Web the ar4ec employee's withholding exemption certificate must be completed by employees so employers know how much state income tax to withhold from wages. Create your signature and click ok.

Instructions For The Texarkana Exemption.

Employee’s state withholding exemption certificate (form ar4ec) Monthly gross pay x 12 = annual gross pay Web “employees that wish to maintain a higher annual tax refund can simply ask their employer to adjust the ar4ec form to increase the amount withheld each paycheck. However, if you expect to owe more income tax for the year, you may increase your withholding by claiming a

Enjoy Smart Fillable Fields And Interactivity.

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Multiply the period gross pay by the number of pay periods per year to arrive at the annual gross pay. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer.