Are Attorney Fees Deductible On Form 1041

Are Attorney Fees Deductible On Form 1041 - Web when filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration fees. Web you do not deduct estate taxes on form 1041. (the same administrative expenses cannot be deducted on both the 706. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Web these include a deduction for personal representatives' fees or trustees' fees, whichever is applicable, attorneys' fees, accountants' fees, custodial fees, investment advisors' fees,. Web executor and trustee fees. In this case the 1041 is required for 2020 and all of the transactions (sales happened then). It may not help, as. If only a portion is deductible under section 67(e), see instructions. The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts.

I'm filling out a 1041 form. Prepaid mortgage interest and qualified mortgage. On form 1041, you can claim deductions for expenses such as attorney, accountant and return. Web executor and trustee fees. The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. It may not help, as. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Web level 1 form 1041 fiduciary fees deduction? These can include charitable deductions,.

Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of death if the estate generated $600 or more of gross income during the tax year. Web level 1 form 1041 fiduciary fees deduction? It may not help, as. Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Web can you deduct all of the attorneys fees on form 1041 even if it is substantially more than the amount of income you are claiming. The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. Web what year are attorney fees deductible on 1041? If only a portion is deductible under section 67(e), see instructions. My attorney itemized several fees in addition to his fees that he paid.

How Much Does A Lawyer Cost?

Web yes, attorney fees are deductible on form 1040, schedule a (itemized deductions). (the same administrative expenses cannot be deducted on both the 706. The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income.

Are Divorce Lawyer Fees Deductible The Renken Law Firm

Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Deductions for attorney, accountant, and. Web what year are attorney fees deductible on 1041? Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. Web as mentioned.

Court Rules That Property Owner, Not Towing Company, Liable For 6,000

Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. This deduction is available for both criminal and civil attorney fees. Prepaid mortgage interest and qualified mortgage. Web can you deduct all of the attorneys fees on form 1041 even if it is substantially more than the amount of.

Legal Fees for Divorce Renken Law Firm

Web attorney, accountant, and return preparer fees. Web what administrative expenses are deductible on form 1041? The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. I'm filling out a 1041 form. Web you do not deduct estate taxes on form 1041.

When are attorney fees tax deductible On what basis?

The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. Web these include a deduction for personal representatives' fees or trustees' fees, whichever is applicable, attorneys' fees, accountants' fees, custodial fees, investment advisors' fees,. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income.

Are Attorney Fees Deductible On Form 1041? AZexplained

Deductions for attorney, accountant, and. On form 1041, you can claim deductions for expenses such as attorney, accountant and return. Prepaid mortgage interest and qualified mortgage. If only a portion is deductible under section 67(e), see instructions. These can include charitable deductions,.

Attorney Fees, First Step in Preventing Prosecutorial Misconduct

These can include charitable deductions,. In this case the 1041 is required for 2020 and all of the transactions (sales happened then). Web executor and trustee fees. Web yes, attorney fees are deductible on form 1040, schedule a (itemized deductions). On form 1041, you can claim deductions for expenses such as attorney, accountant and return.

A Lawyer's Blog Jon Michael Probstein, Esq. AWARDING ATTORNEY FEES

I'm filling out a 1041 form. Web legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if required to file them. If only a portion is deductible under section 67(e), see instructions. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns,.

How Much Does an DUI / Bankrupcy Lawyer Cost Affordable Payments

On form 1041, you can claim deductions for expenses such as attorney, accountant and return. My attorney itemized several fees in addition to his fees that he paid. Web as mentioned above, form 1041 allows for the inclusion of expenses and deductions against the estate’s income. Fees paid to attorneys, accountants, and tax preparers. Web you are required to file.

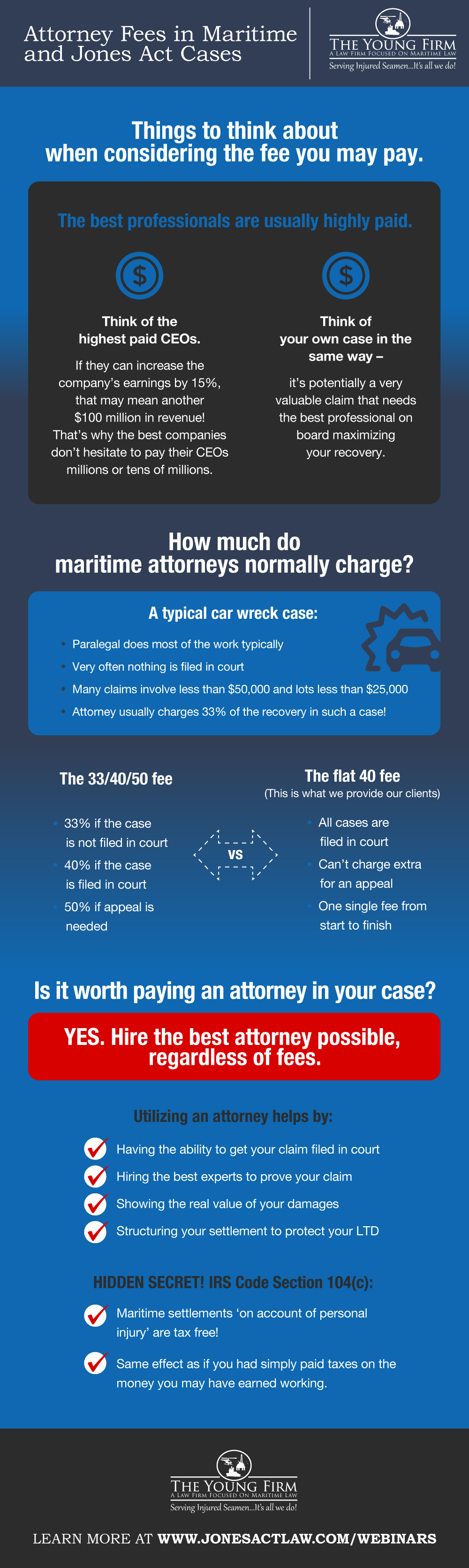

Attorney Fees in Maritime Cases The Young Firm

If only a portion is deductible under section 67(e), see instructions. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. Web you are required to file.

On Form 1041, You Can Claim Deductions For Expenses Such As Attorney, Accountant And Return.

My attorney itemized several fees in addition to his fees that he paid. The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. (the same administrative expenses cannot be deducted on both the 706. This deduction is available for both criminal and civil attorney fees.

Web What Year Are Attorney Fees Deductible On 1041?

Web as mentioned above, form 1041 allows for the inclusion of expenses and deductions against the estate’s income. Fees paid to attorneys, accountants, and tax preparers. It may not help, as. Web you do not deduct estate taxes on form 1041.

Web You Are Required To File A Fiduciary Return (Using Irs Form 1041) About 11 Months After The Month Of Death If The Estate Generated $600 Or More Of Gross Income During The Tax Year.

Web level 1 form 1041 fiduciary fees deduction? Web yes, attorney fees are deductible on form 1040, schedule a (itemized deductions). Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. I'm filling out a 1041 form.

In This Case The 1041 Is Required For 2020 And All Of The Transactions (Sales Happened Then).

Web what administrative expenses are deductible on form 1041? Web i usually deduct about 1/3 of attorney fees on the 1041 and 2/3 on the 706 if there is one. These can include charitable deductions,. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax.