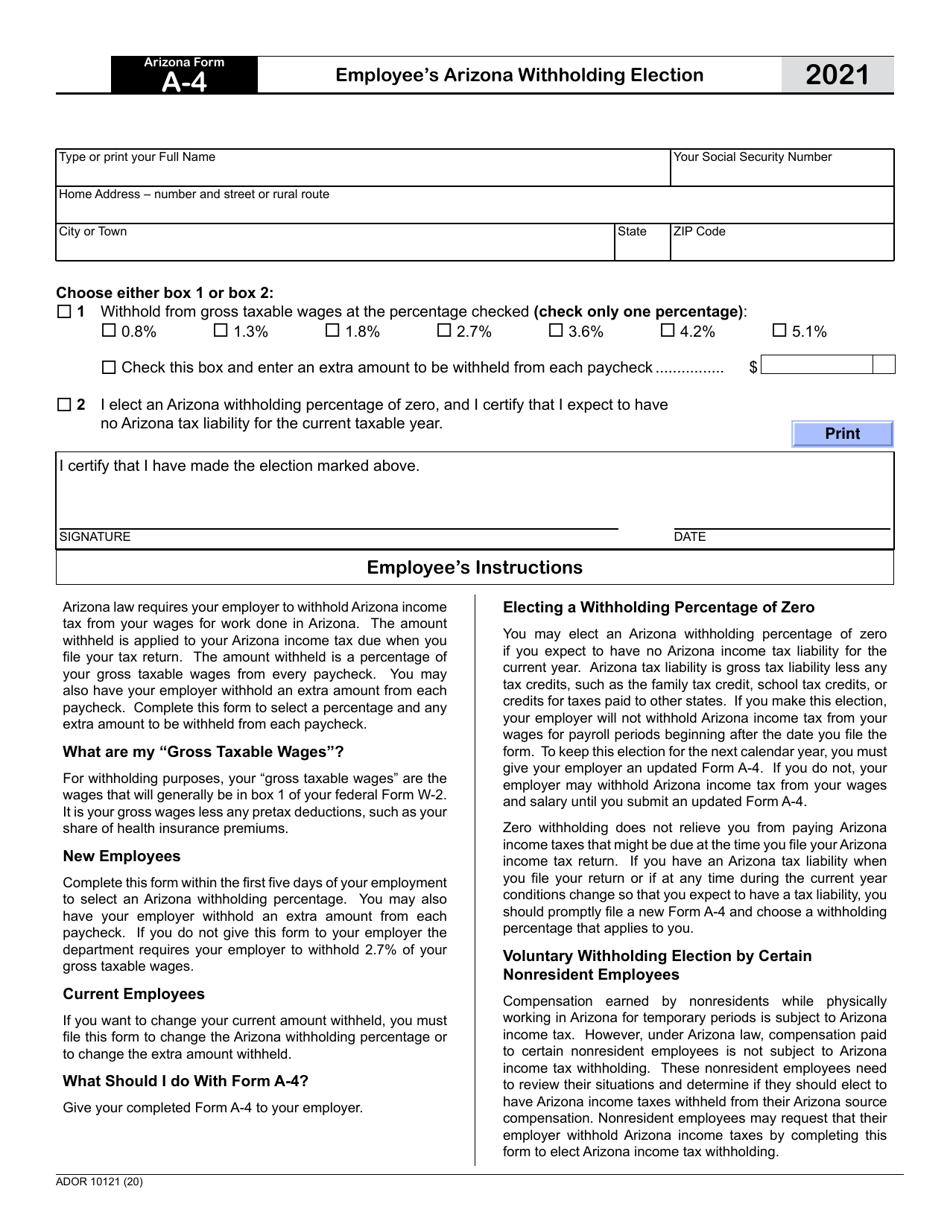

Arizona A 4 Tax Form

Arizona A 4 Tax Form - Is facing intensifying urgency to stop the worsening fentanyl epidemic. Web the hearing was particularly timely, because the u.s. Web 20 rows withholding forms. Complete, edit or print tax forms instantly. Web 26 rows arizona corporate or partnership income tax payment voucher: Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Phoenix, az— the arizona department of revenue and the arizona association of. Drug deaths nationwide hit a record. An employee required to have 0.8% deducted may elect to. This form is for income earned in tax year 2022, with tax returns due in april.

You can use your results. An employee required to have 0.8% deducted may elect to. Web 20 rows withholding forms. Drug deaths nationwide hit a record. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. State employees on the hris. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you. Phoenix, az— the arizona department of revenue and the arizona association of.

An employee required to have 0.8% deducted may elect to. Web july 26, 2023. This form is for income earned in tax year 2022, with tax returns due in april. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you. Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. You can use your results. Phoenix, az— the arizona department of revenue and the arizona association of. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding.

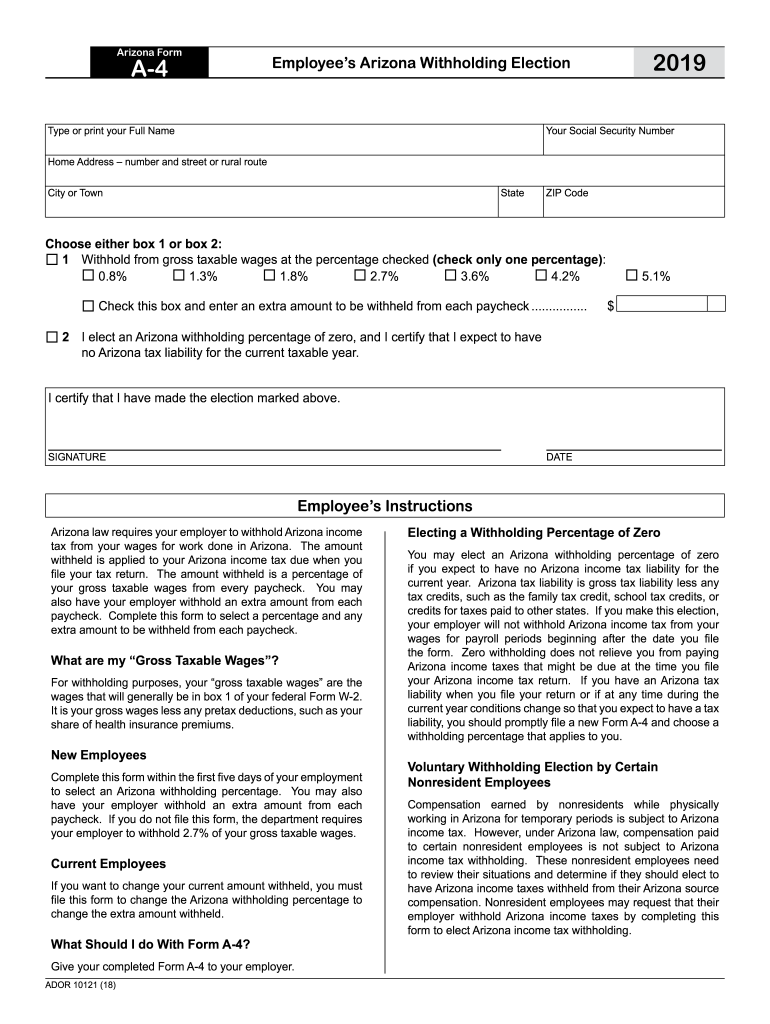

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Web 26 rows arizona corporate or partnership income tax payment voucher: Web 20 rows withholding forms. This form is for income earned in tax year 2022, with tax returns due in april. Get ready for tax season deadlines by completing any required tax forms today. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding.

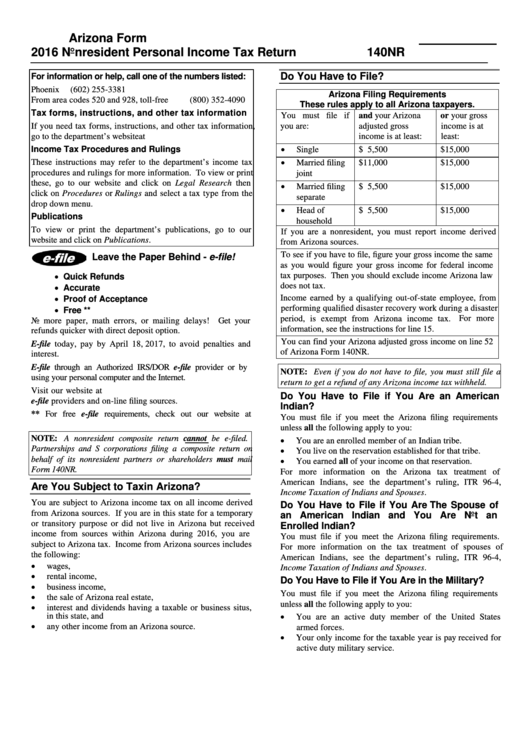

Arizona Form 140nr Nonresident Personal Tax Return 2016

Web the hearing was particularly timely, because the u.s. Web 26 rows arizona corporate or partnership income tax payment voucher: Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. State employees on the hris. This form is for income earned in.

Arizona Employment Tax Forms MENPLOY

Web 26 rows arizona corporate or partnership income tax payment voucher: Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. You can use your results. Web if you have an arizona tax.

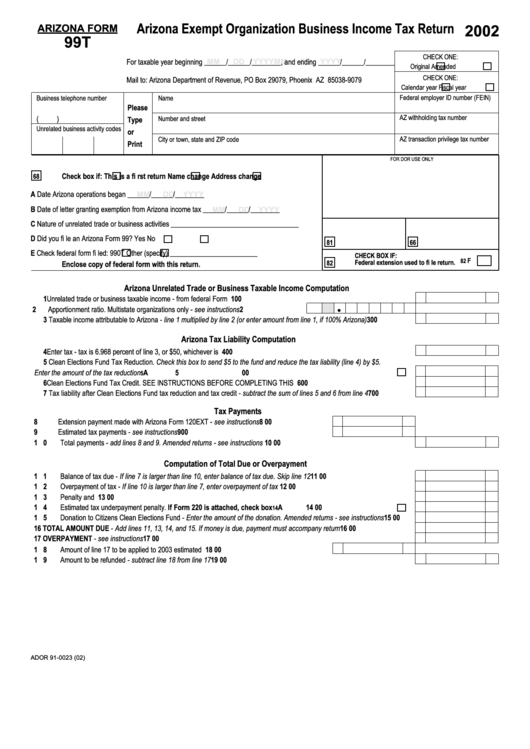

Arizona Form 99t Arizona Exempt Organization Business Tax

Complete, edit or print tax forms instantly. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. An employee required to have 0.8% deducted may elect to..

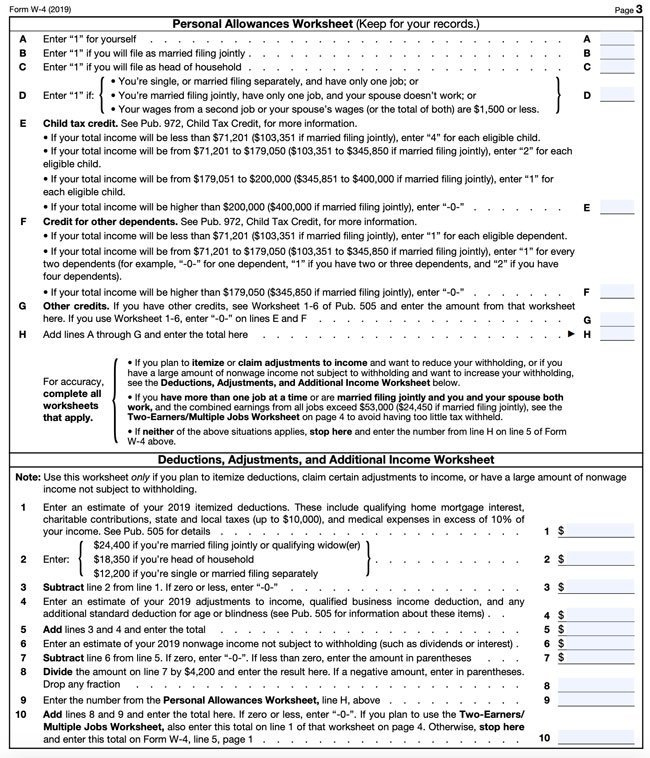

Owe too much in taxes? Here's how to tackle the new W4 tax form

Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you. Drug deaths nationwide hit a record. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today..

A4 Form Fill Out and Sign Printable PDF Template signNow

Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Complete, edit or print tax forms instantly. State employees on the hris. Is facing intensifying urgency to stop the worsening fentanyl epidemic. This form is for income earned in tax year 2022, with tax.

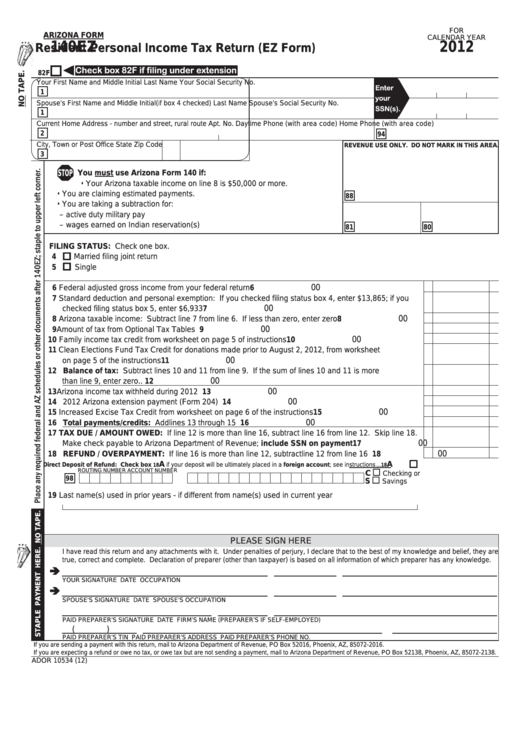

Fillable Arizona Form 140ez Resident Personal Tax Return (Ez

You can use your results. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in.

California W4 Form 2022 W4 Form

Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you. Drug deaths nationwide hit a record. Web 26 rows arizona corporate or partnership income tax payment voucher: Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the.

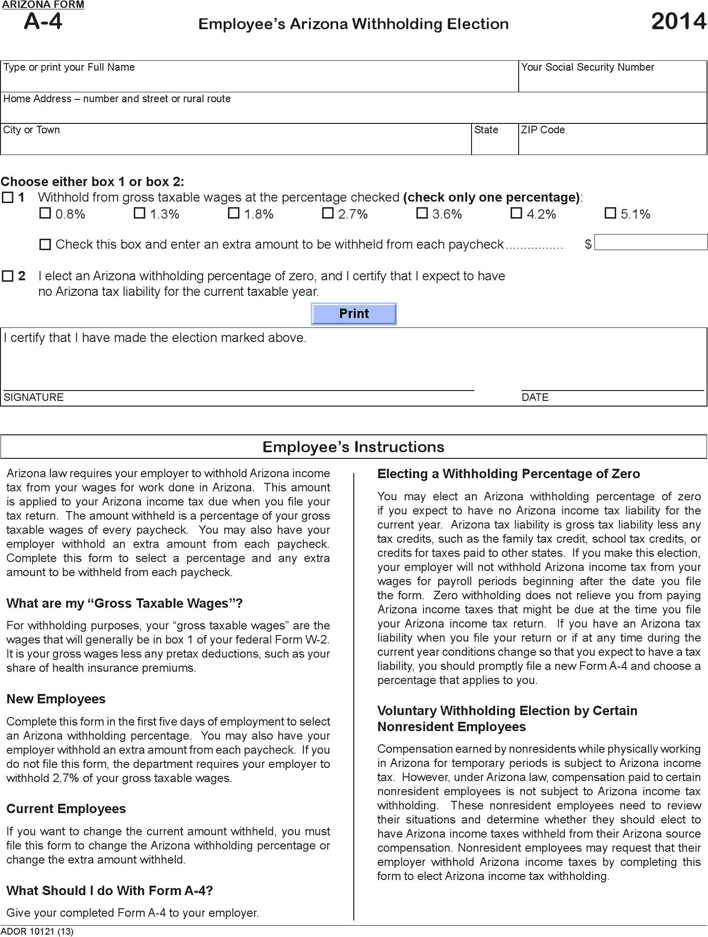

Free Arizona Form A4 (2014) PDF 53KB 1 Page(s)

Get ready for tax season deadlines by completing any required tax forms today. Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web the hearing was particularly timely, because the u.s. Complete, edit or print tax forms instantly. Ador 10121 (12) electing a.

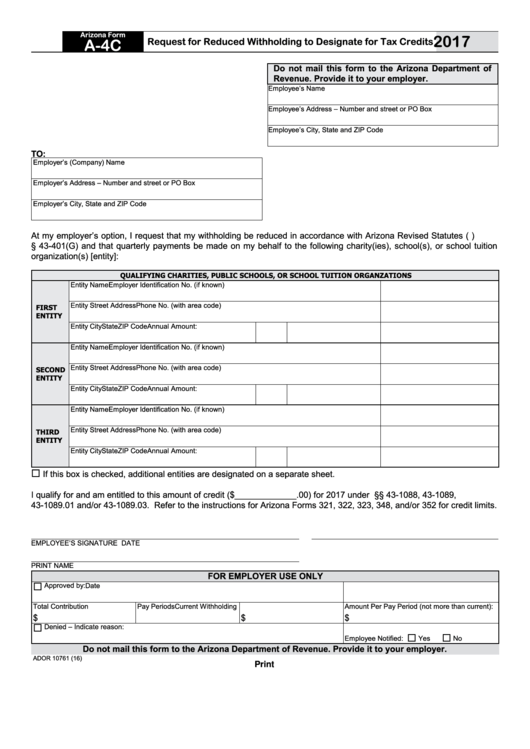

Fillable Arizona Form A4c Request For Reduced Withholding To

Complete, edit or print tax forms instantly. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web july 26, 2023. Complete, edit or print tax forms instantly. Web 26 rows arizona corporate or partnership income tax payment voucher:

Web The Hearing Was Particularly Timely, Because The U.s.

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Drug deaths nationwide hit a record. Get ready for tax season deadlines by completing any required tax forms today.

Web If You Have An Arizona Tax Liability When You File Your Return Or If At Any Time During The Current Year Conditions Change So That You Expect To Have A Tax Liability, You.

Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you. Web 20 rows withholding forms. State employees on the hris. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding.

Complete, Edit Or Print Tax Forms Instantly.

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. This form is for income earned in tax year 2022, with tax returns due in april. Web july 26, 2023. Phoenix, az— the arizona department of revenue and the arizona association of.

Web 26 Rows Arizona Corporate Or Partnership Income Tax Payment Voucher:

Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. An employee required to have 0.8% deducted may elect to. You can use your results. Is facing intensifying urgency to stop the worsening fentanyl epidemic.