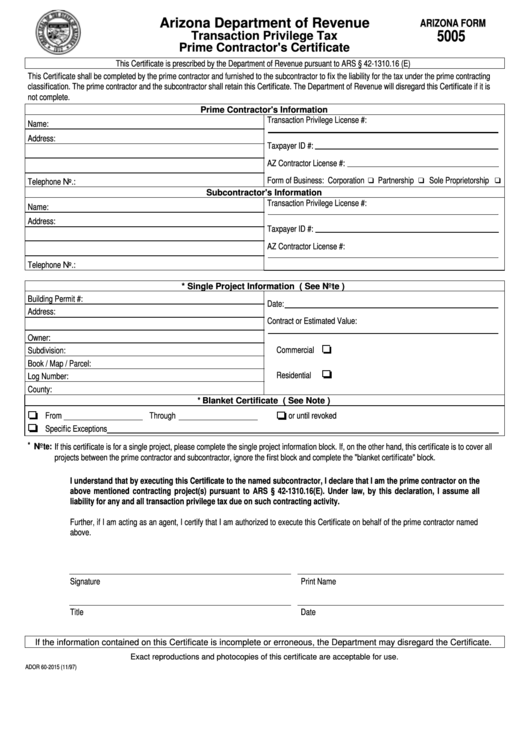

Arizona Form 5005

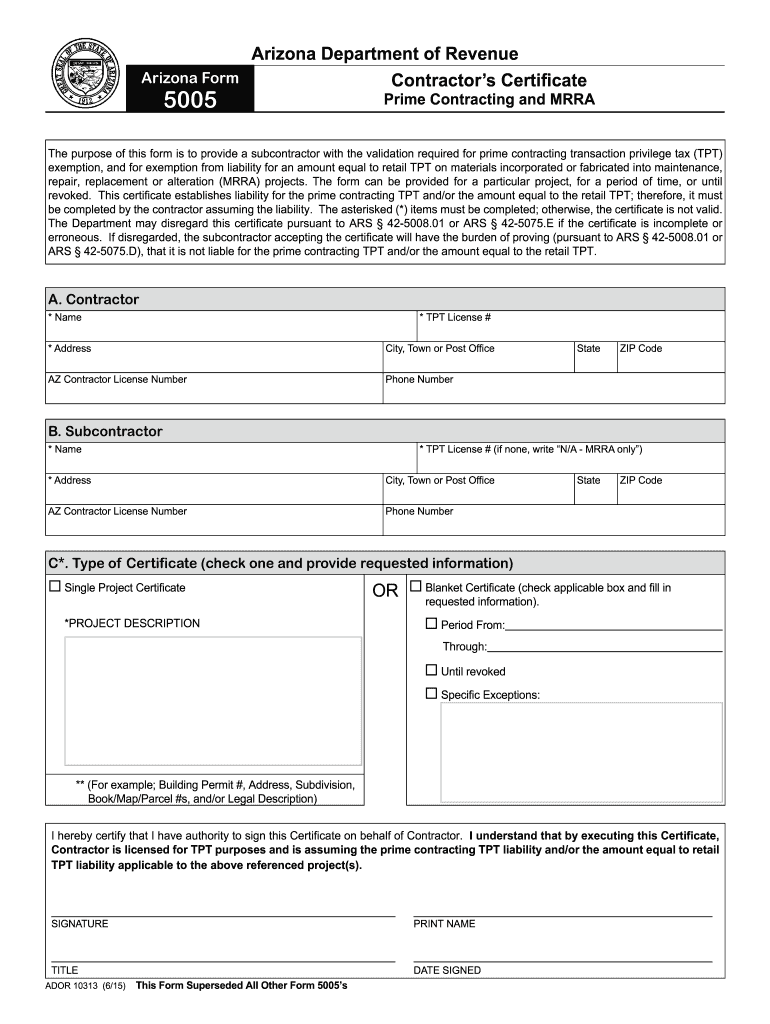

Arizona Form 5005 - Type of certifi cate (check one and provide requested information) single project. Web send az form 5005 via email, link, or fax. This form is not to be provided to a subcontractor. Jet fuel tax rate adjustment certificate: Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, Type text, add images, blackout confidential details, add comments, highlights and more. Web the form 5005 is for documentation of liability for transaction privilege tax (tpt) by the contractor that issued the form. Web 5000 this form replaces earlier forms: Web ador 10313 (5/21) print name date signed this form superseded all other form 5005’s contractor’s certificate instructions general instructions in order to ensure the effectiveness of the certificate, all required fields must be completed. You can also download it, export it or print it out.

Web arizona form 5005 a. Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, Jet fuel tax rate adjustment certificate: Web 5000 this form replaces earlier forms: The “name”, “address”, and “tpt license number” fields of the contractor section must be. Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, Web ador 10313 (5/21) print name date signed this form superseded all other form 5005’s contractor’s certificate instructions general instructions in order to ensure the effectiveness of the certificate, all required fields must be completed. It is to be fi lled out completely by the purchaser and furnished to the vendor. Web send az form 5005 via email, link, or fax. This certificate is not exclusive to contractors, please see the certificate instructions for a list of those who may use the form.

Web 5000 this form replaces earlier forms: Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, Web arizona form 5005 a. This form should be kept by you to show that you do not owe tpt on the gross receipts of the project. * transaction privilege license #: Web vendors should retain copies of the form 5000 for their files. As an unlicensed contractor, you do not have to. You can also download it, export it or print it out. The “name”, “address”, and “tpt license number” fields of the contractor section must be. Web the form 5005 is for documentation of liability for transaction privilege tax (tpt) by the contractor that issued the form.

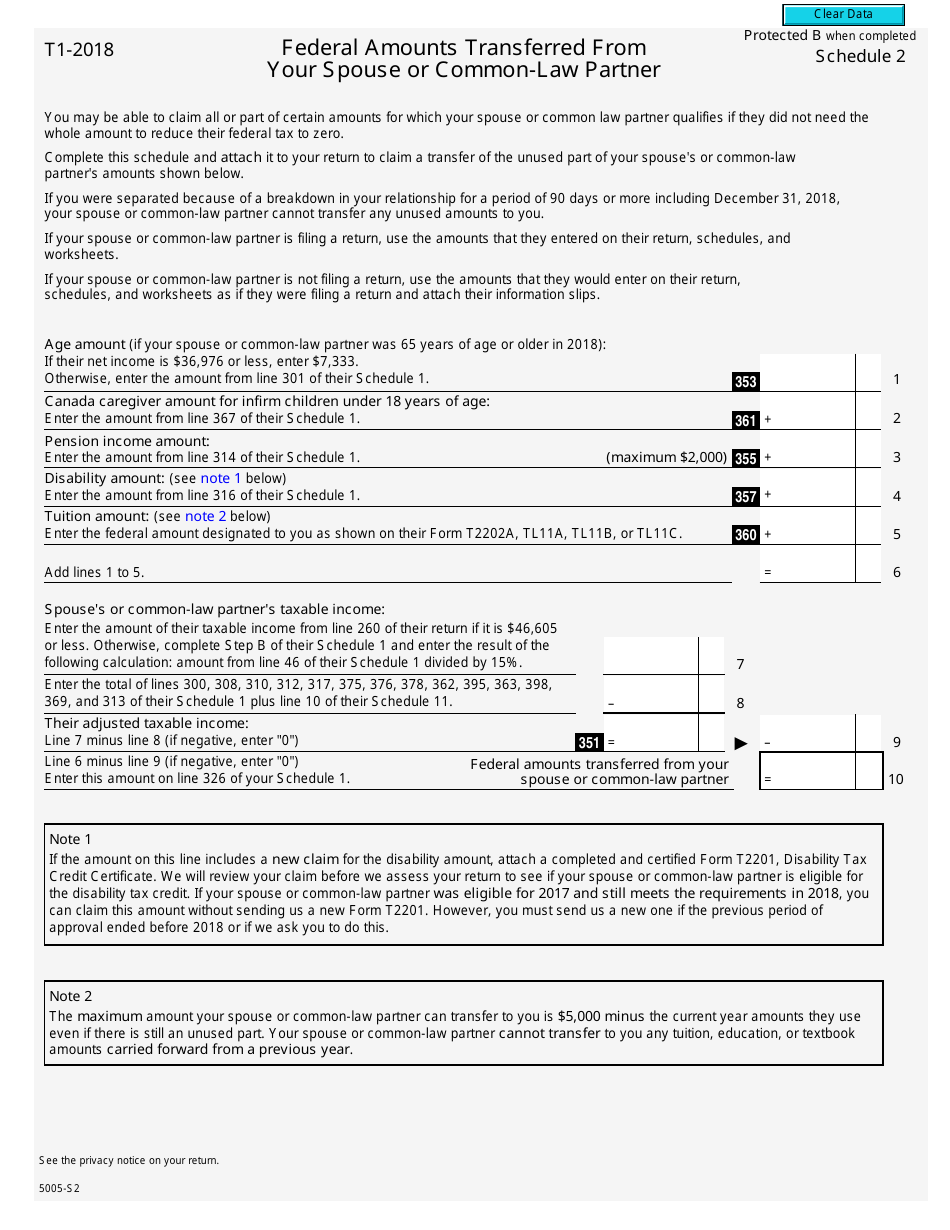

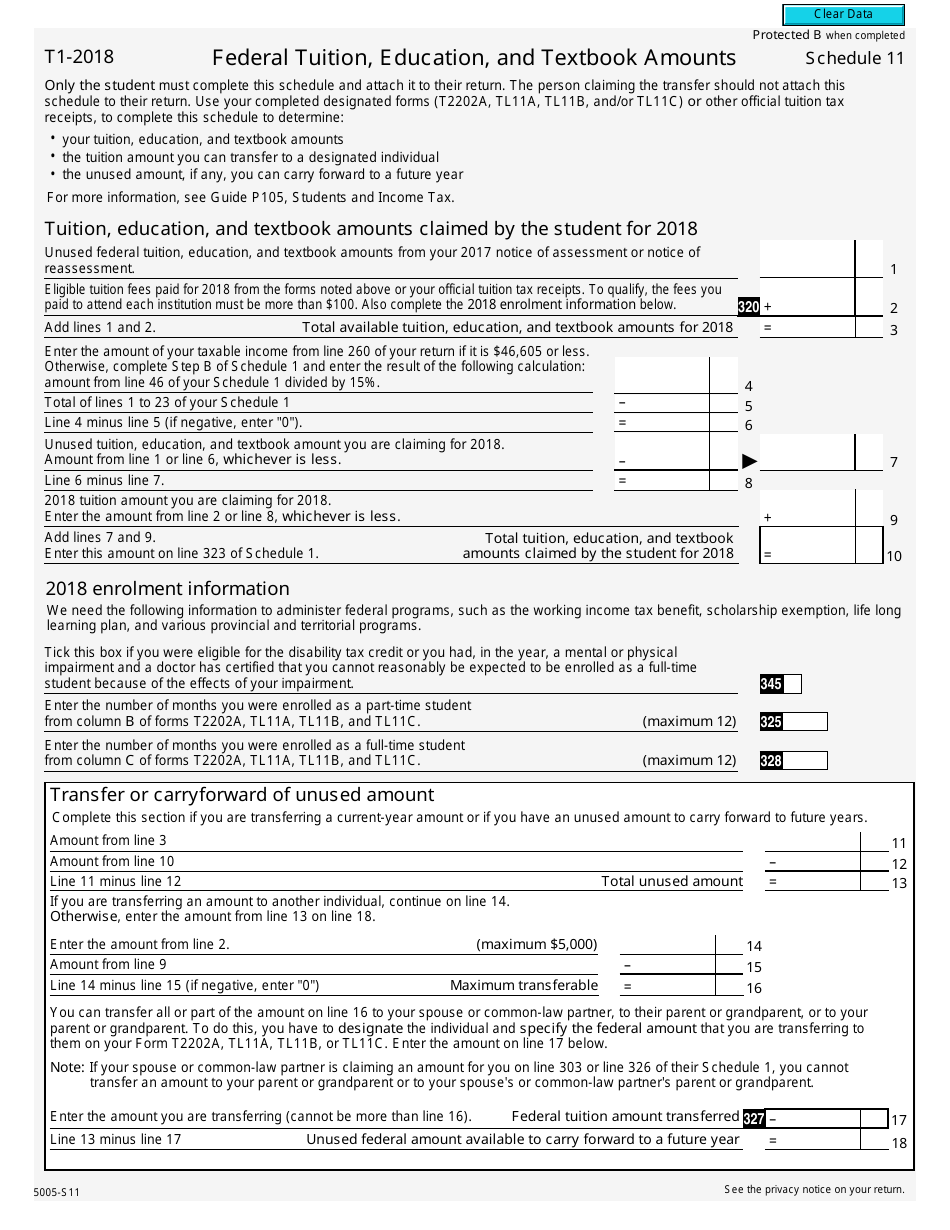

Form 5005S2 Schedule 2 Download Fillable PDF or Fill Online Federal

This form is not to be provided to a subcontractor. The purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, repair, replacement or alteration (mrra) projects. Edit your arizona.

Fillable Arizona Form 5005 Transaction Privilege Tax Prime Contractor

It is to be fi lled out completely by the purchaser and furnished to the vendor. Type text, add images, blackout confidential details, add comments, highlights and more. The purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to.

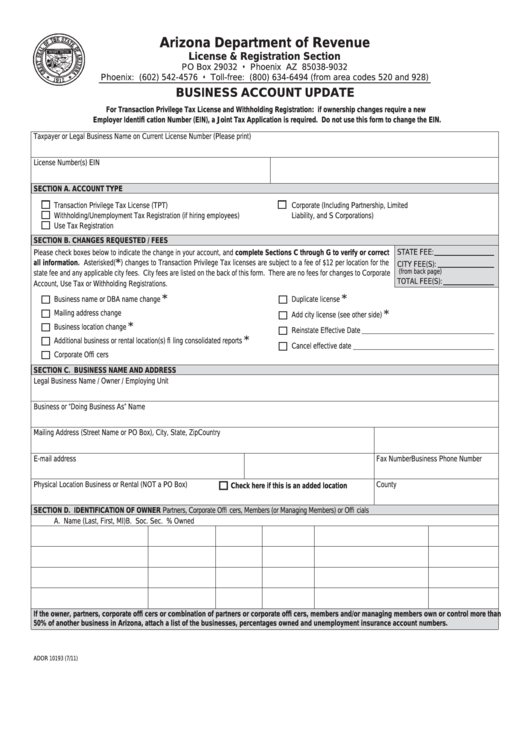

Fillable Arizona Form 10193 Business Account Update printable pdf

Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, Web 5000 this form replaces earlier forms: This form should be kept by you to show that you.

20152020 Form AZ DoR 5005 Fill Online, Printable, Fillable, Blank

This certificate is not exclusive to contractors, please see the certificate instructions for a list of those who may use the form. Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated.

Form 5005S11 Schedule 11 Download Fillable PDF or Fill Online Federal

* transaction privilege license #: Edit your arizona form contractor online. Web 5000 this form replaces earlier forms: This form should be kept by you to show that you do not owe tpt on the gross receipts of the project. Web the form 5005 is for documentation of liability for transaction privilege tax (tpt) by the contractor that issued the.

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

Web ador 10313 (5/21) print name date signed this form superseded all other form 5005’s contractor’s certificate instructions general instructions in order to ensure the effectiveness of the certificate, all required fields must be completed. Type text, add images, blackout confidential details, add comments, highlights and more. Web send az form 5005 via email, link, or fax. Web the form.

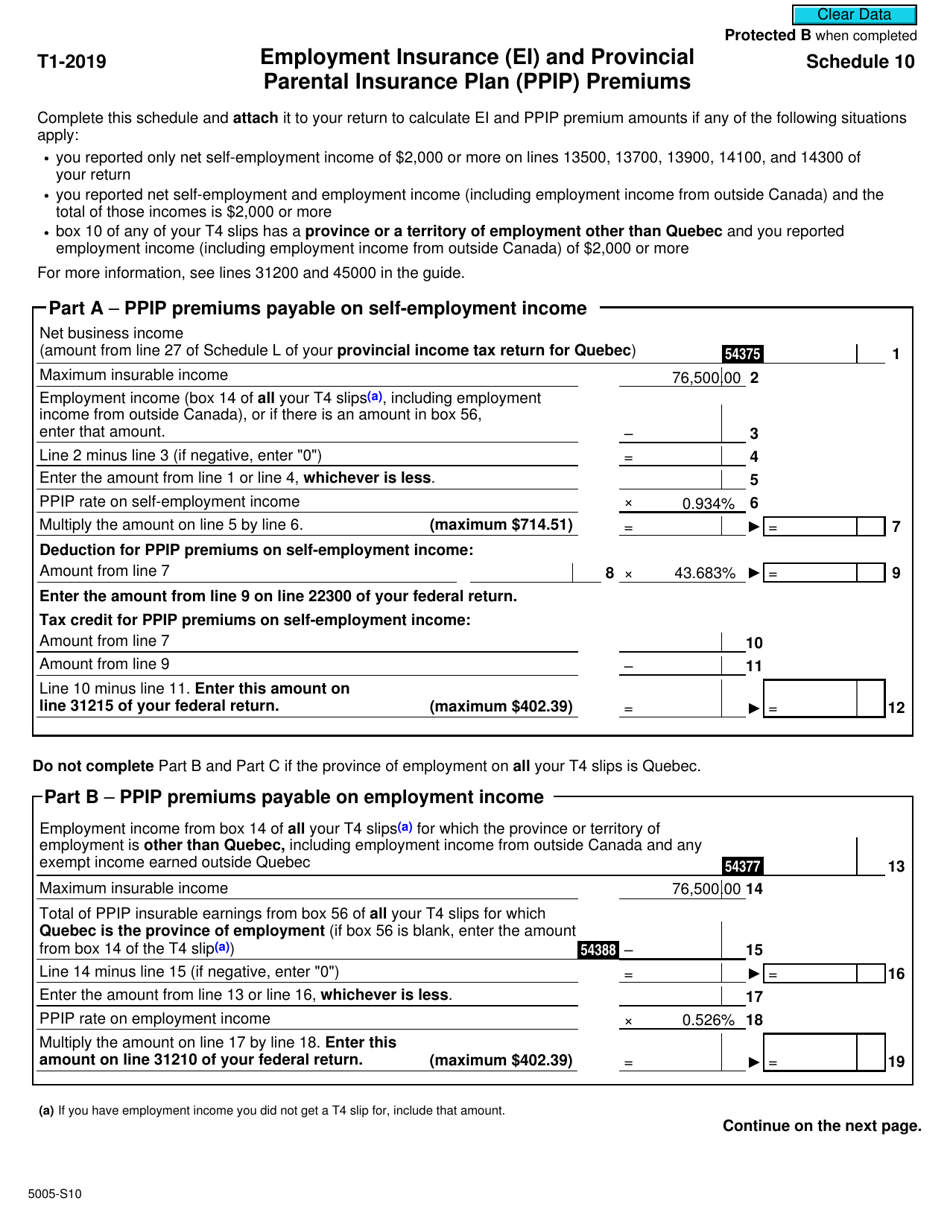

Form 5005S10 Schedule 10 Download Fillable PDF or Fill Online

This form should be kept by you to show that you do not owe tpt on the gross receipts of the project. The purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or.

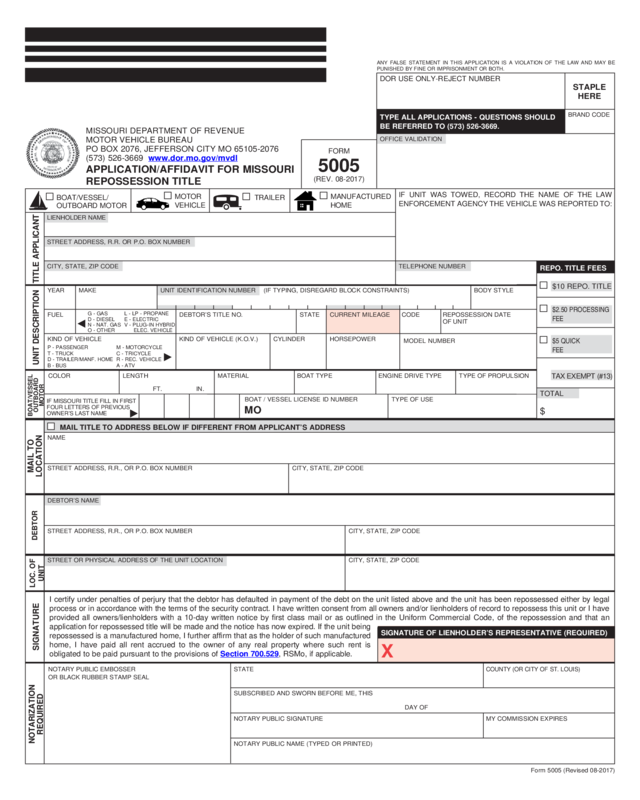

Form 5005 Missouri Department Of Revenue Edit, Fill, Sign Online

Type text, add images, blackout confidential details, add comments, highlights and more. Jet fuel tax rate adjustment certificate: Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance,.

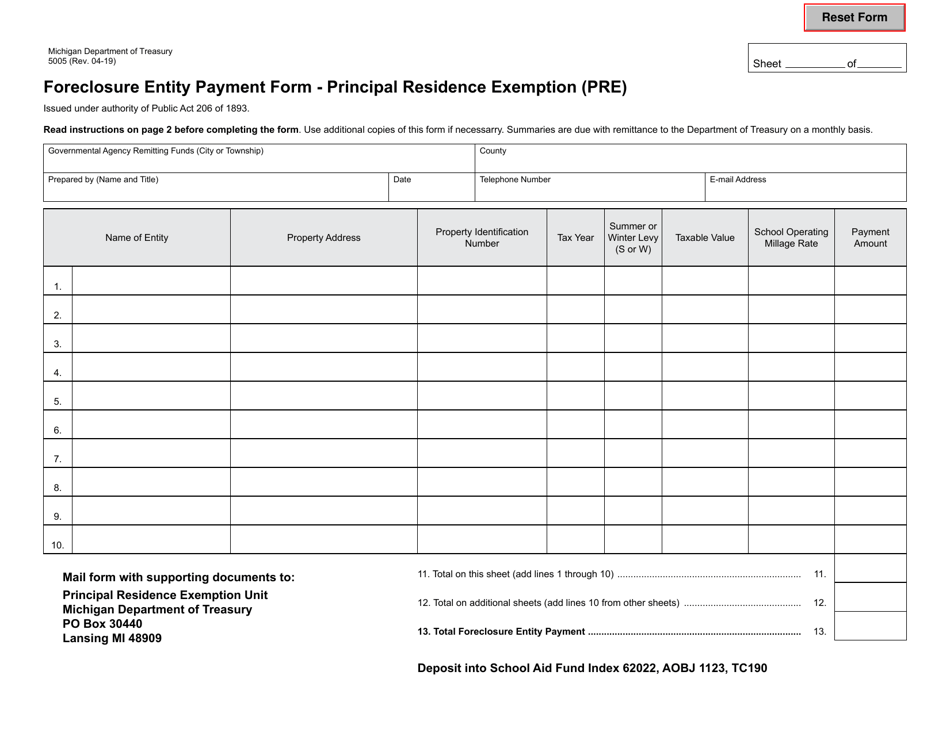

Form 5005 Download Fillable PDF or Fill Online Foreclosure Entity

Jet fuel tax rate adjustment certificate: Web send az form 5005 via email, link, or fax. The “name”, “address”, and “tpt license number” fields of the contractor section must be. As an unlicensed contractor, you do not have to. Sign it in a few clicks.

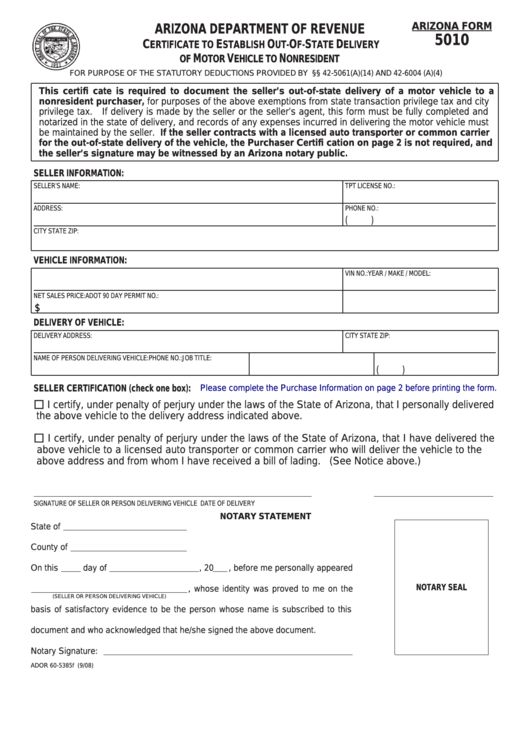

Fillable Arizona Form 5010 Certificate To Establish OutOfState

* transaction privilege license #: Jet fuel tax rate adjustment certificate: Web the purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, Web send az form 5005 via email,.

Web The Purpose Of This Form Is To Provide A Subcontractor With The Validation Required For Prime Contracting Transaction Privilege Tax (Tpt) Exemption, And For Exemption From Liability For An Amount Equal To Retail Tpt On Materials Incorporated Or Fabricated Into Maintenance,

Web arizona form 5005 a. As an unlicensed contractor, you do not have to. Type of certifi cate (check one and provide requested information) single project. Edit your arizona form contractor online.

* Transaction Privilege License #:

Jet fuel tax rate adjustment certificate: Type text, add images, blackout confidential details, add comments, highlights and more. Web vendors should retain copies of the form 5000 for their files. Web send az form 5005 via email, link, or fax.

Web The Purpose Of This Form Is To Provide A Subcontractor With The Validation Required For Prime Contracting Transaction Privilege Tax (Tpt) Exemption, And For Exemption From Liability For An Amount Equal To Retail Tpt On Materials Incorporated Or Fabricated Into Maintenance,

* transaction privilege license #: This form should be kept by you to show that you do not owe tpt on the gross receipts of the project. You can also download it, export it or print it out. This form is not to be provided to a subcontractor.

Web 5000 This Form Replaces Earlier Forms:

The purpose of this form is to provide a subcontractor with the validation required for prime contracting transaction privilege tax (tpt) exemption, and for exemption from liability for an amount equal to retail tpt on materials incorporated or fabricated into maintenance, repair, replacement or alteration (mrra) projects. The “name”, “address”, and “tpt license number” fields of the contractor section must be. Web the form 5005 is for documentation of liability for transaction privilege tax (tpt) by the contractor that issued the form. This certificate is not exclusive to contractors, please see the certificate instructions for a list of those who may use the form.