Arkansas State Tax Form

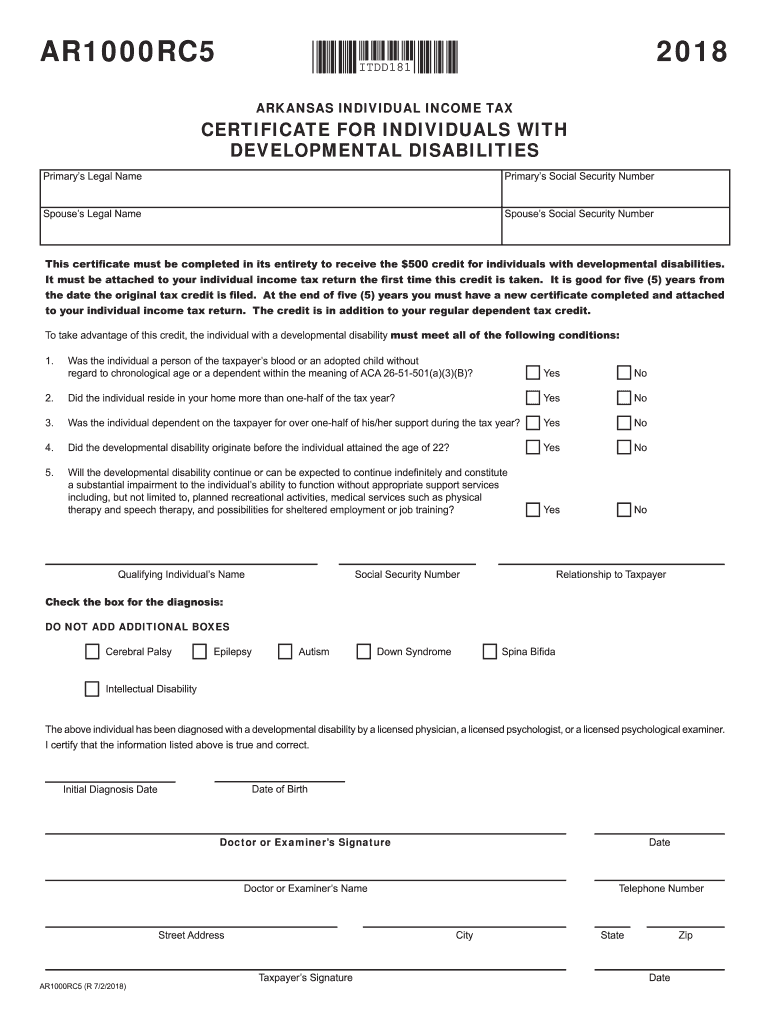

Arkansas State Tax Form - Ar1000nol schedule of net operating loss: Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Ar1000rc5 individuals with developmental disabilites certificate: Web 2021 tax year forms. Web ar1000f full year resident individual income tax return: Web fiduciary and estate income tax forms; Web fiduciary and estate income tax forms; Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. This line is used to report your allowable contribution to an individual retirement account (ira).

Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web fiduciary and estate income tax forms; Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web 2021 tax year forms. Web ar1000f full year resident individual income tax return: Ar1000rc5 individuals with developmental disabilites certificate: Ar1000nol schedule of net operating loss: Web withholding tax formula (effective 06/01/2023) 06/05/2023.

Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Web ar1000f full year resident individual income tax return: Ar1000rc5 individuals with developmental disabilites certificate: Web fiduciary and estate income tax forms; This line is used to report your allowable contribution to an individual retirement account (ira). Web withholding tax formula (effective 06/01/2023) 06/05/2023. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov.

Ar1000Rc5 Fill Out and Sign Printable PDF Template signNow

Web withholding tax formula (effective 06/01/2023) 06/05/2023. Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Web ar1000f full year resident individual income tax return: This line is used to report your allowable contribution to an individual retirement account (ira). Withholding tax tables for employers (effective 06/01/2023) 06/05/2023.

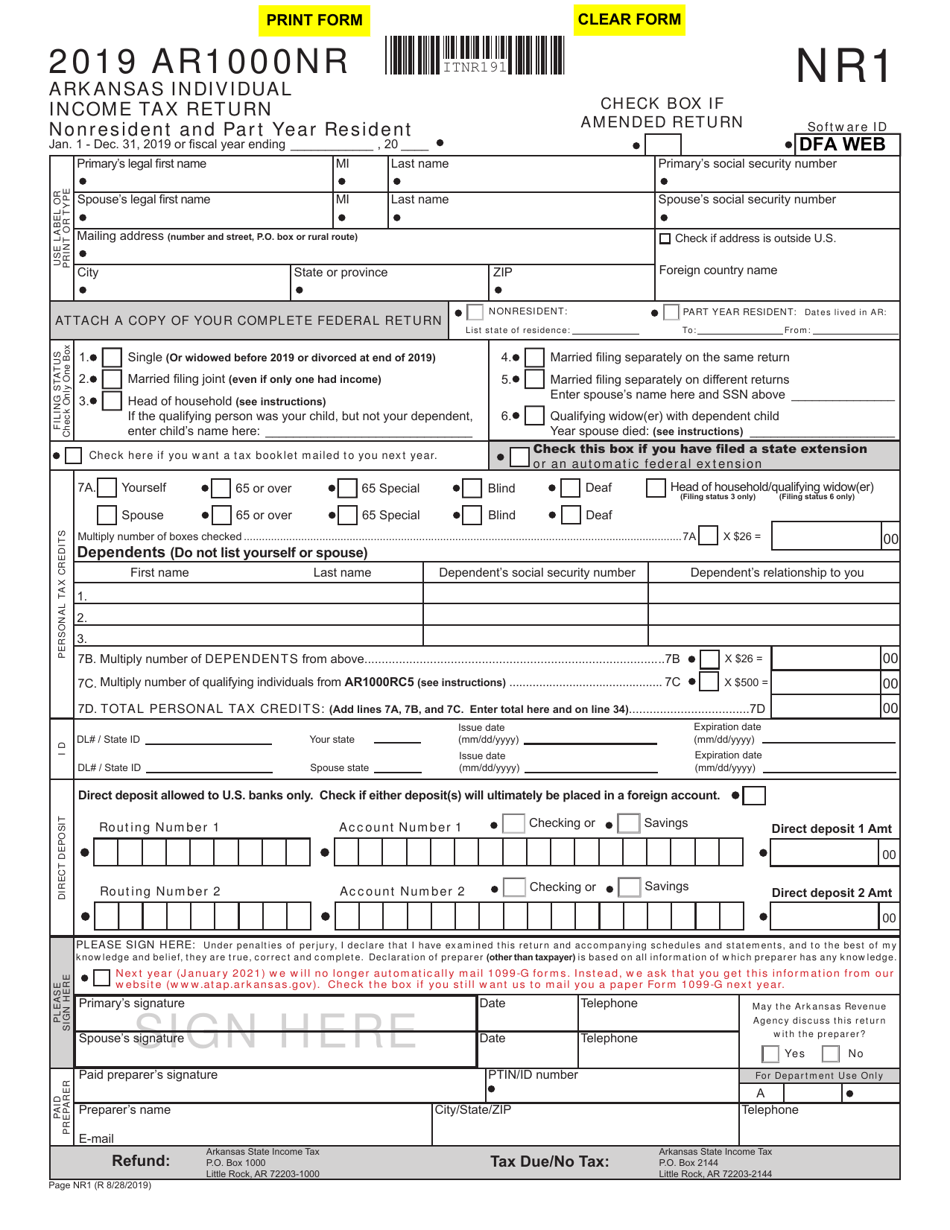

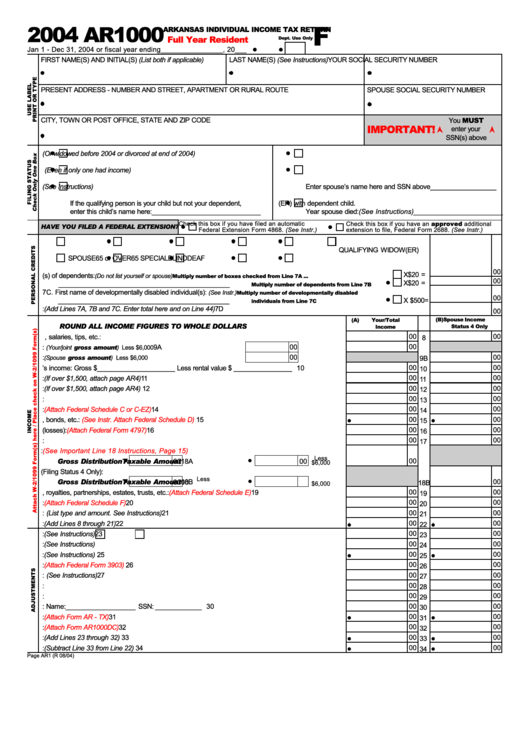

Form AR1000NR Download Fillable PDF or Fill Online Arkansas Individual

Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. This line is used to report your allowable contribution to an individual retirement account (ira). Ar1000es individual estimated tax vouchers for 2021. Web ar1000f full year resident individual income tax return:

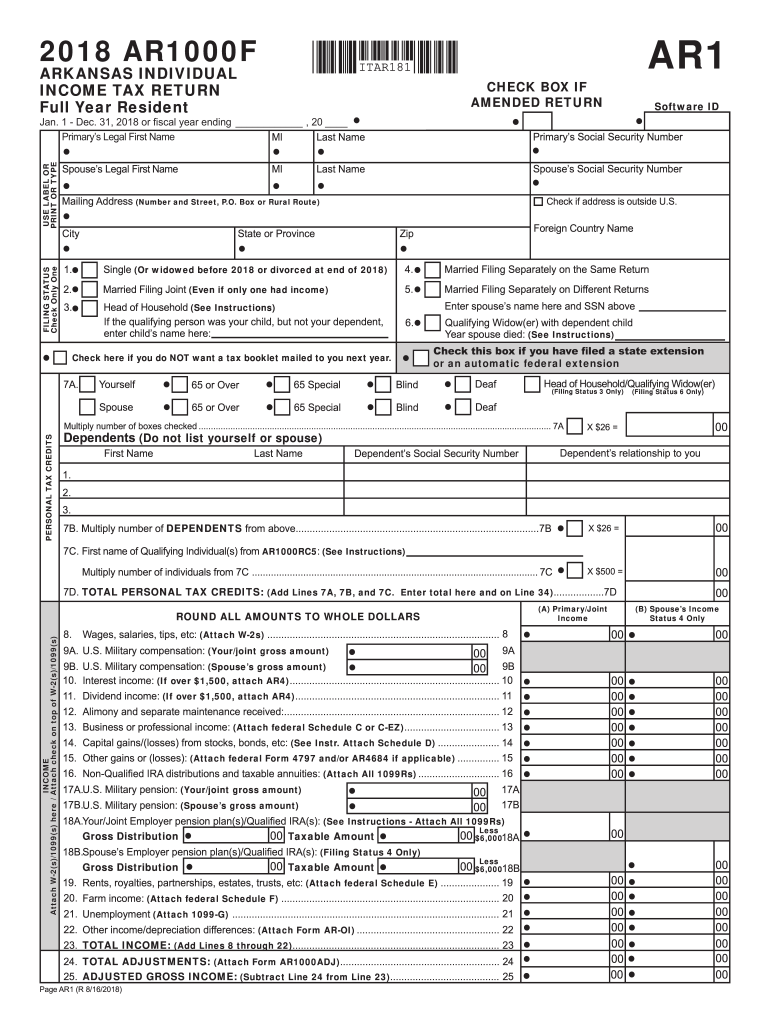

2017 state tax return form ar1000f Fill out & sign online DocHub

Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Ar1000nol schedule of net operating loss: Web fiduciary and estate income tax forms; Withholding tax tables for low income (effective 06/01/2023) 06/05/2023.

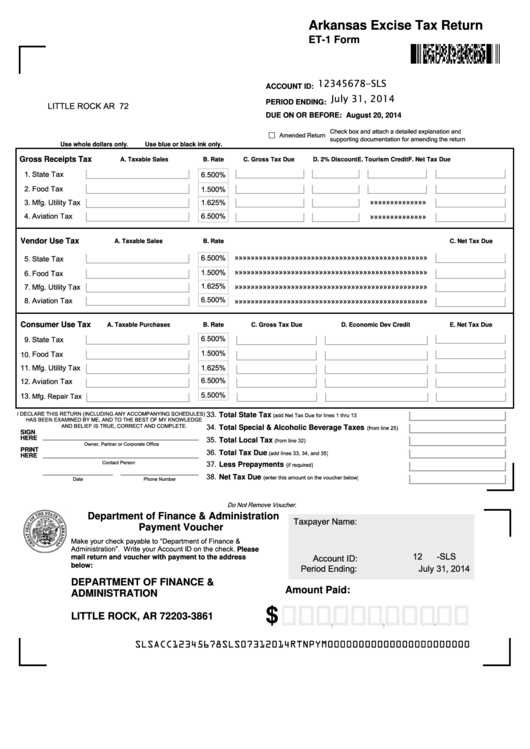

Fillable Form Et1 Arkansas Excise Tax Return printable pdf download

Web 2021 tax year forms. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Web fiduciary and estate income tax forms; Web fiduciary and estate income tax forms; Withholding tax tables for employers (effective 06/01/2023) 06/05/2023.

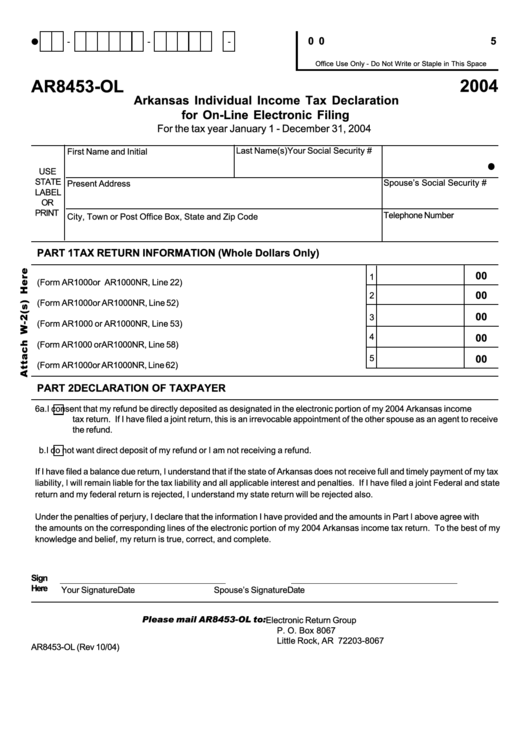

Form Ar8453Ol Arkansas Individual Tax Declaration For OnLine

Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Web 2021 tax year forms. This line is used to report your allowable contribution to an individual retirement account (ira). Ar1000es individual estimated tax vouchers for 2021.

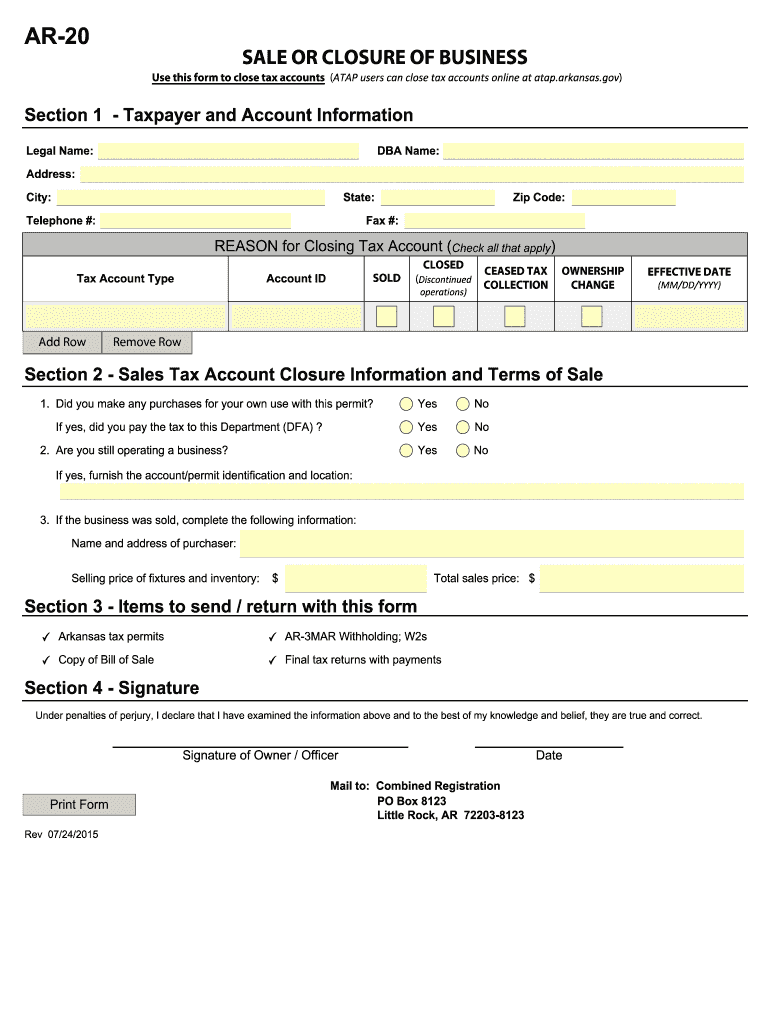

20152022 Form AR AR20 Fill Online, Printable, Fillable, Blank pdfFiller

Web 2021 tax year forms. Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Ar1000es individual estimated tax vouchers for 2021. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web ar1000f full year resident individual income tax return:

Form Ar1000 Arkansas Individual Tax Return Full Year Resident

Ar1000rc5 individuals with developmental disabilites certificate: This line is used to report your allowable contribution to an individual retirement account (ira). Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,.

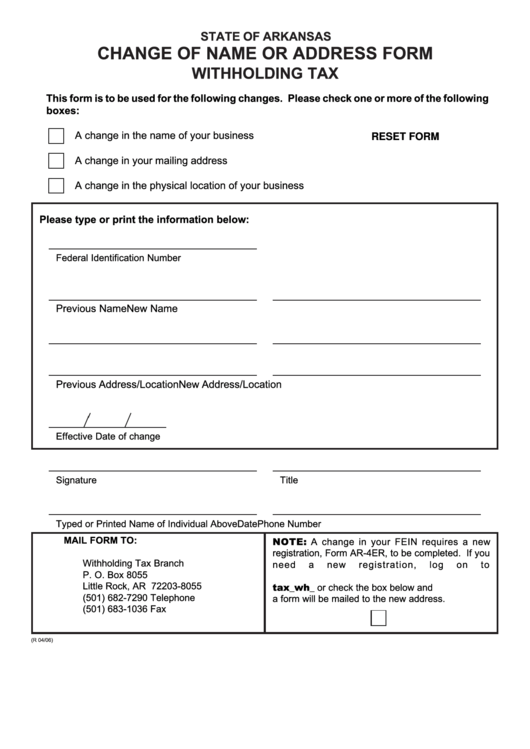

Fillable Change Of Name Or Address Withholding Tax Form State Of

Web 2021 tax year forms. Ar1000nol schedule of net operating loss: Ar1000rc5 individuals with developmental disabilites certificate: Web withholding tax formula (effective 06/01/2023) 06/05/2023. Ar1000es individual estimated tax vouchers for 2021.

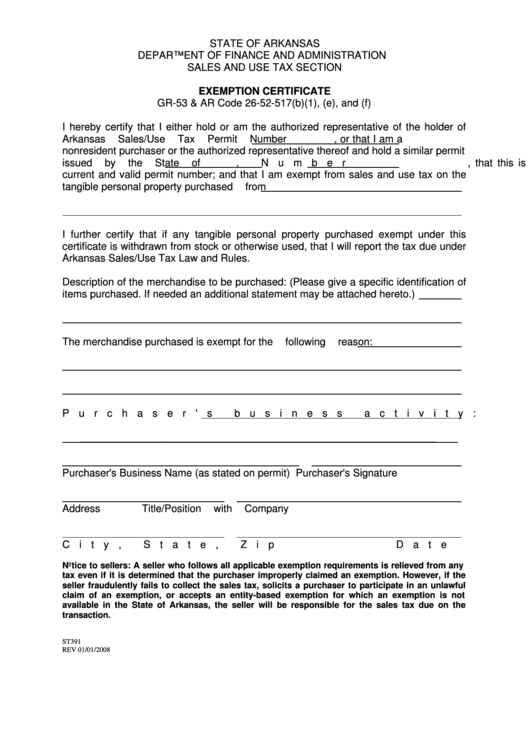

Fillable Form Gr53 & Ar Exemption Certificate Form State Of

Web fiduciary and estate income tax forms; Web ar1000f full year resident individual income tax return: Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web fiduciary and estate income tax forms;

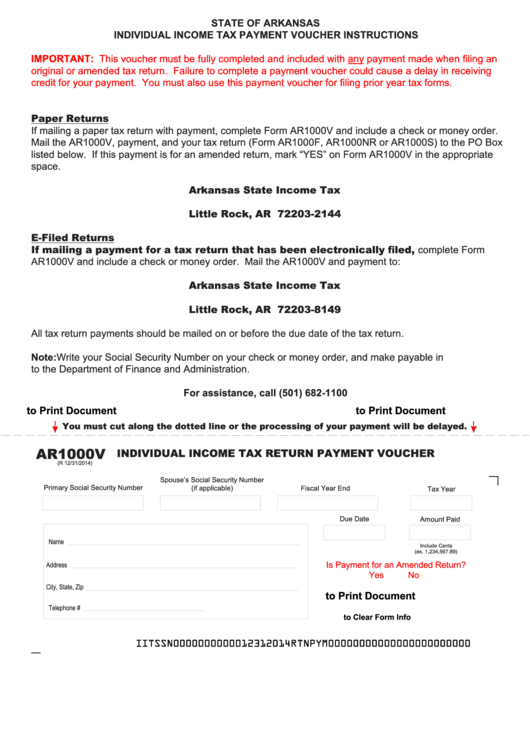

Fillable Form Ar1000v Arkansas Individual Tax Return Payment

Ar1000nol schedule of net operating loss: Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and.

Printable Arkansas State Tax Forms For The 2022 Tax Year Will Be Based On Income Earned Between January 1,.

Web fiduciary and estate income tax forms; Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Ar1000nol schedule of net operating loss:

Web Withholding Tax Formula (Effective 06/01/2023) 06/05/2023.

Ar1000rc5 individuals with developmental disabilites certificate: Web ar1000f full year resident individual income tax return: Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov.

Withholding Tax Instructions For Employers (Effective 10/01/2022) 09/02/2022.

Web fiduciary and estate income tax forms; This line is used to report your allowable contribution to an individual retirement account (ira). Web 2021 tax year forms. Ar1000es individual estimated tax vouchers for 2021.