Arkansas W 9 Form

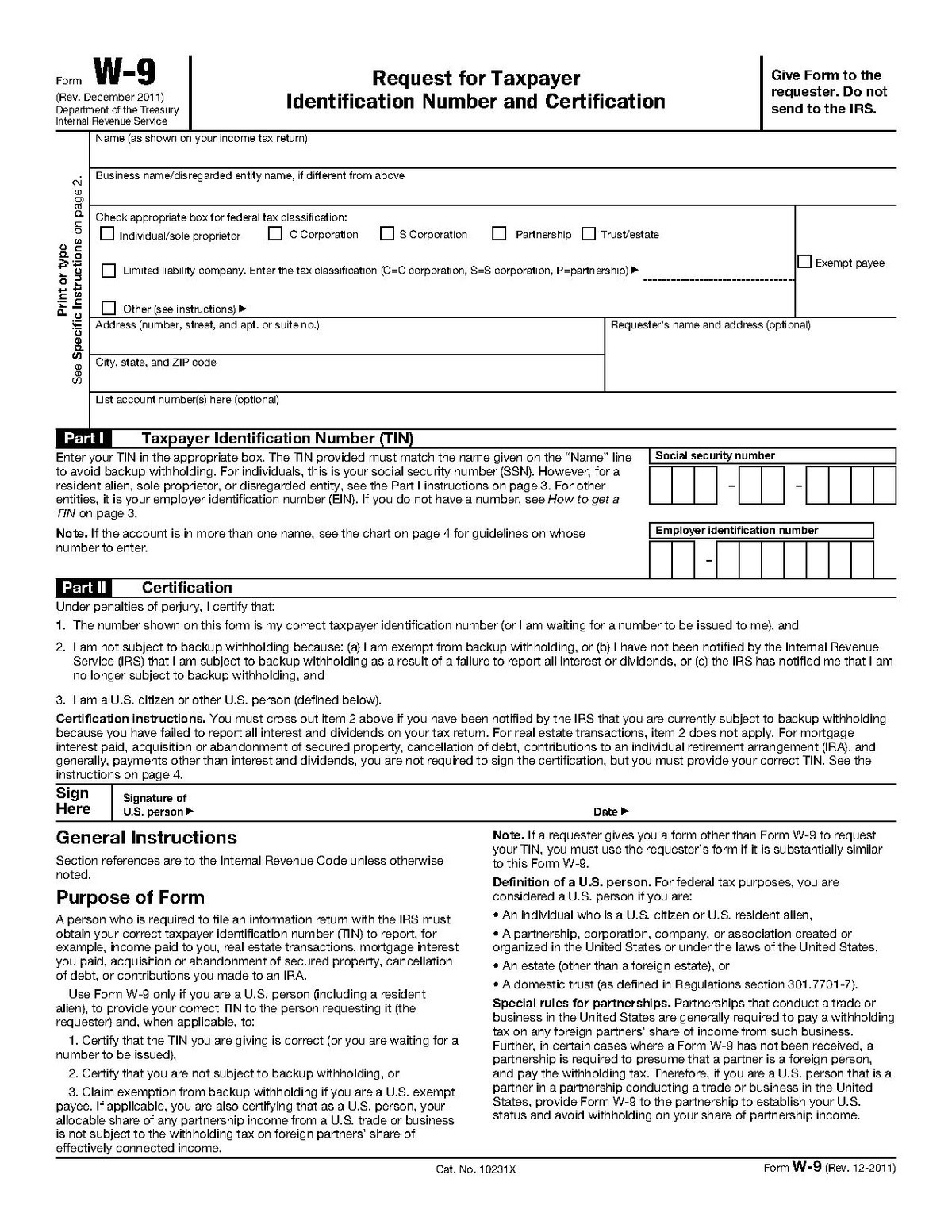

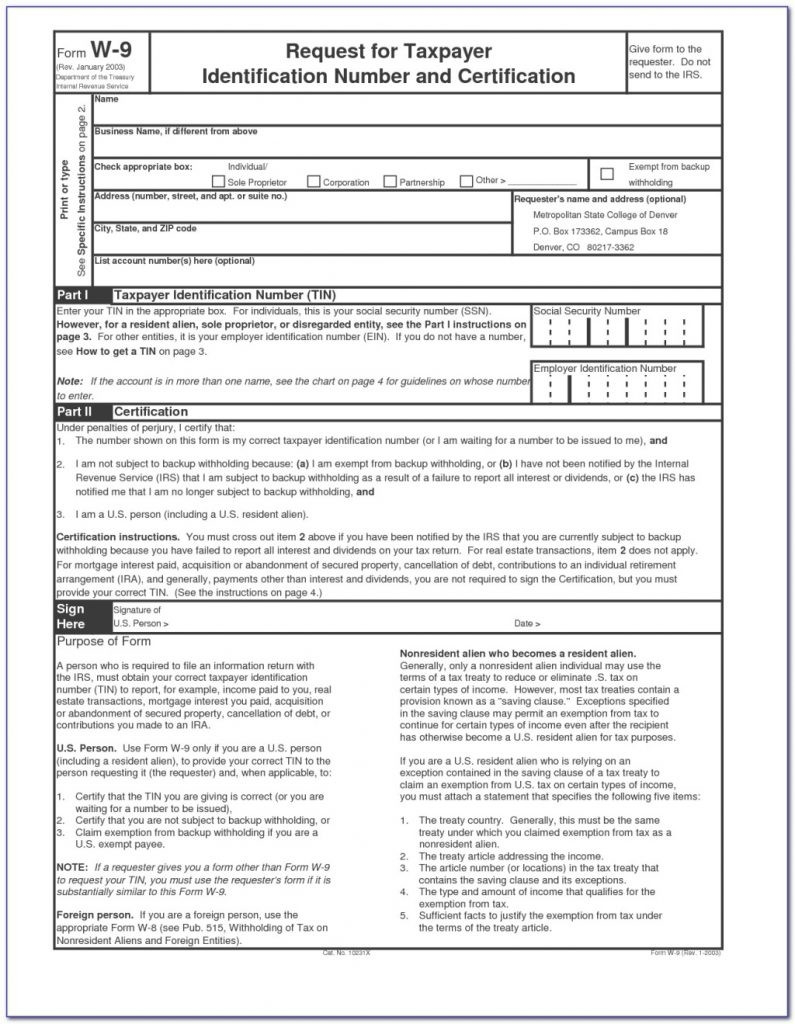

Arkansas W 9 Form - University of arkansas for medical sciences university of arkansas for medical sciences. 4301 west markham street, little. Request for taxpayer identification number and certification. Therefore, if you are a u.s. If you have any questions, contact jenni overstreet at. Web 42 rows arkansas efile; Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Fiduciary and estate income tax forms; This will be your social. This includes their name, address, employer identification number (ein),.

Request for taxpayer identification number (tin) and. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web one ticket in california matched all five numbers and the powerball. This includes their name, address, employer identification number (ein),. 4301 west markham street, little. If you are a u.s. Web 42 rows arkansas efile; Individual tax return form 1040 instructions; Person (including a resident alien), to. Web 17 rows withholding tax instructions for employers (effective 10/01/2022) 09/02/2022.

Fiduciary and estate income tax forms; Person (including a resident alien), to. Web awcc form w (wage statemen t) 1. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. December 2011) department of the treasury internal revenue service. Individual tax return form 1040 instructions; Request for taxpayer identification number and certification. Web 17 rows withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. 4301 west markham street, little. Request for taxpayer identification number (tin) and.

How to pay contractors and freelancers in 5 simple steps Clockify

Web 42 rows arkansas efile; Web awcc form w (wage statemen t) 1. Request for taxpayer identification number and certificate keywords: Therefore, if you are a u.s. Request for taxpayer identification number and certification.

W9 Form

Web one ticket in california matched all five numbers and the powerball. Therefore, if you are a u.s. 4301 west markham street, little. This will be your social. Web file this form with your employer.

W 9 Form 2020 Printable Free Blank Calendar Template Printable

Web awcc form w (wage statemen t) 1. This will be your social. November 2017) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for. University of arkansas for medical sciences university of arkansas for medical sciences. December 2011) department of the treasury internal revenue service.

KPB Joint Information Center 07/14/20 W9 Form Required with The

Web awcc form w (wage statemen t) 1. Therefore, if you are a u.s. Person (including a resident alien), to. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. 4301 west markham street, little.

Blank W9 Forms 2020 Printable Calendar Template Printable

Request for taxpayer identification number (tin) and. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. If you have any questions, contact jenni overstreet at. Request for taxpayer identification number and certificate keywords: Person (including a resident alien), to.

Arkansas W9 Form 2021 Calendar Template Printable

File the employer’s annual reconciliation of income tax withheld (form. Individual tax return form 1040 instructions; Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. 4301 west markham street, little. If you have any questions, contact jenni overstreet at.

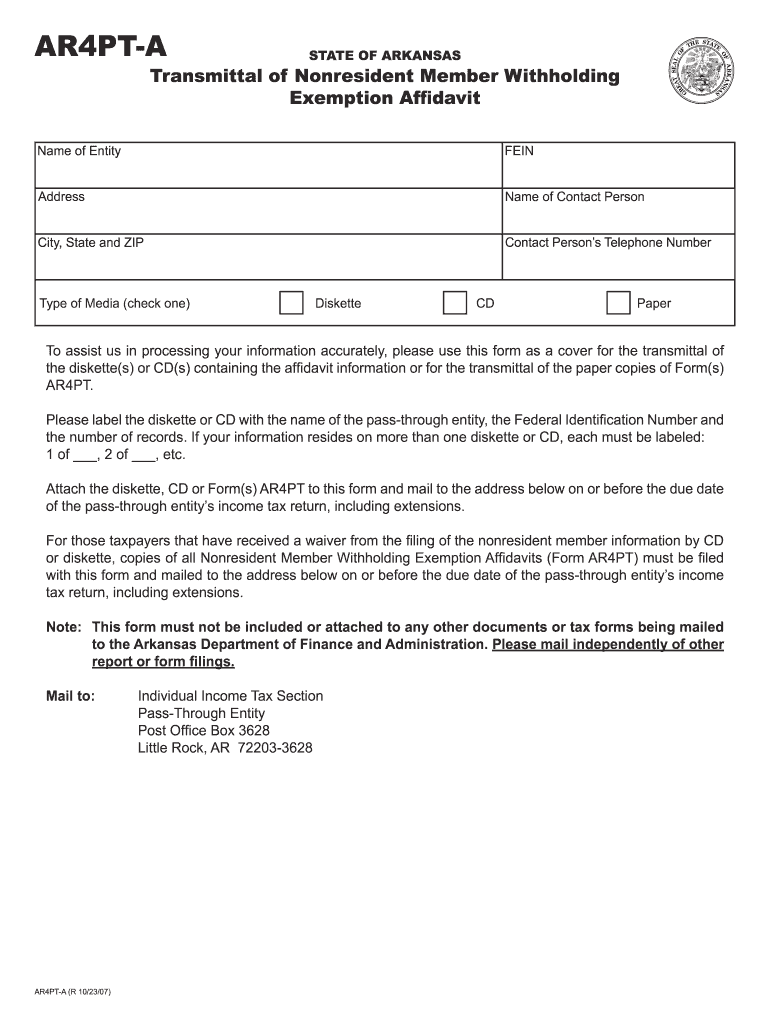

Ar4Pt Fill Out and Sign Printable PDF Template signNow

File the employer’s annual reconciliation of income tax withheld (form. Therefore, if you are a u.s. November 2017) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for. 4301 west markham street, little. Request for taxpayer identification number and certification.

Arkansas W9 Form 2021 Calendar Template Printable

December 2011) department of the treasury internal revenue service. Web file this form with your employer. Individual tax return form 1040 instructions; Request for taxpayer identification number and certificate keywords: November 2017) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for.

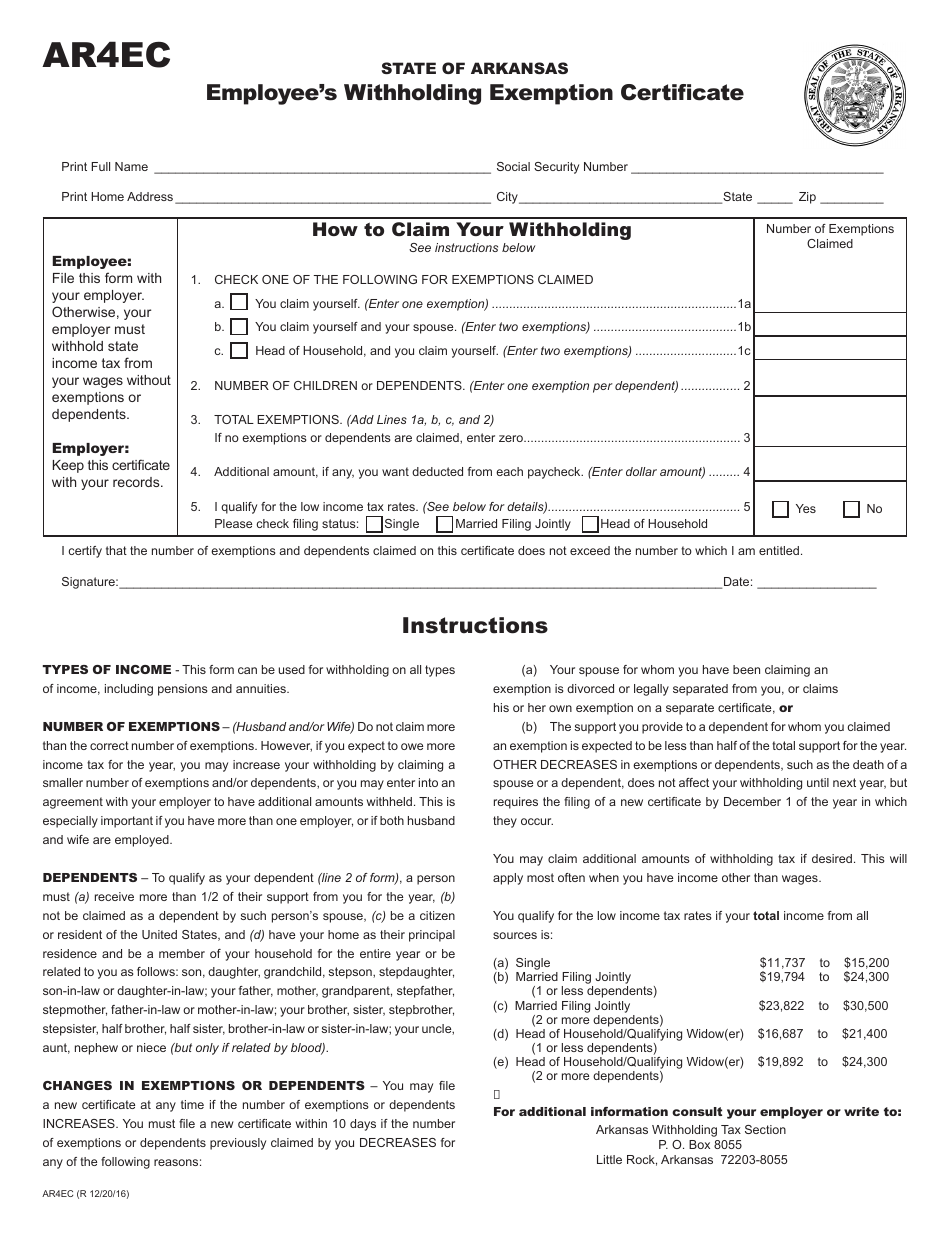

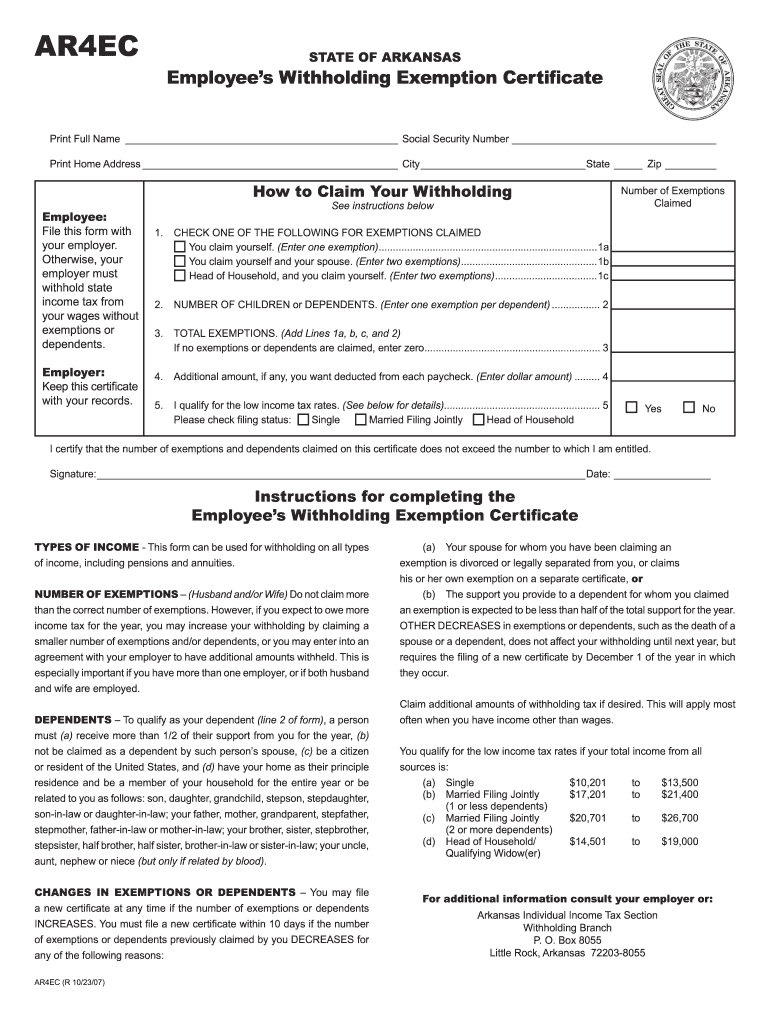

Form AR4ec Download Fillable PDF or Fill Online Employee's Withholding

Web file this form with your employer. 4301 west markham street, little. Therefore, if you are a u.s. This includes their name, address, employer identification number (ein),. University of arkansas for medical sciences university of arkansas for medical sciences.

December 2011) Department Of The Treasury Internal Revenue Service.

Web 17 rows withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Individual tax return form 1040 instructions; Web one ticket in california matched all five numbers and the powerball. File the employer’s annual reconciliation of income tax withheld (form.

If You Have Any Questions, Contact Jenni Overstreet At.

Request for taxpayer identification number and certificate keywords: Request for taxpayer identification number (tin) and. This includes their name, address, employer identification number (ein),. Person (including a resident alien), to.

November 2017) Department Of The Treasury Internal Revenue Service Request For Taxpayer Identification Number And Certification Go To Www.irs.gov/Formw9 For.

This will be your social. 4301 west markham street, little. Web file this form with your employer. Therefore, if you are a u.s.

Otherwise, Your Employer Must Withhold State Income Tax From Your Wages Without Exemptions Or Dependents.

Request for taxpayer identification number and certification. Fiduciary and estate income tax forms; University of arkansas for medical sciences university of arkansas for medical sciences. Web 42 rows arkansas efile;