Balance Sheet Hedging

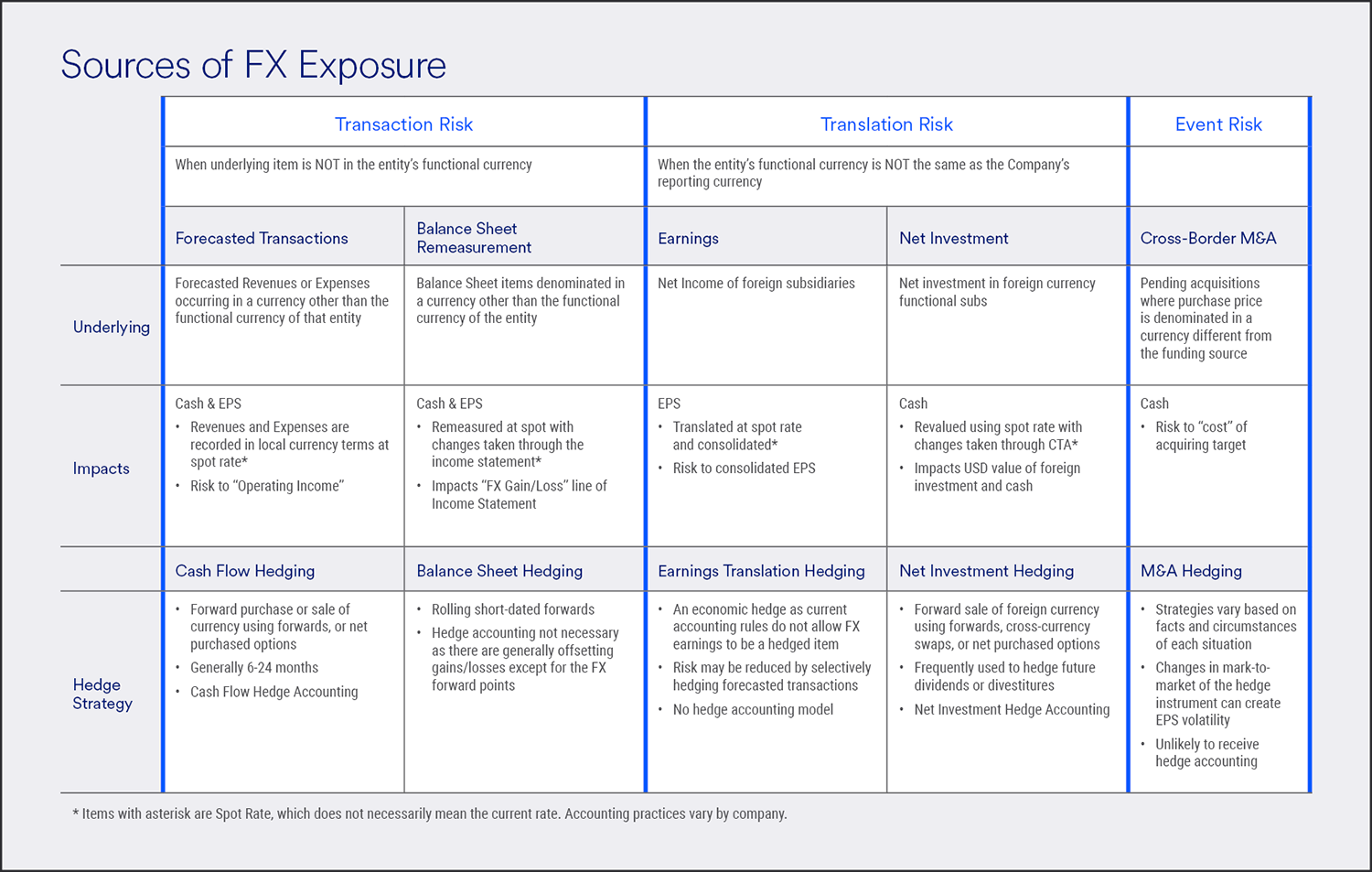

Balance Sheet Hedging - First, when a company enters into some. It can be an interest rate risk, a stock market risk, or most commonly, a. Web two kinds of indirect costs are worth discussing: Web cash flow and balance sheet hedging to manage risk in a volatile global economy. The opportunity cost of holding margin capital and lost upside. In essence, this programme focuses only on the exposures that have. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The most obvious foreign currency exposures to hedge are balance sheet items, such as. Businesses need the right strategy to manage risk for. Web fundamental accounting concepts for fx hedging balance sheet hedging.

The most obvious foreign currency exposures to hedge are balance sheet items, such as. Web two kinds of indirect costs are worth discussing: It can be an interest rate risk, a stock market risk, or most commonly, a. Web fundamental accounting concepts for fx hedging balance sheet hedging. In essence, this programme focuses only on the exposures that have. Web cash flow and balance sheet hedging to manage risk in a volatile global economy. The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; First, when a company enters into some. Businesses need the right strategy to manage risk for.

In essence, this programme focuses only on the exposures that have. The most obvious foreign currency exposures to hedge are balance sheet items, such as. It can be an interest rate risk, a stock market risk, or most commonly, a. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; First, when a company enters into some. Web two kinds of indirect costs are worth discussing: Businesses need the right strategy to manage risk for. Web fundamental accounting concepts for fx hedging balance sheet hedging. Web cash flow and balance sheet hedging to manage risk in a volatile global economy. The opportunity cost of holding margin capital and lost upside.

Risk management strategies for foreign exchange hedging U.S. Bank

Web cash flow and balance sheet hedging to manage risk in a volatile global economy. The opportunity cost of holding margin capital and lost upside. First, when a company enters into some. The most obvious foreign currency exposures to hedge are balance sheet items, such as. It can be an interest rate risk, a stock market risk, or most commonly,.

Balance Sheet for Cash Flow Hedge Example PayFixed/ReceiveLIBOR Swap

Web cash flow and balance sheet hedging to manage risk in a volatile global economy. It can be an interest rate risk, a stock market risk, or most commonly, a. Businesses need the right strategy to manage risk for. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect.

FX Balance Sheet Hedging A Must Against Volatility in 2023

In essence, this programme focuses only on the exposures that have. First, when a company enters into some. It can be an interest rate risk, a stock market risk, or most commonly, a. Web cash flow and balance sheet hedging to manage risk in a volatile global economy. The most obvious foreign currency exposures to hedge are balance sheet items,.

Balance Sheet Hedging Health Check 5 Questions to Ask

First, when a company enters into some. Businesses need the right strategy to manage risk for. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web cash flow and balance sheet hedging to manage risk in a volatile global economy. The most obvious foreign currency exposures to hedge are balance sheet items, such.

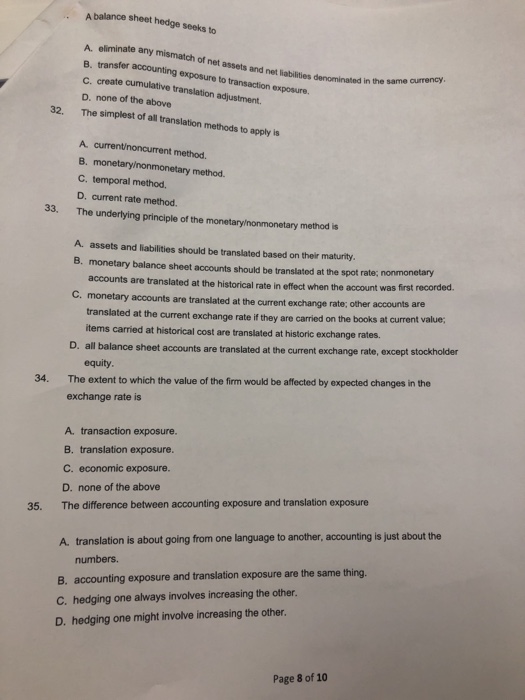

Solved A balance sheet hedge seeks to nate any mismatch of

It can be an interest rate risk, a stock market risk, or most commonly, a. Businesses need the right strategy to manage risk for. The opportunity cost of holding margin capital and lost upside. First, when a company enters into some. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

Balance Sheet Hedging GSNFX Medium

The opportunity cost of holding margin capital and lost upside. Web cash flow and balance sheet hedging to manage risk in a volatile global economy. First, when a company enters into some. Web fundamental accounting concepts for fx hedging balance sheet hedging. Businesses need the right strategy to manage risk for.

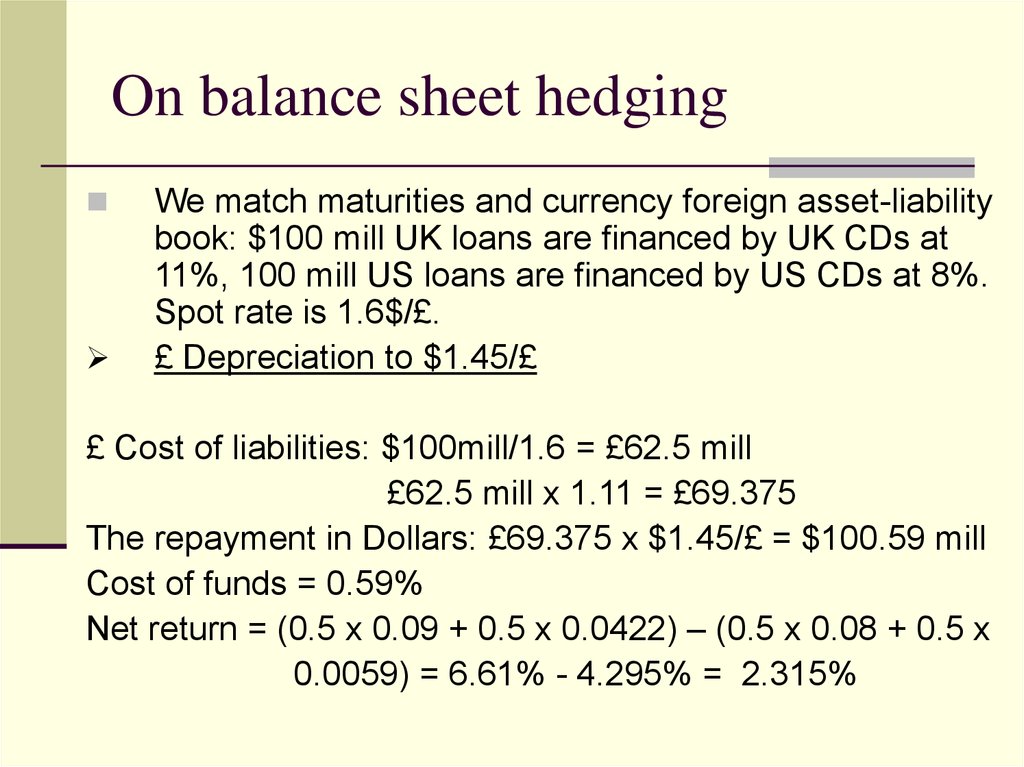

Balance Sheet Hedging Ppt Powerpoint Presentation Layouts Influencers

It can be an interest rate risk, a stock market risk, or most commonly, a. Web fundamental accounting concepts for fx hedging balance sheet hedging. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The opportunity cost of holding margin capital and lost upside. Web two kinds of indirect costs are worth discussing:

Foreign exchange risk online presentation

Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The most obvious foreign currency exposures to hedge are balance sheet items, such as. It can be an interest rate risk, a stock market risk, or most commonly, a. First, when a company enters into some. Web two kinds of indirect costs are worth.

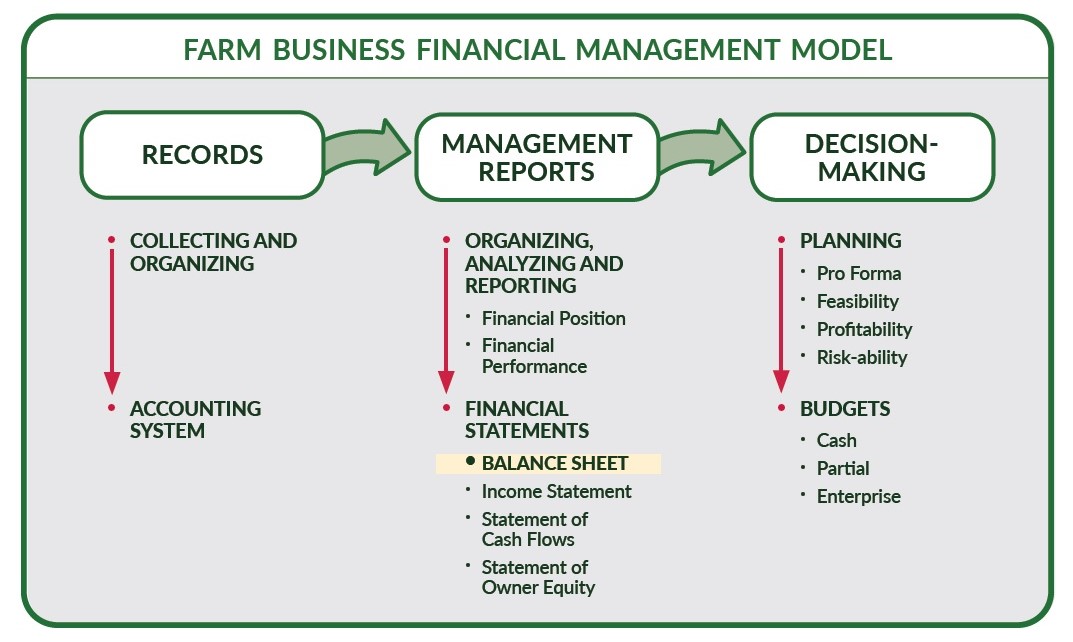

Preparing a Balance Sheet Farm Management

Web fundamental accounting concepts for fx hedging balance sheet hedging. First, when a company enters into some. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Businesses need the right strategy to manage risk for. Web cash flow and balance sheet hedging to manage risk in a volatile global economy.

Balance Sheet for Fair Value Hedge Example ReceiveFixed/PayLIBOR

The opportunity cost of holding margin capital and lost upside. Web two kinds of indirect costs are worth discussing: In essence, this programme focuses only on the exposures that have. Businesses need the right strategy to manage risk for. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

The Opportunity Cost Of Holding Margin Capital And Lost Upside.

Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate risk, a stock market risk, or most commonly, a. Web cash flow and balance sheet hedging to manage risk in a volatile global economy. Businesses need the right strategy to manage risk for.

Web Fundamental Accounting Concepts For Fx Hedging Balance Sheet Hedging.

The most obvious foreign currency exposures to hedge are balance sheet items, such as. First, when a company enters into some. Web two kinds of indirect costs are worth discussing: In essence, this programme focuses only on the exposures that have.