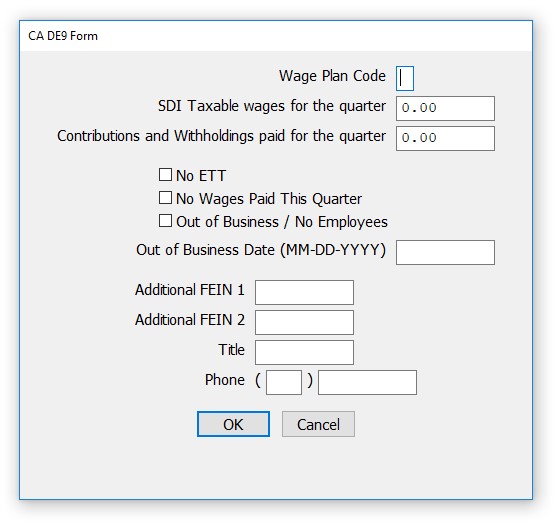

Ca De 9 Form

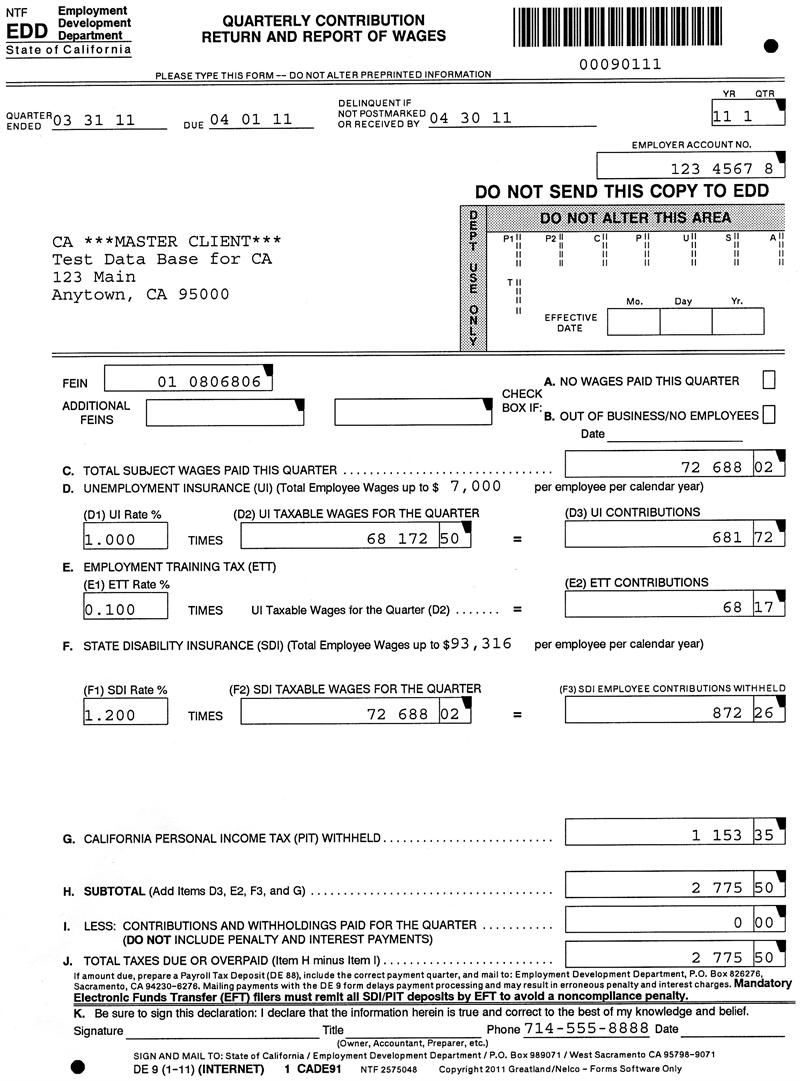

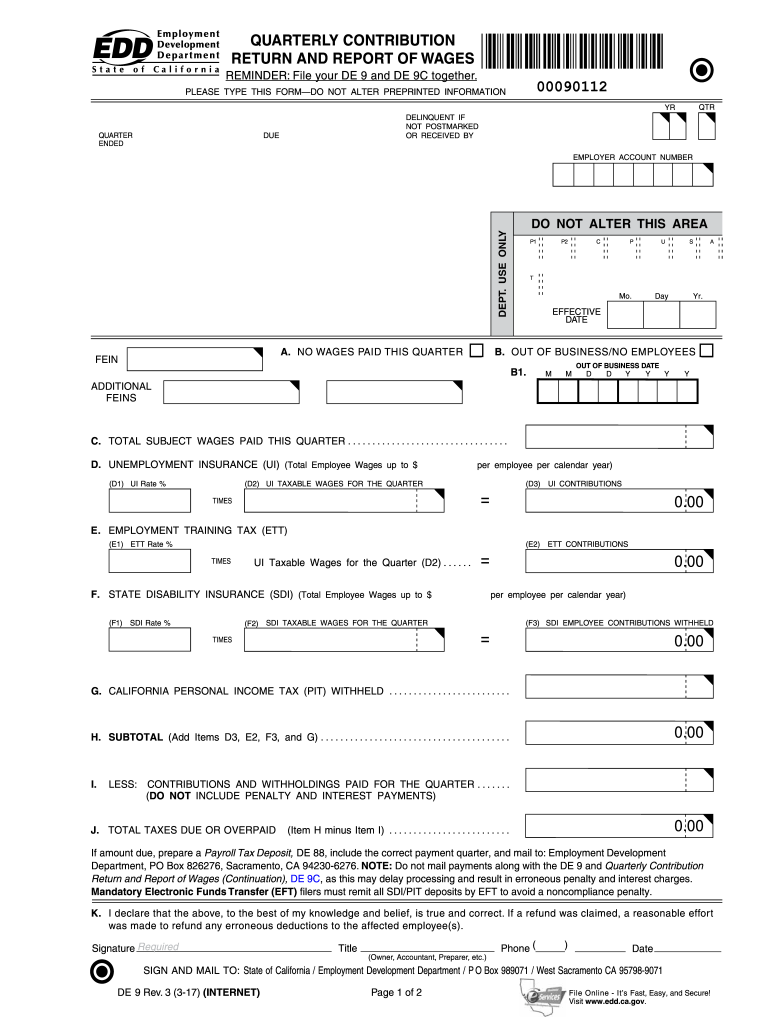

Ca De 9 Form - Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. Web this module contains california form de 9, quarterly contribution return and report of wages. Prepare a de 9c to report the types of exemptions listed below. You may be required to electronically file this form. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements Quarterly contribution return and report of wages, de 9. Web wages and withholdings to report on a separate de 9c. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). (please print) year / quarter. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of.

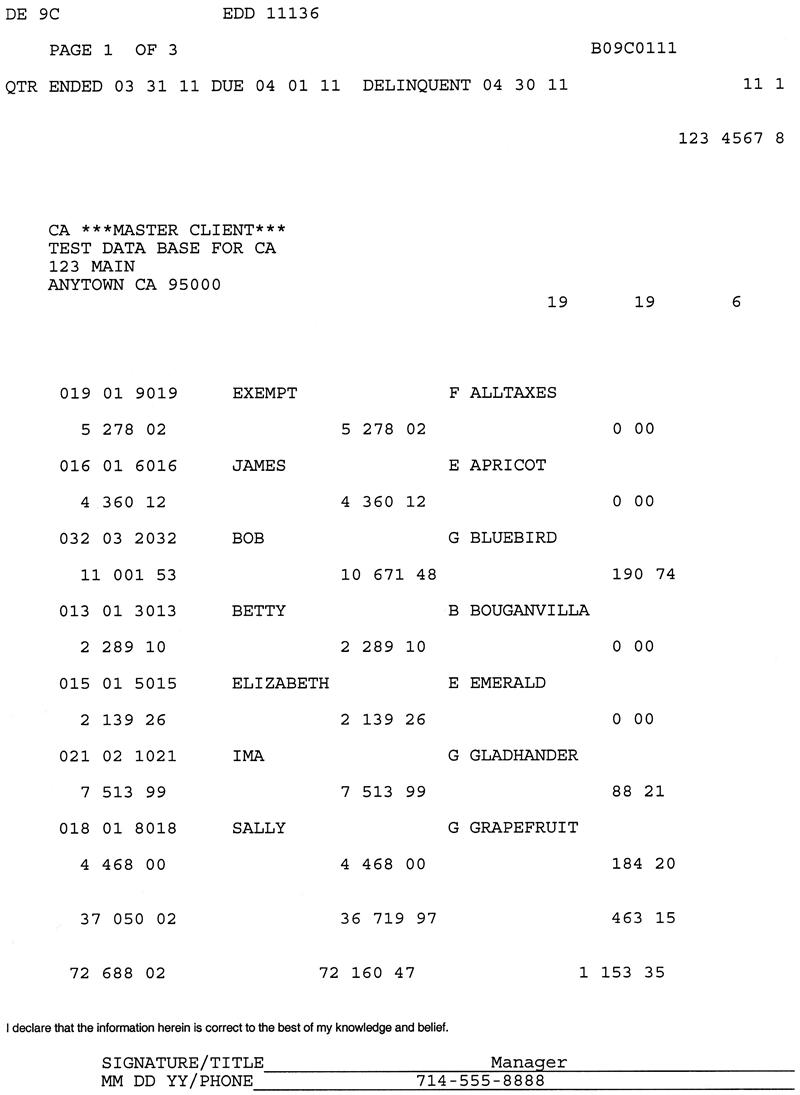

Prepare a de 9c to report the types of exemptions listed below. All three exemptions can be reported on one de 9c. You may be required to electronically file this form. Web (de 9) please type all information. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). Quarterly contribution and wage adjustment form. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of. Special red paper is not needed. Data may be imported from the payroll data previously entered by selecting import data from the menu. (please print) year / quarter.

Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements Quarterly contribution and wage adjustment form. Web this module contains california form de 9, quarterly contribution return and report of wages. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). Web (de 9) please type all information. Data may be imported from the payroll data previously entered by selecting import data from the menu. Web wages and withholdings to report on a separate de 9c. (please print) year / quarter. Prepare a de 9c to report the types of exemptions listed below.

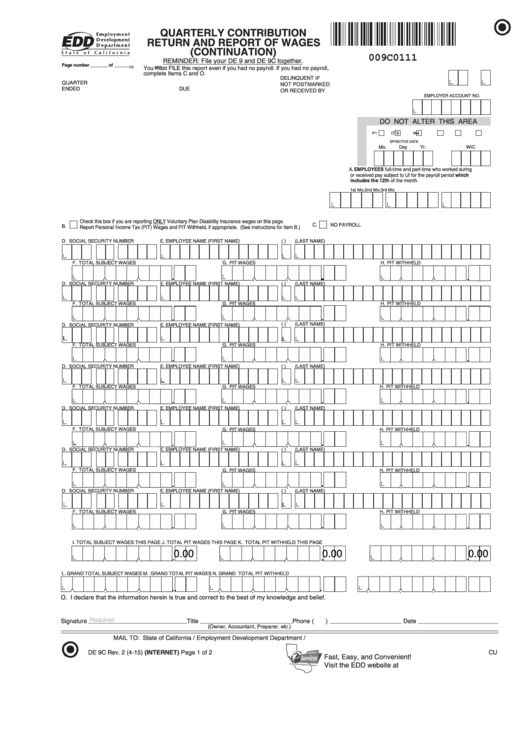

Form De 9c With Instructions Quarterly Contribution Return And Report

Web wages and withholdings to report on a separate de 9c. Quarterly contribution and wage adjustment form. Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. The form is printed as a black, scannable version. You may be required to electronically file this form.

CA DE 9ADJ 2013 Fill and Sign Printable Template Online US Legal Forms

For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. Special red paper is not needed. Web (de 9) please type all information. Prepare a de 9c to report the types of exemptions.

U.S.C. Title 11 BANKRUPTCY

Quarterly contribution and wage adjustment form. All three exemptions can be reported on one de 9c. Web (de 9) please type all information. For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. You may be required to electronically file this form.

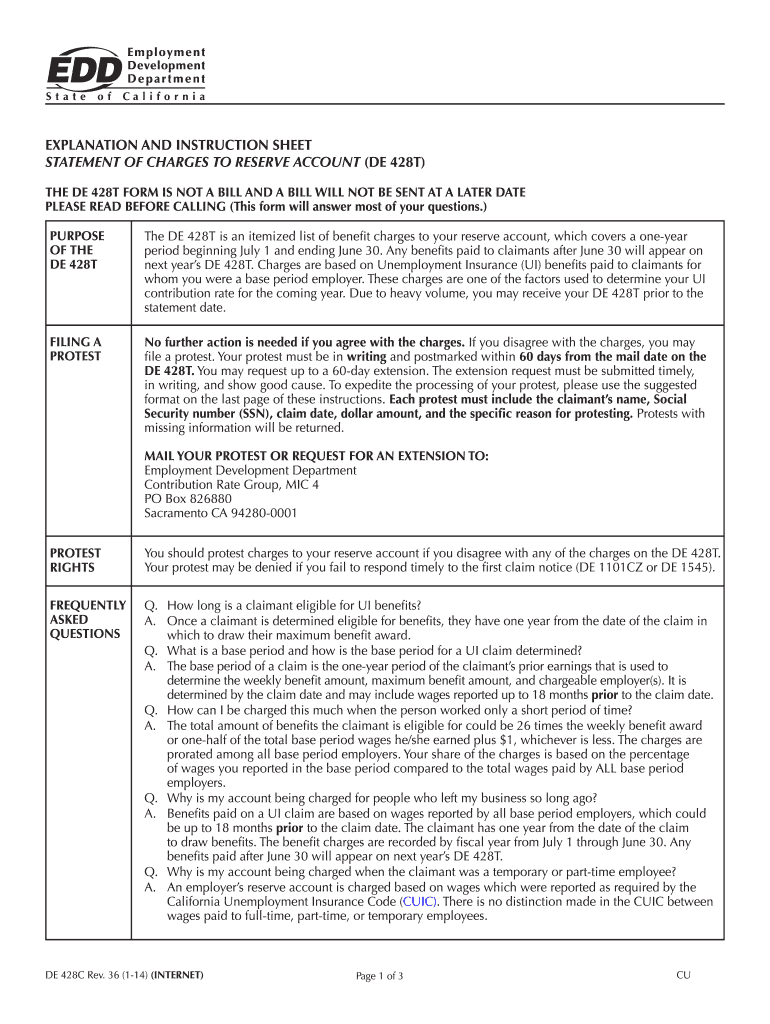

2014 Form CA DE 428C Fill Online, Printable, Fillable, Blank pdfFiller

Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. Web this module contains california form de 9, quarterly contribution return and report of wages. You may be required to electronically file this form. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to.

EDD DE9 PDF

Quarterly contribution return and report of wages, de 9. Quarterly contribution and wage adjustment form. Prepare a de 9c to report the types of exemptions listed below. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements.

California DE 9 and DE 9C Fileable Reports

Data may be imported from the payroll data previously entered by selecting import data from the menu. Web this module contains california form de 9, quarterly contribution return and report of wages. Prepare a de 9c to report the types of exemptions listed below. The form is printed as a black, scannable version. Special red paper is not needed.

How to Print California DE9 Form in CheckMark Payroll CheckMark

All three exemptions can be reported on one de 9c. Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. Data may be imported from the payroll data previously entered by selecting import data from the menu. Quarterly contribution return and report of wages, de 9. Web (de 9).

Form I9 Wikipedia

Prepare a de 9c to report the types of exemptions listed below. All three exemptions can be reported on one de 9c. Quarterly contribution and wage adjustment form. The form is printed as a black, scannable version. (please print) year / quarter.

20142021 Form CA DE 9 Fill Online, Printable, Fillable, Blank pdfFiller

The form is printed as a black, scannable version. Special red paper is not needed. Quarterly contribution return and report of wages, de 9. Web (de 9) please type all information. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9).

Prepare A De 9C To Report The Types Of Exemptions Listed Below.

Quarterly contribution and wage adjustment form. Data may be imported from the payroll data previously entered by selecting import data from the menu. For a faster, easier, and more convenient method of reporting your de 9 information, visit the edd’s website at www.edd.ca.gov. Special red paper is not needed.

All Three Exemptions Can Be Reported On One De 9C.

The form is printed as a black, scannable version. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. Web wages and withholdings to report on a separate de 9c.

Quarterly Contribution Return And Report Of Wages, De 9.

Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission requirements timeliness of forms deposit requirements (please print) year / quarter. You may be required to electronically file this form.

Web This Module Contains California Form De 9, Quarterly Contribution Return And Report Of Wages.

Web (de 9) please type all information. Web most employers, including quarterly household employers, are required to file the de 9 and de 9c.