Ca Form 199 Extension

Ca Form 199 Extension - Web we impose a penalty if you do not file your organization’s form 199 by the extended due date regardless of whether you pay the fee. Web internal revenue service to request an extension to file income tax returns after the due date, use the form that applies to you. Get ready for tax season deadlines by completing any required tax forms today. Web 2019 form 199 california exempt organization annual information return author: Web 2021 form 199 california exempt organization annual information return author: Exempt organization annual statement or return: From side 2, part ii, line 8. 1.1k views | last modified 4/20/2023 7:15:00 am est | yes, the organization will be. 2021, form 199, california exempt organization. The penalty is $5 per month or part of a.

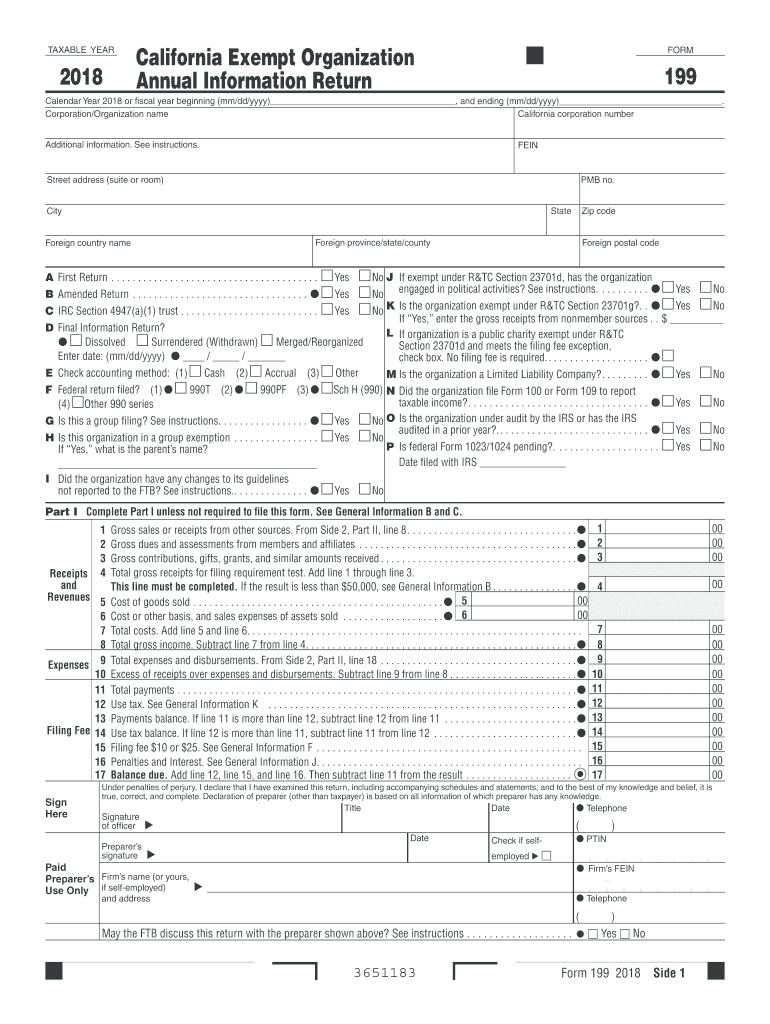

Complete, edit or print tax forms instantly. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Ad download or email ftb 199 & more fillable forms, register and subscribe now! View our emergency tax relief page. Web 2019 form 199 california exempt organization annual information return author: Web 2021 form 199 california exempt organization annual information return author: Web we impose a penalty if you do not file your organization’s form 199 by the extended due date regardless of whether you pay the fee. Web form 199 2018 side 1 1gross sales or receipts from other sources. Web form 199 2022 side 1 1gross sales or receipts from other sources. The penalty is $5 per month or part of a.

Get ready for tax season deadlines by completing any required tax forms today. Exempt organization annual statement or return: From side 2, part ii, line 8.•100 2gross dues and assessments from members and affiliates. The penalty is $5 per month or part of a. 16, 2023, to file and pay taxes. Web we impose a penalty if you do not file your organization’s form 199 by the extended due date regardless of whether you pay the fee. From side 2, part ii, line 8. Web form 199 2018 side 1 1gross sales or receipts from other sources. Exempt organization business income tax return: 2021, form 199, california exempt organization.

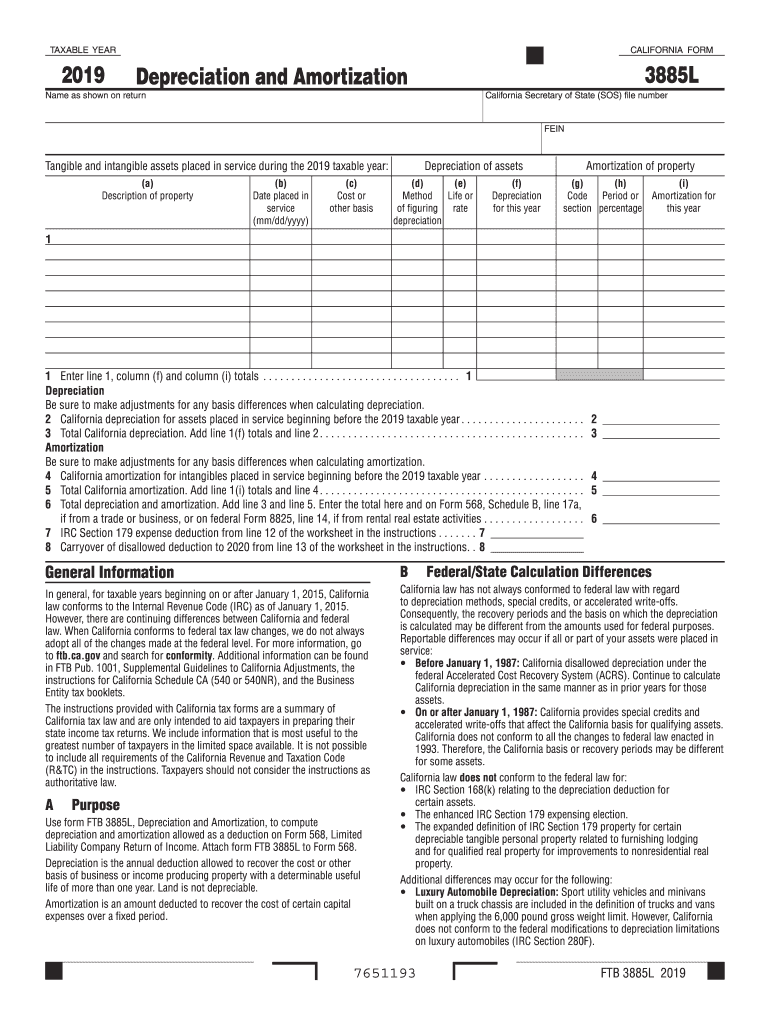

CA Form 3885L 2019 Fill out Tax Template Online US Legal Forms

Web 2021 form 199 california exempt organization annual information return author: Web we impose a penalty if you do not file your organization’s form 199 by the extended due date regardless of whether you pay the fee. 16, 2023, to file and pay taxes. Web we last updated the exempt organization annual information return in january 2023, so this is.

Form 199 ExpressTaxExempt Blog Efile tax Exempt Organizations for

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. The penalty is $5 per month or part of a. The irs will grant a reasonable extension of time. Get ready for tax season deadlines by completing any required tax forms today..

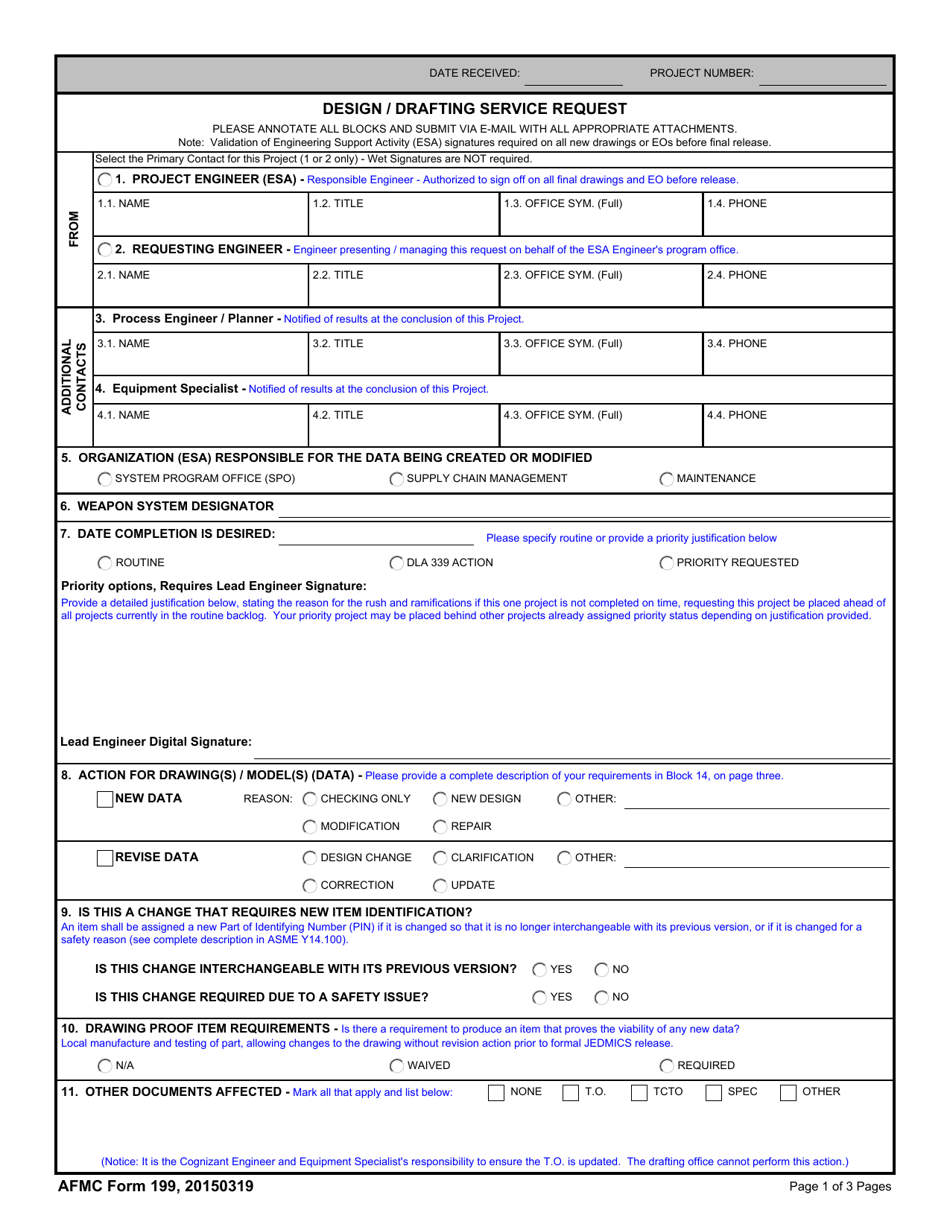

AFMC Form 199 Download Fillable PDF or Fill Online Design/Drafting

Complete, edit or print tax forms instantly. Web internal revenue service to request an extension to file income tax returns after the due date, use the form that applies to you. 2019, form 199, california exempt organization. Get ready for tax season deadlines by completing any required tax forms today. Web 2021 form 199 california exempt organization annual information return.

2002 ca form 199 Fill out & sign online DocHub

Web support ca 199 general will i be given an extension of time to file ca form 199? Web 2020 california exempt organization annual information return. 2021, form 199, california exempt organization. 100 2gross dues and assessments from members and affiliates. From side 2, part ii, line 8.

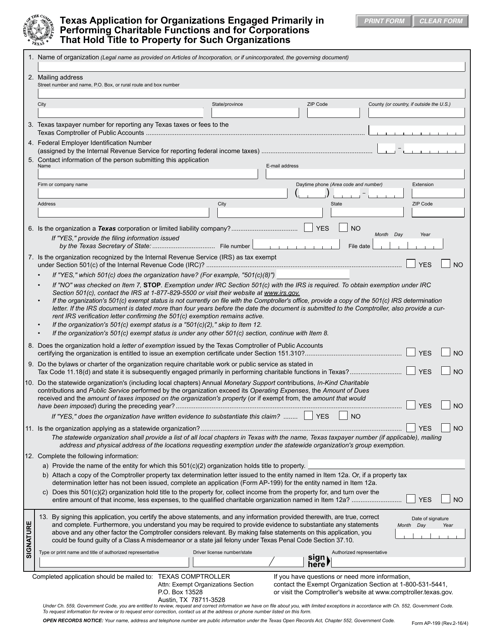

Form AP199 Download Fillable PDF or Fill Online Texas Application for

From side 2, part ii, line 8.•100 2gross dues and assessments from members and affiliates. Exempt organization annual statement or return: Web 2021 form 199 california exempt organization annual information return author: Get ready for tax season deadlines by completing any required tax forms today. Web 2019 form 199 california exempt organization annual information return author:

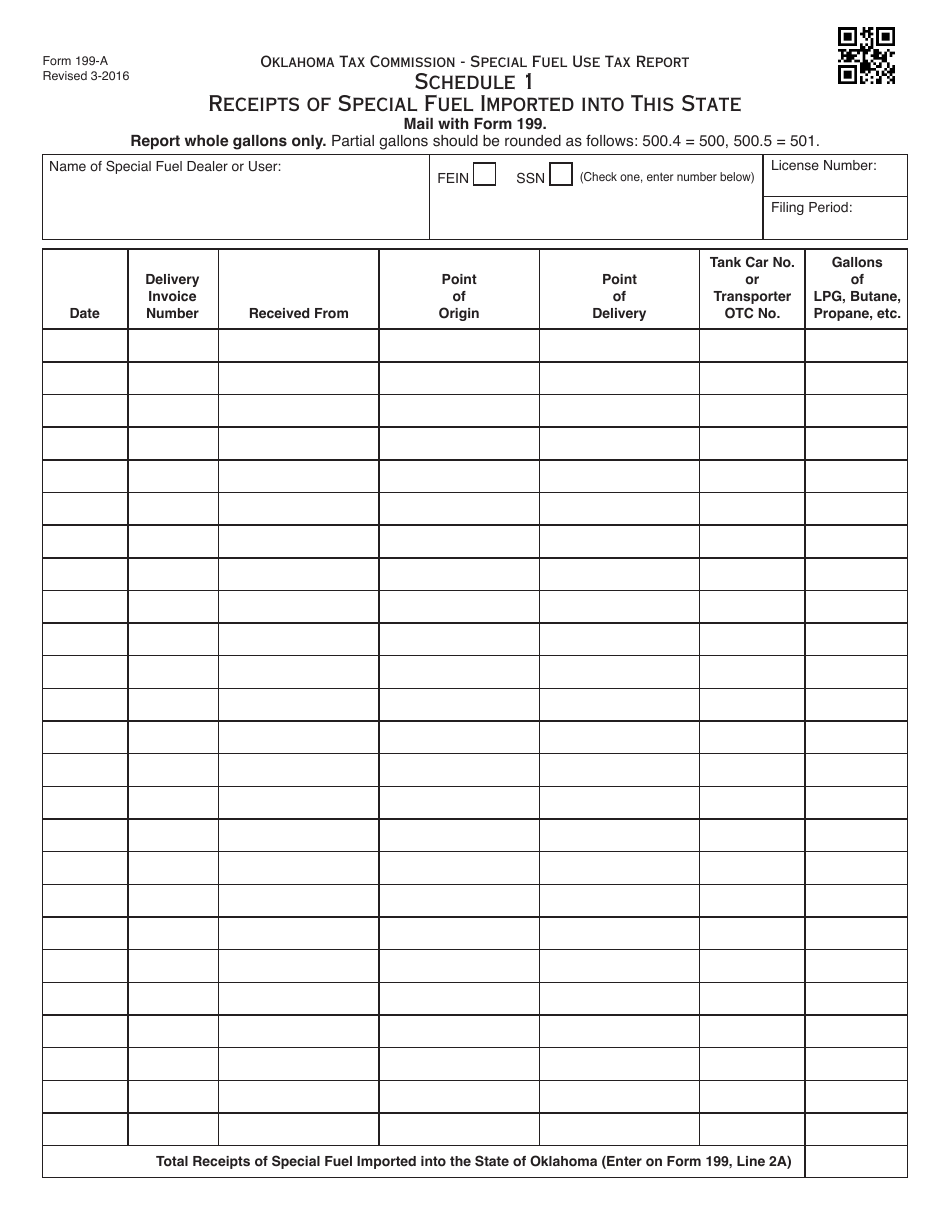

OTC Form 199A Schedule 1 Download Fillable PDF or Fill Online Receipts

Web form 199 2018 side 1 1gross sales or receipts from other sources. Complete, edit or print tax forms instantly. The irs will grant a reasonable extension of time. Web internal revenue service to request an extension to file income tax returns after the due date, use the form that applies to you. Web 2021 form 199 california exempt organization.

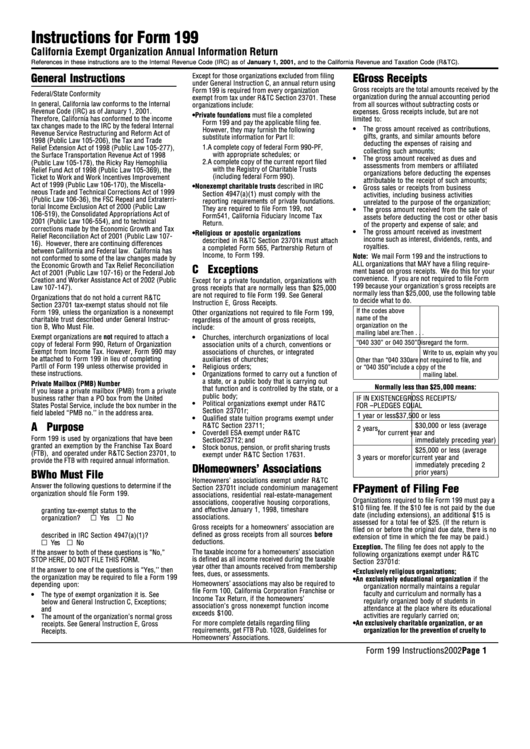

Instructions For Form 199 printable pdf download

Complete, edit or print tax forms instantly. From side 2, part ii, line 8. Web form 199 2018 side 1 1gross sales or receipts from other sources. Web 2020 california exempt organization annual information return. Exempt organization business income tax return:

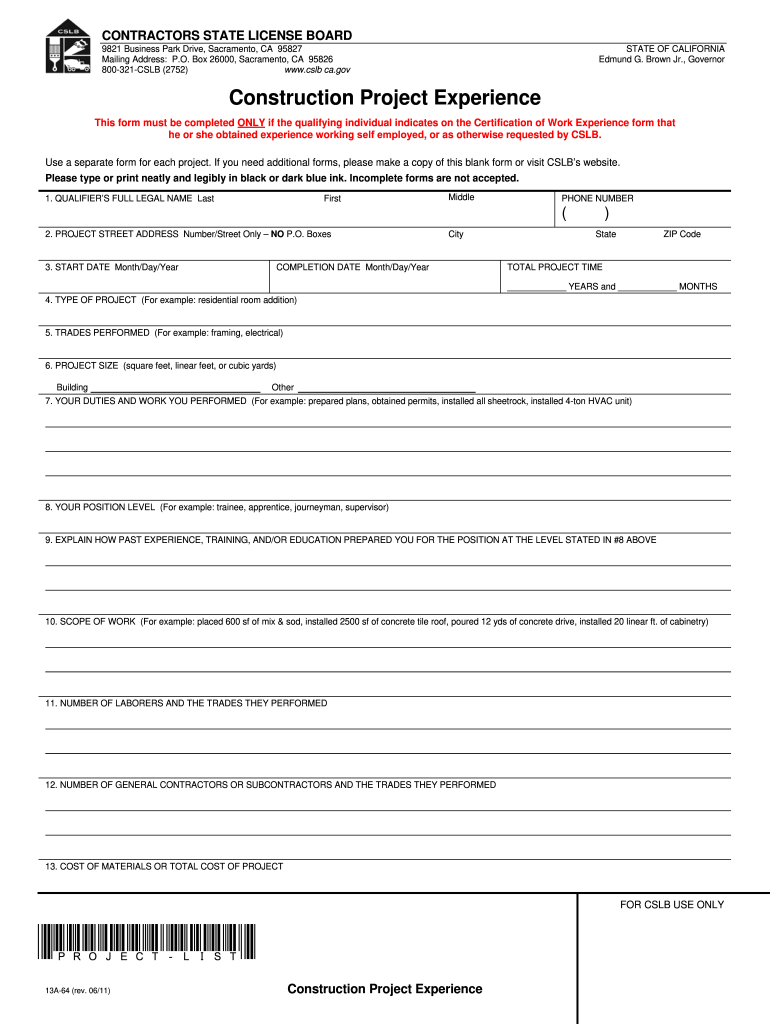

CA Form 13A64 2011 Fill and Sign Printable Template Online US

Ad download or email ftb 199 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. They are required with filings received by the registry on or after january 1, 2022. View our emergency tax relief page. Web form 199 2018 side 1 1gross sales or receipts from other.

california form 199 Fill out & sign online DocHub

The irs will grant a reasonable extension of time. Web 2021 form 199 california exempt organization annual information return author: Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. From side 2, part ii, line 8. 2021, form 199, california exempt.

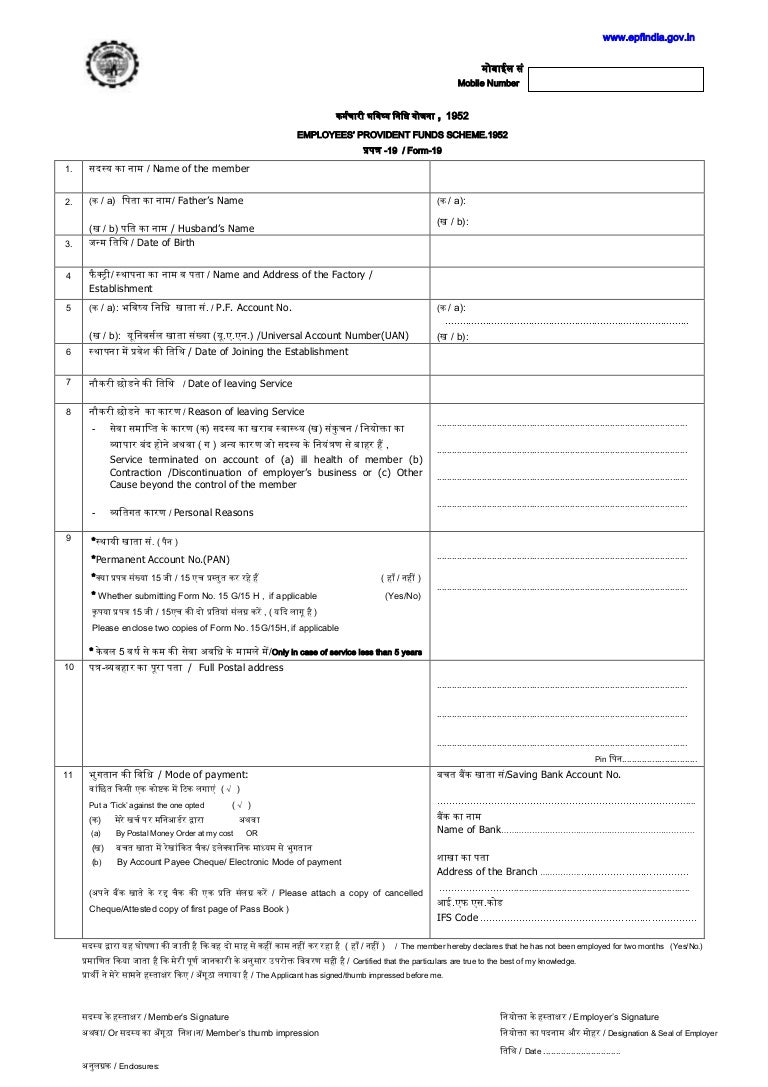

Form19

Web 2021 form 199 california exempt organization annual information return author: Web form 199 2022 side 1 1gross sales or receipts from other sources. The irs will grant a reasonable extension of time. 2021, form 199, california exempt organization. The penalty is $5 per month or part of a.

Web Form 199 2022 Side 1 1Gross Sales Or Receipts From Other Sources.

Exempt organization business income tax return: From side 2, part ii, line 8. From side 2, part ii, line 8.•100 2gross dues and assessments from members and affiliates. Web 2021 form 199 california exempt organization annual information return author:

2021, Form 199, California Exempt Organization.

100 2gross dues and assessments from members and affiliates. 1.1k views | last modified 4/20/2023 7:15:00 am est | yes, the organization will be. Web form 199 2018 side 1 1gross sales or receipts from other sources. Exempt organization annual statement or return:

They Are Required With Filings Received By The Registry On Or After January 1, 2022.

Web 2019 form 199 california exempt organization annual information return author: Web we impose a penalty if you do not file your organization’s form 199 by the extended due date regardless of whether you pay the fee. Web internal revenue service to request an extension to file income tax returns after the due date, use the form that applies to you. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022.

16, 2023, To File And Pay Taxes.

The penalty is $5 per month or part of a. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. The irs will grant a reasonable extension of time.