Ca Form 3853 Instructions

Ca Form 3853 Instructions - Web california resident income tax return. You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. Part iii your ssn or itin: Web 2021, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty this is only available by request. With us legal forms completing legal documents is anxiety. Web form 540 2ez, california resident income tax return; Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. Web coverage purchased through covered california or directly from insurers medicare most medicaid plans for information about other exemptions that may apply, see the. Web 3853 part i applicable household members.

With us legal forms completing legal documents is anxiety. If you and/or a member of. Web the california franchise tax board april 1 issued the 2020 instructions for form ftb 3853, health coverage exemptions and individual shared responsibility. # form ftb 3849, premium assistance subsidy # form ftb 3853,. Below, you will find detailed instructions and a sample of completed sides 1 and 3 of form 540 and a sample of side 1 and side 2 of. Go to covered california’s shop and compare tool. Web for more information, get the following new health care forms, instructions, and publications: Web 2021, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty this is only available by request. Web follow the simple instructions below: Web california resident income tax return.

Web residents of california must provide this documentation by completing form ftb 3853, a tax form that must be enclosed with your form 540,california resident income tax. Part iii your ssn or itin: Web california resident income tax return. Web 3853 part i applicable household members. You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853. What else do i need to know? Web any coverage or are claiming exemptions for the tax year, complete part iii. With us legal forms completing legal documents is anxiety. Web 2020 form 3849 instructions for premium assistance subsidy (pas) is used to compute the taxpayer’s premium assistance subsidy and reconcile it with the.

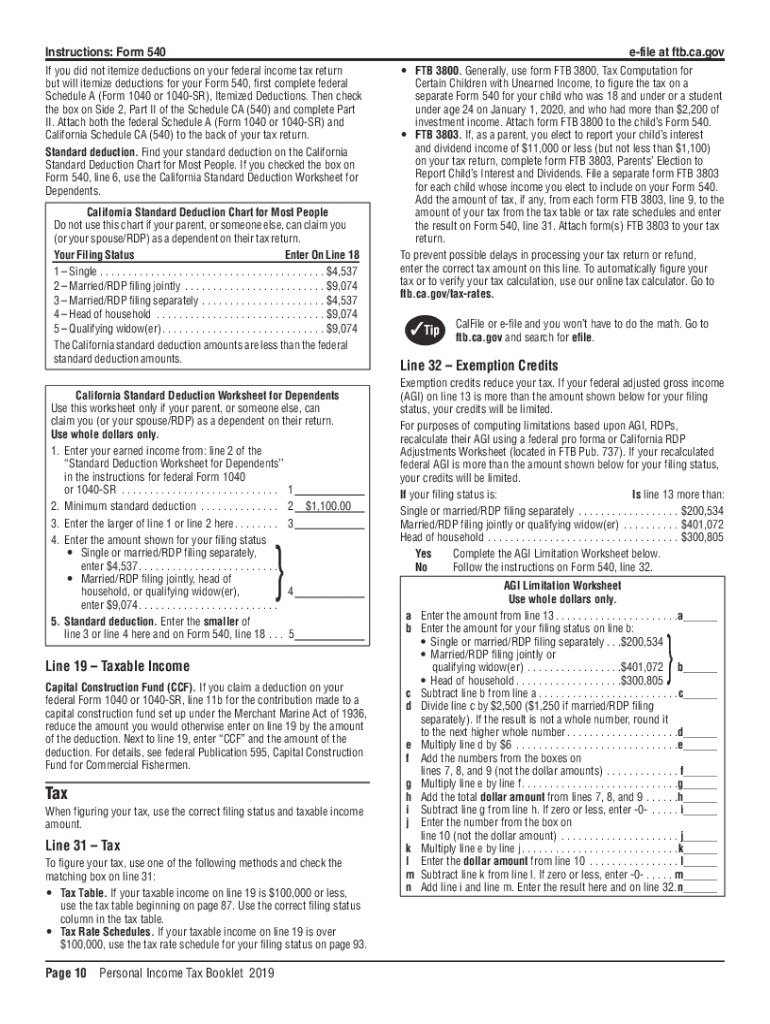

ftb 540 2020 Fill out & sign online DocHub

Web form 540 2ez, california resident income tax return; What is form ca 3853? How do you generate the ca 3853? Web see the form 3853 instructions for the available exemption codes. Coverage and exemptions claimed on your tax return for individuals.

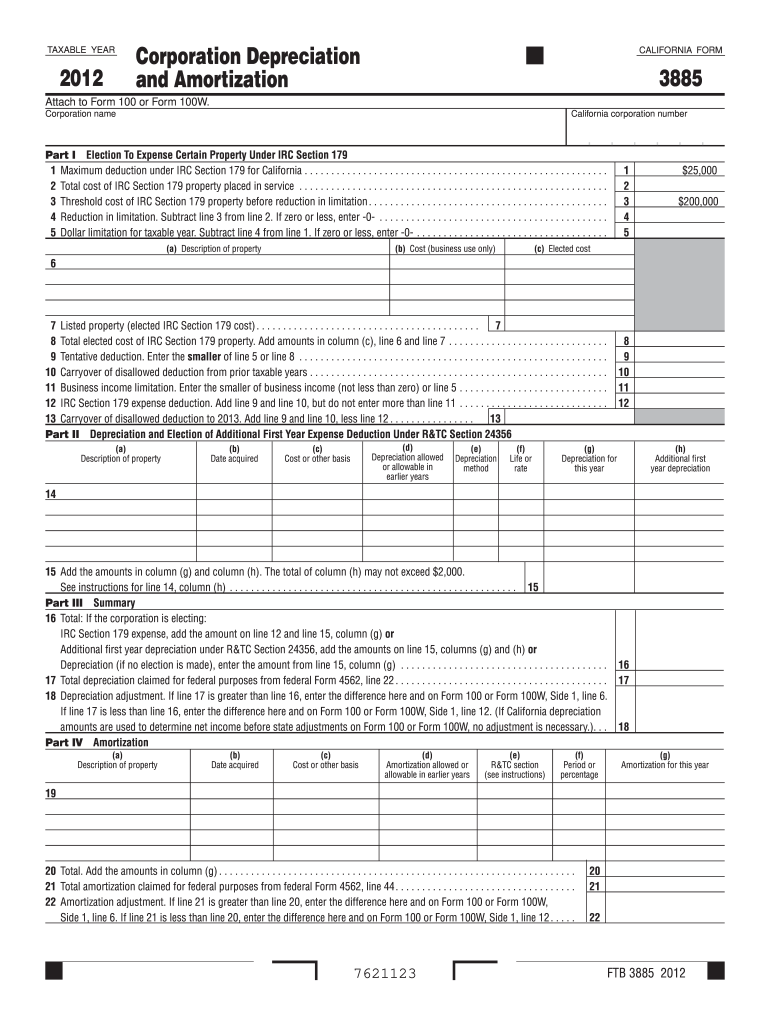

Ftb 3885 Form Fill Out and Sign Printable PDF Template signNow

If you and/or a member of. List all members of your applicable household whether or not they have an exemption or an exemption certificate number (ecn). Web how to apply to apply for an exemption, you must provide all required information and acceptable proof for you and your tax household. How do you generate the ca 3853? Web california resident.

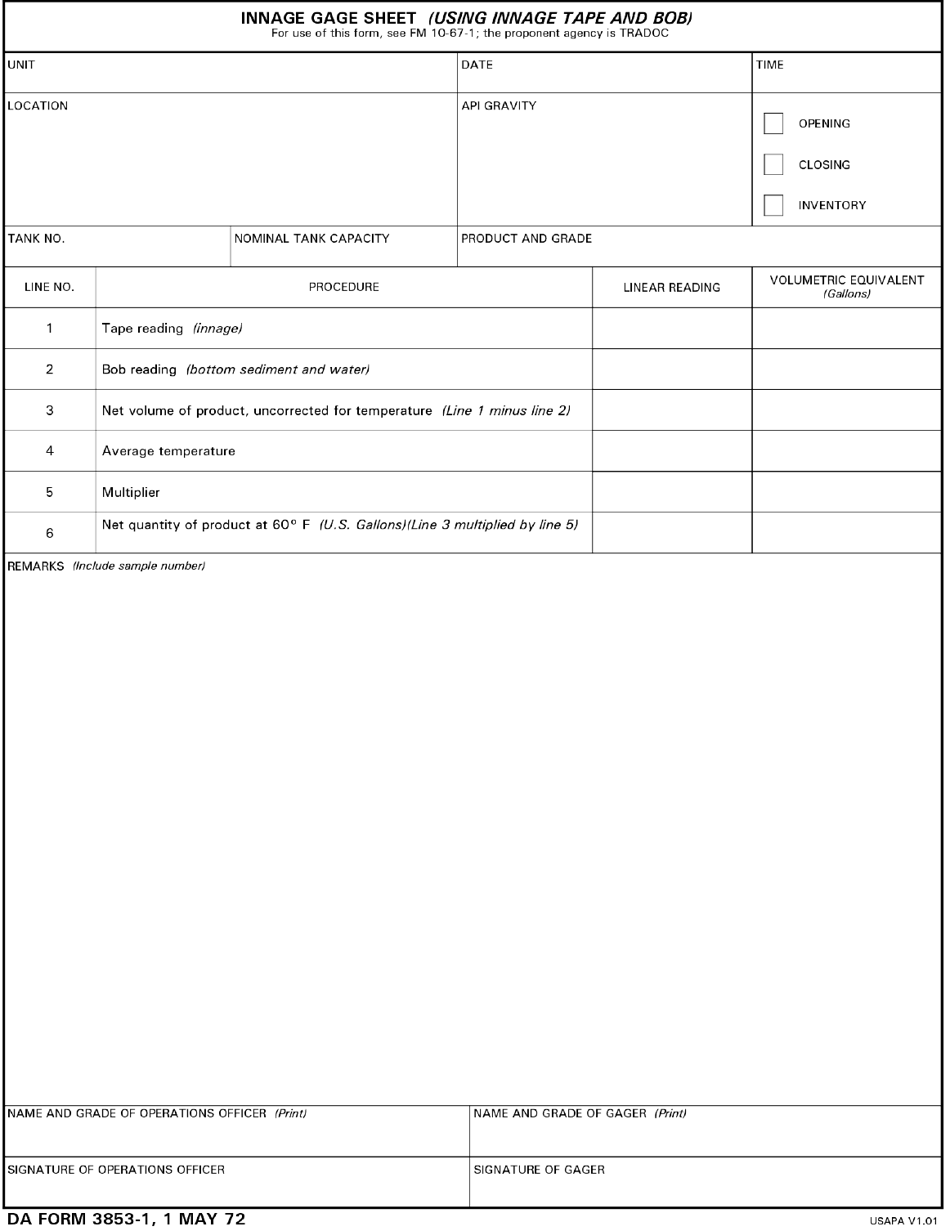

Da Form 3853 1 Related Keywords & Suggestions Da Form 3853 1 Long

Go to covered california’s shop and compare tool. Web for more information, get the following new health care forms, instructions, and publications: Web 3853 part i applicable household members. Web 2020 form 3849 instructions for premium assistance subsidy (pas) is used to compute the taxpayer’s premium assistance subsidy and reconcile it with the. Web 2021, 3853, instructions for form 3853,.

FM 10671 CHAPTER 3

Where is the input to record the time period an individual is covered by health insurance? Web 2021, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty this is only available by request. Web the california franchise tax board april 1 issued the 2020 instructions for form ftb 3853, health coverage exemptions and individual shared responsibility..

3853 Form Fill Online, Printable, Fillable, Blank pdfFiller

The days of terrifying complex legal and tax documents have ended. Select the tax year in which you need information enter your zip code (and. Web any coverage or are claiming exemptions for the tax year, complete part iii. Web residents of california must provide this documentation by completing form ftb 3853, a tax form that must be enclosed with.

Form 3853 Fill Out and Sign Printable PDF Template signNow

Web coverage purchased through covered california or directly from insurers medicare most medicaid plans for information about other exemptions that may apply, see the. Web 3853 part i applicable household members. Go to covered california’s shop and compare tool. Web how to apply to apply for an exemption, you must provide all required information and acceptable proof for you and.

رخيصة يكتب لي المنطقة مقال 7

If you and/or a member of. Web form 540 2ez, california resident income tax return; With us legal forms completing legal documents is anxiety. Web 8661203 ftb 3853 (new 2020) side 1 your name: You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853.

Ca form 100s instructions 2017

Web health care shared responsibility tax (form 3853) if anyone in the taxpayer's household was covered by health insurance from the california health insurance marketplace,. List all members of your applicable household whether or not they have an exemption or an exemption certificate number (ecn). Web the california franchise tax board april 1 issued the 2020 instructions for form ftb.

2018 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

How do you generate the ca 3853? Coverage and exemptions claimed on your tax return for individuals. What is form ca 3853? Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. If you and/or a member of.

Form 3853 1 ezvgqrk

Web 3853 part i applicable household members. Web 8661203 ftb 3853 (new 2020) side 1 your name: Web 2020 form 3849 instructions for premium assistance subsidy (pas) is used to compute the taxpayer’s premium assistance subsidy and reconcile it with the. Web form 540 2ez, california resident income tax return; This is only available by request.

Web 8661203 Ftb 3853 (New 2020) Side 1 Your Name:

Web health care shared responsibility tax (form 3853) if anyone in the taxpayer's household was covered by health insurance from the california health insurance marketplace,. Web see the form 3853 instructions for the available exemption codes. Below, you will find detailed instructions and a sample of completed sides 1 and 3 of form 540 and a sample of side 1 and side 2 of. List all members of your applicable household whether or not they have an exemption or an exemption certificate number (ecn).

Web The California Franchise Tax Board April 1 Issued The 2020 Instructions For Form Ftb 3853, Health Coverage Exemptions And Individual Shared Responsibility.

Coverage and exemptions claimed on your tax return for individuals. Web for more information, get the following new health care forms, instructions, and publications: Web thus, a nonresident will need to complete form 3853 and indicate the nonresident exemption to the penalty for the year. Web coverage purchased through covered california or directly from insurers medicare most medicaid plans for information about other exemptions that may apply, see the.

Web California Resident Income Tax Return.

Web 2020 form 3849 instructions for premium assistance subsidy (pas) is used to compute the taxpayer’s premium assistance subsidy and reconcile it with the. Select the tax year in which you need information enter your zip code (and. Go to covered california’s shop and compare tool. You do not owe the individual shared responsibility penalty and do not need to file form ftb 3853.

Web Form 540 2Ez, California Resident Income Tax Return;

What is form ca 3853? Web how to apply to apply for an exemption, you must provide all required information and acceptable proof for you and your tax household. This is only available by request. Web follow the simple instructions below: