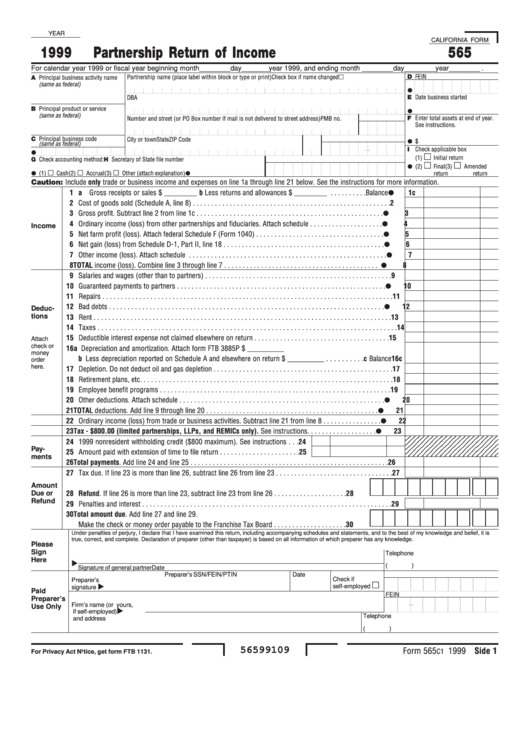

Ca Form 565

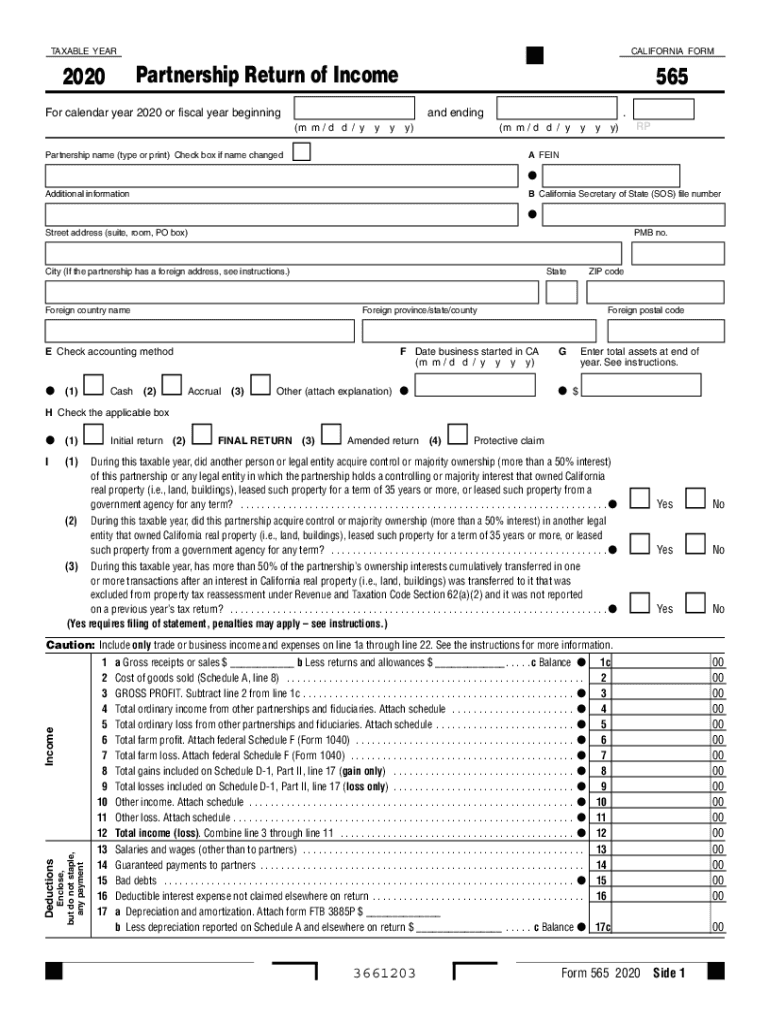

Ca Form 565 - If the due date falls on a saturday, sunday, or legal holiday, the filing date is the next business day. 2 00 3 gross profit. Or to apply for a special certificate of naturalization as a u.s. C balance • 1c 00 2 cost of goods sold (schedule a, line 8). Citizen to be recognized by a foreign country. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account. Web form 565, partnership return of income, or the instructions for federal form 1065, u.s. Cost of goods sold (schedule a, line 8). Short accounting period (15 days or less) california does not require a new limited partnership with a short accounting period of 15 days. The methods are similar to those provided in the 2020 irs form 1065 instructions.

Cost of goods sold (schedule a, line 8). Web a partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Web form 565, partnership return of income, or the instructions for federal form 1065, u.s. The methods are similar to those provided in the 2020 irs form 1065 instructions. 2 00 3 gross profit. Form 565 is due on the 15th day of the fourth month after the close of the year. For more information, see the line instructions, and get the instructions for federal schedule k. Or to apply for a special certificate of naturalization as a u.s. Gross receipts or sales $ _____ b. Web when is form 565 due?

Web form 565, partnership return of income, or the instructions for federal form 1065, u.s. Web when is form 565 due? Or to apply for a special certificate of naturalization as a u.s. Produce the contract alleged in the complaint.; 2 00 3 gross profit. Use this form to apply for a replacement naturalization certificate; Web produce all account statements issued between the dates of january 1, 2019 and july 31, 2020 for the account alleged in the complaint.; Web a partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Form 565 is due on the 15th day of the fourth month after the close of the year. C balance • 1c 00 2 cost of goods sold (schedule a, line 8).

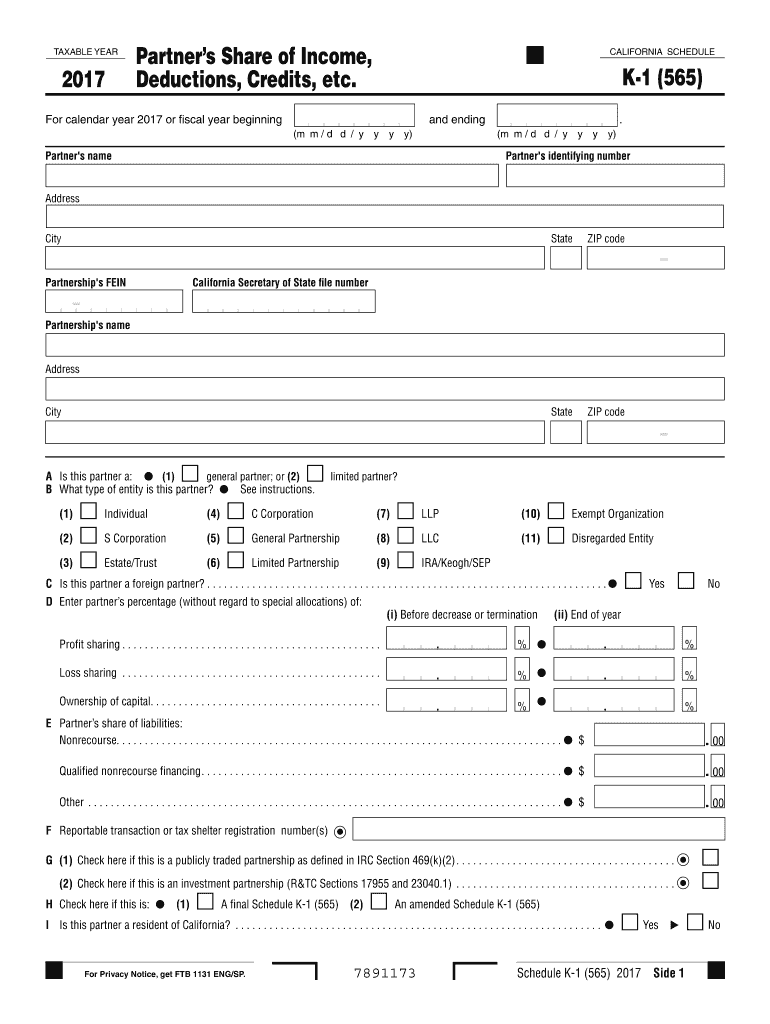

CA Schedule K1 (565) 2017 Fill out Tax Template Online US Legal Forms

If the due date falls on a saturday, sunday, or legal holiday, the filing date is the next business day. Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; Citizen to be recognized by a foreign country. C reporting information from columns (d) and (e) if the partnership.

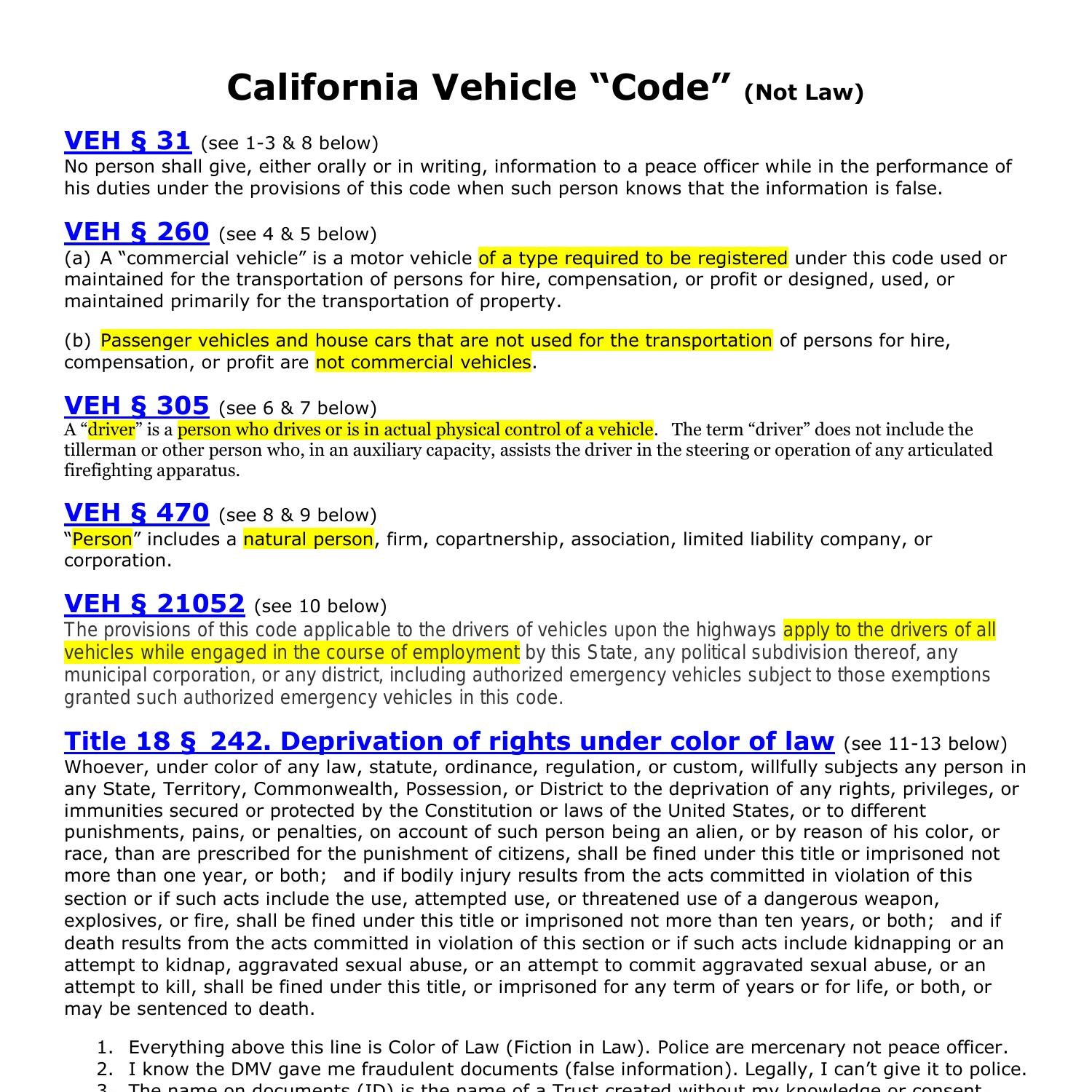

California Vehicle Code.pdf DocDroid

Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; Form 565 is due on the 15th day of the fourth month after the close of the year. Produce the contract alleged in the complaint.; C reporting information from columns (d) and (e) if the partnership derives income from.

2011 ca form 565 Fill out & sign online DocHub

Web produce all account statements issued between the dates of january 1, 2019 and july 31, 2020 for the account alleged in the complaint.; Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web form 565, partnership return of income, or the.

California Form 3538 (565) Payment Voucher For Automatic Extension

Gross receipts or sales $ _____ b. Web when is form 565 due? Allow access to and inspection and. Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; See definition of “doing business” in general information a, important information.

2020 Form CA FTB 565 Fill Online, Printable, Fillable, Blank pdfFiller

Gross receipts or sales $ _____ b. Web a partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Use this form to apply for a replacement naturalization certificate; Less returns and allowances $ _____. Short accounting period (15 days or less) california does.

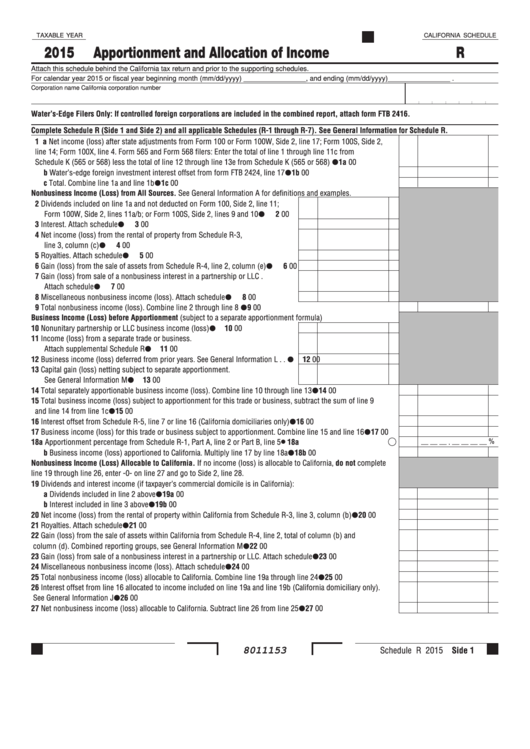

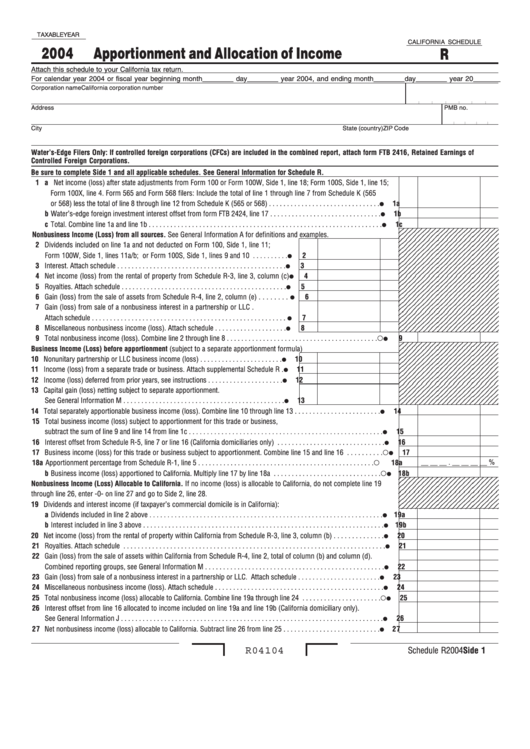

California Schedule R Apportionment And Allocation Of 2015

Cost of goods sold (schedule a, line 8). Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account. 2 00 3 gross profit. C reporting information from columns (d) and (e) if the partnership derives income from activities conducted both.

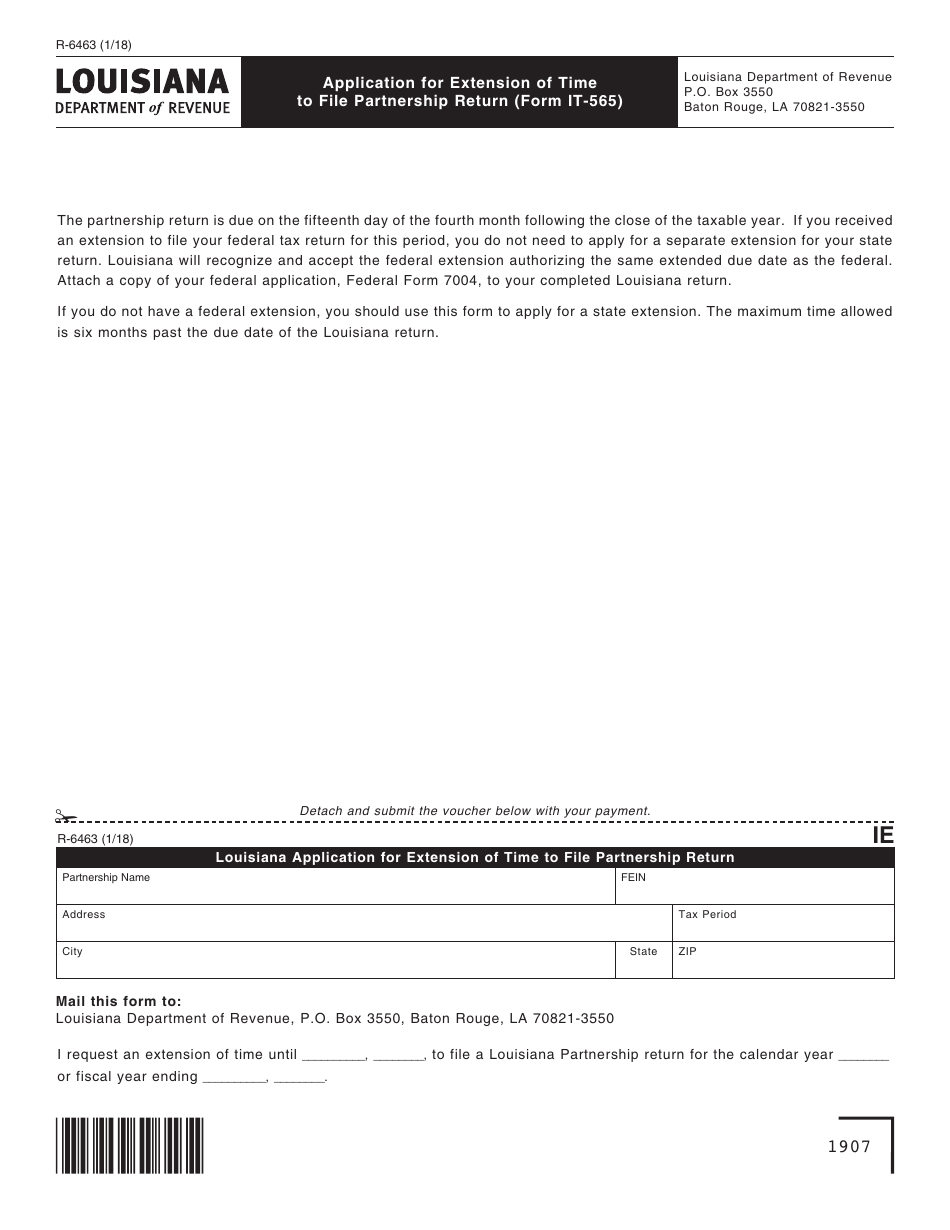

Form R6463 Download Fillable PDF or Fill Online Application for

Allow access to and inspection and. Less returns and allowances $ _____. C balance • 1c 00 2 cost of goods sold (schedule a, line 8). The methods are similar to those provided in the 2020 irs form 1065 instructions. Web form 565, partnership return of income, or the instructions for federal form 1065, u.s.

California Form 565 Partnership Return Of 1999 printable pdf

Web produce all account statements issued between the dates of january 1, 2019 and july 31, 2020 for the account alleged in the complaint.; Citizen to be recognized by a foreign country. See definition of “doing business” in general information a, important information. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and.

20202022 Form CA LLC5 Fill Online, Printable, Fillable, Blank pdfFiller

Or to apply for a special certificate of naturalization as a u.s. Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; If the due date falls on a saturday, sunday, or legal holiday, the filing date is the next business day. Produce the contract alleged in the complaint.;.

California Schedule R Apportionment And Allocation Of 2004

Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web produce all account statements issued between the dates of january 1,.

Web When Is Form 565 Due?

Gross receipts or sales $ _____ b. Produce the contract alleged in the complaint.; See definition of “doing business” in general information a, important information. Form 565 is due on the 15th day of the fourth month after the close of the year.

Web Form 565, Partnership Return Of Income, Or The Instructions For Federal Form 1065, U.s.

Or to apply for a special certificate of naturalization as a u.s. The methods are similar to those provided in the 2020 irs form 1065 instructions. Use this form to apply for a replacement naturalization certificate; Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account.

C Reporting Information From Columns (D) And (E) If The Partnership Derives Income From Activities Conducted Both Within And Outside California, The Partnership Will Complete Schedule R,

Allow access to and inspection and. For more information, see the line instructions, and get the instructions for federal schedule k. 2 00 3 gross profit. Short accounting period (15 days or less) california does not require a new limited partnership with a short accounting period of 15 days.

Web A Partnership (Including Remics Classified As Partnerships) That Engages In A Trade Or Business In California Or Has Income From A California Source Must File Form 565.

Cost of goods sold (schedule a, line 8). C balance • 1c 00 2 cost of goods sold (schedule a, line 8). Less returns and allowances $ _____. Citizen to be recognized by a foreign country.