Ca Form 593 Instructions

Ca Form 593 Instructions - Y complete and file a current tax yearform 593 and the required withholding payment along with. • provide a copy of form 593. Web how do i enter ca form 593 real estate withholding? Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: In general, for taxable years beginning on or after january 1, 2015, california law. Withholding services and compliance ms f182. Web by the 20th day of the month following the month of each installment payment: The seller is to complete. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. File your california and federal tax returns online with turbotax in minutes.

Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: Yee, chair fiona ma, cpa, member michael cohen, member this booklet contains:. Web by the 20th day of the month following the month of each installment payment: For subsequent installment payments, the buyer should file a. Complete ftb form 593 when withholding is done. File your california and federal tax returns online with turbotax in minutes. Web for withholding on installment sales, see form 593 instructions for details or visit the ftb website at ftb.ca.gov. Y complete and file a current tax yearform 593 and the required withholding payment along with. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Web see the following links for form instructions:

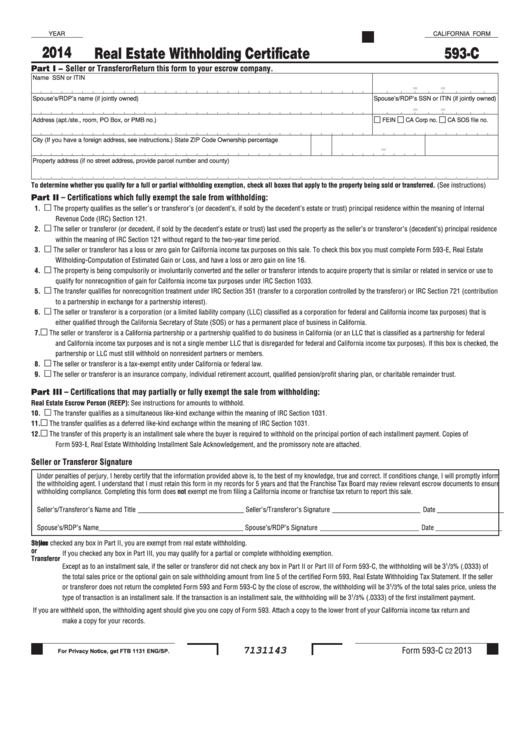

Web california forms & instructions members of the franchise tax board betty t. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. For subsequent installment payments, the buyer should file a. Web how do i enter ca form 593 real estate withholding? Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. File your california and federal tax returns online with turbotax in minutes. Yee, chair fiona ma, cpa, member michael cohen, member this booklet contains:. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to:

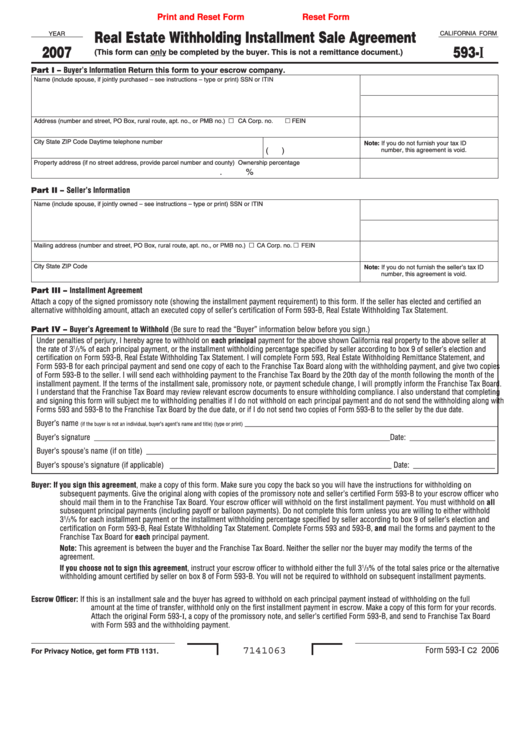

Fillable California Form 593I Real Estate Withholding Installment

Y complete and file a current tax yearform 593 and the required withholding payment along with. Complete ftb form 593 when withholding is done. Yee, chair fiona ma, cpa, member michael cohen, member this booklet contains:. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that.

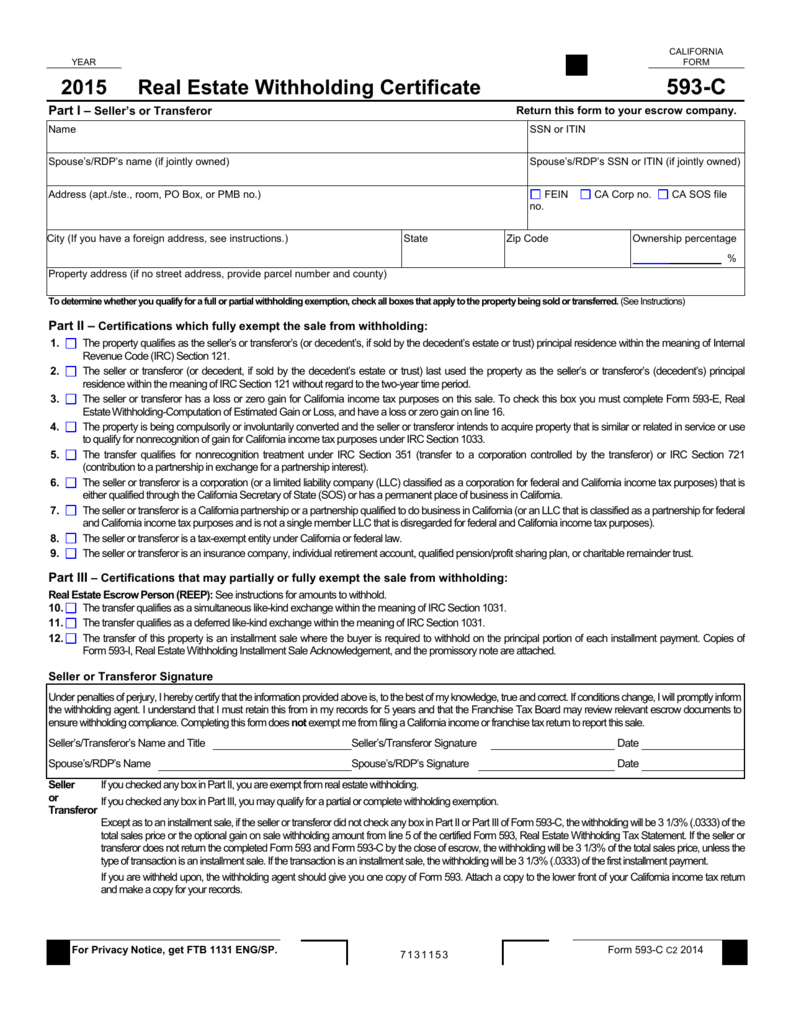

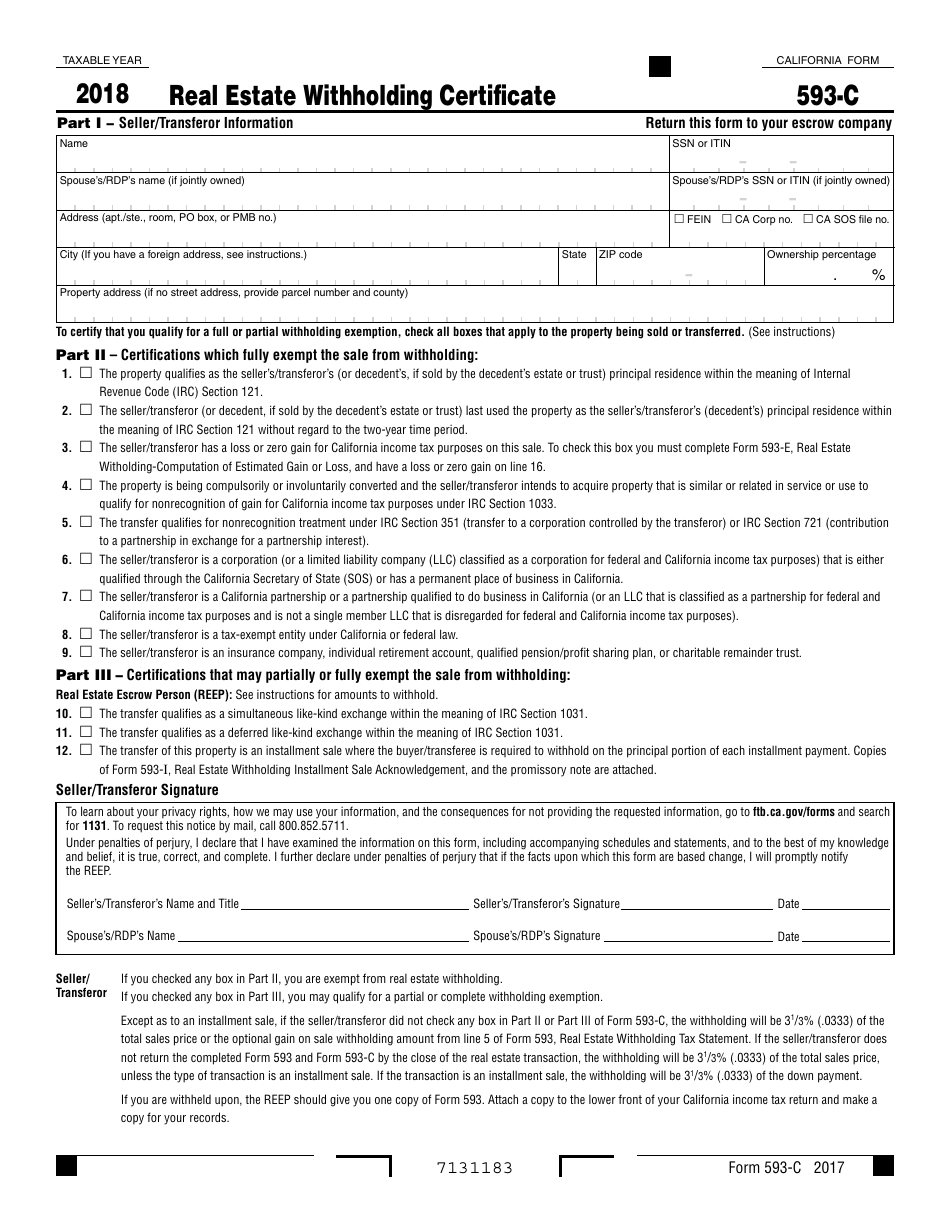

Form 593 C slidesharetrick

The seller is to complete. Withholding services and compliance ms f182. File your california and federal tax returns online with turbotax in minutes. Y complete and file a current tax yearform 593 and the required withholding payment along with. Ca form 568, limited liability.

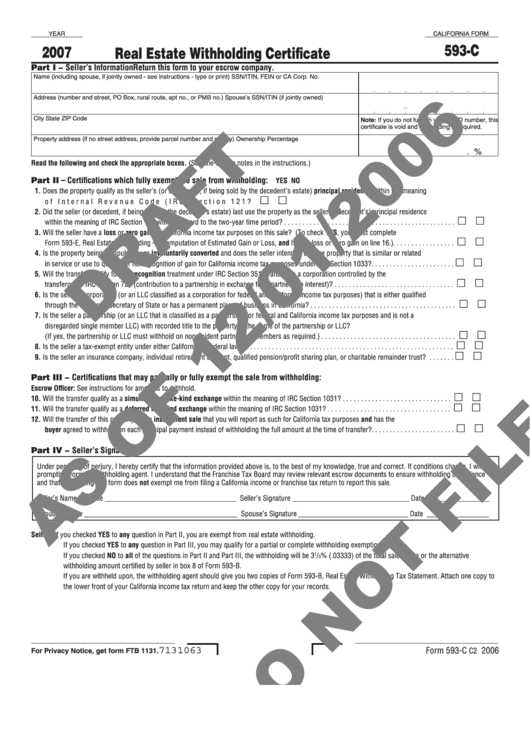

California Form 593C Draft Real Estate Withholding Certificate

Web california form 593 escrow or exchange no. Complete ftb form 593 when withholding is done. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web see the following links for form instructions: Y complete and file a current tax yearform 593 and the required withholding payment along with.

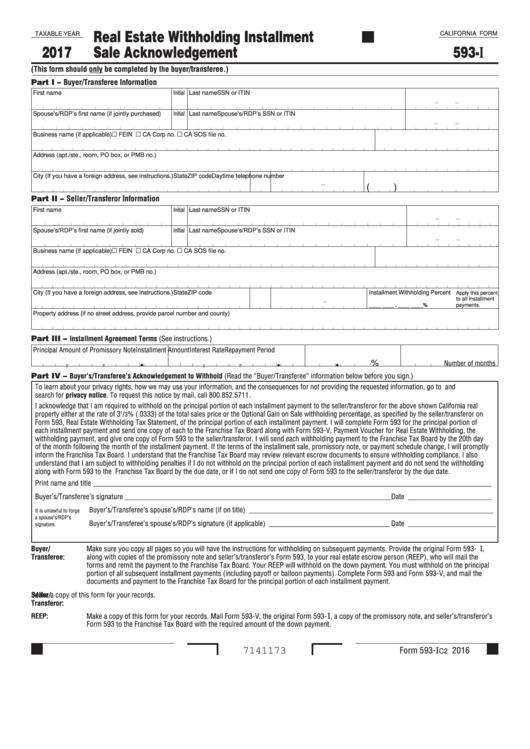

Fillable California Form 593I Real Estate Withholding Installment

Y complete and file a current tax yearform 593 and the required withholding payment along with. • provide a copy of form 593. Web 3 rows instructions for form 593; File your california and federal tax returns online with turbotax in minutes. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018,.

Form 593 C slidesharetrick

Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. Yee, chair fiona ma, cpa, member michael cohen, member this booklet contains:. Y complete and file a current tax yearform 593 and the required withholding payment along with. Web see the.

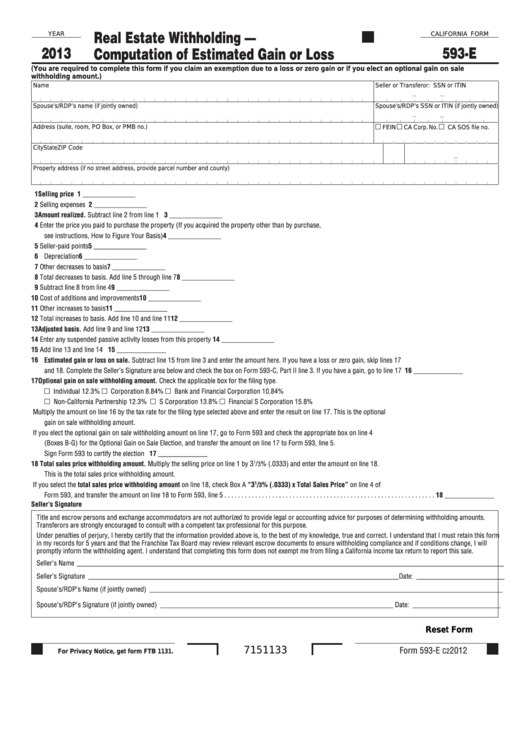

Fillable California Form 593E Real Estate Withholding Computation

Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. Web how do i enter ca form 593 real estate withholding? Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at.

form 593 instructions What Will Form 13 Instructions Be

Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. In general, for taxable years beginning on or after january 1, 2015, california law. Y complete and file a current tax yearform 593 and the required withholding payment along with. For subsequent installment payments, the.

Form 593c Download Fillable PDF or Fill Online Real Estate Withholding

File your california and federal tax returns online with turbotax in minutes. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: Y complete and file a current tax yearform 593 and the required withholding payment along with. Web for withholding on a sale, the remitter will need the original completed form 593.

Fillable California Form 593C Real Estate Withholding Certificate

_________________________ part i remitter information • reep • qualified intermediary buyer/transferee. • provide a copy of form 593. Yee, chair fiona ma, cpa, member michael cohen, member this booklet contains:. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: In general, for taxable years beginning on or after january 1, 2015, california.

CA FTB 540X 20162022 Fill out Tax Template Online US Legal Forms

Web 3 rows instructions for form 593; Yee, chair fiona ma, cpa, member michael cohen, member this booklet contains:. Web california forms & instructions members of the franchise tax board betty t. The seller is to complete. • provide a copy of form 593.

Web See The Following Links For Form Instructions:

Web california form 593 escrow or exchange no. • provide a copy of form 593. Web 3 rows instructions for form 593; • complete form 593, and verify it is accurate.

File Your California And Federal Tax Returns Online With Turbotax In Minutes.

Complete ftb form 593 when withholding is done. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web california forms & instructions members of the franchise tax board betty t. The seller is to complete.

Yee, Chair Fiona Ma, Cpa, Member Michael Cohen, Member This Booklet Contains:.

Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Withholding services and compliance ms f182. Use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to:

Ca Form 568, Limited Liability.

Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. For subsequent installment payments, the buyer should file a. In general, for taxable years beginning on or after january 1, 2015, california law.