California Tax Form 590

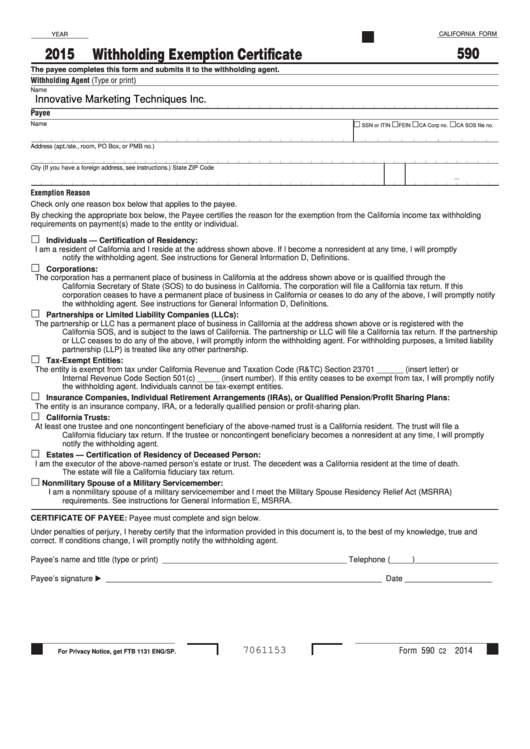

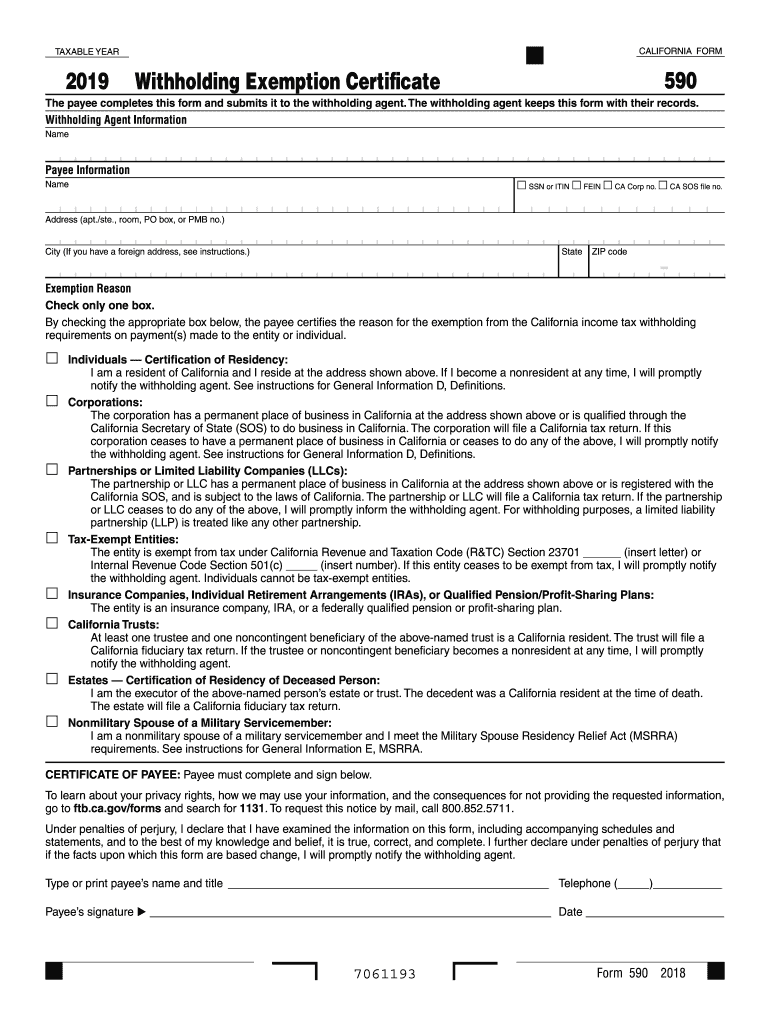

California Tax Form 590 - Individuals — certification of residency: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. Web check only one box. Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet The withholding agent keeps this form with their records. For more information, go to ftb.ca.gov and search for backup withholding. Wage withholding is administered by the california employment development department (edd). Web form 590 does not apply to payments for wages to employees. California residents or entities should complete and present form 590 to the withholding agent.

Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet Payee must complete and sign below. Form 590 does not apply to payments of backup withholding. Web check only one box. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. California residents or entities should complete and present form 590 to the withholding agent. Do not use form 590 to certify an exemption from withholding if you are a seller of california real estate. The withholding agent keeps this form with their records. Web form 590 does not apply to payments for wages to employees. For more information, go to ftb.ca.gov and search for backup withholding.

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Individuals — certification of residency: Payee’s certificate of previously reported income: Payee must complete and sign below. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Am a resident of california and i reside at the address shown above. The withholding agent keeps this form with their records. California residents or entities should complete and present form 590 to the withholding agent. Web 2022 form 590 withholding exemption certificate. Form 590 does not apply to payments of backup withholding.

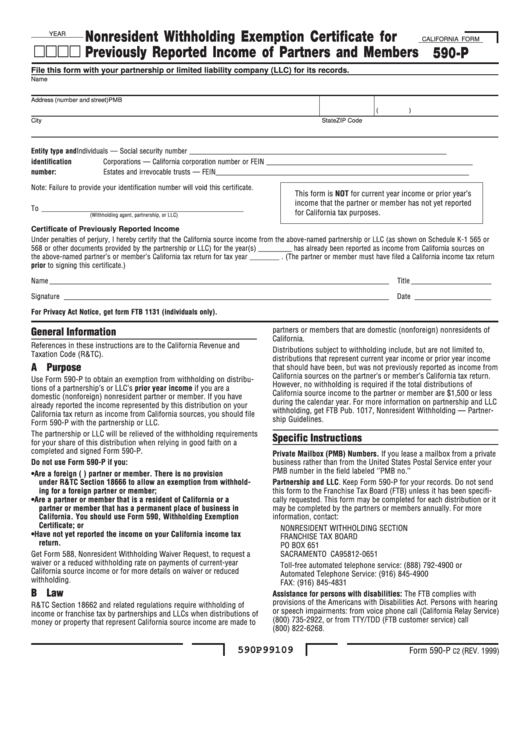

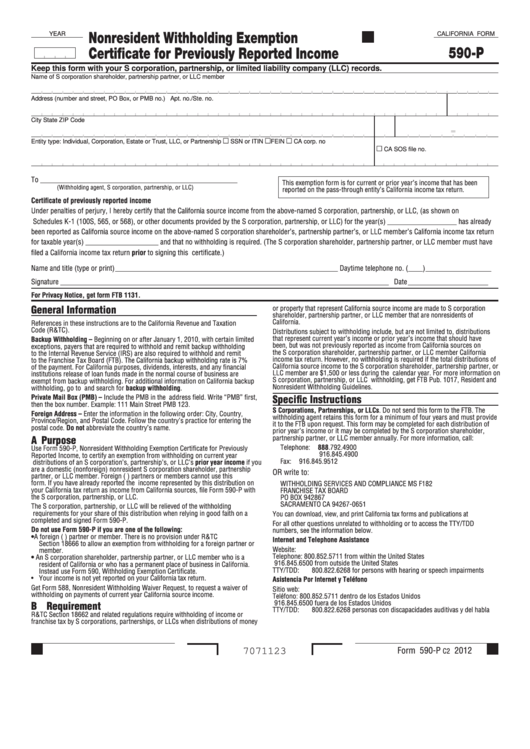

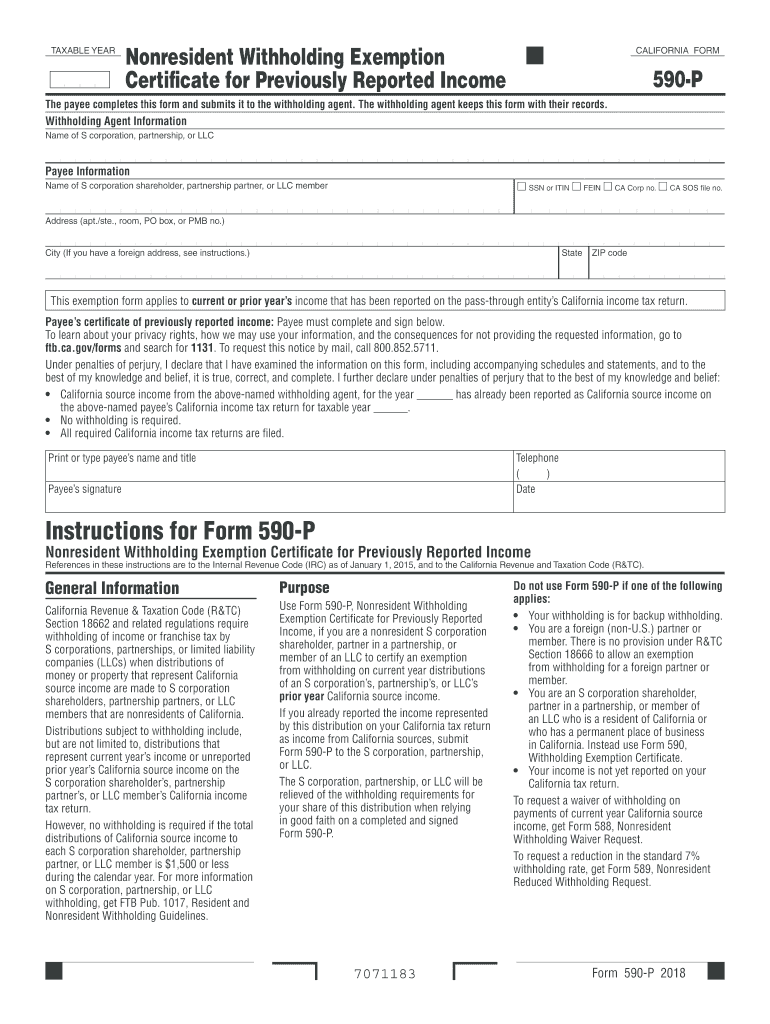

Form 590P Nonresident Withholding Exemption Certificate For

For more information, go to ftb.ca.gov and search for backup withholding. California residents or entities should complete and present form 590 to the withholding agent. Individuals — certification of residency: Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Web form 590 does.

Form 590 Withholding Exemption Certificate City Of Fill Out and Sign

Payee must complete and sign below. Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. The payee completes this form and submits it to the withholding agent. Web check only one box. By checking the appropriate box below, the payee certifies the reason.

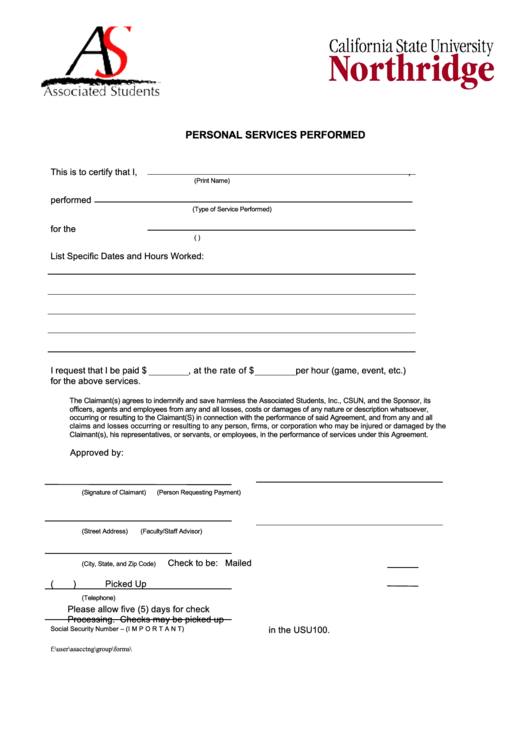

Fillable Personal Services Performed Form/california Form 590

Web form 590 does not apply to payments for wages to employees. The payee completes this form and submits it to the withholding agent. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. Payee’s certificate of previously reported income:

California Form 590 Withholding Exemption Certificate 2015

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Payee must complete and sign below. Wage withholding is administered by the california employment development department (edd). Web simplified income, payroll, sales and use tax information for you and your business California residents or entities should complete and present form 590 to the withholding agent.

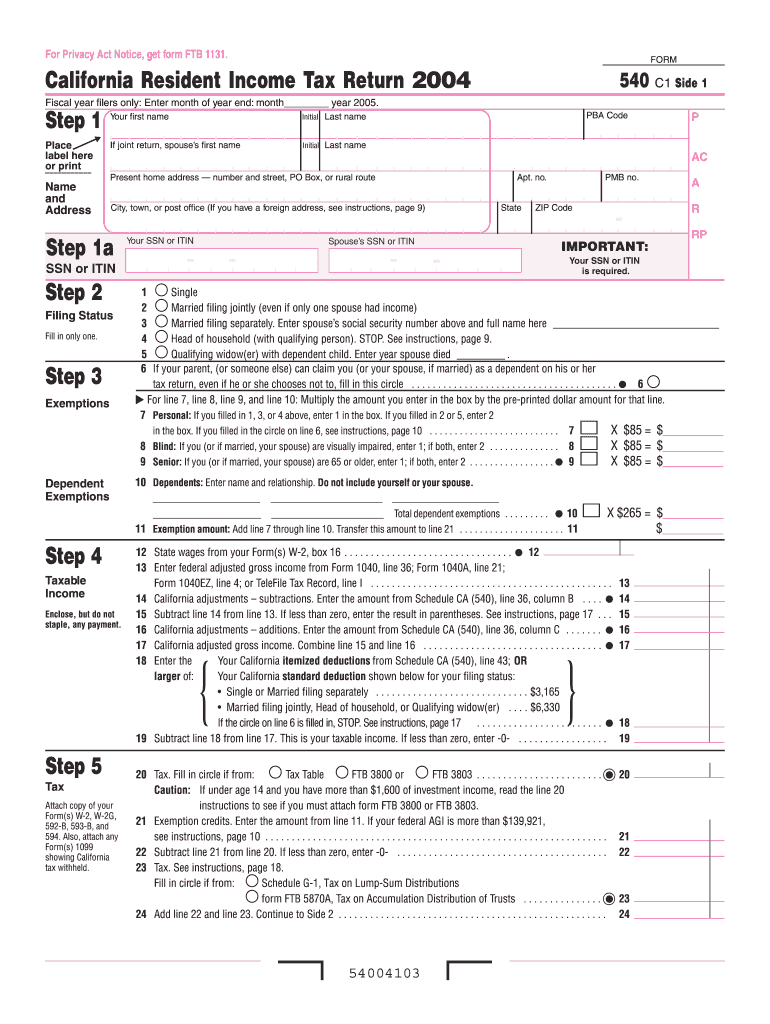

2004 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Web check only one box. California residents or entities should complete and present form 590 to the withholding agent. Web simplified income, payroll, sales and use tax information for you and your business Do.

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

Form 590 does not apply to payments of backup withholding. Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. By checking the appropriate box below,.

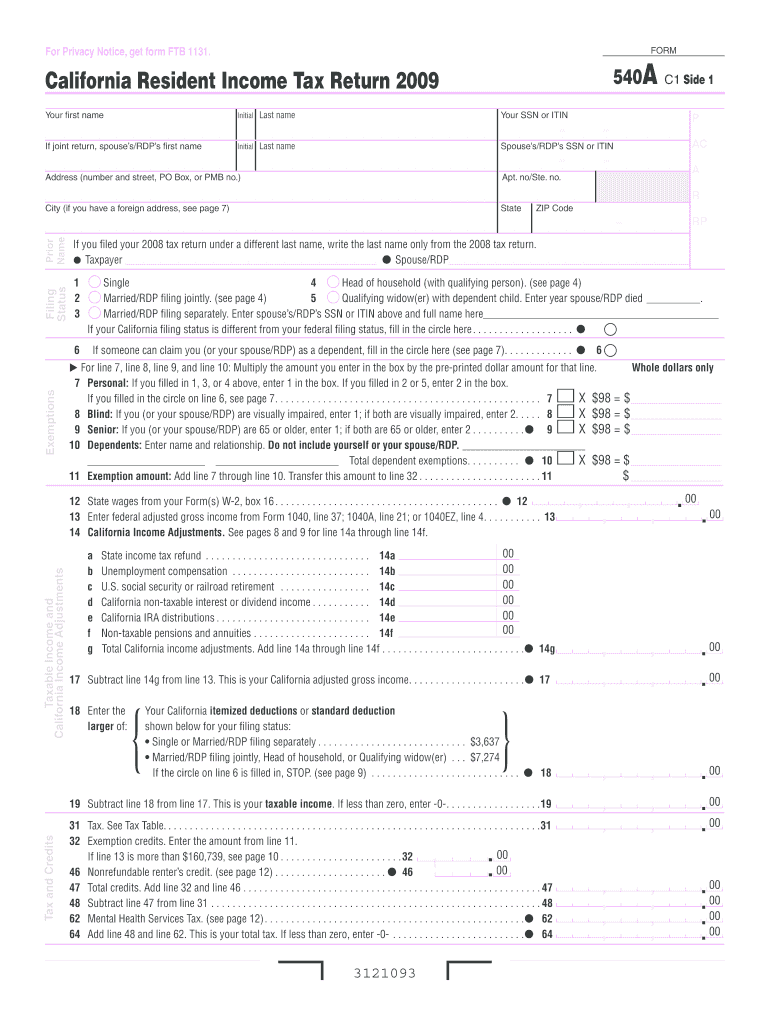

2009 Ca Tax Fill Out and Sign Printable PDF Template signNow

Am a resident of california and i reside at the address shown above. Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet Web we last updated the withholding exemption certificate in february 2023, so this is the latest version.

Fillable California Form 590P Nonresident Withholding Exemption

Payee’s certificate of previously reported income: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Wage withholding is administered by the california employment development department (edd). Web form 590 does not apply to payments for wages to employees. Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540.

Ca590 Fill Out and Sign Printable PDF Template signNow

Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet California residents or entities should complete and present form 590 to the withholding agent. Wage withholding is administered by the california employment development department (edd). Payee must complete and sign.

2019 Form CA FTB 590P Fill Online, Printable, Fillable, Blank PDFfiller

Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. Do not use form 590 to certify an exemption from withholding if you are a seller of california real estate. Web simplified income, payroll, sales and use tax information for you and your business.

By Checking The Appropriate Box Below, The Payee Certifies The Reason For The Exemption From The California Income Tax Withholding Requirements On Payment(S) Made To The Entity Or Individual.

Do not use form 590 to certify an exemption from withholding if you are a seller of california real estate. Web form 590 does not apply to payments for wages to employees. Web check only one box. For more information, go to ftb.ca.gov and search for backup withholding.

Wage Withholding Is Administered By The California Employment Development Department (Edd).

Form 590 does not apply to payments for wages to employees. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. California residents or entities should complete and present form 590 to the withholding agent.

Web Simplified Income, Payroll, Sales And Use Tax Information For You And Your Business

Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. Form 590 does not apply to payments of backup withholding. Payee must complete and sign below. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

Mail By Phone Popular Forms 540 California Resident Income Tax Return Form 540 Form 540 Booklet 540 2Ez California Resident Income Tax Return Form 540 2Ez Form 540 2Ez Booklet

The withholding agent keeps this form with their records. The payee completes this form and submits it to the withholding agent. Web 2022 form 590 withholding exemption certificate. Am a resident of california and i reside at the address shown above.