Can Federal Form 941 Be Filed Electronically

Can Federal Form 941 Be Filed Electronically - Web select federal form 941 from the list, then click edit. Those returns are processed in. Connecticut, delaware, district of columbia, georgia,. Web mailing addresses for forms 941. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers to consider filing their federal employment tax returns. Ad file irs form 941 online in minutes. Employers use this form to report income. You will have to use. Web there are two options for filing form 941:

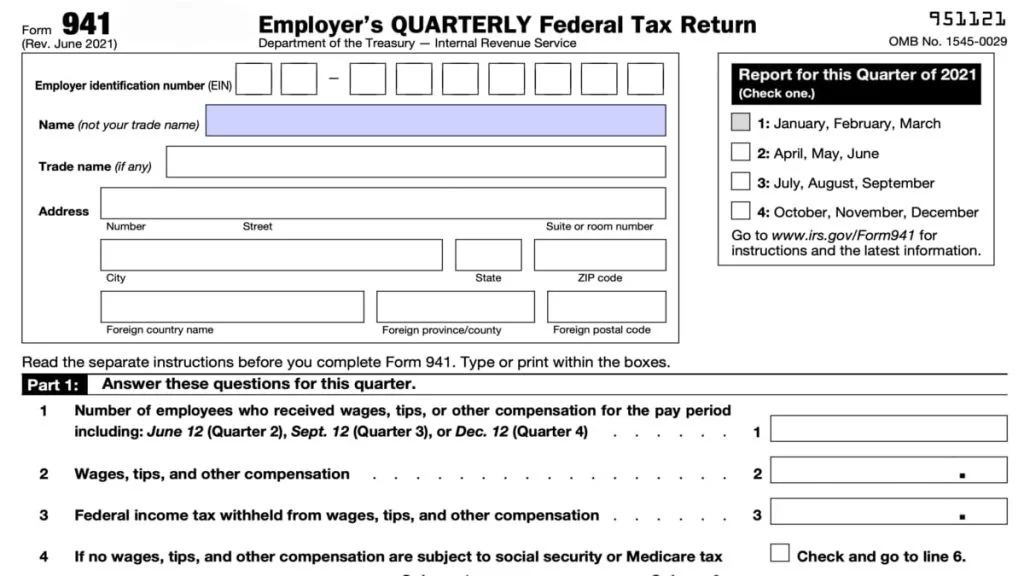

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employers use this form to report income. Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Web select federal form 941 from the list, then click edit. Those returns are processed in. However, you cannot file forms directly with the irs. Connecticut, delaware, district of columbia, georgia,. Web there are two options for filing form 941: You will have to use. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

You will have to use. Web there are two options for filing form 941: However, you cannot file forms directly with the irs. Those returns are processed in. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &. Employers use this form to report income. Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. Web eftps is ideal for making recurring payments such as estimated tax payments and federal tax deposits (ftds). Form 941 is used by employers. Web select federal form 941 from the list, then click edit.

941 Employee Federal Tax Form 2023

Web eftps is ideal for making recurring payments such as estimated tax payments and federal tax deposits (ftds). Web there are two options for filing form 941: Ad file irs form 941 online in minutes. Schedule r (form 941) is filed as an attachment to. You will have to use.

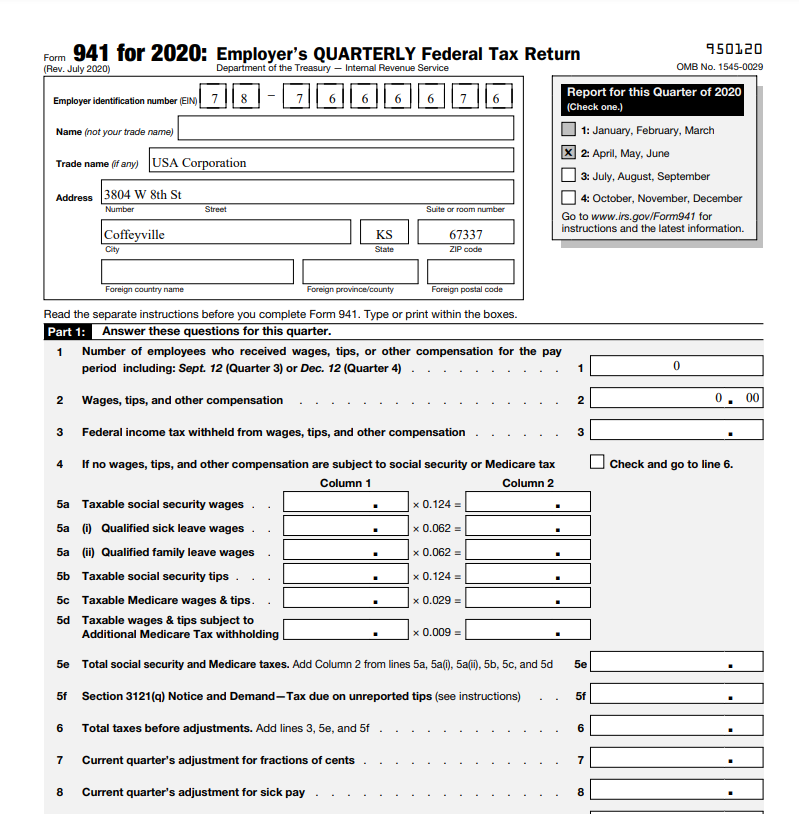

A The first quarter tax return needs to be filed for Prevosti Farms and

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web eftps is ideal for making recurring payments such as estimated tax payments and federal tax deposits (ftds). Web there are two options for filing form 941: Web select federal form 941 from.

IRS Form 941 Schedule B 2023

Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. Web select federal form 941 from the list, then click edit. Web there are two options for filing form 941: For more information about a Web eftps is ideal for making recurring payments such as.

Form 941 Employer's Quarterly Federal Tax Return Definition

Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. Web mailing addresses for forms 941. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web cpeos must generally file form 941 and.

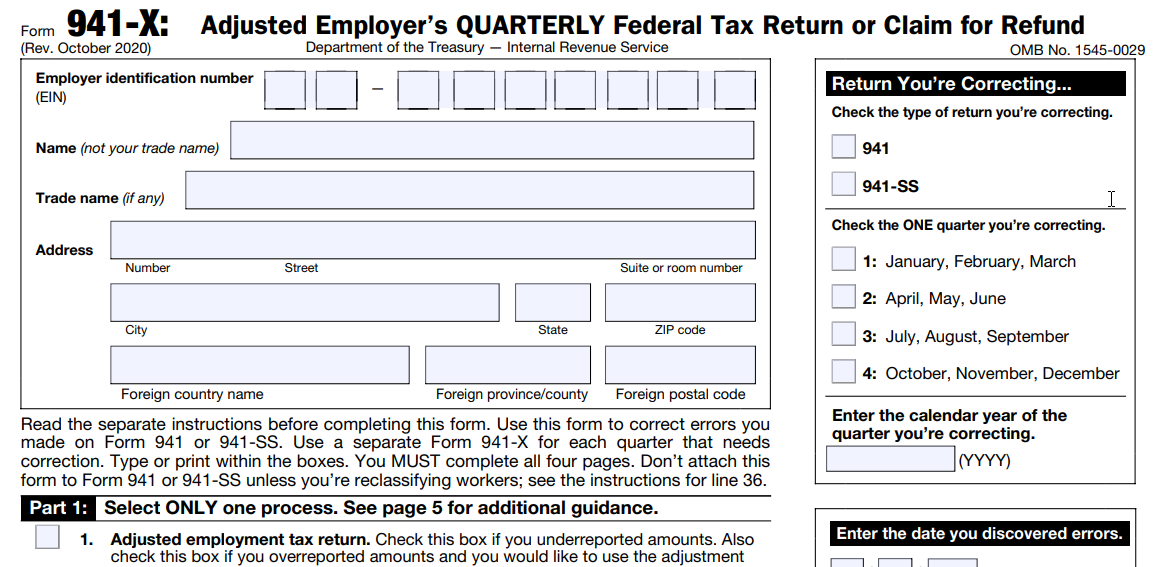

For Now, IRS Okays ESignatures On Tax Forms That Can’t Be Filed

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. You will have to use. Ad file irs form 941 online in minutes. However, you cannot file forms directly with the irs.

What is Federal Form 941 for employers? How to Download Form 941 Using

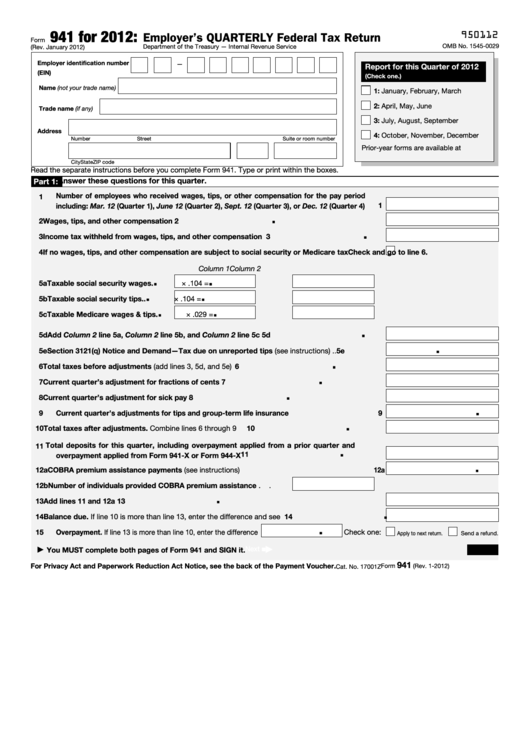

Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Those returns are processed in. Web mailing addresses for forms 941. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. 1 choose tax year & quarter 2 enter social security & medicare taxes.

How to fill out IRS Form 941 2019 PDF Expert

Web select federal form 941 from the list, then click edit. Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers to consider filing their federal employment tax returns. You will have to use. Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance.

941 Form 2023

Web mailing addresses for forms 941. Those returns are processed in. Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &. Form 941 is used by employers.

Solved Required Complete Form 941 for Prevosti Farms and

Web mailing addresses for forms 941. Yes, you can file form 941 electronically. Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web payroll tax returns.

EFile Form 941 for 2022 File 941 Electronically at 4.95

However, you cannot file forms directly with the irs. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. You will have to use. Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers,.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web (see the updated form 941 mailing addresses starting on page 3.) at the same time, the irs encourages employers to consider filing their federal employment tax returns.

Schedule R (Form 941) Is Filed As An Attachment To.

Yes, you can file form 941 electronically. Web payroll tax returns. Those returns are processed in. Employers use this form to report income.

You Will Have To Use.

Form 941 is used by employers. Web eftps is ideal for making recurring payments such as estimated tax payments and federal tax deposits (ftds). Web there are two options for filing form 941: Web march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s.

Connecticut, Delaware, District Of Columbia, Georgia,.

Ad file irs form 941 online in minutes. Web mailing addresses for forms 941. Web why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile. However, you cannot file forms directly with the irs.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)