Can I Form An Llc And Pay Rent To Myself

Can I Form An Llc And Pay Rent To Myself - Web paying yourself from a corporate llc. Instead, they must be hired on as employees, and paid a salary. Web in this guide, we’ll show you how to pay yourself from an llc, including your options, how to choose the right one for you and how to facilitate payments to stay on top of taxes. That $1,000 per month is not a deduction on your personal return and is instead rental income on your llc. Web first and foremost, you cannot rent your llc to a disregarded entity. Web you may want to formalize the lease agreement between the llc and yourself by putting it into a written lease. If you don’t have enough expenses to offset that rental income then you just created phantom taxable income. Here are some things small business owners should keep in mind when it comes to deducting rental expenses: A disregarded entity is an llc that does not file its own tax return. Web your llc structure determines how you pay yourself.

That $1,000 per month is not a deduction on your personal return and is instead rental income on your llc. Web your llc structure determines how you pay yourself. Web in this guide, we’ll show you how to pay yourself from an llc, including your options, how to choose the right one for you and how to facilitate payments to stay on top of taxes. Typically, rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business. Instead, they must be hired on as employees, and paid a salary. In other cases, it’s foolish. If you don’t have enough expenses to offset that rental income then you just created phantom taxable income. Shareholders (llc members) in either an s corporation or a c corporation can’t be paid in draws. After that salary, they may take an extra percentage of the corporation’s income in the form of dividends. Instead, partners collect income in different ways depending on how the llc functions.

Web first and foremost, you cannot rent your llc to a disregarded entity. So if you are going to buy a house with an llc and rent it to yourself, you need to. There also may be restrictions on how much you can charge your llc for rent without undesirable tax consequences, so you should consult a. In some cases, it’s wise to rent from an llc that you set up for your property. Web you may want to formalize the lease agreement between the llc and yourself by putting it into a written lease. If you don’t have enough expenses to offset that rental income then you just created phantom taxable income. Web let’s say you want to put your home in an llc and rent the home to yourself for $1,000 per month. That $1,000 per month is not a deduction on your personal return and is instead rental income on your llc. Instead, partners collect income in different ways depending on how the llc functions. Web as an owner of a limited liability company, known as an llc, you'll generally pay yourself through an owner's draw.

YOU can form an LLC to start doing business in Michigan in 3 easy steps

After that salary, they may take an extra percentage of the corporation’s income in the form of dividends. So if you are going to buy a house with an llc and rent it to yourself, you need to. Web this website states: Web rent is any amount paid for the use of property that a small business doesn't own. This.

How Does an LLC Pay Taxes? LLC WISDOM

Web let’s say you want to put your home in an llc and rent the home to yourself for $1,000 per month. This method of payment essentially transfers a portion of the business's. Web rent is any amount paid for the use of property that a small business doesn't own. In other cases, it’s foolish. Instead, they must be hired.

Should I Pay Myself a Salary or Dividends? Cookco

Here are some things small business owners should keep in mind when it comes to deducting rental expenses: So if you are going to buy a house with an llc and rent it to yourself, you need to. Web the technical answer is, yes, you can rent from your own llc. After that salary, they may take an extra percentage.

Can I Pay Myself as an Employee as the Owner of an LLC?

Web you may want to formalize the lease agreement between the llc and yourself by putting it into a written lease. Web rent is any amount paid for the use of property that a small business doesn't own. Web as an owner of a limited liability company, known as an llc, you'll generally pay yourself through an owner's draw. After.

Tenant said he couldn't pay rent this month. I let myself into his

Shareholders (llc members) in either an s corporation or a c corporation can’t be paid in draws. After that salary, they may take an extra percentage of the corporation’s income in the form of dividends. Web first and foremost, you cannot rent your llc to a disregarded entity. Typically, rent can be deducted as a business expense when the rent.

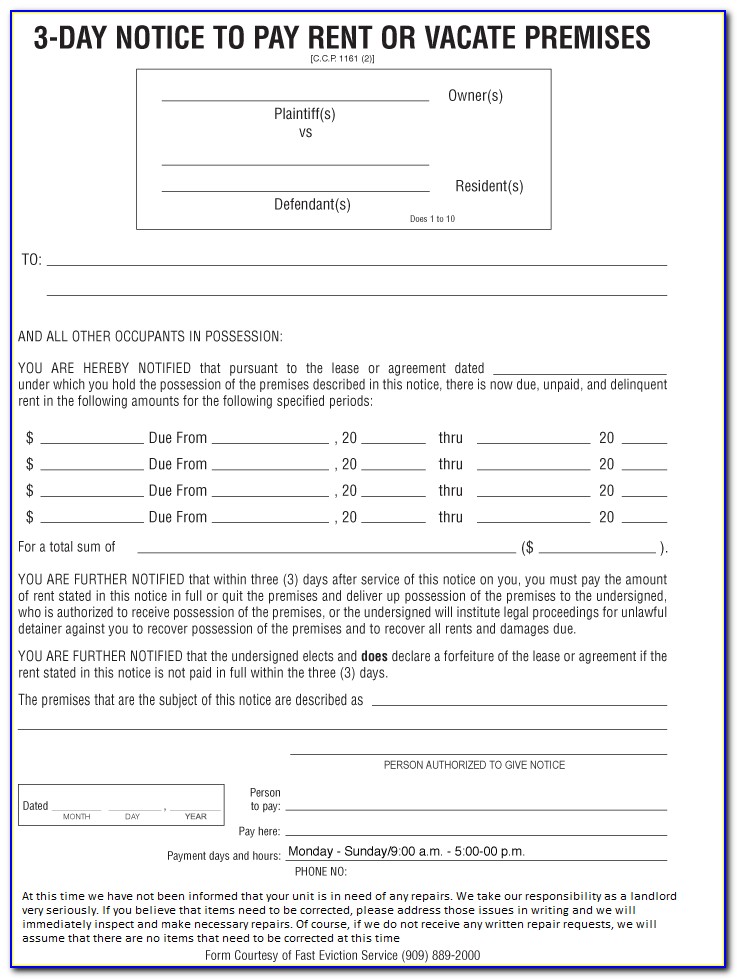

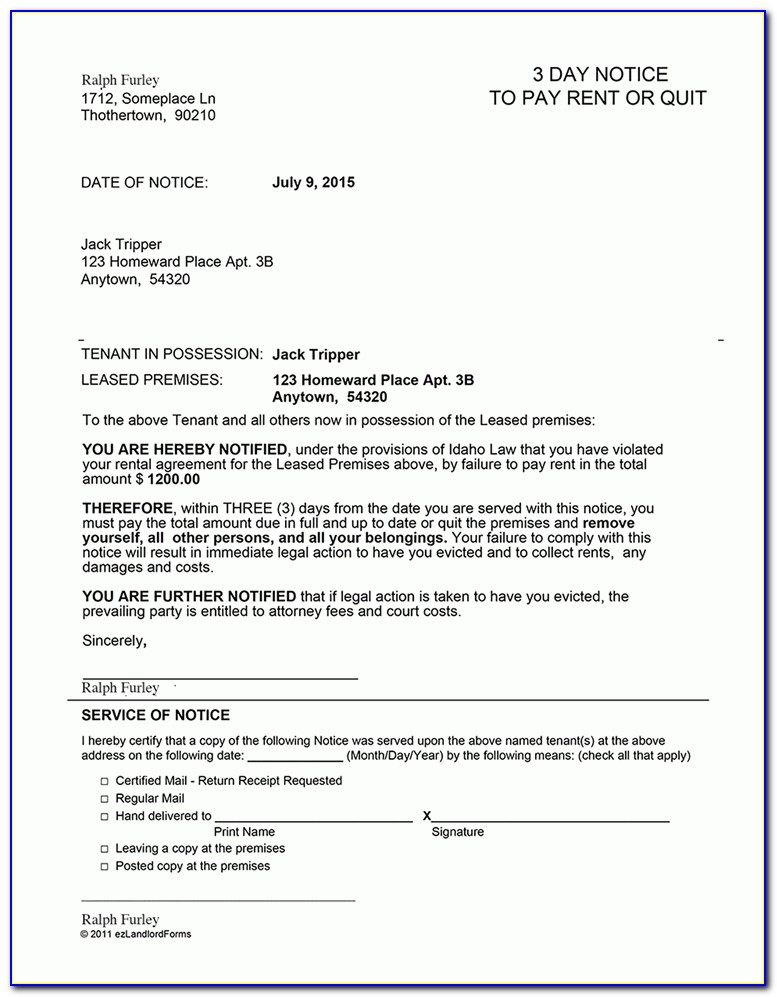

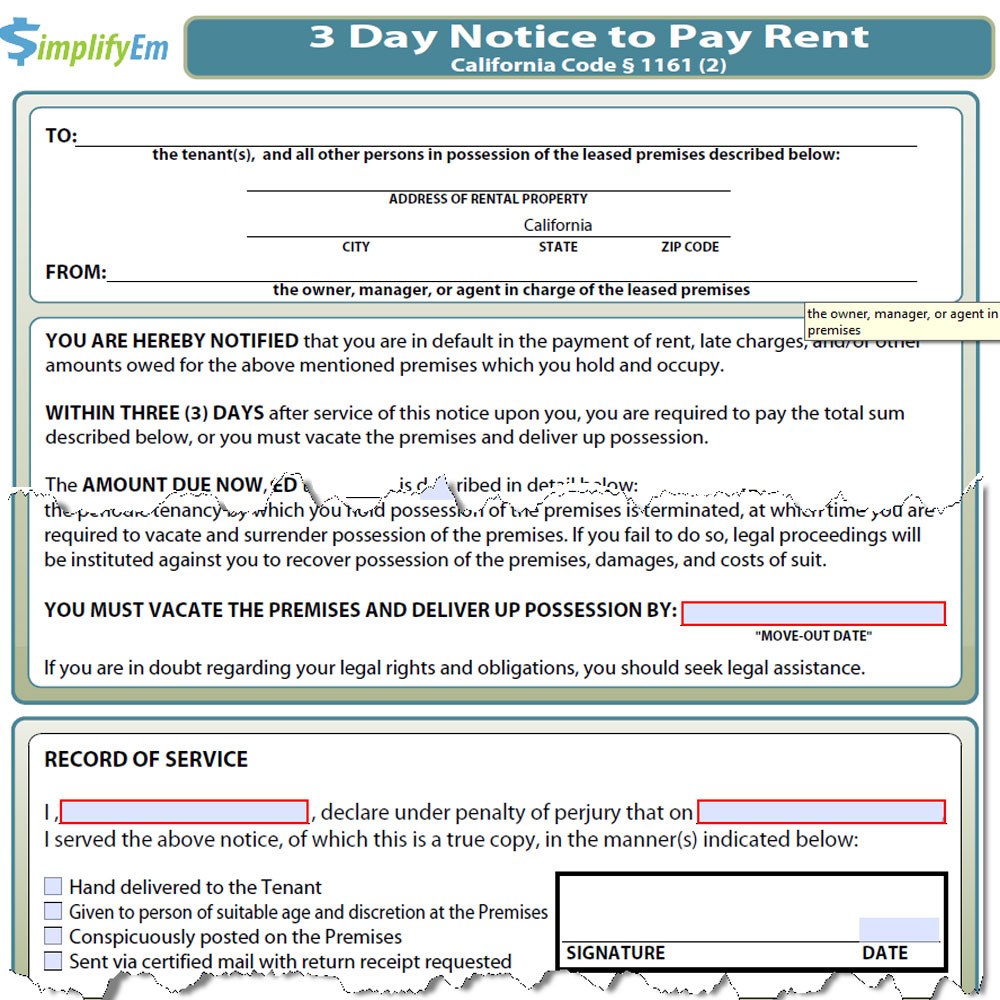

Three Day Notice To Pay Rent Or Quit Form California

That $1,000 per month is not a deduction on your personal return and is instead rental income on your llc. So if you are going to buy a house with an llc and rent it to yourself, you need to. A disregarded entity is an llc that does not file its own tax return. Web in this guide, we’ll show.

3 Day Pay Rent Or Quit Notice Form California

Web you may want to formalize the lease agreement between the llc and yourself by putting it into a written lease. Web rent is any amount paid for the use of property that a small business doesn't own. There also may be restrictions on how much you can charge your llc for rent without undesirable tax consequences, so you should.

Fractal Realty LLC Home

There also may be restrictions on how much you can charge your llc for rent without undesirable tax consequences, so you should consult a. Web let’s say you want to put your home in an llc and rent the home to yourself for $1,000 per month. Web as an owner of a limited liability company, known as an llc, you'll.

How Do I Pay Myself in a SingleMember LLC? All Up In Yo' Business

Web as an owner of a limited liability company, known as an llc, you'll generally pay yourself through an owner's draw. After that salary, they may take an extra percentage of the corporation’s income in the form of dividends. Web rent is any amount paid for the use of property that a small business doesn't own. Web first and foremost,.

Notice to Pay Rent

Typically, rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business. In some cases, it’s wise to rent from an llc that you set up for your property. Web as an owner of a limited liability company, known as an llc, you'll generally pay yourself through an owner's draw. Web.

Web First And Foremost, You Cannot Rent Your Llc To A Disregarded Entity.

Web your llc structure determines how you pay yourself. That $1,000 per month is not a deduction on your personal return and is instead rental income on your llc. Web the technical answer is, yes, you can rent from your own llc. A disregarded entity is an llc that does not file its own tax return.

Instead, Partners Collect Income In Different Ways Depending On How The Llc Functions.

If you don’t have enough expenses to offset that rental income then you just created phantom taxable income. Web paying yourself from a corporate llc. After that salary, they may take an extra percentage of the corporation’s income in the form of dividends. Web this website states:

In Other Cases, It’s Foolish.

In some cases, it’s wise to rent from an llc that you set up for your property. Web you may want to formalize the lease agreement between the llc and yourself by putting it into a written lease. This method of payment essentially transfers a portion of the business's. Web let’s say you want to put your home in an llc and rent the home to yourself for $1,000 per month.

Web Rent Is Any Amount Paid For The Use Of Property That A Small Business Doesn't Own.

So if you are going to buy a house with an llc and rent it to yourself, you need to. Here are some things small business owners should keep in mind when it comes to deducting rental expenses: Instead, they must be hired on as employees, and paid a salary. Web in this guide, we’ll show you how to pay yourself from an llc, including your options, how to choose the right one for you and how to facilitate payments to stay on top of taxes.