Can You File An Extension For Form 990

Can You File An Extension For Form 990 - Web file a separate form 8868 for each return for which you are requesting an automatic extension of time to file. If you’re overwhelmed and need more time to file your return, you have the option to file an extension using. How to create and file form 8868 (request for extension of time to file irs 990/990. For more information, see form 8868 and its. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Each request must be for a single organization and. Web requests for extension: This extension will apply only to the specific return. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Web what does it mean to file for an extension?

Web how do i file an extension for a 990 return? And will that extension request automatically extend to my state filing deadline? Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. How to create and file form 8868 (request for extension of time to file irs 990/990. If you’re overwhelmed and need more time to file your return, you have the option to file an extension using. Batch extensions while this article explains how to create extensions for individual clients, you have the. For more information, see form 8868 and its. Web what does it mean to file for an extension? Web the rules, among other things: Can i use the 990 online to rquest an extension?

Web what does it mean to file for an extension? You can always file for an extension. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. Log into your tax990 account. Web the rules, among other things: Web file a separate form 8868 for each return for which you are requesting an automatic extension of time to file. Batch extensions while this article explains how to create extensions for individual clients, you have the. Can i use the 990 online to rquest an extension? For more information, see form 8868 and its. Web requests for extension:

LastMinute Tax Advice for 2021 Wow Gallery eBaum's World

Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Web file a separate form 8868 for each return for which you are requesting an automatic extension of time to file. How to create and file form 8868 (request for extension of time to file irs 990/990. Web.

File Form 990 Online Efile 990 990 Filing Deadline 2021

Batch extensions while this article explains how to create extensions for individual clients, you have the. You can always file for an extension. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Each request must be for a single organization and. How to create and file form 8868 (request for.

Oh [Bleep]! I Need to File a Form 990 Extension! File 990

You can always file for an extension. And will that extension request automatically extend to my state filing deadline? Can i use the 990 online to rquest an extension? Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. Taxpayers can file form 4868 by mail, but.

form 990 extension due date 2020 Fill Online, Printable, Fillable

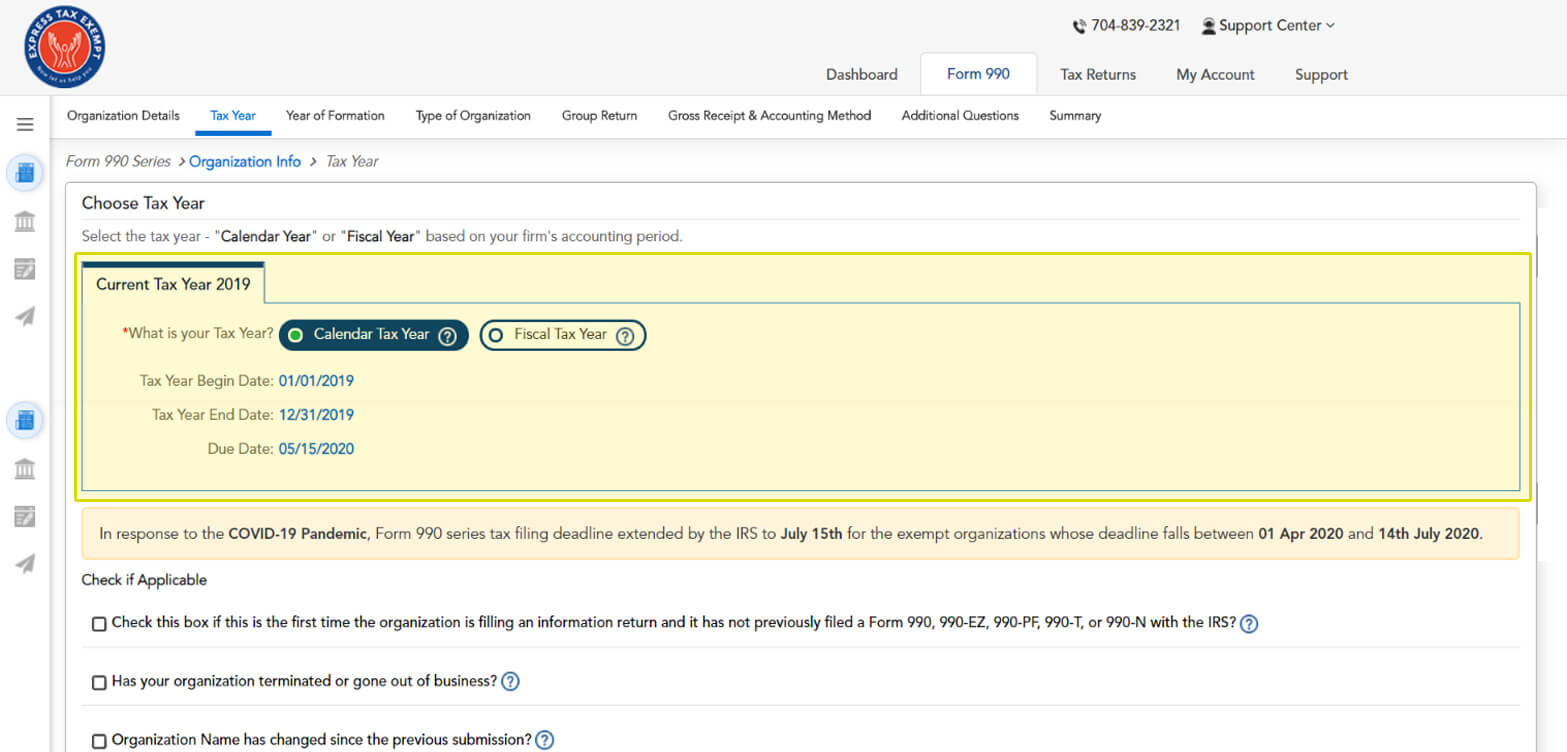

Log into your tax990 account. Web if you need more time to file your form 990, your nonprofit can file an extension request with form 8868. And will that extension request automatically extend to my state filing deadline? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Can i use.

Don’t to File Form 990 Charity Lawyer Blog Nonprofit Law

Web what does it mean to file for an extension? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you need more time to file your form 990, your nonprofit can file an extension request with form 8868. This extension will apply only to the specific return. Each.

IRS Form 990 You Can Do This Secure Nonprofit Tax Efiling 990EZ

Web there are several ways to submit form 4868. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web how do i file an extension for a 990 return? Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms,.

How to Keep Your TaxExempt Status by Filing IRS Form 990

Web the rules, among other things: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web can any officer file the extension request? For more information, see form 8868 and its. Filing an extension only extends the time to file your return and does not extend the time to pay.

How to File A LastMinute 990 Extension With Form 8868

Web how do i file an extension for a 990 return? Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. How to create and file form 8868 (request for extension of time to file irs 990/990. And will that extension request automatically extend to my state filing.

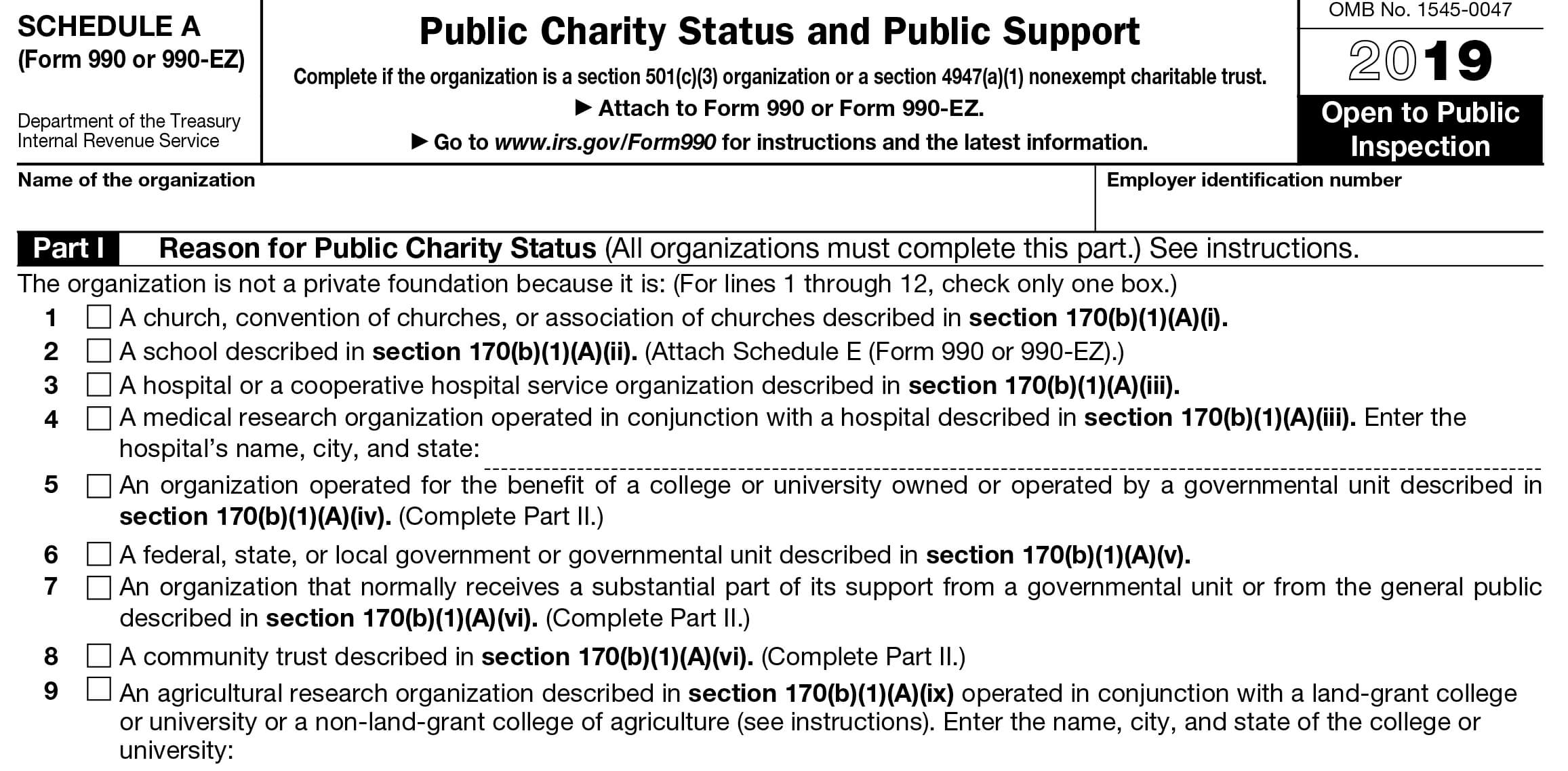

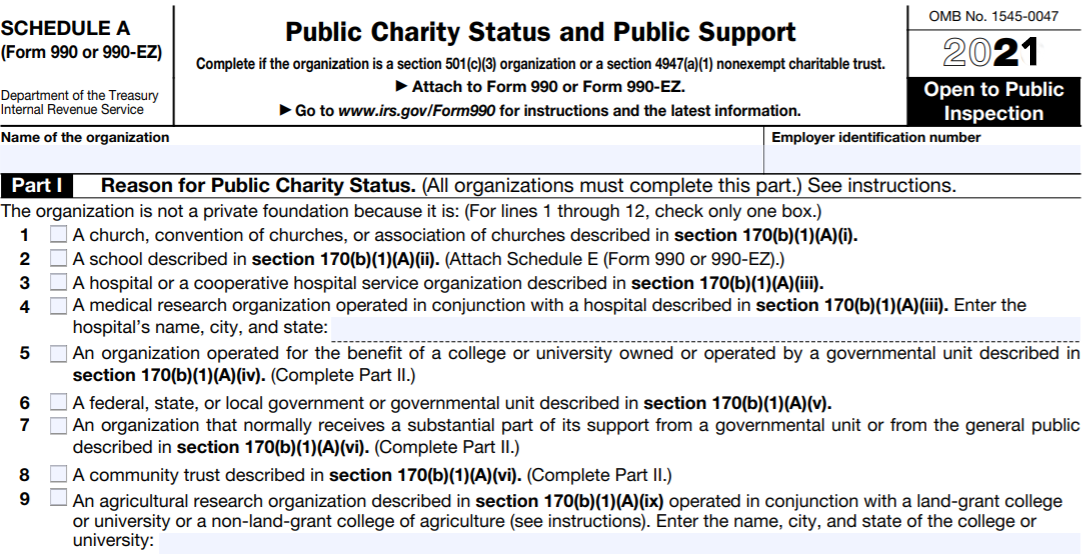

IRS Form 990 Schedules

Web can any officer file the extension request? Web file a separate form 8868 for each return for which you are requesting an automatic extension of time to file. Web here is how you can file your extension form 8868 using tax990: Batch extensions while this article explains how to create extensions for individual clients, you have the. On the.

IRS Form 990 Schedules

Web can any officer file the extension request? You can always file for an extension. Each request must be for a single organization and. Web file a separate form 8868 for each return for which you are requesting an automatic extension of time to file. Web information about form 8868, application for extension of time to file an exempt organization.

For More Information, See Form 8868 And Its.

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions. Web requests for extension: Web can any officer file the extension request? Each request must be for a single organization and.

Web How Do I File An Extension For A 990 Return?

When is form 990 due with extension form 8868? And will that extension request automatically extend to my state filing deadline? Web there are several ways to submit form 4868. Can i use the 990 online to rquest an extension?

If You’re Overwhelmed And Need More Time To File Your Return, You Have The Option To File An Extension Using.

How to create and file form 8868 (request for extension of time to file irs 990/990. Log into your tax990 account. Web the rules, among other things: Web file a separate form 8868 for each return for which you are requesting an automatic extension of time to file.

Batch Extensions While This Article Explains How To Create Extensions For Individual Clients, You Have The.

Web what does it mean to file for an extension? On the dashboard, click on the start return button. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. You can always file for an extension.

![Oh [Bleep]! I Need to File a Form 990 Extension! File 990](https://www.file990.org/hubfs/Imported_Blog_Media/I-Need-to-File-a-Form-990-Extension-1.jpg)