Capital Improvement Form Nj

Capital Improvement Form Nj - Web in a capital improvement to real property. Web instructions to the property owner: Web capital program capital program documents are used by the new jersey department of transportation to allocate funds. Charges for installation that result in an exempt capital improvement are not taxable as long as the property owner gives the contractor a completed new jersey. Certain landscaping services, carpet and. A capital improvement to real property is defined in section 1101 (b)(9) of the tax law and sales tax regulation section. New jersey sales taxes do not treat all work on your. Do not send this form to the division of taxation. Web capital improvement means an installation of tangible personal property that increases the capital value or useful life of the real property (land or buildings). In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they.

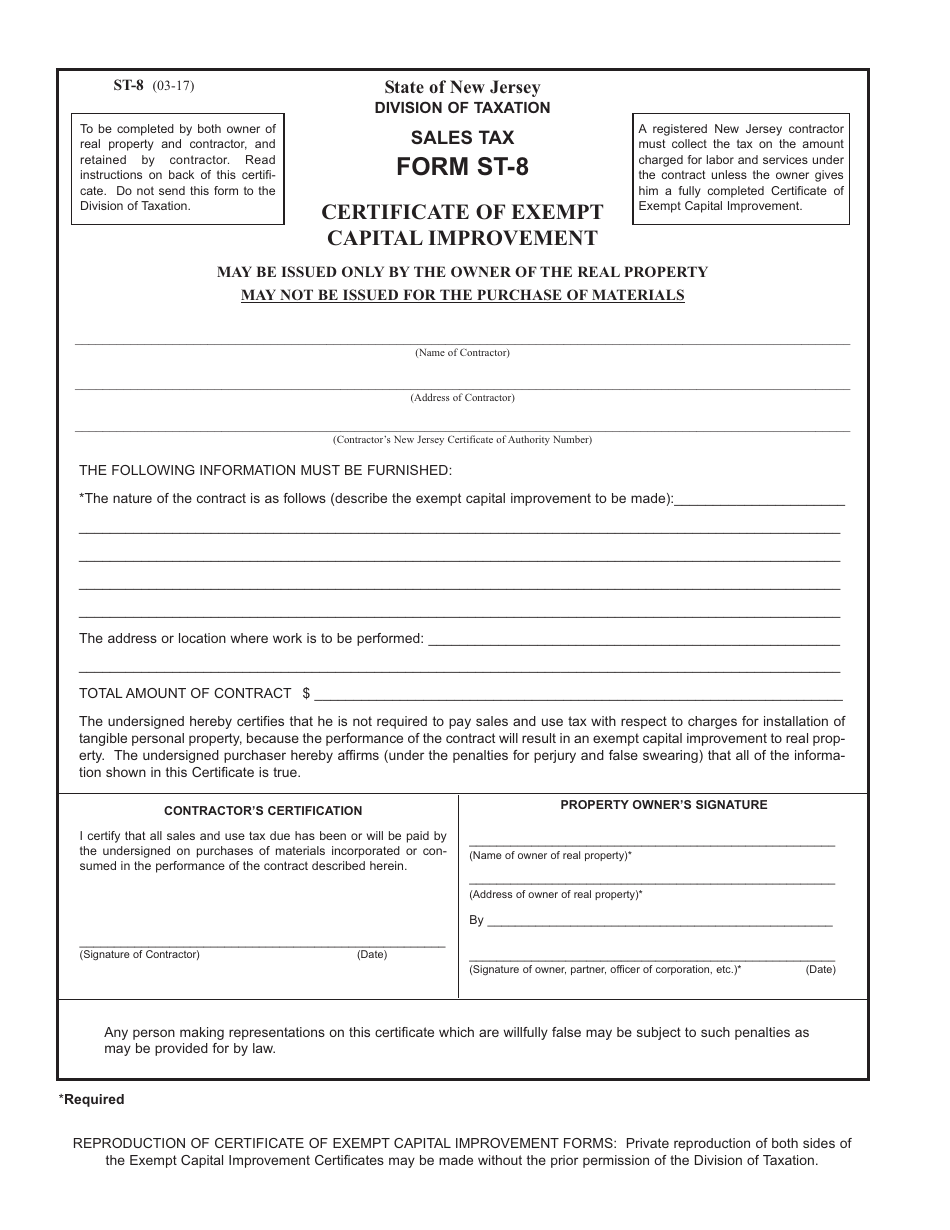

Web a blueprint for success capital improvements significantly impact property values, operating costs and residents’ lifestyles at your building or community. Web capital improvements performed by landscapers and similar businesses, as well as charges for certain defined landscaping services, have been subject to tax since october. Web capital improvements are exempt from tax with the exception of the following, which became subject to tax as of october 1, 2006: Web capital improvement means an installation of tangible personal property that increases the capital value or useful life of the real property (land or buildings). Web capital program capital program documents are used by the new jersey department of transportation to allocate funds. Web 30 rows certificate of exempt capital improvement: Web registered new jersey contractor must collect the tax on the amount charged for labor and services under the contract unless the owner gives him a properly completed certificate. Electronic reporting is required for most parameters including iocs, vocs, radiologicals, and total coliform. Web in a capital improvement to real property. In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they.

Web 30 rows certificate of exempt capital improvement: Web sampling & regulatory forms note: Web registered new jersey contractor must collect the tax on the amount charged for labor and services under the contract unless the owner gives him a properly completed certificate. Electronic reporting is required for most parameters including iocs, vocs, radiologicals, and total coliform. Certain landscaping services, carpet and. A registered new jersey contractor must collect the tax on the amount charged for labor and services under the contract. Web capital improvement means an installation of tangible personal property that increases the capital value or useful life of the real property (land or buildings). Charges for installation that result in an exempt capital improvement are not taxable as long as the property owner gives the contractor a completed new jersey. Web capital improvements performed by landscapers and similar businesses, as well as charges for certain defined landscaping services, have been subject to tax since october. Web capital program capital program documents are used by the new jersey department of transportation to allocate funds.

Capital Improvement Plan (CIP) Milton, WI Official Website

Web in a capital improvement to real property. Charges for installation that result in an exempt capital improvement are not taxable as long as the property owner gives the contractor a completed new jersey. Web 30 rows certificate of exempt capital improvement: Web registered new jersey contractor must collect the tax on the amount charged for labor and services under.

Form ST8 Download Printable PDF or Fill Online Certificate of Exempt

Web sampling & regulatory forms note: Do not send this form to the division of taxation. A registered new jersey contractor must collect the tax on the amount charged for labor and services under the contract. Web 30 rows certificate of exempt capital improvement: Web registered new jersey contractor must collect the tax on the amount charged for labor and.

Capital Improvement Plans YouTube

In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they. Web capital improvements performed by landscapers and similar businesses, as well as charges for certain defined landscaping services, have been subject to tax since october. A registered new jersey contractor must collect the tax on the amount charged.

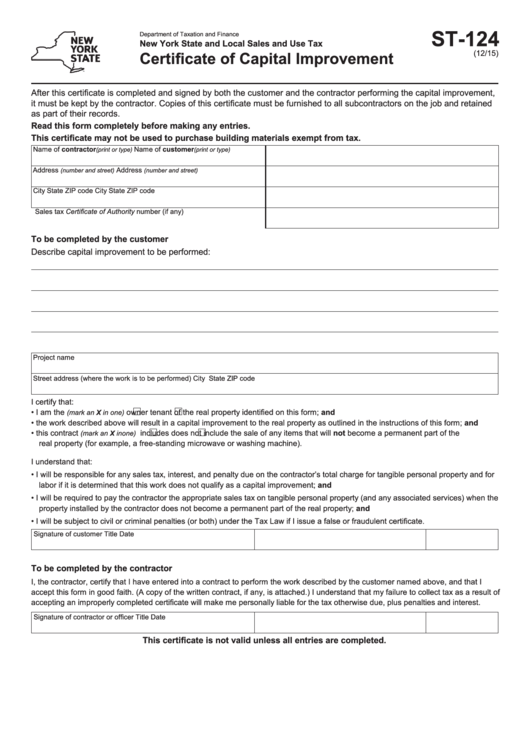

Fillable Form St124 Certificate Of Capital Improvement printable pdf

New jersey sales taxes do not treat all work on your. Web instructions to the property owner: Web certificate of exemptcapital improvement registered new jersey contractormust collect the tax on the amountcharged for labor and services underthe. Web capital improvements performed by landscapers and similar businesses, as well as charges for certain defined landscaping services, have been subject to tax.

Gallery of Nys Capital Improvement form Inspirational 24 Fresh Gallery

Web sampling & regulatory forms note: Web capital improvement means an installation of tangible personal property that increases the capital value or useful life of the real property (land or buildings). Electronic reporting is required for most parameters including iocs, vocs, radiologicals, and total coliform. Web in a capital improvement to real property. Web capital improvements are exempt from tax.

Capital Improvement Program Lake County, IL

Web certificate of exemptcapital improvement registered new jersey contractormust collect the tax on the amountcharged for labor and services underthe. Electronic reporting is required for most parameters including iocs, vocs, radiologicals, and total coliform. Certain landscaping services, carpet and. Web capital improvements performed by landscapers and similar businesses, as well as charges for certain defined landscaping services, have been subject.

PPT Capital Improvement program PowerPoint Presentation, free

Web sampling & regulatory forms note: Web certificate of exemptcapital improvement registered new jersey contractormust collect the tax on the amountcharged for labor and services underthe. Web a blueprint for success capital improvements significantly impact property values, operating costs and residents’ lifestyles at your building or community. Web registered new jersey contractor must collect the tax on the amount charged.

What's Considered a Capital Improvement on a Home vs. a Repair?

Web a blueprint for success capital improvements significantly impact property values, operating costs and residents’ lifestyles at your building or community. Certain landscaping services, carpet and. Web capital improvements performed by landscapers and similar businesses, as well as charges for certain defined landscaping services, have been subject to tax since october. Web capital improvement means an installation of tangible personal.

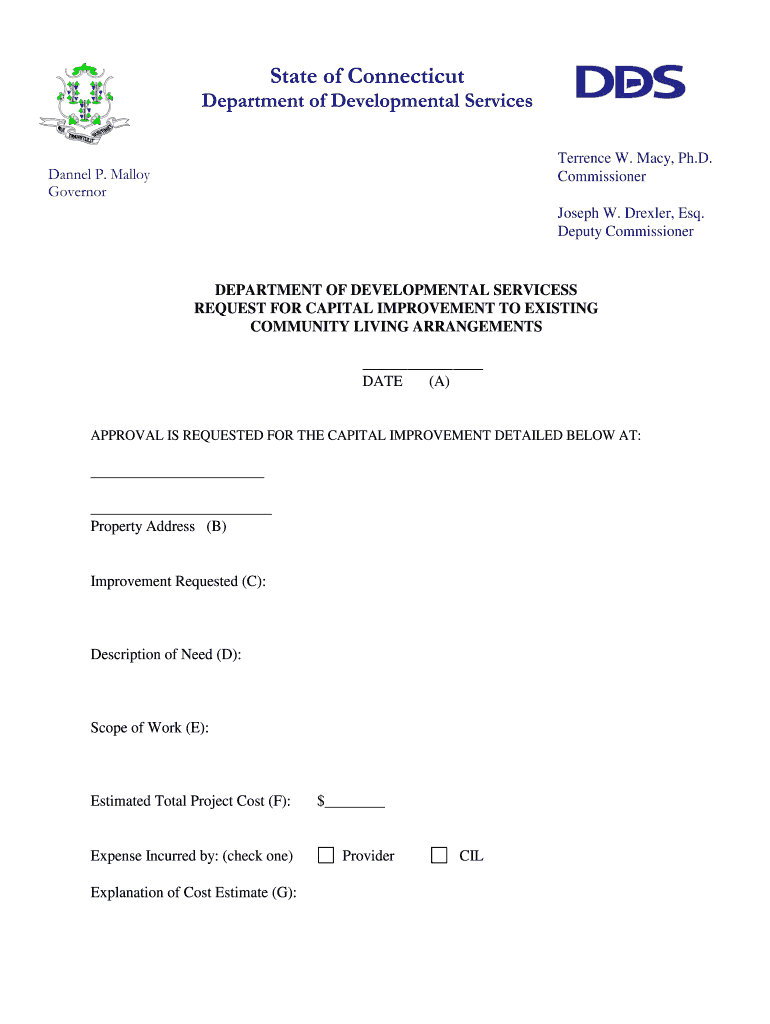

Certificate of Capital Improvement Ct Form Fill Out and Sign

Web capital improvements are exempt from tax with the exception of the following, which became subject to tax as of october 1, 2006: Web registered new jersey contractor must collect the tax on the amount charged for labor and services under the contract unless the owner gives him a properly completed certificate. New jersey sales taxes do not treat all.

Gallery of Nys Capital Improvement form Inspirational 24 Fresh Gallery

Web capital improvements are exempt from tax with the exception of the following, which became subject to tax as of october 1, 2006: Web sampling & regulatory forms note: Electronic reporting is required for most parameters including iocs, vocs, radiologicals, and total coliform. Web 30 rows certificate of exempt capital improvement: Web capital improvements performed by landscapers and similar businesses,.

Web Capital Program Capital Program Documents Are Used By The New Jersey Department Of Transportation To Allocate Funds.

Web capital improvements are exempt from tax with the exception of the following, which became subject to tax as of october 1, 2006: Web in a capital improvement to real property. A registered new jersey contractor must collect the tax on the amount charged for labor and services under the contract. Web a blueprint for success capital improvements significantly impact property values, operating costs and residents’ lifestyles at your building or community.

Electronic Reporting Is Required For Most Parameters Including Iocs, Vocs, Radiologicals, And Total Coliform.

Web capital improvements performed by landscapers and similar businesses, as well as charges for certain defined landscaping services, have been subject to tax since october. Web capital improvement means an installation of tangible personal property that increases the capital value or useful life of the real property (land or buildings). Do not send this form to the division of taxation. Web certificate of exemptcapital improvement registered new jersey contractormust collect the tax on the amountcharged for labor and services underthe.

New Jersey Sales Taxes Do Not Treat All Work On Your.

In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they. Web 30 rows certificate of exempt capital improvement: Certain landscaping services, carpet and. Web registered new jersey contractor must collect the tax on the amount charged for labor and services under the contract unless the owner gives him a properly completed certificate.

Web Sampling & Regulatory Forms Note:

Charges for installation that result in an exempt capital improvement are not taxable as long as the property owner gives the contractor a completed new jersey. A capital improvement to real property is defined in section 1101 (b)(9) of the tax law and sales tax regulation section. Web instructions to the property owner: